Best Cheap Health Insurance in Hawaii (2025)

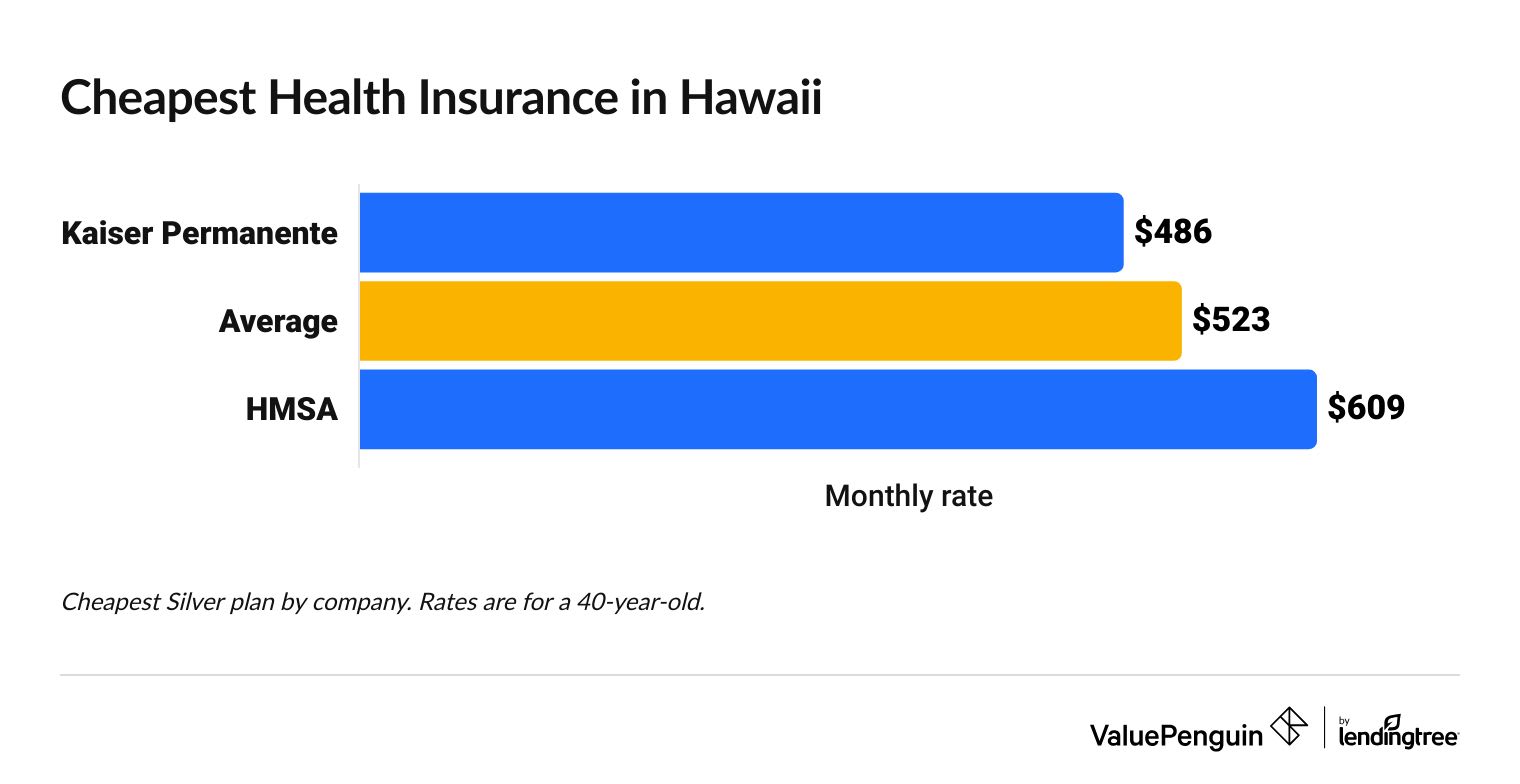

Kaiser Permanente is the best health insurance company in Hawaii. Silver plans from Kaiser start at $486 per month before discounts.

Find Cheap Health Insurance Quotes in Hawaii

Best and cheapest health insurance in Hawaii

Cheapest health insurance companies in Hawaii

Kaiser Permanente sells the cheapest health insurance in Hawaii, with Silver plans starting at $486 per month.

