Best Cheap Health Insurance in Oklahoma (2025)

Blue Cross and Blue Shield of Oklahoma is the best health insurance company in Oklahoma. Silver plans start at $485 per month before discounts.

Find Cheap Health Insurance Quotes in Oklahoma

Best and cheapest health insurance in Oklahoma

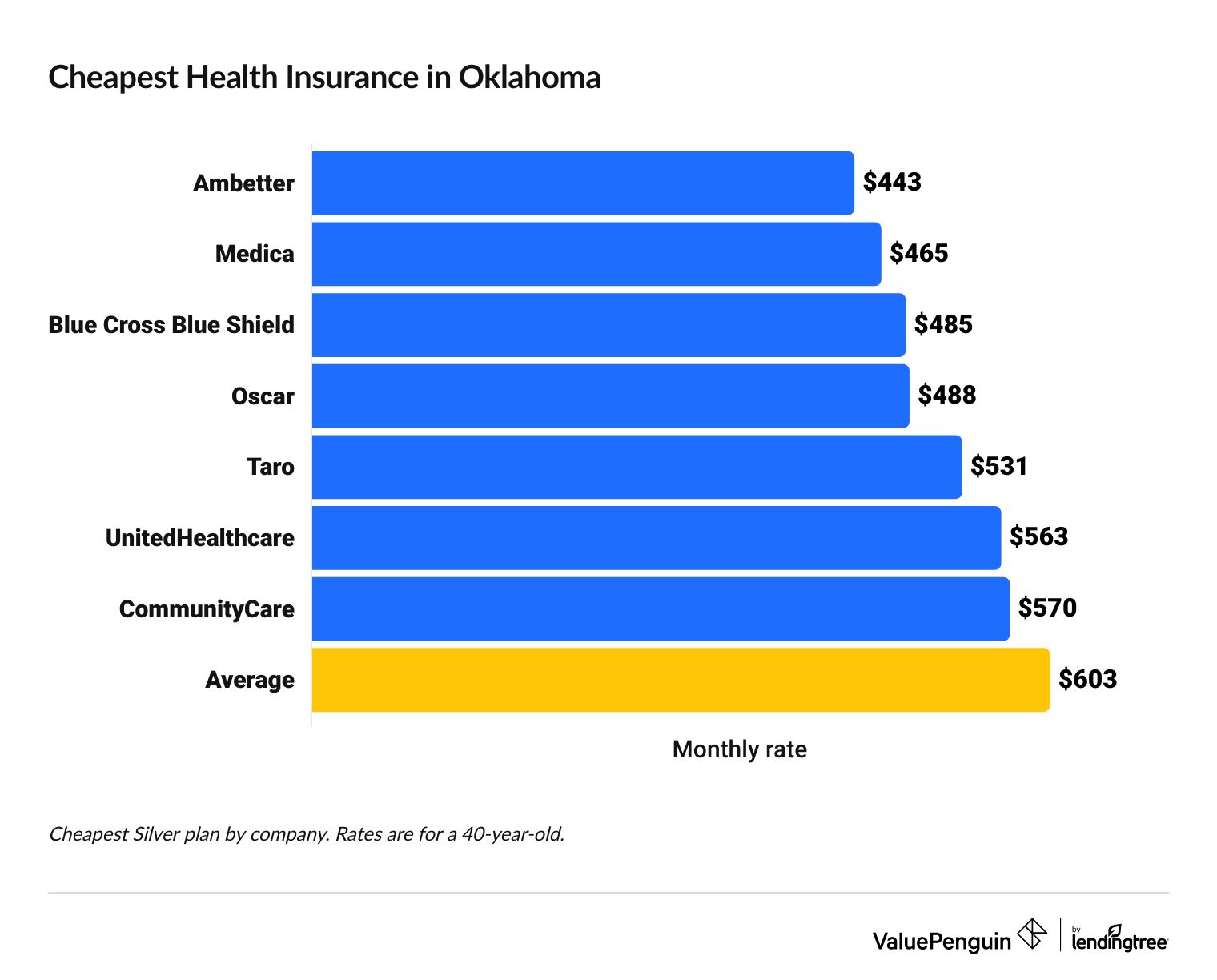

Cheapest health insurance companies in Oklahoma

Ambetter has the most affordable health insurance in Oklahoma, at $443 per month before discounts.

