Best and Cheapest Home Insurance Rates in West Virginia (2024)

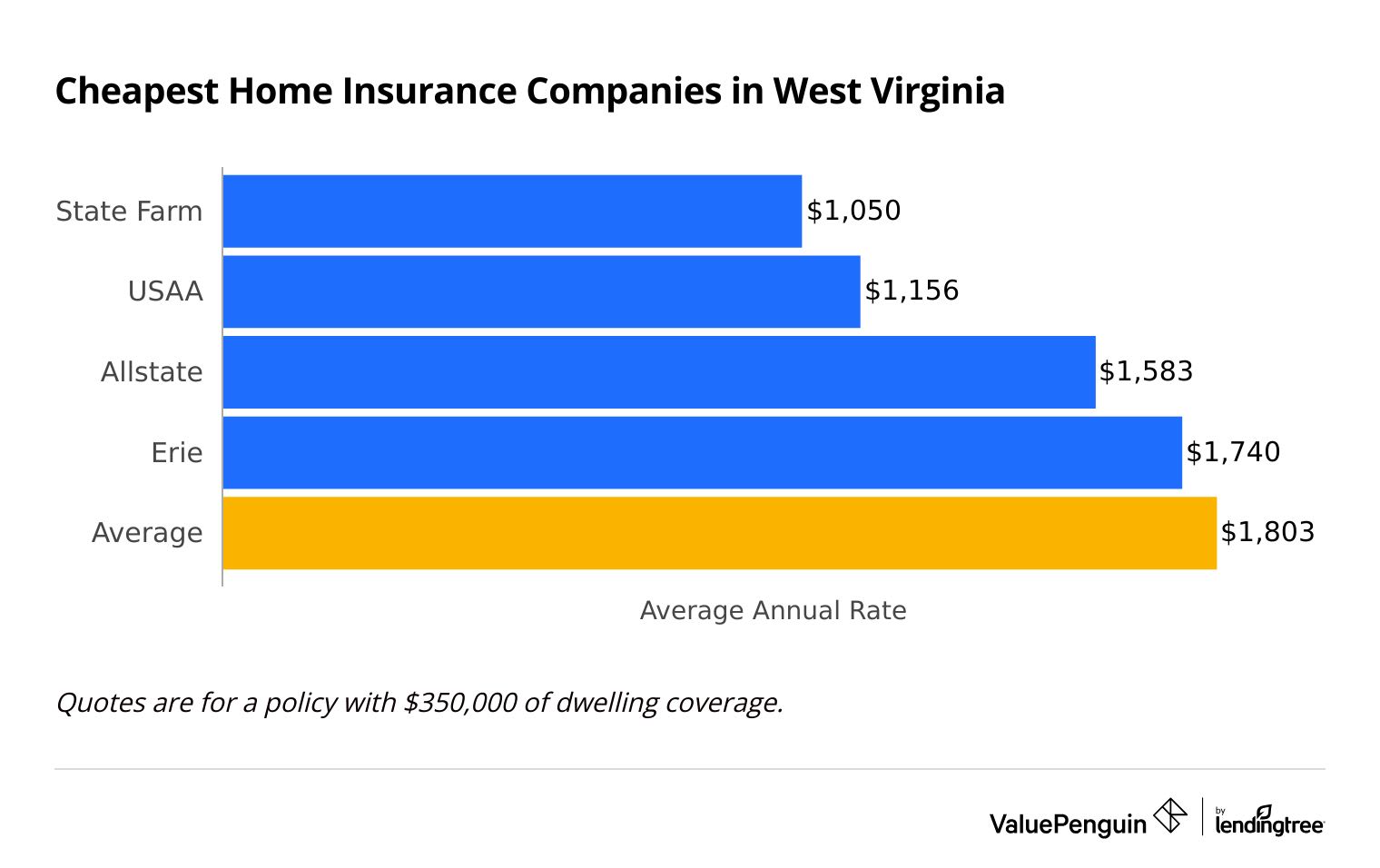

State Farm offers the best and cheapest home insurance for most people in West Virginia. The average cost of a policy is $1,050 per year.

Compare Home Insurance Quotes in West Virginia

Best Cheap West Virginia Home Insurance

ValuePenguin experts made top picks by analyzing companies using their rates, customer service, extra coverage options and other unique features.

To find the cheapest home insurance in WV, ValuePenguin collected and analyzed thousands of quotes from seven top insurance companies across every ZIP code in the state. Full methodology.

Cheapest homeowners insurance in West Virginia

State Farm offers West Virginia's cheapest home insurance rates no matter the value of your home.

State Farm's policies cost an average of $1,050 per year for $350,000 of dwelling coverage. That's $753 per year cheaper than the average price in WV, which is $1,803 per year.

Compare Home Insurance Quotes in West Virginia

USAA also has some of the cheapest WV homeowners insurance if you have ties to the military.

The average rate from USAA is $1,156 per year for $350,000 of dwelling coverage. However, you can only get coverage with USAA if you are or have been in the military, or if you have a parent, spouse or former spouse who has been an active member.