Find Cheap Health Insurance Quotes in Hawaii

Affordable health insurance in Hawaii

Company |

Cost

| |

|---|---|---|

| Kaiser Permanente | $486 - $502 | |

| HMSA | $609 | |

- Kaiser Permanente sells the cheapest plans throughout Hawaii. But Kaiser makes you use certain doctors and hospitals, which limits where you can get medical care.

- If you want the flexibility to see any doctor, HMSA is a better option. Its plans are more expensive but you can see specialists without a referral. Plus, you'll still have some coverage for out-of-network doctors.

Best health insurance companies in Hawaii

Kaiser Permanente sells the best health insurance in Hawaii.

Not only does Kaiser have the cheapest rates in the state, it also gets a perfect 5-out-of-5 score from HealthCare.gov. That means that Kaiser's plans are high quality and come with excellent customer satisfaction.

But all of Kaiser Permanente's plans are HMOs, which limits you to using Kaiser doctors and hospitals except in emergencies. If you want the ability to see any doctor, a plan from HMSA is a better choice.

Best-rated health insurance companies in Hawaii

Company |

Editor rating

|

ACA rating

|

|---|---|---|

| Kaiser Permanente | 5.0 | |

| HMSA | 4.0 |

Find Cheap Health Insurance Quotes in Hawaii

Best doctor network in Hawaii: HMSA

Hawaii Medical Service Association, or HMSA, sells plans that let you see any doctor and still have coverage.

That's because all of HMSA's plans are PPOs. With a PPO, you'll pay less when you see an in-network doctor, but you'll still have some coverage when you go to a doctor that isn't in your plan's network. You can also see a specialist without a referral, which can make getting medical care faster.

Because of the added flexibility, HMSA plans are usually more expensive than plans from Kaiser Permanente. But HMSA gets a high rating from HealthCare.gov. It also has excellent customer satisfaction, with 75% fewer complaints than expected. HMSA is part of Blue Cross Blue Shield.

How much does health insurance cost in Hawaii?

Health insurance in Hawaii costs $523 per month, but you could pay an average of $183 per month if you get discounts based on your income.

