The Best Cheap Car Insurance for New Drivers

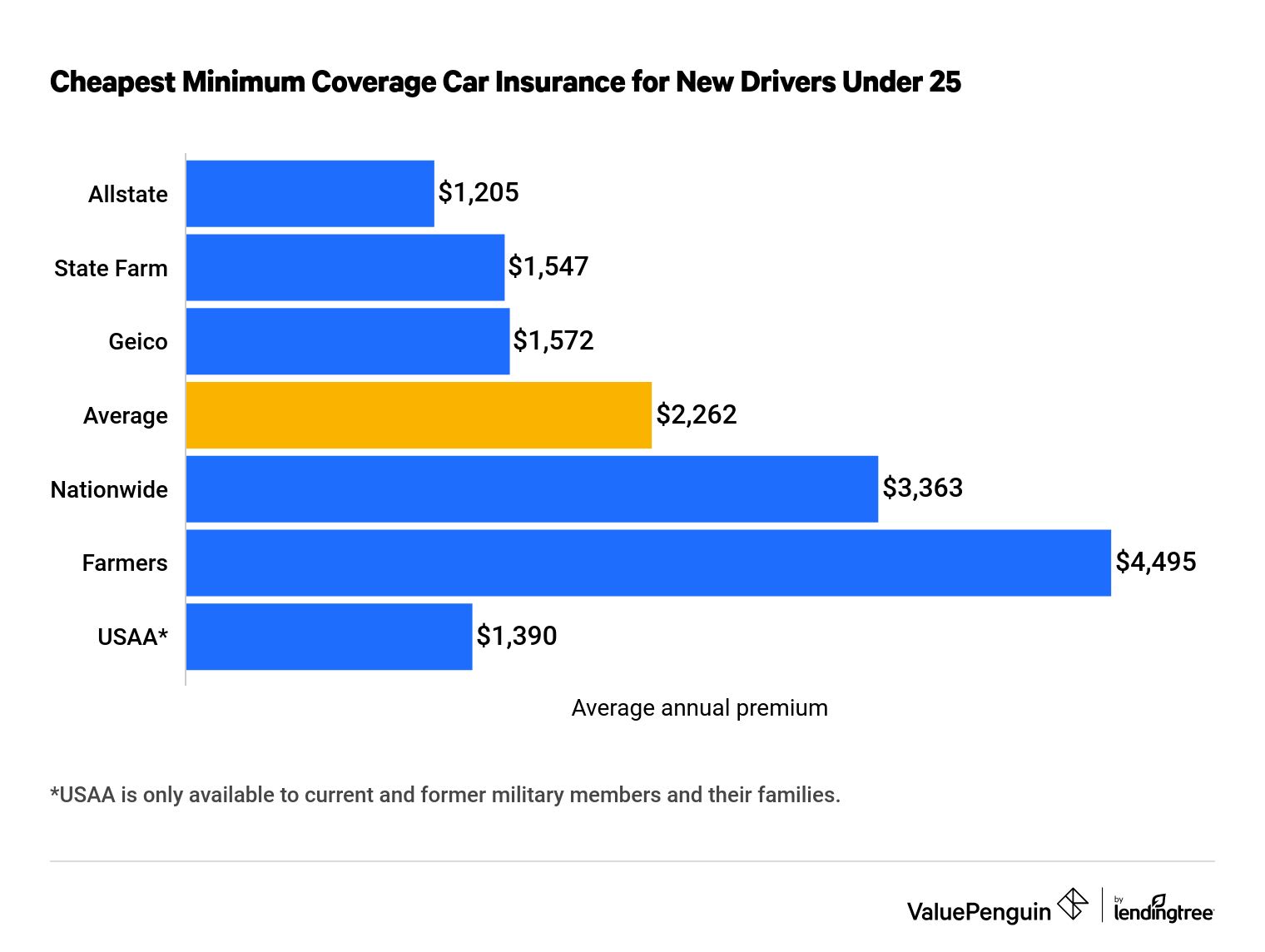

Allstate has the cheapest liability-only coverage car insurance rates for new drivers. State Farm has the best rates for full coverage.

First-time drivers pay more for car insurance because they have less driving experience and could be more likely to be in a car accident. New drivers under 25 years old pay an average of $189 per month for insurance, but new drivers that are added onto an existing policy — like their parent's, family's or roommate's policy — can get a big discount.

We collected tens of thousands of car insurance quotes from every ZIP code in Texas to find the lowest rates. Rates are for new drivers ages 16, 17, 18, 21, 25, 35, 45 and 55, as well as a 16-year-old on the policy of his two 50-year-old parents.

