The Best and Cheapest Home Insurance Companies in Illinois in 2024

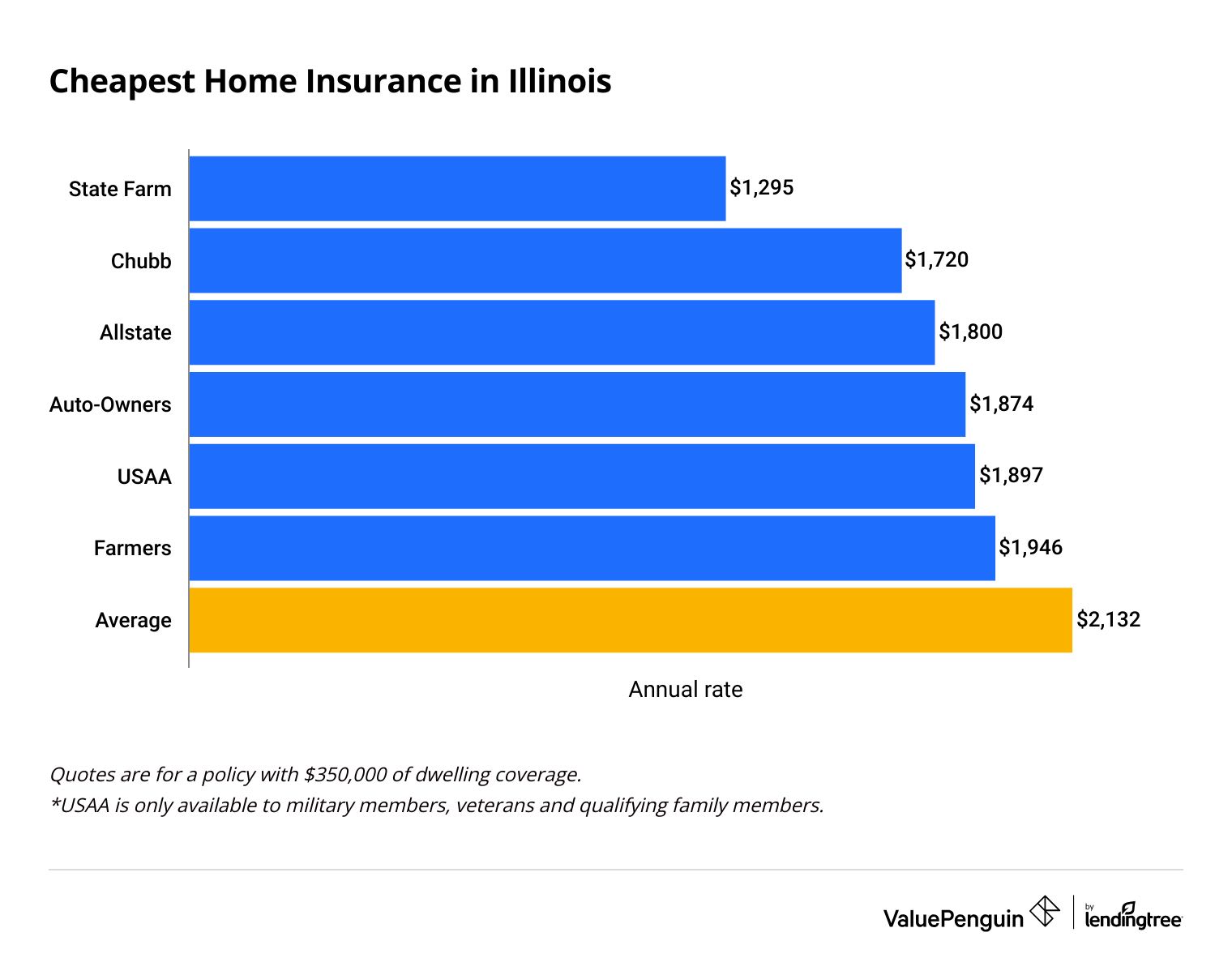

State Farm has the cheapest homeowners insurance in Illinois, with an average price of $1,295 per year.