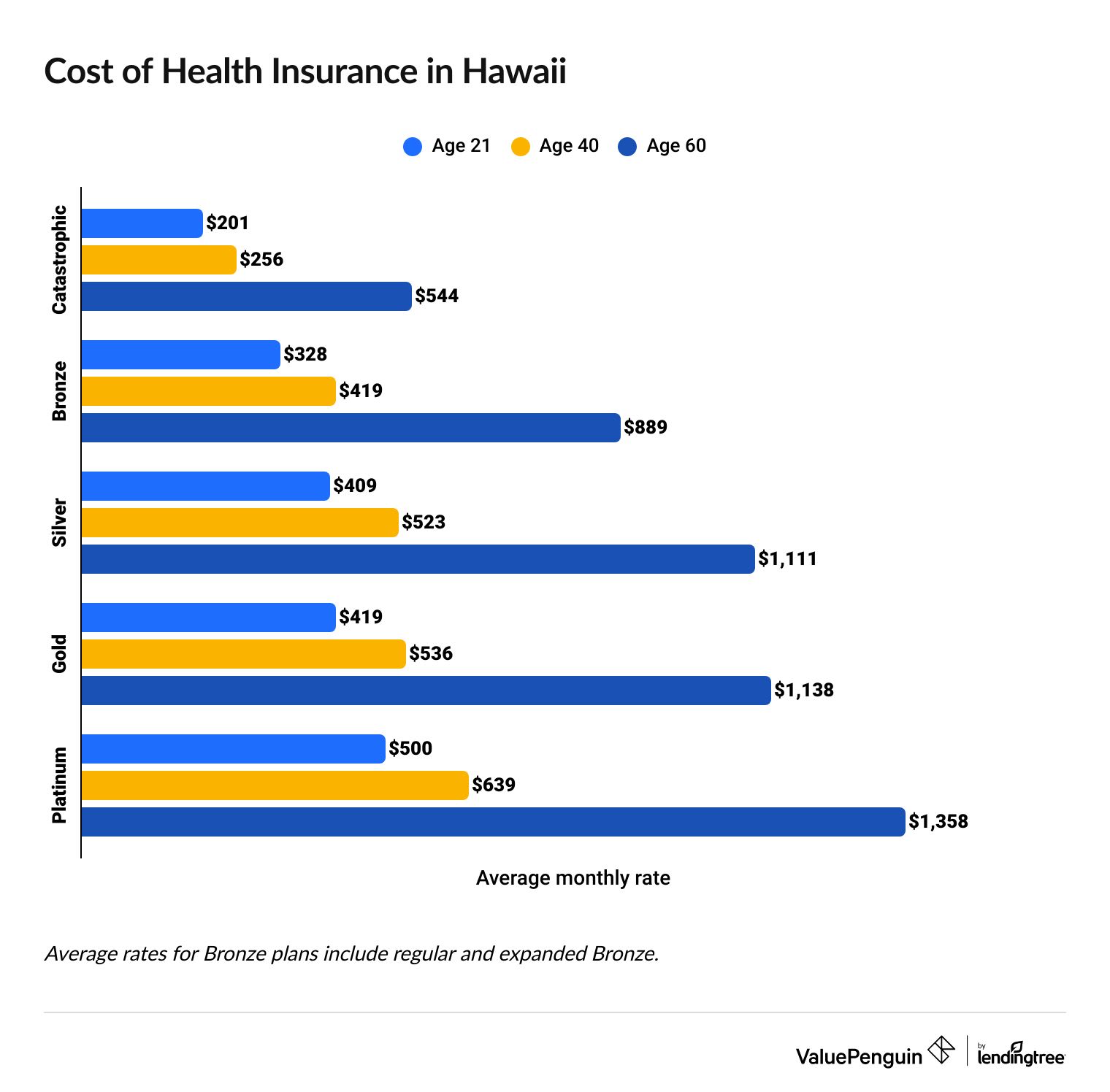

- The plan tier you buy affects how much you pay for health insurance. You'll pay more for higher-tier plans like Platinum or Gold compared to lower-tier plans like Bronze and Catastrophic. Keep in mind that although high-tier plans have expensive monthly rates, you'll pay less when you go to the doctor or fill a prescription.

- Your age is another big factor that influences your health insurance rates. In Hawaii, a 60-year-old will pay more than twice as much as a 40-year-old for the same coverage.

Get affordable health insurance in Hawaii with subsidies

If you have a low income, you could pay an average of $183 per month for health insurance in Hawaii.

That's because people with low incomes qualify for discounts, called subsidies or tax credits that make your health insurance cheaper each month. More than 8 in 10 people who shop on HealthCare.gov in Hawaii can get subsidies. About 1 in 10 shoppers pay less than $10 per month for a plan.

- How to qualify: If you're single, you have to make between $17,310 and $69,240 per year to get subsidies. If you're part of a family of four, the range is $35,880 to $143,520 per year. But if you can get Medicaid, you can't get subsidies.

- How to use subsidies: You can use a subsidy to buy any Bronze, Silver, Gold or Platinum plan from any company on HealthCare.gov. You can't use subsidies on Catastrophic plans.

- How much you'll save: You can use a subsidy calculator to see how much of a discount you could get on your health insurance.

If you can get subsidies, you might also get another discount that lets you spend less when you go to the doctor. It's called a cost-sharing reduction. Subsidies make your monthly rate cheaper, but cost-sharing reductions make your medical bills cheaper. You can only get them if you buy a Silver plan, though.

Cheap Hawaii health insurance plans by city

Kaiser Permanente sells the cheapest health insurance in Honolulu.

In fact, no matter where you live in Hawaii, Kaiser has the cheapest plan.

But just because a plan is cheap doesn't mean it's the best option for you. Make sure you compare each plan's coverage and customer satisfaction, so you pick the right plan for your needs. Only two companies, Kaiser Permanente and HMSA, sell plans on HealthCare.gov in Hawaii. That makes it pretty easy to compare your options.