Best car insurance for new drivers under 25

Allstate offers the cheapest liability coverage car insurance rates for first-time drivers under 25 years old. On average, new drivers can expect to pay $2,743 per year for insurance. However, Allstate's policy costs 56% less, at $1,205 per year.

State Farm has the best rates for full-coverage insurance, with an average of $3,308 per year, or $276 per month. That's about half the average rate for full coverage insurance, which is $6,527 per year.

Find Cheap New Driver Car Insurance Quotes

Cheapest new-driver car insurance monthly rates

Company | Liability coverage | Full coverage | |

|---|---|---|---|

| Allstate | $100 | $374 | |

| State Farm | $129 | $276 | |

| Geico | $131 | $296 | |

| Nationwide | $280 | $692 | |

| Farmers | $375 | $796 | |

| USAA | $116 | $293 |

USAA is only available to current and former military members and their families.

What kind of car insurance should new drivers get?

Minimum coverage policies are the cheapest car insurance for new drivers because they include the lowest level of coverage you can legally have in your state.

But liability insurance only pays for damage to other drivers if you cause a crash. It doesn't pay for your own car repairs or medical bills.

So if you're in an accident, you could end up paying more for repairs than you saved on insurance. That's why most people should get a full coverage auto insurance policy instead of a minimum coverage policy, if they can afford it.

Best car insurance for new drivers over 25

First-time drivers over 25 years old can find the cheapest minimum coverage auto insurance with Allstate. The company charges $395 per year, which is 56% less than average.

State Farm has the cheapest rates for a full coverage policy. New drivers with State Farm pay $1,398 per year, which means a policy with State Farm is $1,000 cheaper than average.

Find Cheap New Driver Car Insurance Quotes

Cheap car insurance companies for new drivers over 25

Company | Minimum coverage | Full coverage |

|---|---|---|

| Allstate | $33 | $131 |

| State Farm | $49 | $117 |

| Geico | $79 | $168 |

| Nationwide | $88 | $238 |

| Farmers | $142 | $330 |

| USAA | $59 | $158 |

USAA is only available to current and former military members and their families.

