The Best Cheap Motorcycle Insurance in North Carolina

Progressive offers the cheapest motorcycle insurance in NC, at $18 per month for full coverage.

Compare Motorcycle Insurance Quotes in North Carolina

Best cheap NC motorcycle insurance

To help you find the best cheap motorcycle insurance in North Carolina, ValuePenguin collected quotes across 24 of the state’s largest cities.

Our experts rated the best motorcycle insurance companies in North Carolina based on cost, customer service and coverage availability.

To find the cheapest companies, we compared rates for a full coverage policy with collision and comprehensive coverage, plus higher liability limits than the state minimum. Full methodology.

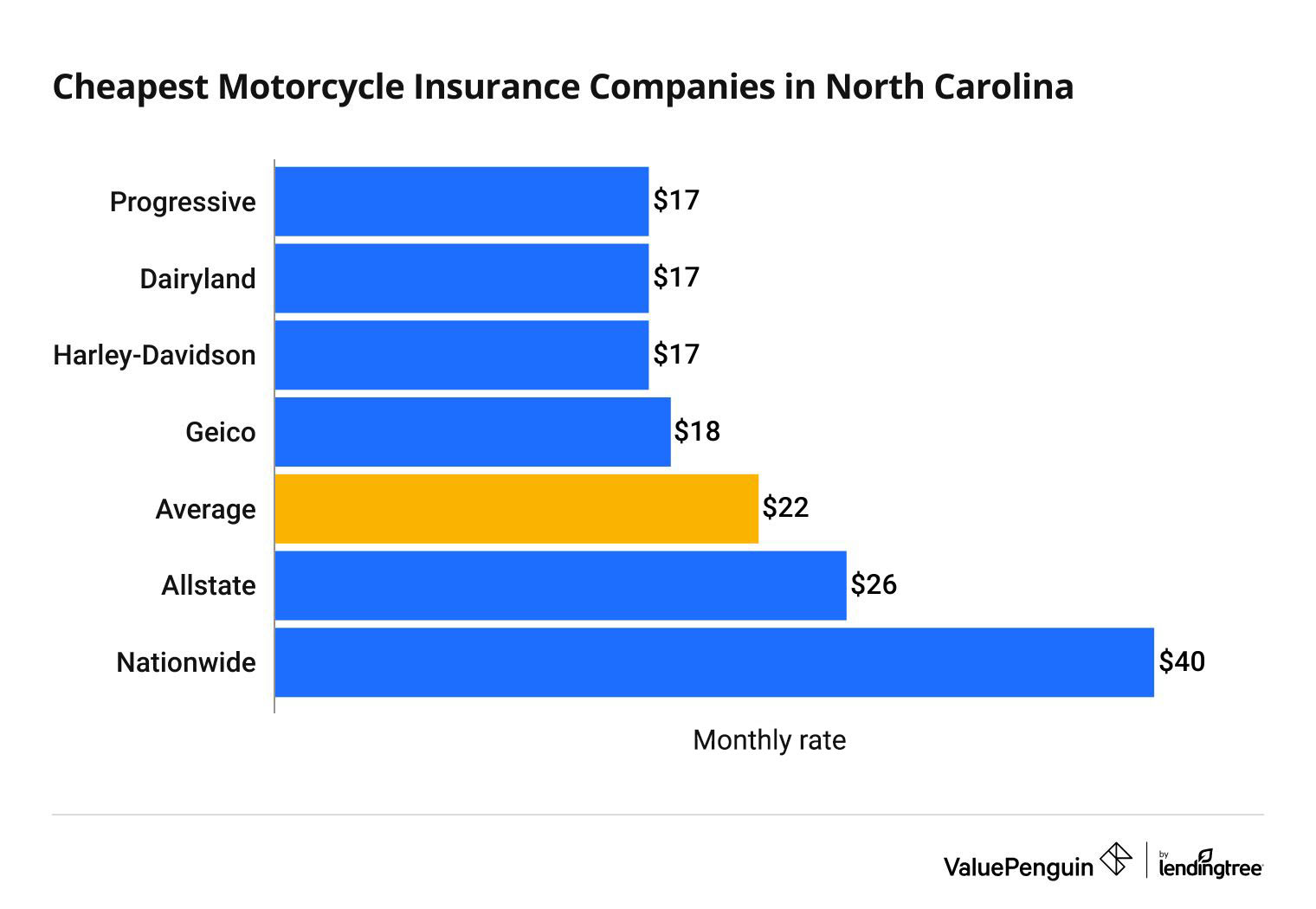

Cheapest motorcycle insurance in North Carolina

Progressive has the most affordable motorcycle insurance rates in North Carolina.

A full coverage policy from Progressive costs around $17 per month, which is 26% cheaper than the North Carolina average.

But Dairyland, Harley-Davidson and Geico all offered rates that are within a dollar per month of Progressive, so they're worth looking at, too.

Compare Motorcycle Insurance Quotes in North Carolina

The average cost of motorcycle insurance in North Carolina is $22 per month. Riders in North Carolina pay 33% less for motorcycle insurance than the national average, which is $33 per month.

Cheapest motorcycle insurance companies in NC

Company | Monthly rate | ||

|---|---|---|---|

| Progressive | $17 | ||

| Dairyland | $17 | ||

| Harley-Davidson | $17 | ||

| Geico | $18 | ||

| Allstate | $26 | ||

Best for most people: Progressive

-

Editor rating

-

Monthly rate

$17 ?

Pros and cons

The best motorcycle insurance for most people in North Carolina is Progressive. It has great prices and lots of coverage options, in addition to dependable customer service. Progressive costs $17 per month on average, though that's about the same price as ValuePenguin's other top picks.

Standard motorcycle insurance from Progressive comes with many perks that usually cost extra at other companies. For instance, you get replacement cost coverage with any policy, as well as $3,000 of custom parts protection.