Cheapest health insurance by HI county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Hawaii | Kaiser Permanente Silver 4000 Ded/600 Rx Ded | $486 |

| Honolulu | Kaiser Permanente Silver 4000 Ded/600 Rx Ded | $486 |

| Kalawao | Kaiser Permanente Silver 4000 Ded/600 Rx Ded | $486 |

| Kauai | Kaiser Permanente Silver 4000 Ded/600 Rx Ded | $486 |

| Maui | Kaiser Permanente Silver 4000 Ded/600 Rx Ded | $486 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Hawaii

Best health insurance by level of coverage

The best health insurance for you depends on your budget and your medical needs.

If you go to the doctor often, a higher-tier plan like Platinum or Gold is usually a good idea. You'll pay more each month, but your plan will pay a larger share of your medical bills.

If you're young and healthy, a lower-tier plan like Bronze can be a good choice. You'll save money on your monthly rate, but you'll pay more when you need medical care.

Plan tiers have nothing to do with covered medical services. A Gold plan doesn't necessarily cover more medical care than a Bronze plan, it just pays for a bigger share of your bills.

Platinum plans: Best for people with serious health issues

| Platinum plans pay for about 90% of your medical care. |

Platinum plans pay for about 90% of your covered medical bills, so they're a good choice if you need expensive medical treatments. If you have a chronic condition or serious illness, a Platinum plan can be worth it. Even though the monthly rate is higher, you could save money overall because the plan lets you pay less toward your medical bills.

Platinum plans in Hawaii also don't have a deductible, which means your coverage starts right away.

In Hawaii, Platinum plans cost $639 per month, on average.

Gold plans: Best for people who need frequent medical care

| Gold plans pay for about 80% of your medical care. |

Gold plans are a good option if you need medical care often, but don't want to pay for a Platinum plan. In Hawaii, Gold plans cost about $100 less each month compared to Platinum plans but still cover about 80% of your medical bills.

With a Gold plan, you could pay up to $1,500 per year of your own bills before your coverage starts and up to $8,900 total per year toward your medical bills. So even though the plan covers about 80% of your bills, it's important to still have savings in the bank in case you need expensive care.

Gold plans cost an average of $536 per month in Hawaii.

Silver plans: Best for most people

| Silver plans pay for about 70% of your medical care. |

Silver plans are a good option for most people because they balance affordable monthly rates with good coverage. Silver plans are cheaper than Gold and Platinum plans, but they cover more of your bills than Bronze or Catastrophic plans. If you aren't sure what plan tier to buy, start by looking at Silver plans and see if they fit your needs.

With a Silver plan, you might pay up to $5,000 per year before your coverage starts and up to $8,900 total each year. Overall, a Silver plan will pay for about 70% of your covered medical care.

Silver plans cost $523 per month, on average, in Hawaii.

Bronze plans: Best for healthy people with emergency savings

| Bronze plans pay for about 60% of your medical care. |

If you're young and healthy, a Bronze plan can help you save money each month. That's because Bronze plans have lower monthly rates. The trade-off is that they only cover about 60% of your medical care, so you have to pay more toward your medical bills when they come up.

You could pay up to $7,500 of your medical bills yourself each year with a Bronze plan. After that, your coverage kicks in, but since insurance only pays for a portion of your bills, you could still pay up to $9,200 total out-of-pocket for your medical care each year. So if you buy a Bronze plan, it's important to have savings to pay for your medical bills.

In Hawaii, Bronze plans cost $419 per month, on average.

Catastrophic plans: Best as a last resort

Catastrophic plans have the cheapest monthly rates but cover the lowest share of your medical bills. They're only a good option if you can't afford anything else and you don't qualify for Medicaid.

You can only buy a Catastrophic health plan if you're under the age of 30, or if you qualify for a hardship exemption. Catastrophic plans are rarely worthwhile because of their high deductibles. You also can't get a subsidy with Catastrophic plans.

Catastrophic plans cost an average of $256 per month in Hawaii.

Cheap or free health insurance in Hawaii if you have a low income

If you don't make much money and can't afford health insurance, you might be able to get free coverage from Medicaid. Otherwise, consider buying a Silver plan and using discounts to make your rate and medical care cheaper.

Medicaid in Hawaii

Medicaid is a type of free government health insurance that's available to people who earn a low income.

In Hawaii, you qualify for Medicaid if you make less than about $24,000 per year as a single person or $50,000 per year as a family of four.