Cheap home insurance quotes in West Virginia by dwelling coverage

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $798 | ||

| USAA | $863 | ||

| Erie | $1,109 | ||

| Allstate | $1,172 | ||

| Westfield | $1,434 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $798 | ||

| USAA | $863 | ||

| Erie | $1,109 | ||

| Allstate | $1,172 | ||

| Westfield | $1,434 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,050 | ||

| USAA | $1,156 | ||

| Allstate | $1,583 | ||

| Erie | $1,740 | ||

| Westfield | $2,198 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,282 | ||

| USAA | $1,438 | ||

| Allstate | $2,104 | ||

| Erie | $2,313 | ||

| Westfield | $2,919 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,932 | ||

| USAA | $2,295 | ||

| Allstate | $3,864 | ||

| Erie | $4,180 | ||

| Westfield | $5,300 | ||

Best West Virginia homeowners insurance for most people: State Farm

-

Editor's rating

- Cost: $1,050/yr

State Farm has the cheapest coverage and some of the best customer service in West Virginia

-

Cheapest coverage in WV

-

Top flight customer service

-

Large numbers of local agents

-

Limited discount options

-

Can't fully buy a policy online

State Farm is the cheapest option for West Virginia home insurance, and it has strong customer service. The company's average rate is $1,156 per year .

State Farm's average rate is a savings of more than $750 per year off the state average overall.

State Farm also has strong customer service ratings. Good ratings are a sign homeowners are happy overall with their experience.

The company gets fewer complaints than an average company its size, according to the NAIC. . It's also one of the best-rated companies in J.D. Power's customer satisfaction survey.

The biggest downside for State Farm is you'll have fewer ways to customize or adjust your policy than with other companies. You might not be able to get replacement cost coverage, which pays to replace your stuff with newer items. You also don't have the convenience of buying a policy entirely online, which some homeowners might not like.

Best WV home insurance for customer service: Erie

-

Editor's rating

- Cost: $1,740/yr

Erie offers top-flight customer service to West Virginia homeowners.

-

Great customer service

-

Extra coverage with a basic policy

-

Good bundling discount/icon]

-

Not the cheapest rates

-

Can't get online quotes

Erie has some of the best customer service in the country. Erie gets less than half the complaints expected for an average company its size. If something happens to your house, a good customer service experience can make life much easier in a stressful time.

Erie also ranks among the four best companies nationally for claims satisfaction, according to a recent J.D. Power study. That is a sign the company's customers are happy with the service they get.

In addition, Erie includes extra coverage that most basic policies lack. You won't pay extra for replacement cost coverage, which will pay more to replace your stuff, and protections for specialized items like bills, deeds and passports.

The biggest downside with Erie is that you can get cheaper rates elsewhere. The company's average cost of $1,740 per year is 66% more expensive than State Farm. You also can't get a quote online, so you will have to reach out to an agent instead.

Best home insurance in West Virginia for military members: USAA

-

Editor's rating

- Cost: $1,156/yr

USAA has a great combination of low rates and military-specific coverage.

-

Cheap rates

-

Benefits with a military focus

-

Top-rated customer service

-

Not available to most homeowners

-

Few discount options

USAA is a great option for West Virginians with ties to the military. It has low rates and great customer service.

You can only get USAA coverage if you are currently serving or have served in the military, or you are a spouse, former spouse or child of a military member.

USAA has some of the cheapest rates in West Virginia, at $1,156 per year for $350,000 in coverage. State Farm is the only cheaper option.

The company also has a strong reputation for customer service. It's always at or near the top of J.D. Power's customer satisfaction survey, and it only gets about a third of the complaints of an average company its size, according to the NAIC. .

USAA's regular home insurance policies give you more coverage than most other companies. If it's needed, USAA will pay to fully rebuild your home even if it's more than more than what you're insured for.

USAA also has protection for your military uniform and gear if you're on duty. If they're lost or damaged because of war, you won't have to pay a deductible.

Average cost of home insurance in WV

Home insurance in West Virginia costs an average of $1,803 per year.

That's more expensive than several bordering states including Virginia, Pennsylvania, Ohio and Maryland. Kentucky, however, does have higher rates.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,216 |

| $350,000 | $1,803 |

| $500,000 | $2,372 |

| $1,000,000 | $4,285 |

Home insurance coverage is also $348 per year cheaper than the national average, which is $2,151.

West Virginia home insurance quotes by city

Star City, a small rivertown just outside of Morgantown, has the cheapest home insurance in West Virginia.

The average rate in Star City is $1,425 per year for $350,000 of dwelling coverage.

Breeden has the most expensive home coverage in the state. It costs an average of $2,623 per year for $350,0000 of dwelling coverage in this rural town near the Kentucky border. Many of the state's most expensive cities for coverage are in that area, while the cheapest towns are in and around the Morgantown metro area.

