Best and Cheapest Home Insurance Companies in Ohio for 2024

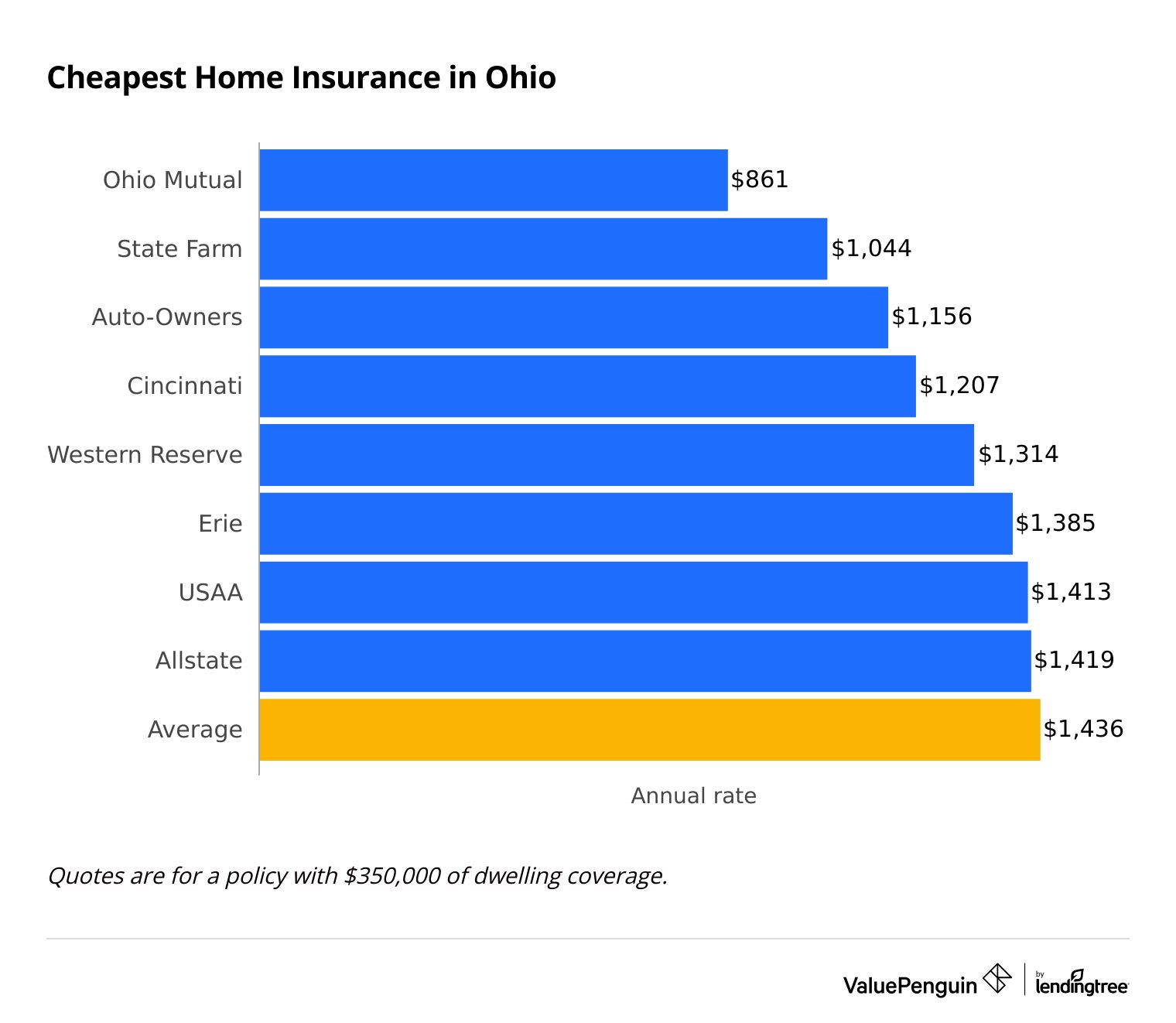

Ohio Mutual has Ohio's cheapest home insurance, with an average rate of $861 per year.

