The Best Motorcycle Insurance Companies in Florida (2024)

Dairyland has the cheapest motorcycle insurance in Florida, at $24 per month.

Florida riders can get the best service at Harley-Davidson.

Compare Motorcycle Insurance Quotes in Florida

Best cheap motorcycle insurance in Florida

It's important to shop around for affordable motorcycle insurance quotes. But the cheapest company isn't always the best choice.

The best motorcycle insurance company should have low rates, dependable customer service and helpful coverage options.

To help you find the best cheap motorcycle insurance in Florida, ValuePenguin collected quotes from six top insurance companies across 36 of the largest cities in the state.

We ranked the best FL motorcycle insurance based on cost, coverage availability and customer service.

To find the cheapest companies, we compared rates for a full coverage policy with higher liability limits than the state minimum, plus comprehensive and collision coverage. Full methodology.

Cheapest motorcycle insurance in Florida

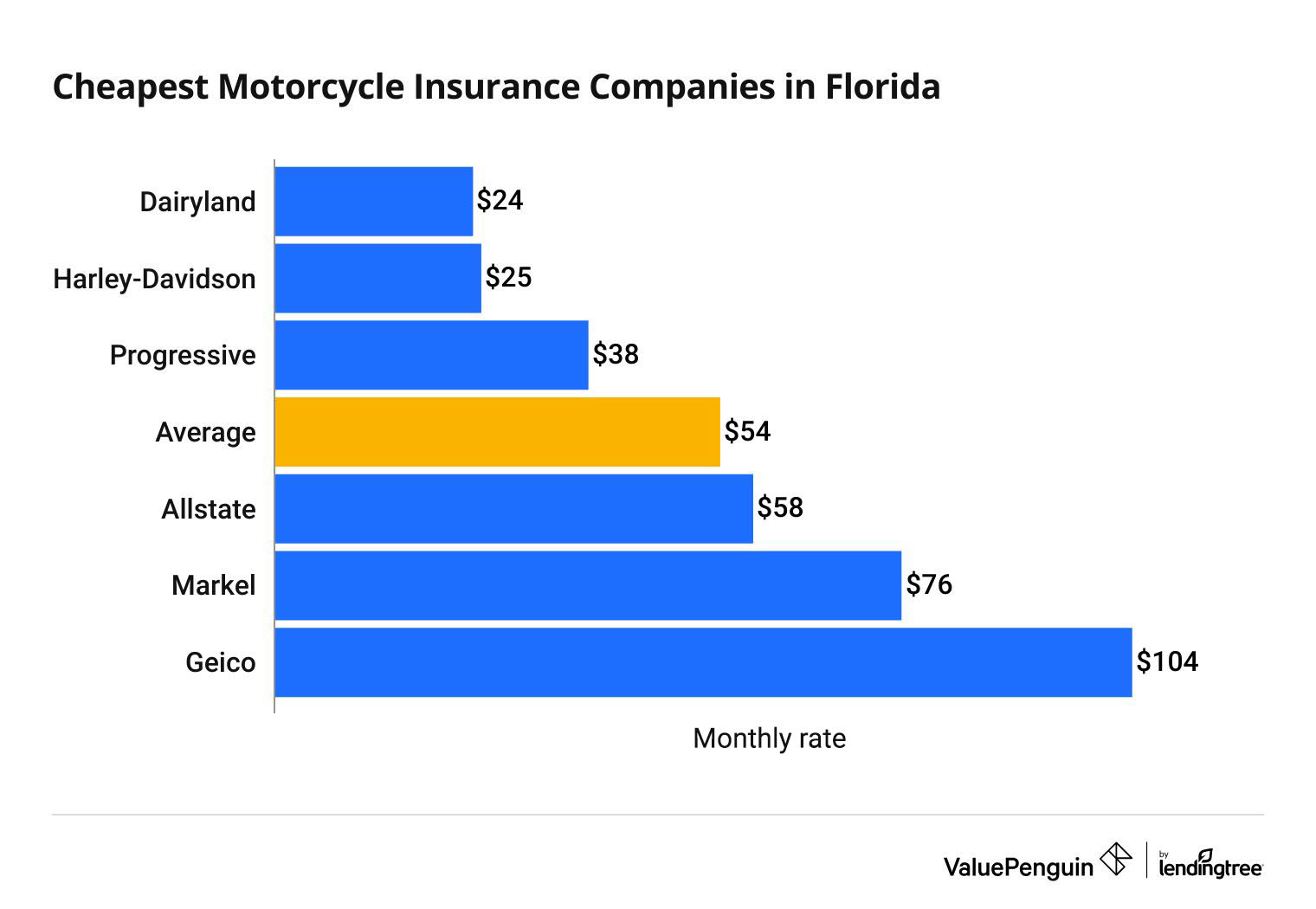

Dairyland has the most affordable motorcycle insurance in Florida.

