Best & Cheapest Car Insurance Quotes in Connecticut (2025)

Travelers has the best car insurance quotes in Connecticut. It costs $99 per month for full coverage and $47 for liability only.

Find Cheap Car Insurance Quotes in Connecticut

Best cheap car insurance in Connecticut

How we chose the top companies

Best and cheapest car insurance in Connecticut

- Cheapest full coverage: Travelers, $99/mo

- Cheapest minimum liability: Travelers, $47/mo

- Cheapest for young drivers: State Farm, $228/mo

- Cheapest after a ticket: Travelers, $133/mo

- Cheapest after an accident: Travelers, $111/mo

- Cheapest for teens after a ticket: State Farm, $64/mo Amica, $246/mo

- Cheapest after a DUI: Travelers, $171/mo

- Cheapest for poor credit: Travelers, $194/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Travelers and State Farm offer the best combination of dependable customer service and cheap rates in Connecticut. Both companies offer online quotes, so you can quickly compare rates to find the best option for you.

Cheapest car insurance in Connecticut: Travelers

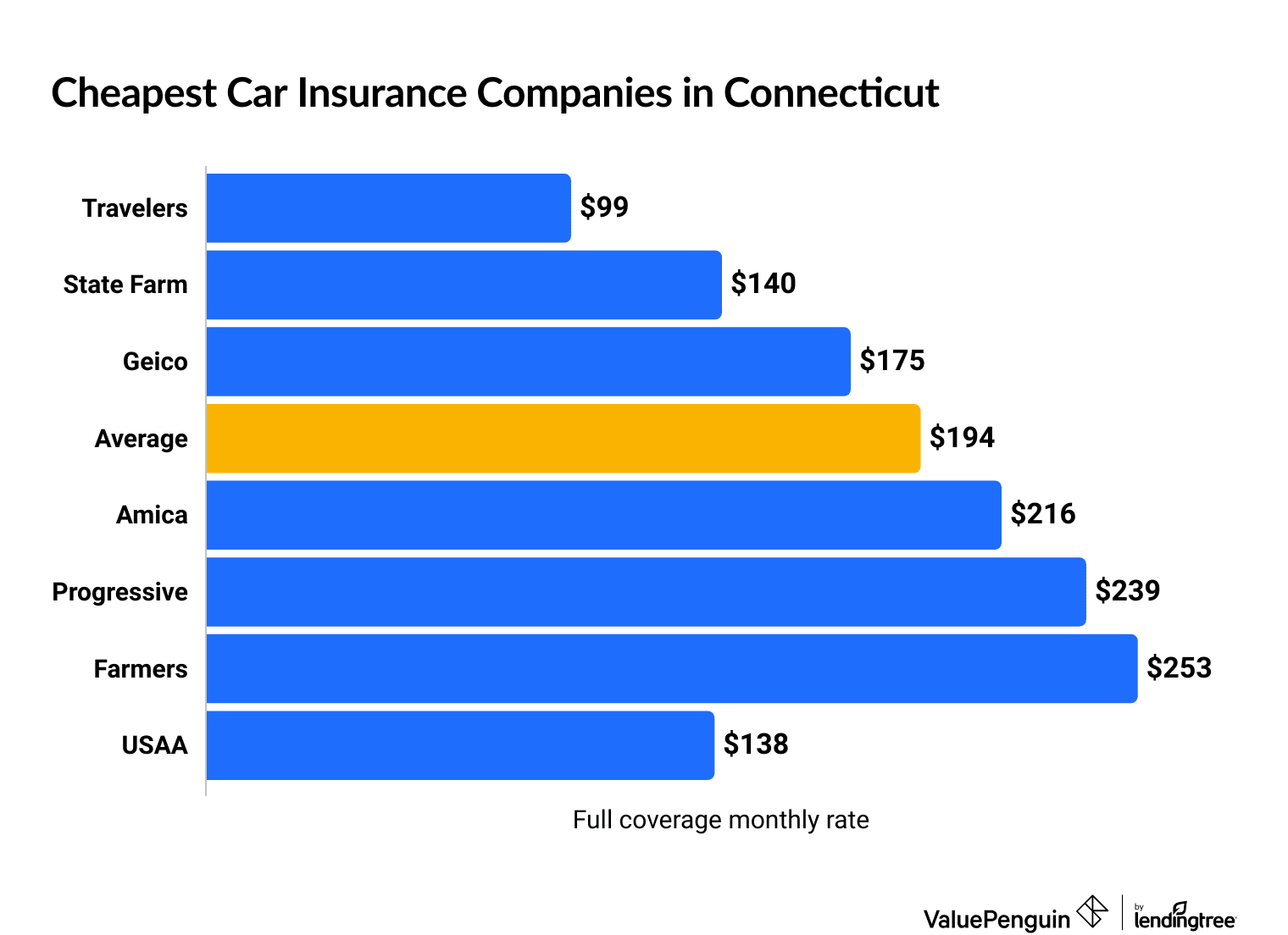

Travelers is the cheapest car insurance company for full coverage in Connecticut, with an average rate of $99 per month. That's half the price of the state average, overall.

