Best Cheap Home Insurance Companies in North Carolina (2024)

State Farm is the cheapest home insurance company in North Carolina, with an average rate of $846 per year.

Find Cheap Home Insurance Quotes in North Carolina

Best cheap home insurance in North Carolina

Average rates are for a home with $350,000 in dwelling coverage, unless otherwise specified.

Our experts also ranked the best insurance companies in NC based on cost, coverage availability, convenience and customer service reviews. Full Methodology

Cheapest options for homeowners insurance in North Carolina

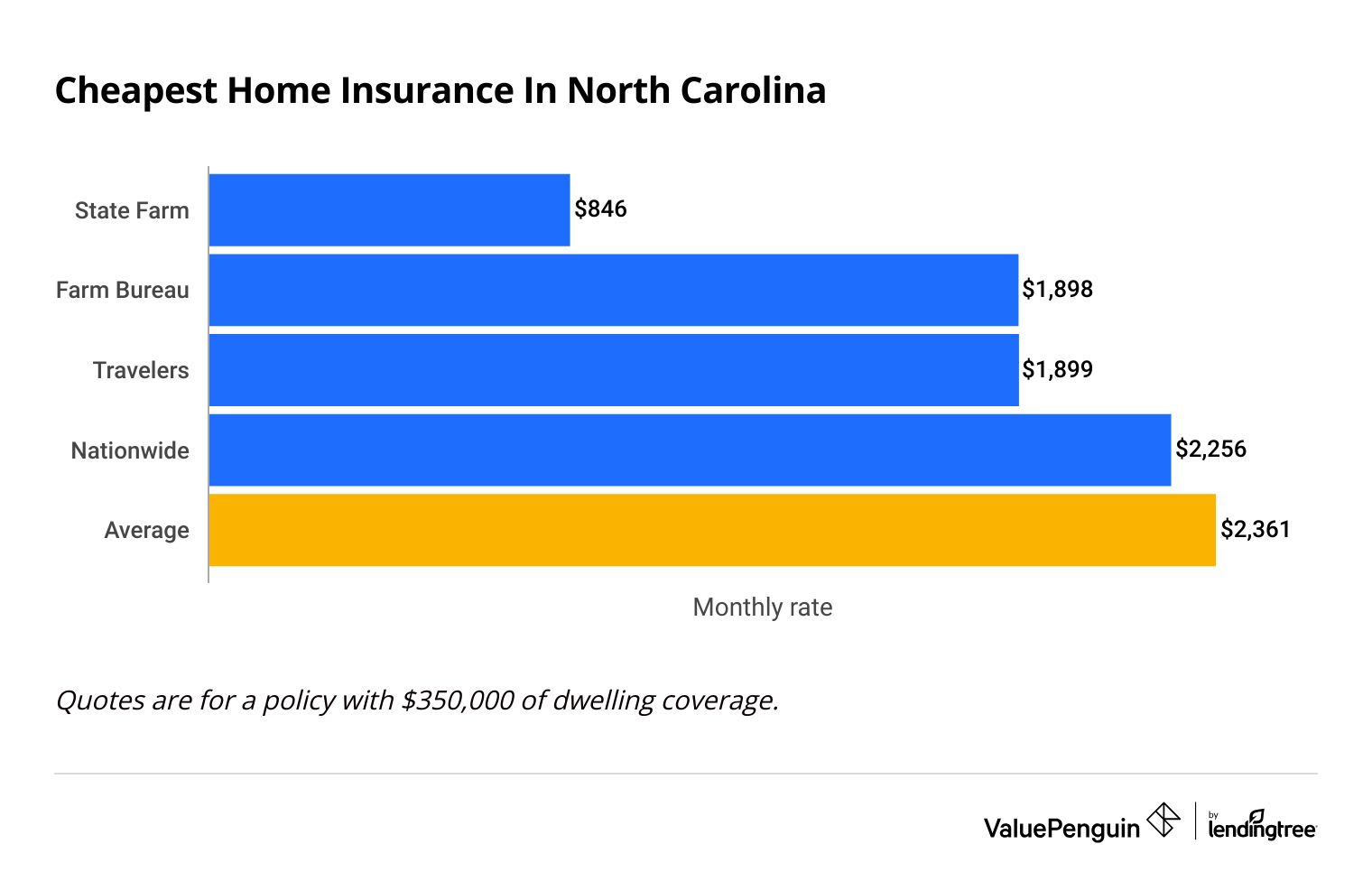

The cheapest home insurance company in North Carolina is State Farm, where a policy costs $846 per year, on average.

That makes State Farm less than half the average rate in North Carolina, which is $2,361 per year. State Farm is also $1,052 per year less expensive than the second-cheapest option, Farm Bureau.