With Progressive, you can reduce your rates even more if you qualify for one of several discounts. You could save by:

- Requesting a quote before your policy is scheduled to start

- Bundling with another form of insurance

- Having a motorcycle endorsement on your license

- Completing a safety course

- Transferring from another motorcycle insurance agency

- Paying your bill on time or in full

In North Carolina, Progressive has well-rated customer service. It receives 28% fewer complaints than a typical insurance company, according to the National Association of Insurance Commissioners (NAIC). That means customers tend to be satisfied with the service they receive.

The one downside of Progressive is that it doesn't offer rental reimbursement. Progressive may not be the best choice for riders who depend on their motorcycle as their primary means of transportation, and don't have another way to get around after an accident.

Best for customer service: Geico

-

Editor rating

-

Monthly rate

$18 ?

Pros and cons

Geico is a great insurance option for riders looking for top-rated service at an affordable price. Geico coverage is $18 per month, or $1 more than Progressive, but its service is rated slightly better by customers.

The company had the best NAIC complaint index numbers in North Carolina, receiving only 64% of complaint volume expected for a company its size.

The biggest drawback to Geico is that it doesn't offer many opportunities to save with discounts or many extra coverage options. You may qualify for savings if you:

- Bundle your policy with another form of coverage

- Insure more than one motorcycle

- Complete a safety course

- Are an older experienced driver

- Renew your policy with Geico

- Switch from another provider

If you have a lot of extra gear, or use your bike for touring or daily commuting, you may benefit from going with another insurer that has coverages that meet your needs.

Best for touring and commuting: Harley-Davidson

-

Editor rating

-

Monthly rate

$17 ?

Pros and cons

For riders who regularly take their bikes touring, or use it for commuting, Harley-Davidson insurance is a top option in NC. It has great rates, plus an unparalleled selection of optional coverages like OEM parts coverage, rental replacement and trip interruption.