Find Cheap Health Insurance Quotes in Oklahoma

Affordable health insurance in Oklahoma

Company |

Cost

| |

|---|---|---|

| Ambetter of Oklahoma | $443 - $598 | |

| Medica | $465 - $682 |

| Blue Cross and Blue Shield of Oklahoma | $485 - $938 | |

| Oscar Insurance Company | $488 - $524 | |

- Ambetter has the cheapest health insurance for about three-quarters of all Oklahomans. The company also sells the most affordable health insurance plans in Oklahoma City.

- Blue Cross Blue Shield (BCBS) offers the most affordable medical insurance to about one out of 10 people in Oklahoma. However, BCBS has the cheapest rates in close to one-third of Oklahoma counties.

Best health insurance companies in Oklahoma

Blue Cross and Blue Shield of Oklahoma is the best health insurance in Oklahoma for most people.

Blue Cross and Blue Shield of Oklahoma gets significantly fewer complaints than an average insurance company its size.

Plus, the company has a good 3-out-of-5-star rating from HealthCare.gov. These ratings measure customer satisfaction, coverage and plan management.

Best-rated health insurance companies in Oklahoma

Company |

Editor rating

|

ACA rating

|

|---|---|---|

| Blue Cross and Blue Shield of Oklahoma | 3.0 | |

| CommunityCare | 3.0 | |

| Taro Health Plan | NA | |

| Ambetter of Oklahoma | 2.0 | |

| UnitedHealthcare | NA |

Find Cheap Health Insurance Quotes in Oklahoma

- Blue Cross Blue Shield and CommunityCare have the best-rated plans in Oklahoma, each with 3 out of 5 stars from HealthCare.gov. Both companies got a perfect 5-out-of-5-star rating on member experience, but a low-2-out-of-5-star score on medical care quality.

- UnitedHealthcare has a strong reputation for customer satisfaction. However, the company is too new to the Oklahoma market to be rated by HealthCare.gov.