Compare Home Insurance Quotes in Illinois

Best Cheap Home Insurance in Illinois

ValuePenguin gathered home insurance quotes for top companies in more than a thousand ZIP codes in Illinois. Each company's rates, customer service, coverage options, discounts and third-party ratings were considered when choosing the best options. Full methodology.

Cheapest home insurance companies in Illinois

State Farm has the cheapest home insurance in Illinois no matter how much coverage you need.

A policy with $350,000 in dwelling coverage costs $1,295 per year, on average. That's more than $800 cheaper than the state average.

Compare Home Insurance Quotes in Illinois

Chubb is a good choice if you have an expensive or luxury home. It's cheap and has coverage options specifically for expensive houses. In addition to price, consider a company's coverage options, discounts and customer service when you choose a policy.

Cheapest home insurance in Illinois

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $962 | ||

| Chubb | $1,271 | ||

| Farmers | $1,315 | ||

| USAA | $1,342 | ||

| Auto-Owners | $1,411 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $962 | ||

| Chubb | $1,271 | ||

| Farmers | $1,315 | ||

| USAA | $1,342 | ||

| Auto-Owners | $1,411 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,295 | ||

| Chubb | $1,720 | ||

| Allstate | $1,800 | ||

| Auto-Owners | $1,874 | ||

| USAA | $1,897 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,564 | ||

| Allstate | $2,217 | ||

| Chubb | $2,228 | ||

| USAA | $2,327 | ||

| Auto-Owners | $2,347 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $2,353 | ||

| USAA | $3,685 | ||

| Allstate | $3,726 | ||

| Chubb | $4,233 | ||

| Farmers | $4,962 | ||

What kind of home insurance coverage do I need in Illinois?

Illinois gets hit by heavy wind, rain and snow. Your home insurance usually covers damage from these events automatically, but it's a good idea to talk to your agent to be sure.

Some parts of Illinois also sit on top of abandoned mines. These mines can collapse and damage the homes above them. You need a special add-on coverage, called mine subsidence coverage, for this type of damage.

Cheapest Illinois home insurance rates: State Farm

-

Editor's rating

- Cost: $1,295/yr

State Farm has cheap home insurance in IL, plus local agents for support.

Pros:

-

Cheapest rates in Illinois

-

Lots of local agents

-

Cheap auto insurance for bundling

Cons:

-

Few extra coverage options

-

Fewer discounts vs. other companies

State Farm is the best home insurance in Illinois for most people since its rates are cheap and it has good service. The company's average rate is about 39% cheaper than the state overall. Plus, State Farm has agents in more than 200 cities in Illinois. Having a local agent can help you choose the right coverage and can make managing your insurance easier.

State Farm also has cheap car insurance in Illinois, which makes it a great option for bundling.

But State Farm doesn't have as many add-on coverage options or discounts compared to other companies, so personalizing your policy can be difficult. Notably, you might not be able to get as much water backup coverage as you can with other companies. This add-on gives you cover if your sump pump fails and water backs up into your basement.

Best Illinois home insurance for customer service: Erie

-

Editor's rating

- Cost: $2,633/yr

Erie is great if good service and good coverage are your biggest priorities.

Pros:

-

Excellent customer service

-

Base policy includes extra coverage

-

Local agents available

Cons:

-

Expensive rates

-

No online quotes

Erie has the best home insurance in Illinois when it comes to good customer service. Erie only gets half the complaints expected for a company its size, according to the National Association of Insurance Commissioners (NAIC). That means that Erie's customers are usually satisfied with their experience.

Customer satisfaction is important when choosing home insurance. Good service can make filing a claim and getting your home repaired easier.

But Erie's rates are expensive, and you can't get quotes online. The company's mobile apps aren't well rated, either. If you want a company with strong digital tools, Erie isn't a good fit.

Best home insurance coverage options in Illinois: Auto-Owners

-

Editor's rating

- Cost: $1,874/yr

Auto-Owners has plenty of add-ons to customize your coverage.