Use cost-sharing reductions for cheaper medical care

If you don't qualify for Medicaid, you can still get cheap health insurance. If you make between $17,310 and $43,275 per year as a single person, or between $35,880 and $89,700 as a family of four, consider buying a Silver plan. You'll qualify for discounts on your monthly rate and extra discounts called cost-sharing reductions (CSRs). These discounts let you pay less when you go to the doctor.

The less you make, the bigger your discount will be. CSRs can even make your Silver plan cover more of your medical costs than a Gold or Platinum plan.

Are health insurance rates going up in HI?

Overall, health insurance in HI is 7% more expensive in 2025 compared to 2024.

Catastrophic plans saw the biggest increase, costing 21% more in 2025. Platinum plans had the lowest price jump, but they're still 4% higher in 2025 compared to 2024.

Tier | 2024 | 2025 | Change |

|---|---|---|---|

| Catastrophic | $212 | $256 | 21% |

| Bronze | $390 | $419 | 7% |

| Silver | $490 | $523 | 7% |

| Gold | $510 | $536 | 5% |

| Platinum | $617 | $639 | 4% |

Monthly costs are for a 40-year-old.

In Hawaii, you can buy an Affordable Care Act (ACA) plan, sometimes called an "Obamacare" plan, on HealthCare.gov between Nov. 1 and Jan. 15 each year. This is called open enrollment. If you move, get married, lose your job or go through another qualifying life change, you can buy a plan outside of open enrollment.

No matter what plan tier you buy, you'll have coverage for at least 10 health situations.

- Doctor visits

- Prescription medicines

- Emergency services

- Laboratory services

- Hospital stays

- Pregnancy and newborn care

- Mental health care

- Rehab services and devices

- Wellness and chronic disease care

- Pediatric services

The plan tier you buy doesn't affect what services are covered. It only affects how much your plan pays toward your bills. Higher-tier plans like Gold and Platinum pay for a bigger share of your medical bills than lower-tier plans like Bronze and Catastrophic.

Average cost of health insurance by family size in Hawaii

You can expect to pay a higher monthly rate for health insurance as the size of your family grows. In Hawaii, two married 40-year-olds will pay $10,46 per month for a Silver plan, on average, while a single parent with a minor child will pay $836 per month on average.

Add $313 for each child under the age of 15 to get an idea of how much you'll pay for your family's health insurance.

Family size | Average monthly cost |

|---|---|

| Individual | $523 |

| Individual + Child | $836 |

| Couple, age 40 | $1,046 |

| Family of three | $1,359 |

| Family of four | $1,672 |

Averages based on a Silver plan for 40-year-old adults and children who are under age 15.

Short-term health insurance in Hawaii

No companies are selling short-term health insurance in Hawaii for 2025.

Frequently asked questions

What is the best health insurance to have in Hawaii?

Kaiser Permanente sells the best and cheapest health insurance in Hawaii. Its Silver plans start at $486 per month. Kaiser also gets great reviews for customer service. But if you want to be able to see any doctor, HMSA is a better option.

Does Hawaii have free health care?

Yes, you might be able to get free health insurance in Hawaii if you have a low income. If you make less than $24,000 per year as a single person or $50,000 per year as a family of four, you might qualify for Medicaid. If you get Medicaid, your health care will likely be free or cost very little.

How much is health insurance in Hawaii per month?

Health insurance in Hawaii costs $523 per month, on average, without subsidies. Your rate will change depending on what company you choose, what plan tier you buy, how old you are, where you live, how many people are on your plan, and whether or not you smoke or use tobacco.

Methodology

Average health insurance rates in Hawaii for 2025 are from the Centers for Medicare & Medicaid Services (CMS) government website. ValuePenguin's experts used the Public Use Files (PUFs) to determine the average cost of health insurance by plan tier, age, county family size and more. All costs are for a 40-year-old with a Silver plan unless a different age or plan level is specifically mentioned.

Rates for plans with subsidies are also from CMS. The rates are for everyone who shopped during the 2024 open enrollment period and who qualified for advanced premium tax credits (APTCs).

ValuePenguin's experts rated each company based on a review of average rates, customer satisfaction, coverage offerings and unique features.

Additional sources include the National Association of Insurance Commissioners (NAIC) and S&P Global Capital IQ.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.