Find Cheap Car Insurance Quotes in Connecticut

Cheapest full coverage car insurance companies in CT

Company | Monthly rate | |

|---|---|---|

| Travelers | $99 | |

| State Farm | $140 | |

| Geico | $175 | |

| Amica | $216 | |

| Progressive | $239 |

*USAA is only available to current and former military members and their families.

Cheapest liability insurance quotes in Connecticut: Travelers

Travelers is the cheapest car insurance company in Connecticut for a minimum liability policy. Quotes from Travelers average $47 per month. That's less than half the CT state average.

Cheapest CT car insurance companies

Company | Monthly rate |

|---|---|

| Travelers | $47 |

| State Farm | $71 |

| Geico | $79 |

| Amica | $95 |

| Progressive | $121 |

*USAA is only available to current and former military members and their families.

Consider USAA if you can get it as a veteran, current military member or close relative to a military member. It has some of the best customer service in Connecticut and is only a little more expensive than Travelers.

Find Cheap Car Insurance Quotes in Connecticut

Cheapest car insurance for young drivers in Connecticut: State Farm

State Farm has the best car insurance rates for young drivers in Connecticut.

At State Farm, younger drivers will pay about $228 per month for minimum liability and $435 for full coverage.

Eighteen-year-olds pay about two and a half times more than an older driver would pay for the same minimum-coverage policy. That's because teen drivers are more likely to get in crashes or make insurance claims than older adults.

Cheapest CT car insurance companies for teens

Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $228 | $435 |

| Amica | $232 | $544 |

| Geico | $270 | $599 |

| Allstate | $421 | $689 |

| Progressive | $425 | $1,044 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance after a speeding ticket: Travelers

Travelers has the best rates for cheap insurance in Connecticut after a speeding ticket. You'll pay $133 per month on average. That's 43% cheaper than the typical rate across all companies.

Cheapest car insurance in CT with a ticket

Company | Monthly rate |

|---|---|

| Travelers | $133 |

| State Farm | $150 |

| Amica | $250 |

| Geico | $262 |

| Allstate | $290 |

*USAA is only available to current and former military members and their families.

On average, a speeding ticket will raise insurance rates for CT drivers by 21%.

Cheapest car insurance quotes after an accident in CT: Travelers

Travelers offers the cheapest car insurance rates for Connecticut drivers who have had an accident. On average, you'll pay $111 per month for a full coverage Travelers policy after an accident. That's only $12 more than the cost without an at-fault crash.

Cheapest CT car insurance with an at-fault accident

Company | Monthly rate |

|---|---|

| Travelers | $111 |

| State Farm | $140 |

| Geico | $314 |

| Amica | $326 |

| Progressive | $339 |

*USAA is only available to current and former military members and their families.

On average, an accident in Connecticut raises rates by 63%.

After you get into an accident, shop around for car insurance to get the best rates. Insurance companies weigh factors like car accidents differently. Farmers customers usually see their rates more than double, while Travelers increases them by only 12%.

But wait until your existing policy is about to expire before you start shopping. Your current insurance company won't consider your recent incident until they recalculate your rates when you renew. Plus, the longer ago your accident, the lower your rate will be.

Cheapest car insurance for young drivers in CT after a ticket or accident: Amica

Amica has the cheapest car insurance in Connecticut for young drivers after both a speeding ticket and an at-fault accident.

Amica charges an 18-year-old in Connecticut an average of $246 per month after a speeding ticket. That's 43% less than the state average.

Teen drivers with an at-fault accident pay an average of $597 per month in CT. Amica charges less than half of that.

Company | Ticket | Accident |

|---|---|---|

| Amica | $246 | $279 |

| State Farm | $247 | $228 |

| Geico | $367 | $406 |

| Allstate | $421 | $846 |

| Progressive | $473 | $479 |

*USAA is only available to current and former military members and their families.

A speeding ticket raises rates for CT teen drivers by 19%, while an accident bumps up rates by 58%.

Teen drivers facing high car insurance bills can often take advantage of discounts for young drivers for getting good grades, sharing a car insurance policy with their parents or taking a defensive driving course.

Cheapest car insurance in Connecticut after a DUI: Travelers

Travelers has the most affordable quotes for those convicted of driving under the influence. On average, you'll pay just $171 per month after a DUI. That's 62% cheaper than the Connecticut state average.