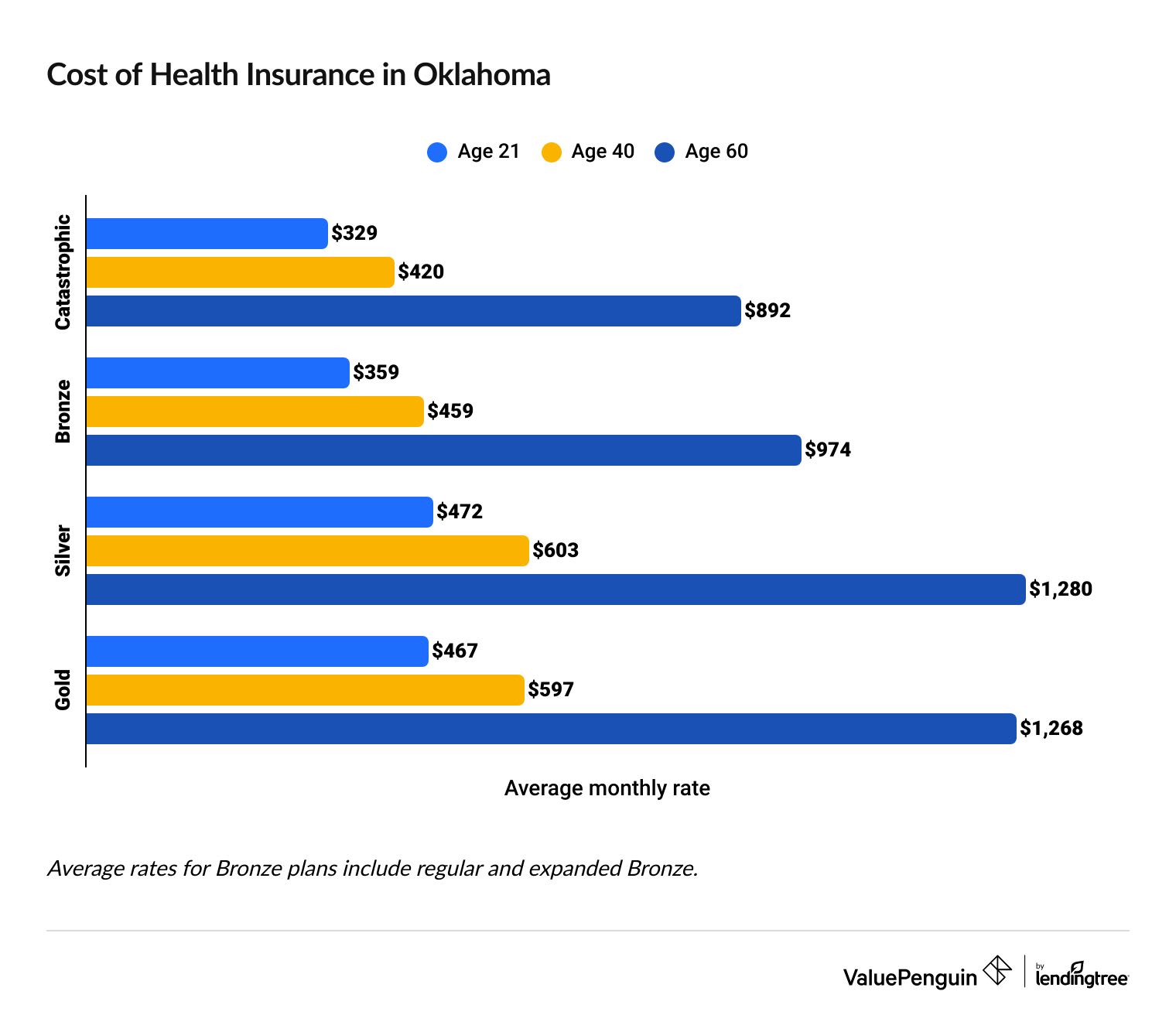

How much is health insurance in Oklahoma per month?

Health insurance in Oklahoma costs an average of $603 per month or $57 per month after discounts.

- Higher plan tiers typically have more expensive monthly costs. In Oklahoma, Gold plans cost $138 per month more than Bronze plans, on average. But, you'll pay less when you go to the hospital with a Gold plan.

- Silver plans actually cost slightly more than Gold plans in Oklahoma, on average. That's because you can qualify for extra discounts, called cost-sharing reductions (CSRs), with Silver plans. Rates rise sharply as you enter middle age. In Oklahoma, a 60-year-old typically pays more than twice as much as a 40-year-old for the same level of coverage.

Save on Oklahoma health insurance with discounts

Discounts can save you hundreds of dollars per month on your Oklahoma health insurance.

Almost everyone who has an Oklahoma health insurance marketplace plan qualifies for discounts, called subsidies or premium tax credits.

The size of your discount depends on your household income: The less you make, the larger your discount. Over half of all Oklahomans with marketplace plans pay less than $10 per month for coverage.

Discounts only apply to Bronze, Silver and Gold health plans bought through HealthCare.gov.

You may qualify for discounted health insurance if you make between about $16,000 and $60,000 per year (roughly $35,000 to $125,000 for a family of four). If you make around $21,000 or less ($44,000 for a family of four) you may qualify for free government health insurance, called Medicaid.

Cheap health insurance in Oklahoma by city

Ambetter has the cheapest rates for Oklahoma City with plans starting at $443 per month.

Blue Cross and Blue Shield of Oklahoma has the most affordable coverage in Tulsa. Plans cost as little as $458 per month.

Cheapest health insurance by OK county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Adair | Medica Silver Share | $599 |

| Alfalfa | Ambetter of Oklahoma Standard Silver | $483 |

| Atoka | Medica Silver Share | $599 |

| Beaver | BCBS Blue Advantage Silver | $618 |

| Beckham | Medica Silver Share | $599 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Oklahoma

Best health insurance by plan tier

Higher plan tiers are better for people who need more medical care. Healthy people who rarely go to the hospital are typically better off with a lower plan tier.