Pros:

-

Cheap rates

-

Lots of extra coverage options

-

Several discounts

Cons:

-

No online quotes

Auto-Owners has a long list of extra coverage options to help you build a policy that fits your needs. One of the most helpful is inland flood coverage, which you can add if you live in a low- or moderate-risk flood zone. Usually, you have to buy a separate flood insurance policy to cover flood damage. Having coverage on your home insurance policy makes things easier if you have to file a claim.

Auto-Owners also offers water backup coverage, guaranteed home replacement cost, equipment breakdown coverage and many more add-ons. And you can lower your rate by paying your bill all at once, going paperless, having a water shutoff system, having an automatic generator and more.

But you can't get Auto-Owners quotes online. If you prefer to shop, buy and manage your policy yourself online, you probably won't like Auto-Owners.

Best home insurance in Illinois for military families: USAA

-

Editor's rating

- Cost: $1,897/yr

USAA has cheap rates and great service for military members.

Pros:

-

Cheap rates

-

Basic policy includes extra features

-

Excellent customer service

Cons:

-

Only available to military, veterans and families

If you qualify, USAA is one of the best options for Illinois home insurance. The company's average rate is $235 per year less than the state average. And USAA has just one-third the number of complaints than an average company its size, according to the NAIC. Most people who have coverage with USAA are happy with their experience.

USAA's homeowners insurance comes with replacement cost coverage at no extra cost. With replacement cost coverage, you'll be reimbursed for the full cost to replace damaged or destroyed property, without factoring in depreciation. Usually, you'd have to pay extra to upgrade to this coverage with other providers. It also offers some extras that appeal to people in the armed forces, such as a $0 deductible on your uniform while you're on active duty.

However, USAA is only available to activity-duty military members, veterans and certain family members. If you don't fall into one of these groups, you won't be able to buy coverage.

Average cost of home insurance in Illinois

Illinois home insurance costs $2,132 per year for $350,000 in dwelling coverage.

It costs more to insure a home in Illinois than it does in nearby Michigan or Wisconsin, where rates are $1,783 and $1,394 per year on average, respectively.

Illinois is likely more expensive since it is more likely to be hit by high winds and tornadoes than the surrounding states. Rates are about the same in Indiana and Iowa, which also experience strong storms. But it costs more to insure a home in Missouri, where the average rate is $3,031 per year.

Average cost of home insurance in Illinois by dwelling amount

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,498 |

| $350,000 | $2,132 |

| $500,000 | $2,775 |

| $1,000,000 | $4,844 |

The more coverage you need, the more you'll pay for home insurance. That's because higher-value homes cost more to repair. So if a high-value home is damaged, the insurance company has to pay more to fix it. Companies charge a higher rate to compensate.

Average home insurance cost in Illinois by city

Naperville has the cheapest home insurance in Illinois, with an average cost of $1,802 per year

Homeowners in Chicago pay an average of $2,496 per year for home insurance. That's about 17% more than the state average. But Thebes, a riverside village in the southwestern tip of the state, has the most expensive average rates. A policy with $350,000 in dwelling coverage costs an average of $2,736 per year.

City | Annual rate | % from avg |

|---|---|---|

| Abingdon | $2,069 | -3% |

| Adair | $2,205 | 3% |

| Addieville | $2,390 | 12% |

| Addison | $1,870 | -12% |

| Albany | $1,964 | -8% |

Rates are for a policy with $350,000 of dwelling coverage.

The cost of homeowners insurance changes depending on where you live. You might see a high cost to insure your home if you live in a rural area with no fire department nearby or if break-ins are common. Your rates will also be higher if you live in an area where damage is more common.

Best-rated homeowners insurance companies in Illinois

Erie and USAA are the highest-rated home insurance companies in Illinois.

Both companies have excellent customer satisfaction and good coverage. Erie's rates are expensive, but it might still be a good option if you value service and a local agent. USAA is only available to military members, veterans and certain family members.