Cheapest CT DUI car insurance

Company | Monthly rate |

|---|---|

| Travelers | $171 |

| Progressive | $274 |

| State Farm | $376 |

| Allstate | $420 |

| Farmers | $611 |

*USAA is only available to current and former military members and their families.

A single DUI conviction will cause your car insurance rate to more than double in Connecticut, on average.

Cheapest CT car insurance for drivers with poor credit: Travelers

Travelers has the best rates for a full coverage policy for a driver with poor credit in Connecticut. It costs $194 per month on average. That's less than half the state average of $406.

Cheap car insurance in Connecticut with bad credit

Company | Monthly rate |

|---|---|

| Travelers | $194 |

| Geico | $262 |

| Progressive | $348 |

| Allstate | $483 |

| Farmers | $507 |

*USAA is only available to current and former military members and their families.

While your credit score isn't related to your ability to drive safely, insurance companies believe people with lower credit scores tend to file claims more often. As a result, drivers with poor credit pay nearly double the rates of drivers with good credit in Connecticut.

Best car insurance companies in Connecticut

State Farm and USAA have the top-rated car insurance in Connecticut.

Both companies offer a great combination of trustworthy customer service and cheap rates. However, USAA car insurance is an option only for military members, veterans and their families.

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| State Farm | 657 | A++ | |

| USAA | 739 | A++ | |

| Geico | 637 | A++ | |

| Amica | 709 | A+ | |

| Travelers | 616 | A++ |

Average cost of car insurance in Connecticut by city

Bridgeport has the most expensive car insurance in Connecticut, at $272 per month.

Residents of Conning Towers pay the least for coverage, at just $170 per month.

Where you live in Connecticut can impact the quotes you get for auto insurance. Factors including road conditions and auto theft in a given area can mean more claims, which in turn means higher rates.

City | Monthly Rate | % from average |

|---|---|---|

| Abington | $196 | 2% |

| Amston | $177 | -8% |

| Andover | $178 | -7% |

| Ansonia | $227 | 18% |

| Ashford | $175 | -9% |

Minimum car insurance requirements in Connecticut

Drivers in Connecticut are required to have car insurance in order to drive on public roads. You must have a policy that includes 25/50/25 liability coverage and underinsured motorist coverage.

Coverage | Limit |

|---|---|

| Bodily injury (BI) liability | $25,000 per person / $50,000 per accident |

| Property damage (PD) liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury (UM/UIMBI) | $25,000 per person / $50,000 per accident |

What's the best car insurance to get in Connecticut?

A full-coverage car insurance policy is the best choice for most people. It includes collision and comprehensive coverage, which pays for repairs to your vehicle after a crash, even if you caused it. Full coverage also includes liability coverage required by the state.

If you lease or finance your car in Connecticut, you’ll usually have to add collision and comprehensive coverage. It's a good idea to have collision and comprehensive car insurance if your car is worth more than $5,000 or newer than eight years old.

Only consider minimum liability car insurance if you want the cheapest way to satisfy Connecticut's insurance requirements. These include bodily injury liability, property damage liability and uninsured/underinsured motorist coverage. But know that if you crash your car, you'll have to pay for repairs yourself.

Frequently asked questions

Who has the cheapest car insurance quotes in Connecticut?

Travelers has the cheapest full coverage and minimum-coverage car insurance in CT. You'll pay $99 per month on average for full coverage and $47 per month for liability only.

How much does car insurance cost in Connecticut?

A minimum-coverage car insurance policy in Connecticut costs an average of $97 per month. A full coverage policy costs an average of $194 per month.

How much car insurance coverage do I need in Connecticut?

Connecticut state law requires that drivers have $25,000 per person and $50,000 per accident in bodily injury liability auto insurance coverage. You'll also need $25,000 in property liability coverage and $25,000 per person and $50,000 per accident in uninsured/underinsured motorist coverage.

Is car insurance cheaper in Connecticut than New York?

No, Connecticut car insurance costs a little more than insurance in New York State. Coverage in CT costs $194 per month, while New York State residents pay $189 per month. But rates in Connecticut are cheaper than in New York City, where the typical price is $378 per month.

Methodology

ValuePenguin collected thousands of quotes from every ZIP code across Connecticut from some of the state's largest insurance companies for a 30-year-old man with good credit who drives a 2015 Honda Civic EX.

For our minimum coverage policy, quotes were taken using the minimum required limits in Connecticut. Full coverage policies included higher liability limits.

- Bodily liability: $50,000 per person/$100,000 per accident

- Personal injury protection: $10,000

- Property damage: $25,000 per accident

- Uninsured/underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates came from insurance company filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.