Compare Home Insurance Quotes in Ohio

Best and Cheapest Home Insurance in Ohio

Ohio Mutual, State Farm, and Auto-owners are the top insurance companies in Ohio because they're reliable, affordable, high-quality, and have good customer service.

Average rates are based on thousands of quotes for the largest home insurance companies in Ohio across every residential ZIP code. Rates are for $350,000 in dwelling coverage unless otherwise specified. Full methodology.

Cheapest home insurance quotes in Ohio

Ohio Mutual has the cheapest home insurance in Ohio for most homeowners in the state.

Ohio Mutual home insurance costs about $861 per year for $350,000 in coverage. That's 40% less than the state average. And it's about $183 per year cheaper than State Farm, which is the second cheapest option.

Compare Home Insurance Quotes in Ohio

If you get home insurance with $200,000 in dwelling coverage, Ohio Mutual costs just $599 per year. That's $85 per month. For these more affordable homes, Cincinnati Financial is the next cheapest option, at $722 per year for $200,000 in coverage.

Best cheap homeowners insurance in OH by dwelling coverage amount

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Ohio Mutual | $599 | |

| Cincinnati | $722 | ||

| State Farm | $802 | ||

| Auto-Owners | $833 | ||

| Western Reserve | $898 | |

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Ohio Mutual | $599 | |

| Cincinnati | $722 | ||

| State Farm | $802 | ||

| Auto-Owners | $833 | ||

| Western Reserve | $898 | |

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Ohio Mutual | $861 | |

| State Farm | $1,044 | ||

| Auto-Owners | $1,156 | ||

| Cincinnati | $1,207 | ||

| Western Reserve | $1,314 | |

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Ohio Mutual | $1,117 | |

| State Farm | $1,267 | ||

| Auto-Owners | $1,534 | ||

| USAA | $1,711 | ||

| Cincinnati | $1,732 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Ohio Mutual | $1,589 | |

| Western Reserve | $1,764 | |

| State Farm | $1,925 | ||

| USAA | $2,614 | ||

| Westfield | $2,703 | ||

What home insurance do I need in OH?

Ohio homeowners will have protection from common types of damage — such as wind, hail, vandalism, or theft — with a standard home insurance policy.

You may also need a separate flood insurance policy since home insurance doesn't cover water damage such as if your basement floods after heavy rain or if a nearby river floods your neighborhood.

Cheapest and best home insurance in OH: Ohio Mutual

-

Editor's rating

- Cost: $861/yr

Ohio Mutual has cheap rates, satisfied customers, and good coverage options.

-

About 40% cheaper than average

-

Few customer complaints

-

Helpful local agents

-

Can't get a quote online

-

Not as well known as a national company

Ohio Mutual is the best home insurance for most people in Ohio because of its cheap rates and good customer satisfaction.

Choosing Ohio Mutual will typically save you about 40% on homeowners insurance, based on policies with $350,000 in dwelling coverage.

To make your monthly rate even more affordable, Ohio Mutual offers several great discounts. You can save if you have a new home, new roof, have alarms like a smoke detector, don't have a mortgage, or are a teacher, first responder, or veteran.

Ohio Mutual also has high-quality coverage with good coverage options, helpful independent agents, and about half as many complaints as average.

While Ohio Mutual's website lets you make claims, pay bills and find agents, you can't get instant personalized rates online. However, the mobile app is well-rated, letting you view ID cards as well as pay your monthly bill.

Plus, Ohio Mutual offers a number of add-ons to give you extra protection, including guaranteed replacement for your home, coverage for second homes, and more.

Best home and auto insurance bundle: State Farm

-

Editor's rating

- Cost: $1,044/yr

State Farm has satisfied customers and cheap rates for both home and auto insurance.

