Who Has the Cheapest Renters Insurance Quotes in Indiana? (2024)

State Farm has the cheapest renters insurance in Indiana. Its rates are 45% cheaper than the state average.

Best Cheap Renters Insurance in Indiana

ValuePenguin editors found the best cheap renters insurance companies in Indiana by looking at rates, customer satisfaction, coverage options and discounts.

Our experts calculated average renters insurance rates by gathering quotes from eight top companies across 24 of Indiana's largest cities.

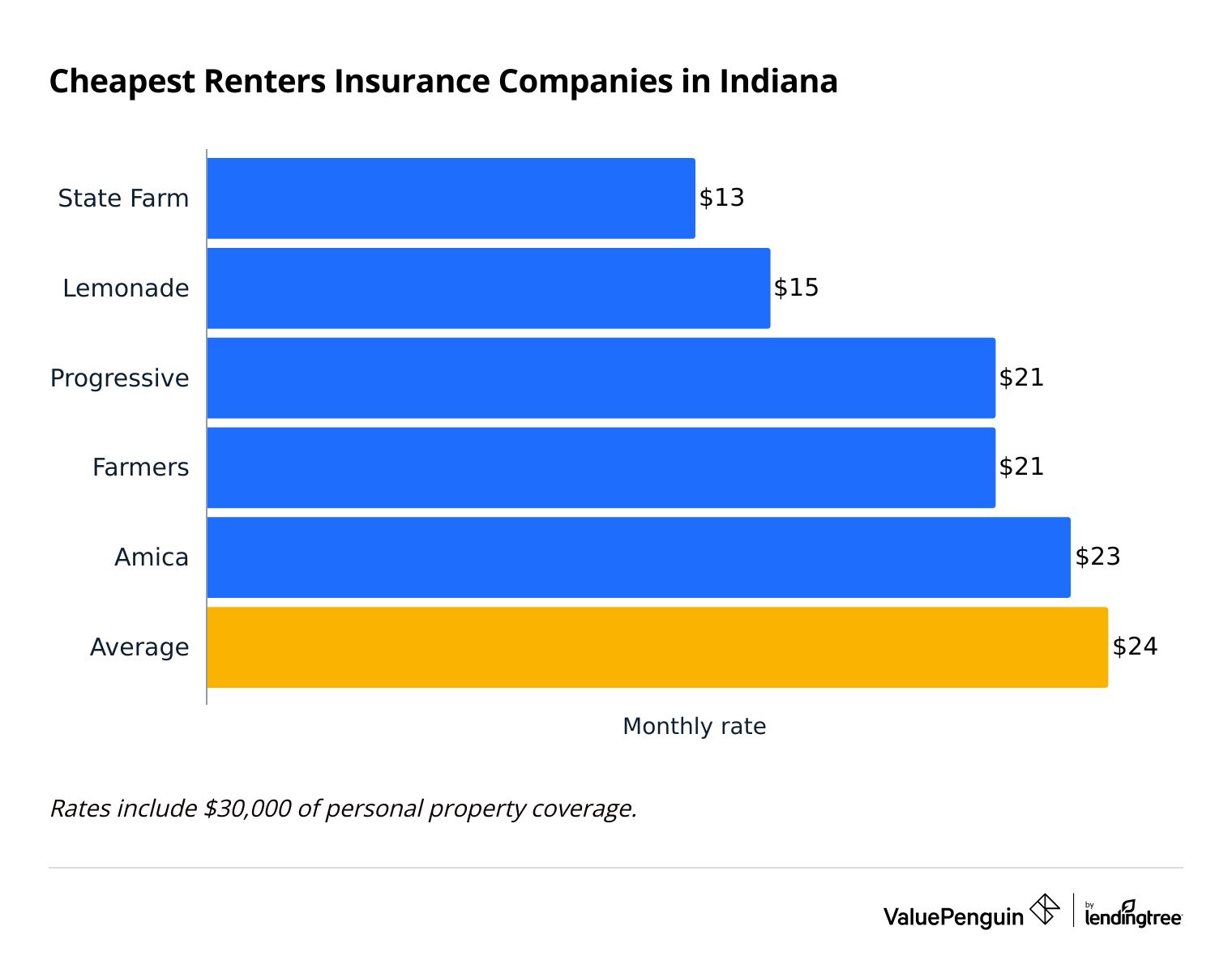

Cheapest renters insurance companies in Indiana

State Farm has the cheapest renters insurance in Indiana, at $13 per month for $30,000 of personal property coverage.