Plan tiers have to do with how you pay for medical care. Gold plans have high monthly rates, but you pay less when you go to the doctor or hospital. Bronze plans have the cheapest monthly rates, but you'll pay a lot more for care.

Silver plans balance affordable rates with middle-of-the-road costs you're responsible for paying.

Gold plans: Best if you have expensive medical needs

| Gold plans pay for about 80% of your medical care. |

Consider a Gold plan if you need expensive or ongoing medical treatment.

Gold plans are a good choice for people who have a serious illness or disability, such as cancer or heart disease. That's because with a Gold plan, you pay relatively little out-of-pocket before coverage starts, also known as your deductible.

Plus, Gold plans have a low annual cap on the total costs you're responsible for when you visit the doctor, called an out-of-pocket maximum.

Because Gold plans have expensive monthly rates, you would need to get a lot of medical care for this plan tier to make good financial sense.

The average Gold plan in Oklahoma costs $597 per month before discounts and has a $1,234 deductible.

Silver plans: Best for average medical needs

| Silver plans pay for about 70% of your medical care. |

Silver health plans offer a good balance between affordable rates and reasonable costs when you get medical care.

Silver health plans are a good choice for people with average medical needs. You should also consider a Silver health plan if you earn less than $37,650 per year ($78,000 per year for a family of four) because you can qualify for extra discounts.

Silver plans in Oklahoma cost $603 per month and have a $4,299 deductible on average.

Bronze plans: Best if you're healthy and have savings

| Bronze plans pay for about 60% of your medical care. |

Bronze plans have cheap average rates, but high costs that you're responsible for paying when you go to the doctor. That makes Bronze plans a good choice for healthy people who can afford a large, unexpected bill. With a Bronze plan, you'll pay thousands of dollars more out of pocket before coverage starts than with a Silver plan. This is something to consider should you get into a bad accident or become seriously ill.

In Oklahoma, Bronze plans cost $459 per month and have a $5,884 deductible on average.

Catastrophic plans: Best to prevent financial disaster

Catastrophic plans are only available to those younger than 30 and people who can't afford a higher plan tier.

Catastrophic plans have cheap rates, but very high deductibles.

With a Catastrophic plan, you will need to pay $9,200 from your own savings before most coverage starts.

Catastrophic plans are usually a poor choice. In addition to their high deductibles, these plans aren't eligible for discounts. That means you're almost always better off with a higher plan tier.

Catastrophic plans in Oklahoma cost an average of $420 per month with an average deductible of $9,200.

Extra discounts and free health insurance options in Oklahoma

Oklahomans who earn a low income may qualify for extra discounts or free health coverage.

Medicaid: Best for free health insurance in Oklahoma

You may qualify for free health insurance from the government, called Medicaid, if you earn about $21,000 per year or less ($44,000 per year or less for a family of four).

You may qualify for Medicaid at a higher income level if you're pregnant or disabled.

Silver plans with cost-sharing reductions: Best for those who don't qualify for Medicaid

| Silver plans will pay 73% to 94% of your medical costs if you have a low income. |

You may qualify for extra discounts, called cost-sharing reductions (CSRs), if you earn less than $37,650 per year and you have a Silver health plan.

Cost-sharing reductions cover up to 94% of the costs you're responsible for paying when you visit the doctor. That means you could save thousands of dollars per year with CSRs.

Are health insurance rates going up in OK?

The cost of health insurance in Oklahoma decreased by 1% overall between 2024 and 2025.

Bronze plans decreased by 5%, on average, Silver plans increased by 1% and Catastrophic plans rose by 5%. Gold plans had the smallest average decrease, at 2%.

Are health insurance rates going up in OK?

Tier | 2024 | 2025 | Change |

|---|---|---|---|

| Catastrophic | $400 | $420 | 5% |

| Bronze | $484 | $459 | -5% |

| Silver | $596 | $603 | 1% |

| Gold | $611 | $597 | -2% |

Monthly costs are for a 40-year-old.

Plans bought through the Oklahoma health insurance marketplace offer several important protections and benefits.

All Obamacare plans in Oklahoma are required to cover 10 essential benefits.