Company |

Rating

|

Complaints

|

|---|---|---|

| Erie | Low | |

| USAA | Low | |

| Auto-Owners | Low | |

| State Farm | Average | |

| American Family | Low |

What type of home insurance do I need in Illinois?

Homes in Illinois have to withstand heavy winds, rain, hail, cold temperatures and flooding. Home insurance covers a lot of types of damage, but it doesn't cover everything. It's a good idea to know what things are most likely to damage your home, and to review your coverage with your agent or company.

Does Illinois home insurance cover floods?

Homeowners insurance doesn't cover flood damage. You have to buy a separate flood insurance policy to have coverage for flooding.

Flooding is especially common in western and northern Illinois, including around Chicago, but it can happen anywhere. If you own a house, check what flood zone you're in using the flood map tool from the Federal Emergency Management Agency (FEMA).

Does Illinois home insurance cover tornadoes?

Home insurance usually covers damage from tornadoes. That includes wind, hail and water damage.

Illinois recorded 136 tornadoes in 2023, the most of any state. Most home insurance policies automatically cover wind damage, but you should talk to your company to be sure. You might have a separate deductible for wind or hail damage, and it's a good idea to know how much you'll have to pay if you file a claim.

Does Illinois home insurance cover mine subsidence?

Home insurance might cover mine subsidence, but only if you have an optional add-on coverage. Mine subsidence happens when the ground above an underground mine shifts or collapses, causing damage to the land, homes and buildings above it.

More than 330,000 homes in Illinois are built above mines and could be at risk for damage. Home insurance doesn't automatically cover mine subsidence. But insurance companies are often required to offer you the coverage, and you can always ask your company or agent to add it to your policy.

How to save on Illinois home insurance

Shopping around and comparing home insurance quotes is the best way to get cheap home insurance in Illinois.

But you can save in other ways, too. Taking advantage of discounts might save you hundreds of dollars each year.

Update your roof: If you get a new roof, be sure to let your home insurance company know. Newer roofs can withstand wind, rain and hail better than older roofs. Because the risk of damage is lower, insurance companies often give you a discount.

Bundle your policies: Get quotes for your auto and home insurance with the same company. Bundling discounts are usually some of the biggest you can find. Plus, it's often easier to have all your insurance policies with one company if you need to make changes or file a claim.

Install an alarm system: Most insurance companies will give you a discount if you have an alarm system, especially if it automatically calls the police when it's set off. Alarms can give you peace of mind, too, since they can help lessen the damage from theft, vandalism and fire.

Frequently asked questions

How much is house insurance per month in Illinois?

Home insurance costs $178 per month in Illinois, on average, for a policy with $350,000 in dwelling coverage. That comes out to $2,132 per year. But several home insurance companies have cheaper rates, including State Farm, Chubb and Allstate.

What is the cheapest home and auto insurance in Illinois?

State Farm has the cheapest home insurance in Illinois, and it also has cheap car insurance rates in the state too. If you want to bundle your policies, State Farm is a good choice.

Is homeowners insurance required in Illinois?

Illinois doesn't require home insurance like it requires car insurance. But if you have a mortgage on your home, you'll need to buy a home insurance policy. Even if your home is paid off, home insurance is a good idea. Home damage can be expensive, and home insurance helps protect your finances from unexpected repair bills.

Methodology

To find the best and cheapest home insurance in Illinois, ValuePenguin got quotes from the state's largest home insurance companies across all ZIP codes. The quotes are for a 45-year-old married man with no claims as a homeowner and the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin used Quadrant Information Services to get the quotes. Quadrant gets rates from publicly-available insurance company filings. Keep in mind that prices vary based on a number of underlying factors. Your quotes will likely be different.

Reviews of the best Illinois home insurance companies use average rates, coverage options, discounts, customer complaint numbers from the National Association of Insurance Commissioners (NAIC), scores from J.D. Power's home insurance customer satisfaction survey and our experts' own editorial ratings.

Other sources include the Federal Emergency Management Agency (FEMA), the Illinois State Geological Survey (ISGS), the Storm Prediction Center, the University of Illinois Coal Mine Viewer and home insurance company websites.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.