Lemonade is also very affordable at $15 per month.

Compare Cheap Renters Insurance Quotes in Indiana

Renters insurance in Indiana costs $24 per month for $30,000 of personal property coverage, on average. That's 6% more expensive than the national average of $23 per month.

The cost of renters insurance in Indiana is about average compared to neighboring states. Coverage is a little cheaper in Illinois and Kentucky, but more expensive in Ohio and Michigan.

Top renters insurance companies in Indiana

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $13 | ||

| Lemonade | $15 | ||

| Progressive | $21 | ||

| Farmers | $21 | ||

| Amica | $23 | ||

Best renters insurance in Indiana for cheap rates: State Farm

-

Editor's rating

- Cost: $13/mo

State Farm offers the best combination of cheap rates and strong customer service in Indiana.

-

Low prices

-

Well-rated customer service

-

Good renters-auto bundling discount

-

Limited coverage options

-

Few discounts

State Farm has the lowest prices for renters insurance in Indiana.

State Farm costs $13 per month for $30,000 of coverage for your belongings. That's 45% less than the average price statewide.

State Farm is especially worth considering if you prefer the security of working with an agent. When you buy a policy, you'll automatically be paired with a State Farm agent in your area who can help you buy a policy. The company has well-rated customer service, though it does have slightly more claims-related complaints than a typical company.

The best discount at State Farm is the renters-auto bundling discount. This is one of the best ways to save on a renters insurance policy, and its auto insurance rates are affordable, too.

The biggest drawback of State Farm is the relatively small number of discounts and coverage options. State Farm offers extended liability coverage and identity theft protection but does not offer extra coverage for replacement cost or water backup damage.

Best online experience: Lemonade

-

Editor's rating

- Cost: $15/mo

Lemonade has a well-designed app, alongside cheap rates and good coverage options.

-

Easy online shopping experience

-

Cheap quotes

-

Lots of extra coverage options

-

Few discounts

-

High number of customer complaints

-

Hard to speak to a person

Lemonade has a great online experience. Plus, it's affordable and convenient to use, with lots of coverage options.

Renters insurance is very cheap at Lemonade, with an average price of $15 per month for $30,000 of coverage. That's 37% less than average.

You'll find lots of coverage options at Lemonade. Most importantly, the policies always include replacement cost coverage. This means that you'll get the full amount needed to replace an item that's damaged or lost, even if your item has gone down in value.

For example, if your TV was $1,000 when you bought it but is now only worth $500, Lemonade will pay the full $1,000 to replace it if it's damaged or stolen.

Other coverages from Lemonade include:

- Extended liability

- Bicycle coverage

- Valuable items (art and jewelry)

- Mold coverage

- Water backup

Signing up and managing your insurance policy with Lemonade is easy. The company has a great mobile app, and you manage your policy entirely online.

Lemonade has a mixed reputation for customer service. It scored very well in J.D. Power's customer satisfaction survey, but also gets a lot of complaints. These complaints typically involve mishandled insurance claims, so that suggests Lemonade may sometimes struggle to pay claims promptly.

The other downside to Lemonade is limited discount options. While companies like Progressive will lower your rates for things like bundling other insurance policies or buying far in advance, Lemonade doesn't. But that shouldn't be a deal-breaker since its prices are already so low.

Best for customer service: Amica

-

Editor's rating

- Cost: $23/mo

Amica provides top-notch customer service with its renters insurance.

-

Top-rated customer service

-

Good discounts

-

Average rates

Amica gets great reviews for its customer service, so it's worth considering if you're willing to pay a little extra for top-notch service.

Rates at Amica are only a little below the Indiana state average, at $23 per month.

However, customers tend to be very happy with the service they receive. The company gets about one-third as many complaints as a typical insurance company its size.

Amica also offers a good selection of discounts, which can bring your monthly insurance bill down.

- Claim-free discount

- Bundle discount

- Loyalty discount

- Online purchase discount

- Automatic payment discount

Indiana renters insurance: Costs by city

The city of Anderson has the lowest renters insurance rates of Indiana's largest cities, with an average rate of $22 per month.