- Hospital care

- Outpatient care

- Emergency care

- Care for pregnant women and newborns

- Services for mental health and substance use disorders

- Prescription drugs

- Laboratory services

- Coverage for babies

- Rehabilitation services and devices

- Preventive, wellness and ongoing disease services

Short-term plans and supplemental policies don't have to cover these services.

Oklahoma health insurance exchange plans also cap the amount of money you'll pay for prescriptions and services each year, called an out-of-pocket maximum.

Finally, companies can't use your health history when determining rates or approving coverage. That means you'll never get turned down or charged a higher price for a marketplace plan even if you have a serious illness or disability.

Average cost of health insurance by family size in Oklahoma

It costs $361 per month for a family to add a child to their health insurance plan in Oklahoma.

That means a single parent with a child pays an average of $963 per month before discounts for coverage in Oklahoma. A family of four with two adults and two children pays an average of $1,205 per month.

It's important to remember that the size of your discount depends on your household size and income. The more people in your household, the more you can earn and still qualify for discounts.

Family size | Average monthly cost |

|---|---|

| Individual | $603 |

| Individual + Child | $963 |

| Couple, age 40 | $1,205 |

| Family of three | $1,566 |

| Family of four | $1,927 |

Averages based on a Silver plan for 40-year-old adults and children who are under age 15.

A family of four in Oklahoma can earn up to about $125,000 and still qualify for discounts.

Average cost of health insurance in Oklahoma by plan type

Oklahoma residents can choose between two types of health insurance: HMOs and PPOs. HMOs are cheaper but offer less flexibility when it comes to choosing your doctor. PPOs typically cost more, but they give you greater freedom when it comes to choosing your doctor.

- HMOs (health maintenance organizations) plans restrict you to a network of doctors. You have to choose a primary care doctor and you need a referral before you can see a specialist. These plans tend to have cheaper rates.

- PPO (preferred provider organization) plans don't require that you choose a primary care doctor and you don't need a referral to see a specialist. You can also see doctors outside your network for a higher cost. PPOs typically cost more than HMOs, which is their major drawback.

Type | Cost |

|---|---|

| HMO | $585 |

| PPO | $611 |

Monthly costs are for a 40-year-old with a Silver plan.

Short-term health insurance in OK

You can buy short-term health insurance for an initial term of up to three months in Oklahoma.

You can renew your coverage for an additional month, for a total of four months in a 12-month period. That is the maximum coverage allowed during that period. You would then need to wait at least eight months before you can buy another short-term plan.

Short-term plans should only be used to help you bridge a temporary coverage gap if you're outside open enrollment and you don't qualify for a special enrollment period. Otherwise, these plans are generally a bad choice because they don't offer the same level of coverage as marketplace plans.

Before September, you could stay on them for up to a year. Now, short-term plans only work as a stop gap.

Pros of short-term health insurance in OK

Cons of short-term health insurance in OK

Short-term health plans sold before Sept. 1, 2024, can last for up to 364 days and you can renew your coverage for up to three years.

Frequently asked questions

Who has the best health insurance in Oklahoma?

Blue Cross and Blue Shield of Oklahoma has the best health insurance in Oklahoma. The company has a good reputation for customer satisfaction and cheap rates.

What's the cheapest health insurance in Oklahoma?

Ambetter has the cheapest health insurance in Oklahoma. Silver plans start at $443 per month before discounts for a 40-year-old.

How much is health insurance in Oklahoma?

In Oklahoma, health insurance costs an average of $603 per month without discounts, called subsidies, or $57 per month after discounts, on average. Roughly 96% of Oklahomans with marketplace coverage qualify for subsidies.

Methodology

Oklahoma health insurance rate data for 2025 is from the Centers for Medicare & Medicaid Services (CMS) website. ValuePenguin used the CMS public use files (PUFs) to find average rates for different plan tiers and counties. Only plans and insurance companies for which county-level data was included in the CMS Crosswalk file were used in our analysis.

Rates are for a 40-year-old with a Silver plan, unless otherwise noted. Other sources include S&P Global Capital IQ, NAIC (National Association of Insurance Commissioners) and the Oklahoma Health Care Authority.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.