Cost of WV homeowners insurance by city

City | Annual rate | % from avg |

|---|---|---|

| Accoville | $2,315 | 28% |

| Adrian | $1,710 | -5% |

| Advent | $2,018 | 12% |

| Albright | $1,686 | -6% |

| Alderson | $1,655 | -8% |

Rates are for a policy with $350,000 of dwelling coverage.

Best West Virginia homeowners insurance companies

Erie and USAA have the best home insurance in West Virginia, based on a combination of great customer service, excellent coverage options and affordable rates.

Both companies receive fewer complaints than average, according to the NAIC. , and are rated well by J.D. Power. You can only get USAA if you served or have certain military ties.

Top homeowners insurance companies in WV

Company |

Rating

|

Complaints

|

|---|---|---|

| State Farm | Average | |

| Westfield | Low | |

| Nationwide | Low | |

| Allstate | Average | |

| Progressive | Average |

What homeowners insurance do you need in West Virginia?

Flooding, earth movement related to coal mining and landslides are some of the bigger concerns for homeowners in West Virginia. You should look for coverage that protects your home from events like these.

Does home insurance in West Virginia cover flood damage?

A basic home insurance policy will not cover flood damage, so you'll have to buy a separate flood insurance policy.

Flood insurance can be bought through either the National Flood Insurance Program (NFIP) or through private companies. NFIP policies offer limited coverage, but you can get a locked-in rate. They will also cover damage from mudflow caused by flooding, but usually will not cover damage from a mudslide.

West Virginia ranks 16th in damage covered by the National Flood Insurance Program, despite being the 40th-largest state in the U.S.

Does West Virginia homeowners insurance cover damage from earth movement?

Standard home insurance policies won't cover damage from shifts in the ground caused by heavy mining.

Some companies offer coverage to pay for this damage, which is called mine subsidence insurance. State Farm offers this coverage, but not every company will. So you'll likely have to check when getting a quote for West Virginia house insurance.

You can reach out to the state of West Virginia to find out if local mining means you should look into this coverage.

Does West Virginia homeowners insurance cover damage from landslides?

Your regular home insurance won't cover damage from landslides, which are a notable risk in West Virginia.

If you want protection for your home, you will usually need a DIC policy, which fills in a range of gaps in standard coverage. Landslides are not covered by flood or earthquake coverage.

Between the state's mountainous terrain, a significant history of mining and the risk of flooding, West Virginia is the state most prone to landslides by a significant margin. They can happen almost anywhere in the state.

How to find the best home insurance in West Virginia

The best home insurance for you will match your needs in terms of price, customer service and coverage options. To find the best insurance, start by deciding what kind of coverage you need. Then, compare quotes and customer service ratings from multiple companies.

Decide how much coverage you want. Most home insurance includes the same basic coverages. These will protect the structure of your house as well as your property inside of it.

You might also want additional protections that are not covered under a basic plan. For example, State Farm offers sewer and drain back-up coverage. This means you'll be protected if your home is damaged by a sewer backup or sump pump failure. Make sure to include these optional protections when you get a quote.

Compare rates from multiple companies. Depending on the company, average rates can differ by more than more than $750 per year in West Virginia. So the company you pick can have a big impact on your final bill.

Things like your insurance history, your age, the kind of home you have and your credit score can also have a big impact on your rates. Because quotes are personalized, the cheapest company for someone you know in your neighborhood might not be the cheapest for you.

Check customer service reviews. You'll only see the payoff of good service when something happens, but it can make your life a lot easier at that point.

A company with good customer service will often be easy to contact with helpful employees. You're also more likely to have a smoother claims process and maybe more fair payouts.

A good place to start is looking at ValuePenguin editor's ratings. Our experts weigh customer service ratings from multiple sources, along with a broader picture of the company through its coverage options and rates.

You can also look at ratings from J.D. Power's customer service and claims satisfaction studies and complaint data from the National Association of Insurance Commissioners (NAIC) website.

Frequently asked questions

What is the average cost of homeowners insurance in West Virginia?

The average cost of homeowners insurance in West Virginia is $1,803 per year for $350,000 of dwelling coverage. That's 16% less the national average of $2,151 per year.

Is home insurance required in West Virginia?

West Virginia doesn't legally require you to have home insurance. However, mortgage lenders usually require you to get coverage to get a loan.

Which is the cheapest homeowners insurance in WV?

State Farm has the cheapest home insurance in West Virginia. It has an average rate of $1,050 per year for $350,000 in dwelling coverage. The company has the lowest rates whether your house is only a few hundred thousand dollars to rebuild or more than a million.

Methodology

To find the cheapest home insurance in West Virginia, ValuePenguin collected thousands of quotes from top companies across every ZIP code in the state. Rates are for a 45-year-old married man with good credit and no recent home insurance claims.

Quotes used have a range of coverage limits.

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Home insurance company ratings are based on a combination of the J.D. Power customer satisfaction survey, complaint information from the NAIC and ValuePenguin's own editorial ratings.

ValuePenguin collected insurance rate data using Quadrant Information Services. Rates are sourced from public insurance company filings. They should be used for comparative purposes only, as your quotes might be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.