Full coverage insurance from Dairyland costs $24 per month, which is 55% cheaper than the Florida state average.

The average cost of motorcycle insurance in Florida is $54 per month for a full coverage policy.

Compare Motorcycle Insurance Quotes in Florida

Florida riders should also consider Harley-Davidson. At $25 per month, full coverage from Harley-Davidson is less than half the state average.

Cheapest motorcycle insurance companies in Florida

Company | Monthly rate | ||

|---|---|---|---|

| Dairyland | $24 | ||

| Harley-Davidson | $25 | ||

| Progressive | $38 | ||

| Allstate | $58 | ||

| Markel | $76 | ||

Motorcycle insurance is not required by law for most riders in Florida.

However, buying motorcycle insurance is the best way to protect yourself and your bike if you cause a crash. Without insurance, you'll have to pay for any damage or injuries you cause out of pocket.

Best for most riders in Florida: Harley-Davidson

-

Editor rating

-

Monthly rate

$25 ?

Pros and cons

We recommend Harley-Davidson for riders who value customer service. Having an insurance company you can depend on is essential.

Great customer service can help you get back on the road quickly if you're in an accident.

Harley-Davidson receives far fewer complaints than an average company its size, according to the National Association of Insurance Commissioners (NAIC).

Harley-Davidson's motorcycle insurance rates are affordable, with an average price of $25 per month for full coverage insurance. That's only $1 per month more expensive than the cheapest option in Florida, Dairyland. In addition, Harley-Davidson offers lots of discounts to help riders save money on insurance.

- Anti-theft discount if your motorcycle has a theft deterrent installed, like an audible alarm

- Bundled protection discount when you buy another insurance product from Harley-Davidson, like an extended service plan

- Claim-free renewal discount after each policy period that you avoid an at-fault accident

- H-D Riding Academy discount if you complete the H-D Riding Academy New Rider Course

- Harley Owners Group discount for HOG members

- Homeownership discount if you own a home that's protected by an insurance policy

- Experienced rider discount based on the number of years you've had a motorcycle license

- Loyalty discount after having Harley-Davidson motorcycle insurance for one year

- Military and law enforcement discount for active or retired military or law enforcement

- "Multi-cycle" discount if you insure more than one bike with Harley-Davidson

- Motorcycle endorsement discount if you have a motorcycle endorsement on your driver's license

- New bike discount if you own a brand-new motorcycle

- Prompt payer discount for paying your insurance bill on time

Best cheap motorcycle insurance in FL: Dairyland

-

Editor rating

-

Monthly rate

$24 ?

Pros and cons

Dairyland's rates for motorcycle insurance are the cheapest in Florida, averaging $24 per month for full coverage insurance. That's $30 less per month than the state average.

Dairyland has a few helpful coverage add-ons for Florida riders. Customers can add roadside assistance and rental car reimbursement. Both coverages are important add-ons for riders who use their motorcycle as their primary vehicle.

However, Dairyland doesn't offer trip interruption coverage or protection for trailered bikes. People who take regular road trips should consider a company with these options, like Progressive.

In addition, Dairyland could take a long time to pay out your claim if you wreck your bike. It receives 60% more complaints than other insurance companies of its size, according to the NAIC. Most of Dairyland's complaints are about its slow claims process. You should consider another company if it's important that your bike is fixed quickly after an accident.

Best for military families: USAA

-

Editor rating

-

Monthly rate

$36 ?

Pros and cons

USAA has the best motorcycle insurance for Floridians with military ties.

But it's only available to military members, veterans and some family members.

USAA doesn't sell its own motorcycle insurance. Instead, USAA members get a 5% discount on coverage from Progressive.

A full coverage policy from Progressive costs $38 per month. That means USAA members can expect to pay around $36 per month. Although that's not the cheapest rate in Florida, it's still 33% less than the state average.

It may cost more money, but basic motorcycle insurance from Progressive comes with more protection than most companies include.

For example, a Progressive policy includes full replacement cost coverage. This coverage will help fix your bike using brand-new parts after a crash, regardless of wear and tear. Most other companies charge extra for replacement cost coverage.

FL motorcycle insurance costs by city

Riders in Deltona pay the cheapest motorcycle rates in Florida, with an average of $38 per month.