Find Cheap Home Insurance Quotes in North Carolina

Cheap annual home insurance in North Carolina by dwelling coverage

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $621 | ||

| Nationwide | $717 | ||

| Farm Bureau | $1,134 | ||

| Travelers | $1,138 | ||

| Allstate | $1,626 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $621 | ||

| Nationwide | $717 | ||

| Farm Bureau | $1,134 | ||

| Travelers | $1,138 | ||

| Allstate | $1,626 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $846 | ||

| Farm Bureau | $1,898 | ||

| Travelers | $1,899 | ||

| Nationwide | $2,256 | ||

| Allstate | $2,730 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,059 | ||

| Farm Bureau | $2,492 | ||

| Travelers | $2,572 | ||

| Nationwide | $3,091 | ||

| Allstate | $3,588 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,800 | ||

| Farm Bureau | $4,476 | ||

| Travelers | $4,822 | ||

| Allstate | $6,453 | ||

| Nationwide | $6,528 | ||

NC natural disasters

The most common natural disasters in North Carolina are hurricanes and tropical storms, and the flooding that often follows them. These events impact the state every two years, on average, and cause more than three-fourths of the damage.

Areas along the coast are most heavily affected, especially the southeast, where downriver flooding is a risk. Home insurance usually covers damage from hurricane winds, but won't cover damage from flooding. For that, you'll have to buy flood insurance.

Best home insurance overall in NC: State Farm

-

Editor's rating

- Cost: $846/yr

State Farm is the cheapest company in North Carolina and is one of the most reliable companies for customer service and claims.

Pros:

-

Cheap rates

-

Great customer service

-

Lots of local agents

Cons:

-

Can't buy a policy completely

-

Few coverage options and discounts

State Farm offers North Carolina homeowners a great combination of good customer service and cheap coverage. The company has the lowest rates in the state and some of the highest-rated customer service.

A big drawback is you won't have as many options to customize with extra coverages or lower rates with discounts. You also won't be able to add on coverage for equipment breakdown to protect your appliances or service line coverage. However, you can add to your State Farm policy with some extras such as coverage if you rent your home out with Airbnb or if a backed-up drain damages your home.

Best in North Carolina for local agents: Farm Bureau

-

Editor's rating

- Cost: $1,898/yr

Farm Bureau offers the convenience of knowledgeable local agents to answer your questions and has some of North Carolina's cheapest coverage.

Pros:

-

Many local agents who can answer your questions

-

Low rates

-

Well-rated customer service

Cons:

-

Limited set of coverage add-ons

-

No online quotes

Farm Bureau is a strong option for home insurance customers who want great service and an affordable rate. Farm Bureau has a large network of local agents. This puts the company in a better position to provide coverage tailored to match your local needs.

Farm Bureau is the second-cheapest insurance company statewide, but it doesn't have an online quote tool, which means you'll have to speak to an agent to compare rates.

Best home insurance in NC for extra coverage: Travelers

-

Editor's rating

- Cost: $1,899/yr

Travelers offers many ways to add to your policy, but customer service can be mixed.

Pros:

-

Lots of ways to add to your policy

-

Cheaper rates

Cons:

-

Few options for discounts

-

Claims process can be subpar

Travelers stands out as the best home insurance option in North Carolina if you want to add extra protection to your policy. The company has extras like water backup protection or replacement cost coverage for your belongings.

However, Travelers customer service has mixed reviews. Although it gets fewer customer complaints than other insurers of the same size, according to the National Association of Insurance Commissioners (NAIC), Travelers earned a poor customer satisfaction score from J.D. Power. That means homeowners can probably find a better customer service experience elsewhere.

Best for North Carolina military families: USAA

-

Editor's rating

- Cost: $3,419/yr

USAA has military-specific coverages and great customer service, but it can be expensive.

Pros:

-

Basic policy includes extra coverage

-

Great customer service

-

Good option for bundling

Cons:

-

High rates

-

Only available to homeowners with military connections

USAA is a good option if you have ties to the military and don't mind paying a bit more for extra coverage. Its basic policy comes with protections for damaged uniforms and replacement cost coverage, which pays for better versions of your damaged property.

USAA also has strong customer service. It's well-rated by J.D. Power and receives fewer complaints than average. That's a good sign you'll have a smoother and supportive experience if something happens to your home.

The biggest drawback is that USAA is expensive, with rates that are 45% more than average. USAA is also only available to people who are associated with the U.S. military, or who have a current or former USAA member in their family.

Average cost of home insurance in North Carolina

The average cost of home insurance in North Carolina is $2,361 per year for a policy with $350,000 in dwelling coverage.

That ranks as the 14th most expensive state in the county. North Carolina's rates cost 24% more than average, ahead of nearby coastal states like South Carolina and Georgia.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,314 |

| $350,000 | $2,361 |

| $500,000 | $3,155 |

| $1,000,000 | $6,012 |

North Carolina home insurance rates by city

The most expensive city for home insurance in North Carolina is Atlantic Beach, a coastal barrier island with rates more than four times the state average.

The cheapest city in the state for home insurance is Burnsville, a mountain town near the Tennessee border, where the average rate is $1,433.

Cost of North Carolina home insurance by city

City | Annual rate | % from avg |

|---|---|---|

| Aberdeen | $2,021 | -14% |

| Advance | $1,606 | -32% |

| Ahoskie | $2,514 | 6% |

| Alamance | $1,783 | -25% |

| Albemarle | $1,673 | -29% |

Rates are for a policy with $350,000 of dwelling coverage.