-

Affordable home insurance

-

Reliable for paying claims

-

Great for bundling

-

Only a basic set of coverage options

-

May need to talk to an agent to buy a policy

State Farm has the best bundle of home and auto insurance in Ohio, making it a great choice for simplifying coverage.

State Farm's home insurance rates are about 27% cheaper than Ohio's average. And it's the cheapest car insurance company in Ohio for most drivers. These low rates, combined with a bundling discount of around 24% means you'll get a very good deal on coverage.

State Farm is also a high-quality insurance company with good customer service and high satisfaction with the claims process. It also has strong finances to pay claims even after a big disaster.

The downside of State Farm is that its home insurance options are fairly basic. The company offers few coverage extras and discounts. So if you have specific coverage needs for your property, consider Ohio Mutual or Auto Owners.

Best for extra coverage: Auto-Owners

-

Editor's rating

- Cost: $1,156/yr

Auto-Owners offers the best ways to customize your home insurance coverage.

-

Few customer complaints

-

Lots of coverage options

-

Great set of discounts

-

Expensive rates for high-value homes

-

Can't get a quote online

Auto-Owners stands out for its options that protect you and your home from a wide range of possible damages.

You can select coverage options for identity theft, equipment breakdown, guaranteed replacement, water backup, inland flood damage, and extra protection for high-value items. You can also add on a package called "Homeowners Plus" which is a bundle of multiple coverage extras including protection for damage caused by appliance leaks.

Auto-Owners home insurance rates are affordable in Ohio, costing an average of $1,156 per year for $350,000 in coverage

You'll have to pay more for any coverage options that you add. However, the company's many discounts can offset the extra cost. You can save for going paper-free, not having a recent claim, paying in full, getting a quote early, and having smoke detectors. You'll even get a discount if you have a backup generator.

Average home insurance cost in Ohio

The average cost of homeowners insurance in Ohio is $1,436 per year for $350,000 in coverage and $1,015 per year for $200,000 in coverage.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,015 |

| $350,000 | $1,436 |

| $500,000 | $1,889 |

| $1,000,000 | $3,379 |

Ohio is the 14th cheapest state for home insurance, with rates that are 33% less than the average cost of home insurance in the U.S.

How much you pay depends on where you live, the value of your home, the company you choose, and personal details like your credit score and claims history.

Ohio home insurance rates by city

Average home insurance rates can differ by as much as $667 per year based on where you live in Ohio.

In Ohio, the cheapest place for home insurance is Mentor-on-the-Lake near Cleveland, where the average cost is $1,187 per year.

Home insurance is most expensive in Otway in the southern part of Ohio near Portsmouth, where rates average $1,854 per year. With less than 100 residents, this small village was damaged by a tornado in 2012 and had a large portion of land in a flood plain.

Average annual home insurance cost by city

City | Annual rate | % from avg |

|---|---|---|

| Aberdeen | $1,758 | 22% |

| Ada | $1,514 | 5% |

| Adamsville | $1,425 | -1% |

| Addyston | $1,484 | 3% |

| Adelphi | $1,612 | 12% |

Rates are for a policy with $350,000 of dwelling coverage.

Home insurance rates in Ohio's major cities

Among Ohio's larger cities, Akron has the cheapest home insurance at $1,353 per year, and Dayton has the most expensive home insurance at $1,685 per year.

Ohio Mutual is the cheapest company in each city, though how much you save varies

City | Avg cost |

Savings with Ohio Mutual

|

|---|---|---|

| Akron | $1,353 | 39% |

| Columbus | $1,448 | 38% |

| Cleveland | $1,454 | 50% |

| Cincinnati | $1,471 | 30% |

| Toledo | $1,505 | 44% |

| Dayton | $1,685 | 32% |

Average annual cost of home insurance for $350,000 in coverage

The cost of home insurance in Columbus, Ohio is $1,448 per year. That's about average compared to the rest of the state.

Best home insurance companies in Ohio

Erie is the best-rated home insurance company in Ohio because of its great customer service and reliability.