People living in Miami and Miami Gardens have the most expensive rates, averaging $74 per month.

Average full coverage motorcycle quotes by Florida city

City | Monthly cost | % from average |

|---|---|---|

| Boca Raton | $48 | -12% |

| Boynton Beach | $50 | -8% |

| Cape Coral | $42 | -23% |

| Clearwater | $50 | -9% |

| Coral Springs | $62 | 14% |

Full coverage motorcycle insurance rates can vary by $36 per month across Florida's largest cities. That's because many factors affect motorcycle insurance rates, including accident statistics, crime rates, traffic and weather.

Do you need motorcycle insurance in Florida?

Most riders in Florida aren't required to have motorcycle insurance. But you'll have to pay the medical bills of anyone hurt and the cost of any damage if you cause an accident.

Many Florida riders choose to buy motorcycle insurance so they're not stuck with a big bill after a crash.

If you cause a motorcycle accident and don't have insurance, you'll need to buy a policy. Your policy must have bodily injury and property damage liability insurance. This requirement is sometimes written as 10/20/10.

Florida motorcycle insurance requirement after an accident

- Bodily injury liability: $10,000 per person and $20,000 per accident

- Property damage liability: $10,000 per accident

You'll need to have an active policy for three years to avoid having your license and registration suspended.

Do you need a motorcycle license in Florida?

Riders in Florida need a motorcycle license or endorsement for bikes with an engine larger than 50cc. Riding without a license can result in fines and jail time.

How to get a motorcycle license in Florida

Once you've met the requirements, you can schedule an appointment at any Florida Highway Safety and Motor Vehicles (FLHSMV) office to get a Florida motorcycle license. You'll need to pay at least one of these fees with your application:

- Florida Class E licensing fee: $48

- Florida motorcycle endorsement fee: $7

- Florida identification card fee: $25

Penalties for riding without a motorcycle endorsement in FL

Riding a motorcycle without an endorsement is a second-degree misdemeanor in Florida.

It can lead to serious consequences, including:

- Immediate impounding of your motorcycle

- A fine of $500

- Six months of probation

- Up to 60 days in jail

The process of getting a motorcycle endorsement in Florida can take some time. But riding without a proper license is never worth the risk to your safety, bike or freedom.

Motorcycle helmet law in Florida

Florida motorcycle laws require all riders and passengers to wear helmets that meet the U.S. Department of Transportation Federal Motor Vehicle Safety Standards. In addition, riders must wear eye protection.

There are exceptions to Florida's helmet rule. However, you should wear a helmet at all times for your safety.

Exceptions to Florida's helmet requirement

You aren't required to wear a helmet if you're:

- Riding inside an enclosed cab

- Over 21 years old and have motorcycle insurance with at least $10,000 in medical payments coverage

-

Over 16 years old and ride a motorcycle that can't go faster than 30 mph and either:

- Is not rated over two braking horsepower or

- Has a motor that's 50cc or less

If you're under 16, there are no exceptions. You must always wear a helmet when on a motorcycle in Florida.

Other Florida motorcycle laws

Frequently asked questions

Who has the best motorcycle insurance in FL?

Harley-Davidson has the best motorcycle insurance for most riders in Florida. At $25 per month, full coverage from Harley-Davidson is slightly more expensive than the cheapest company, Dairyland. However, Harley-Davidson has better customer service and offers lots of discounts to help make its rates even more affordable.

How much is motorcycle insurance in Florida?

Floridians pay around $54 per month for full coverage motorcycle insurance. The cheapest company, Dairyland, offers coverage for $24 per month — $30 per month less than the state average.

Do you need motorcycle insurance in Florida?

Most riders in Florida don't have to buy motorcycle insurance. It's only required if you've caused an accident in the last three years. However, you should buy motorcycle insurance so you don't have to pay a lot of money if you're in a serious accident.

How much is motorcycle insurance in Miami, FL?

Riders in Miami pay around $74 per month for full coverage motorcycle insurance. That's 37% more expensive than the Florida average. In comparison, motorcycle insurance in Orlando costs $54 per month.

Compare motorcycle insurance in Florida vs other states

Methodology

To find the cheapest motorcycle insurance company in Florida, we gathered more than 200 quotes across 36 of the largest cities in the state. Rates are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

We collected quotes for a full coverage policy with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

We studied the National Association of Insurance Commissioners (NAIC) complaint index scores to determine the best customer service in Florida. These scores show the number of complaints a company receives compared to its insurance market share.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.