The cost of homeowners insurance varies widely depending on where you live in North Carolina. For example, you will likely pay more for coverage if your home is near the coast. That's because it's susceptible to tropical storms, hurricanes and flooding.

Best-rated homeowners insurance companies in North Carolina

USAA and Erie have the best customer service in North Carolina.

Each company scores well in J.D. Power's annual survey for customer satisfaction, and both receive far fewer complaints than average, according to the National Association of Insurance Commissioners. USAA isn't available to everyone; State Farm and Auto-Owners are also good options.

North Carolina home insurance company reviews

Company |

Rating

|

Complaints

|

|---|---|---|

| USAA | Low | |

| Erie | Low | |

| State Farm | Average | |

| Auto-Owners | Low | |

| Farm Bureau | High |

Biggest home insurance risks in North Carolina

Hurricanes are the biggest worry when it comes to your homeowners insurance in North Carolina. Each year, homes in the Tar Heel State suffer millions of dollars in damage from high winds and flooding. However, lightning strikes also cause major losses to North Carolina homeowners.

Hurricanes and flood insurance in North Carolina

Hurricanes and tropical storms are common occurrences in North Carolina, with an average of more than two tropical storms per year and a hurricane about every five to seven years. Because hurricanes and floods can be devastating one year and not the next, the best policy is to have active insurance coverage at all times.

Does NC home insurance cover wind damage?

Wind damage from hurricanes and storms is almost always covered as part of your standard homeowners insurance. This includes things like shingles falling off the roof and trees being uprooted.

However, you should always confirm this by reading your coverage details. If you live in an area companies see as high risk, they may exclude wind damage from your regular policy and require you to buy it as an extra coverage.

Does NC home insurance cover flooding?

Flood damage is never covered by standard home insurance. Floods can be extremely expensive for insurers when they occur, damaging thousands of insured properties at the same time.

If you're in a high-risk flood zone, you should consider buying a separate flood insurance policy through the government-sponsored National Flood Insurance Program (NFIP) or a private flood insurer.

Lightning strikes in North Carolina

Lightning strikes on private property are also responsible for thousands of claims in North Carolina every year.

On average, insurance claims involving lightning cost North Carolina homeowners just over $11,500 per incident. The most serious incidents involve fires started by a lightning strike, while the most common are usually ground surges that overload electronics and appliances plugged into the home.

Homeowners insurance covers most kinds of damage that lightning can inflict on your property. However, the amount you actually get from insurance for lightning-related losses depends on your ability to prove the cause of damage. This can be easier for fires or stricken trees than for ground surges.

Tips to lower your North Carolina home insurance rates

The three best ways to lower what you pay for home insurance in North Carolina are to compare quotes, change your coverage or look for discounts.

Getting quotes from companies is the best way to lower what you pay for home insurance coverage.

The difference between the cheapest and most expensive home insurance companies is $3,947 per year . That difference in quotes shows why you should shop around every year or two.

Almost every company will offer a number of discounts that will lower your home insurance rates.

One of the best ways to money is bundling home insurance with cheap car insurance in North Carolina. Other discounts are available for things like repairing your roof with stronger materials or putting in a home security system.

A slightly riskier way to lower home insurance rates is to reduce your coverage limits or raise your deductible.

Lowering your coverage and shedding extra protections will save you money. But it also means your insurance will pay less if your home is significantly damaged and may not cover anything after some disasters. You should still have enough coverage to pay for rebuilding your home and replacing your belongings if a disaster happens.

When you have a higher deductible, you'll get less from your insurance company when your home is damaged. This also means it won't be worth it to file some claims. One key thing is that you'll want a deductible you can easily afford in an emergency.

Frequently asked questions

How much is the average home insurance in NC?

The average price of home insurance in NC is $2,361 per year for $350,000 in coverage. That makes it the 14th-most expensive state of coverage.

What is the cheapest home insurance in NC?

State Farm has the cheapest home insurance in North Carolina. The company's average rate is $846 per year for $350,000 in coverage. It's also the cheapest option for more expensive and cheaper homes.

Is homeowners insurance required in North Carolina?

Homeowners insurance is not required in North Carolina. But you will need coverage to get a mortgage. This is because your lender will own part of the house and wants to make sure it doesn't lose value before your loan is paid off

Does Progressive do home insurance in North Carolina?

Progressive sells home insurance in North Carolina, but it's underwritten by a partner company, Homesite. Policies from Homesite tend to be expensive, and the company has a poor customer service reputation.

Methodology

To find the cheapest home insurance in North Carolina, ValuePenguin collected quotes from every ZIP code in the state for most of the state's top companies. Rates are for a 45-year-old man with no insurance claims and a range of coverage limits.

The specific insurers we covered included:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Ratings for the best home insurance companies in North Carolina used data from the National Association of Insurance Commissioners and J.D. Power, alongside internal research and analysis.

This analysis used insurance rate data from Quadrant Information Services. We publicly sourced these rates from insurer filings, which means they should only be used for comparative purposes. Rates you request for your own coverage may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.