Even though Erie is cheap in many states, its rates are close to average in Ohio. Options like State Farm and Auto-Owners have slightly lower ratings and much cheaper quotes, on average.

Company |

Rating

|

Complaints

|

|---|---|---|

| Erie | Low | |

| USAA | Low | |

| State Farm | Average | |

| Auto-Owners | Low | |

| Cincinnati | Low |

When buying home insurance in Ohio, it's important to choose a company that is well-rated so you can count on them if you have to file a claim. Ths can help you get your home fixed quicker and replace your things that were lost or stolen. Plus, helpful customer service agents can make the process less stressful.

Luckily, Ohio has several home insurance companies that have both high ratings and cheap prices. So you don't necessarily need to pay more to get home insurance from one of the best companies.

What home insurance do I need in Ohio?

Tornados and flash floods cause the most home damage in Ohio.

Home insurance covers damage caused by tornadoes, wind, lightning, and hail.

However, home insurance won't pay for damage caused by flooding. For example, it won't pay for damage if heavy rain causes water in your basement or if a nearby river floods your neighborhood. You'd need a separate flood insurance policy to cover flood damage.

How does home insurance cover tornadoes, wind, and hail?

Wind damage is covered by almost all policies, including direct damage, such as wind ripping siding off of your home, and indirect damage, such as a tree getting blown over and falling on your roof.

Tornado and hail damage is also covered by most home insurance policies. However, many companies have a cosmetic exception, saying that if the damage caused by a storm is only affecting the way the property looks, your policy might not cover the damage.

How to get coverage for flood damage?

Standard homeowners insurance policies won't cover flood damage. Instead, you'll need to get a separate flood insurance policy from a private insurance company or the government's National Flood Insurance Program (NFIP).

The average cost of flood insurance in Ohio is $1,008 per year. Your rates will vary based on how likely your home is to be damaged by a flood.

How save money on Ohio home insurance

The best way to save is by comparing rates from multiple home insurance companies in Ohio.

The companies with the cheapest average rates are usually a good deal for most people. However, each company uses a different method for setting rates. That's why the best deal for you will depend on your address, personal details, and the discounts you qualify for.

Getting multiple quotes at once is easy if you use an independent insurance agent to shop around for a policy for you. Or you can do it yourself by getting online quotes from a comparison website to get multiple home insurance quotes at once.

Compare Home Insurance Quotes in Ohio

Frequently asked questions

How much does home insurance cost in Ohio?

The average cost of home insurance in Ohio is $1,436 per year, or $120 per month, for a policy with $350,000 in coverage. This is around 33% cheaper than the national average of $2,151.

Is home insurance required in Ohio?

No, there isn't a law that requires home insurance in Ohio. However, your mortgage company usually requires home insurance, and it may also require flood insurance if you live in an area that has a high chance of flooding. After you pay off your mortgage, you can choose to cancel your insurance. But that's risky because you could lose all the money you put into your home if there's a fire, tornado, or other disaster.

Who has the cheapest home insurance in Ohio?

Ohio Mutual offers the cheapest home insurance in Ohio at $861 per year or $72 per month for $350,000 in coverage. If you need $200,000 in coverage, Ohio Mutual is still the cheapest company, costing $599 per year or $50 per month.

How much does home insurance cost in Cincinnati?

The average cost of home insurance in Cincinnati is $1,471 per year for $350,000 in coverage. Ohio Mutual is the cheapest company in Cincinnati, costing $1,037 per year. That's a saving of about 30%.

Methodology

The average cost of Ohio home insurance is based on quotes from the top companies across every residential ZIP code in the state. Rates are for a 45-year-old married man with no prior insurance claims. And quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Averages are based on a $350,000 dwelling limit, unless otherwise specified. ValuePenguin used insurance rate data from Quadrant Information Services. Quadrant's rates were publicly sourced from insurer filings and should only be used for comparative purposes.

Home insurance ratings are based on complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey and ValuePenguin's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.