You can purchase trip interruption protection for damages you encounter after you're 100 miles from home, including assistance if you:

- Run out of gas or oil

- Have a dead battery

- Lose your keys

- Get a flat tire

- Need a tow

A base policy at Harley-Davidson costs $17 per month. That matches Progressive for the cheapest rate in the state.

The biggest downside to Harley-Davidson is that it only offers motorcycle insurance. That means you'll have to work with a different company to insure your home and car. You're also missing out on a bundle discount, which is one of the best ways to save on your insurance rates overall.

Average cost of motorcycle insurance in North Carolina by city

Asheboro, Burlington, Chapel Hill and Eden all have an average cost of motorcycle insurance of $20 per month, the cheapest in the state.

Gastonia, outside of Charlotte, has the most expensive motorcycle insurance in the state, with an average of $26 per month.

Full coverage motorcycle insurance rates in NC by city

City | Monthly cost | % from average |

|---|---|---|

| Asheboro | $20 | -9% |

| Burlington | $20 | -9% |

| Cary | $22 | -2% |

| Chapel Hill | $20 | -10% |

| Clayton | $23 | 2% |

Full coverage motorcycle insurance costs in North Carolina do not change much by city. The difference between the cheapest and most expensive of the larger cities in the state is only $6 per month.

What are North Carolina's motorcycle laws?

North Carolina requires all riders to have a motorcycle license and wear a helmet while on a bike, even if you're a passenger. This is true whether you're a resident of North Carolina or just passing through.

North Carolina's motorcycle license requirements

North Carolina requires you to have a motorcycle learner's permit or endorsement on your regular driver's license. Fortunately, it's fairly straightforward to get certified. If you just need a learner's permit, you must pass a motorcycle knowledge test, road sign identification test and vision test.

To get a motorcycle endorsement on your license, you’ll have to pass a motorcycle knowledge test and an on-road skills test. Both types of certification require you to already have a regular license.

Helmet laws in North Carolina

Whether you're driving a motorcycle or riding with someone else, you must wear a helmet. Helmets in compliance with the state's safety standards are marked by a Department of Transportation sticker stuck permanently to the back. Helmets that are in compliance will have a lining of foam that's at least one inch thick.

Sometimes it's possible to find novelty-style helmets with facsimiles of the Department of Transportation's sticker. However, these aren't actually compliant with North Carolina's regulations.

All motorcycle riders in North Carolina must have liability insurance in order to ride.

North Carolina's legally mandated coverage minimums are listed below, but it's a good idea to purchase enough insurance to adequately protect your assets — even if it exceeds the state's minimum requirements.

- Bodily injury liability: $30,000 per person and $60,000 per accident

- Property damage liability: $25,000

Frequently asked questions

How much is motorcycle insurance in North Carolina?

The average cost of motorcycle insurance in North Carolina is $22 per month, or $268 per year, for a full coverage policy.

Do I need insurance for a motorcycle in North Carolina?

Yes, motorcycle insurance is required for riders in North Carolina. You're required to have at least $30,000 of bodily injury liability per person and $60,000 per accident, along with matching uninsured motorist limits. You will also need to get $25,000 of property damage liability.

What company has the cheapest motorcycle insurance in North Carolina?

Progressive has the cheapest motorcycle insurance in North Carolina, at $17 per month for full coverage. And Dairyland and Harley-Davidson are only a few cents more per month.

Compare motorcycle insurance in North Carolina vs other states

Methodology

To find the cheapest motorcycle insurance in North Carolina, ValuePenguin collected 140 motorcycle insurance quotes from five major motorcycle insurance companies across 24 of the largest cities in North Carolina. Rates are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

Quotes are for a full coverage policy. It includes comprehensive and collision coverage and higher liability limits than the state requirement.

- Bodily injury liability coverage: $50,000 per person and $100,000 per accident

- Property damage liability coverage: $25,000 per accident

- Uninsured motorist bodily injury liability: $50,000 per person and $100,000 per accident

- Personal injury protection (PIP): $50,000

- Collision and comprehensive deductible: $500

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.