The cities of Bloomington, Carmel, Elkhart, Fishers, Kokomo, Noblesville, Portage, West Lafayette and Westfield all have average rates a few cents higher than Anderson.

Gary has the highest rates in the state, with an average of $30 per month. That's 24% higher than the state average.

How much you pay for renters insurance will depend on where you live in Indiana. You'll likely pay more if you live in a city with high crime, or less if you live close to a firehouse.

City | Monthly rate | % from average |

|---|---|---|

| Anderson | $22 | -11% |

| Bloomington | $22 | -10% |

| Carmel | $22 | -10% |

| Columbus | $28 | 13% |

| Elkhart | $22 | -8% |

Tips for getting cheap renters insurance in Indiana

Compare prices, use discounts and understand your coverage needs to get the lowest price on your Indiana renters insurance policy.

Add up the cost of the items you own to find out how much coverage you need. Your renters insurance should include high enough limits on your personal property coverage. But buying more coverage than you need won't increase your payout if the worst happens.

You can save hundreds of dollars per year without sacrificing coverage by comparing prices from multiple companies. The most expensive renters insurance company in Indiana, American Family, costs $415 per year more than the cheapest company, State Farm, for the same level of coverage.

It's a good idea to compare quotes each year because rates can change over time. The cheapest company today might not have the best rates the next time you renew your policy.

Renters insurance companies offer discounts that reduce what you spend each month.

Some discounts, like being claim-free, you'll get automatically when you apply. But other discounts you'll need to qualify for. For example, some companies give you a cheaper price if you buy a policy more than a week or two before it starts.

Common renters insurance discounts in Indiana

- Renters-auto bundling

- Claim-free discount

- Automatic payments

- Pay in full

- Loyalty

- Home protection device

Common natural disasters in Indiana

Renters in Indiana should make sure they're protected from tornadoes, flooding and rapid changes in temperature.

Indiana windstorms

Wind damage is almost always covered by renters insurance.

Wind damage to your property is one of the events most commonly covered by renters and home insurance, regardless of the type of storm or cause of damage. Damage from a broken window from a tornado is covered, as is damage from a fallen tree branch.

One thing that's usually not covered is damage to your car. Instead, wind damage to your vehicle is covered by comprehensive coverage, part of your car insurance.

Snow, ice and cold temperatures

Damage from ice, snow and cold temperatures is usually covered by renters insurance, but not every type of damage is included.

For example, if a pipe bursts and soaks your stuff, renters insurance will pay to fix anything that got wet. You'll also be covered if a tree collapses under the weight of snow and damages your belongings.

Hail damage is covered by renters insurance, too.

But remember that renters insurance only covers your belongings. It doesn't protect the structure of your apartment or rental home. If your roof is damaged by an ice dam or weight of snow, that's your landlord's responsibility to cover.

Frequently asked questions

How much is renters insurance per month in Indiana?

The average cost of renters insurance in Indiana is $24 per month. The cheapest quotes can be found at State Farm, where a policy costs $13 per month.

Is renters insurance required by law in Indiana?

Renters insurance isn't required in the state of Indiana. However, you often have to buy coverage if your landlord or property management company requires you to do so when you move in.

What does Indiana renters insurance cover?

Renters insurance in Indiana should always cover property damage, personal liability, medical payments for guests and additional living expenses like a hotel or apartment sublet. Most companies also give renters the option to expand their coverage with extra add-ons, like protection for valuable property.

How much is renters insurance in Indianapolis?

Renters insurance in Indianapolis, the largest city in Indiana, costs $29 per month, which is 20% more expensive than the statewide average. In comparison, renters in Fort Wayne, the state's second-largest city, pay an average of $24 per month.

Methodology

ValuePenguin collected more than 150 quotes from across Indiana's 24 largest cities for a single 30-year-old woman who has never filed a renters insurance claim. Coverage limits include:

- $30,000 of personal property coverage

- $9,000 for loss of use

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

Customer service ratings were created using cost data, information from the National Association of Insurance Commissioners (NAIC) complaint index and J.D. Power's 2023 renters insurance customer satisfaction study rankings.

These rates should be used for comparative purposes only. Your quotes will likely differ.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.