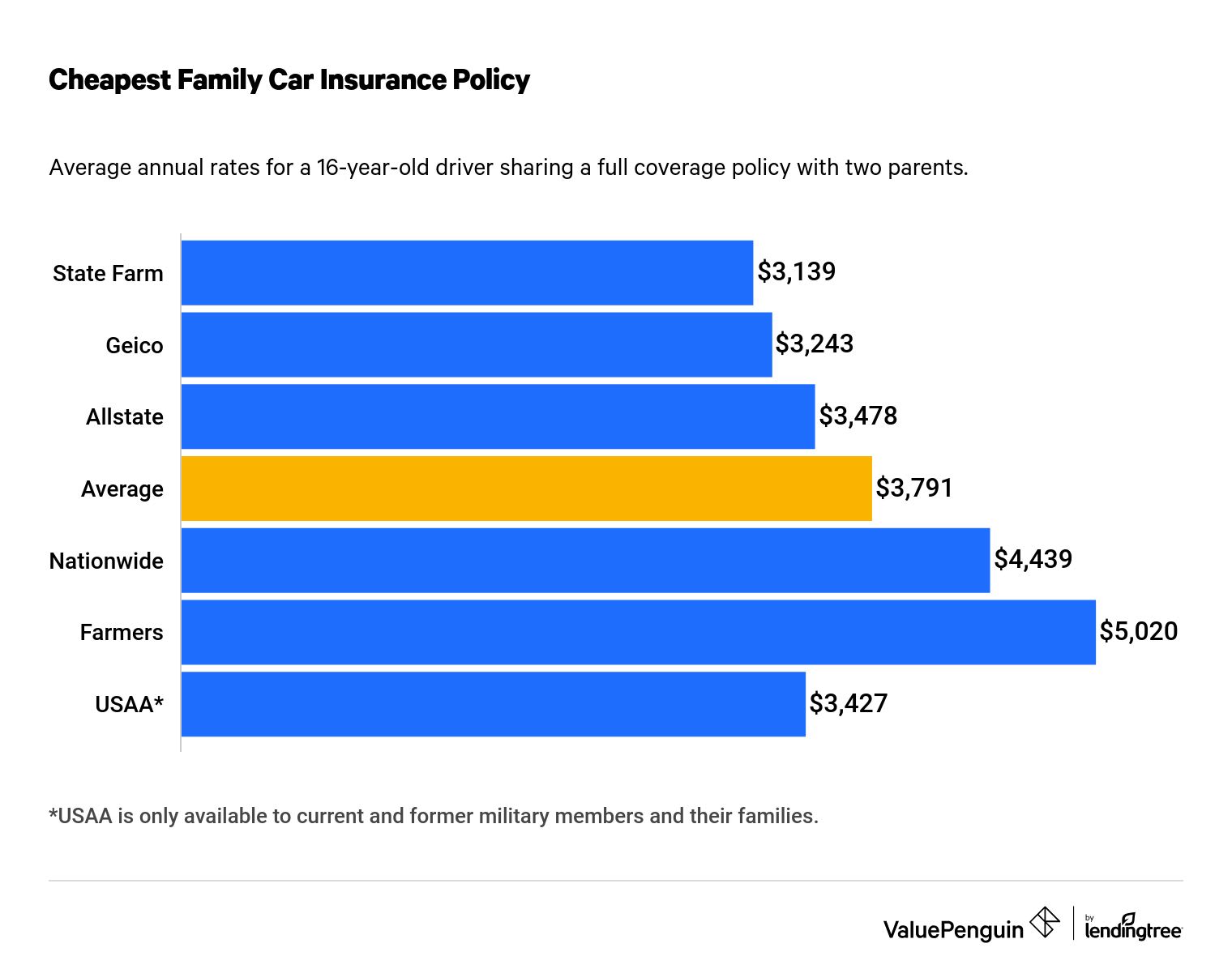

Best car insurance for new drivers on a family policy

Car insurance for new drivers is three to five times cheaper if you share a policy with your family.

Rates from Allstate, Geico and State Farm are all cheaper than average. Geico charges the least to add another car and driver to an existing policy — $1,419 per year, on average.

Although State Farm charges more to add another car and driver, its overall rates are better than its competitors'. On average, a full coverage policy with parents and a teen driver from State Farm costs $2,201 per year. That's $813 cheaper than average.

Family policy car insurance monthly rates with a new driver by age

Company | Parents only | 16-year-old | 18-year-old | 21-year-old |

|---|---|---|---|---|

| State Farm | $87 | $262 | $220 | $165 |

| Allstate | $127 | $290 | $290 | $190 |

| Geico | $137 | $270 | $258 | $237 |

| Nationwide | $160 | $370 | $366 | $274 |

| Farmers | $199 | $418 | $397 | $461 |

| USAA | $91 | $286 | $265 | $209 |

Rates are for a first-time driver and two parents sharing a full coverage policy with coverage for three cars. USAA is only available to military members and their families.

How long can you stay on your parents' insurance?

There is no age limit for sharing a car insurance policy with your parents. As long as you live in the same house, you can share a policy.

Once you move out, you will need to get your own policy, unless you're still considered their dependent as a college student, for example.

Best insurance companies for new drivers

State Farm is the best car insurance company for new drivers thanks to its good customer service and affordable quotes.

It's important for first-time drivers to compare auto insurance quotes to find the cheapest quotes, but choosing an insurance company with a great customer service reputation is just as important. Good support can mean it's faster and easier to get your claim completed and your car fixed after an accident.

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| State Farm | 859 | A++ | |

| Geico | 843 | A++ | |

| Nationwide | 831 | A+ | |

| Farmers | 818 | A | |

| Allstate | 838 | A+ | |

| USAA | 890 | A++ |

USAA is only available to current and former military members and their families.

How much does new-driver insurance cost?

Car insurance for new drivers costs an average of $1,582 per year for minimum coverage and $3,867 per year for full coverage.

However, car insurance rates can vary a lot based on your age, where you live and other factors, such as your credit score.

Who's considered a new driver?

How does driving experience affect car insurance rates?

Auto insurance companies consider a broad range of factors when determining rates, including your driving experience.

People with little to no driving history tend to be much riskier to insure, so they'll have to pay higher insurance rates during the first few years of their driving careers. However, as you spend more time behind the wheel, you'll likely see your insurance rates begin to fall.

Car insurance rates by years of driving experience

Years licensed | Monthly rate | Rate increase |

|---|---|---|

| 0 | $92 | 43% |

| 1 | $74 | 15% |

| 2 | $71 | 11% |

| 3 | $69 | 8% |

| 4 | $69 | 7% |

| 5 | $64 | 0% |

Rate increase is compared to a base level monthly rate for a driver with five years of experience.

In Texas, a 30-year-old man with no driving experience can expect to pay $1,105 per year for a minimum coverage policy. After one year of driving without any tickets, his rates go down by $221.

After having his license for five years, he has shown that he is a good driver with safe driving habits, and his rates are $333 per year cheaper.

Insurance companies only consider the driving experience you have within the U.S. Immigrants and foreign drivers typically pay higher rates as well, even if they have driving experience in their country.

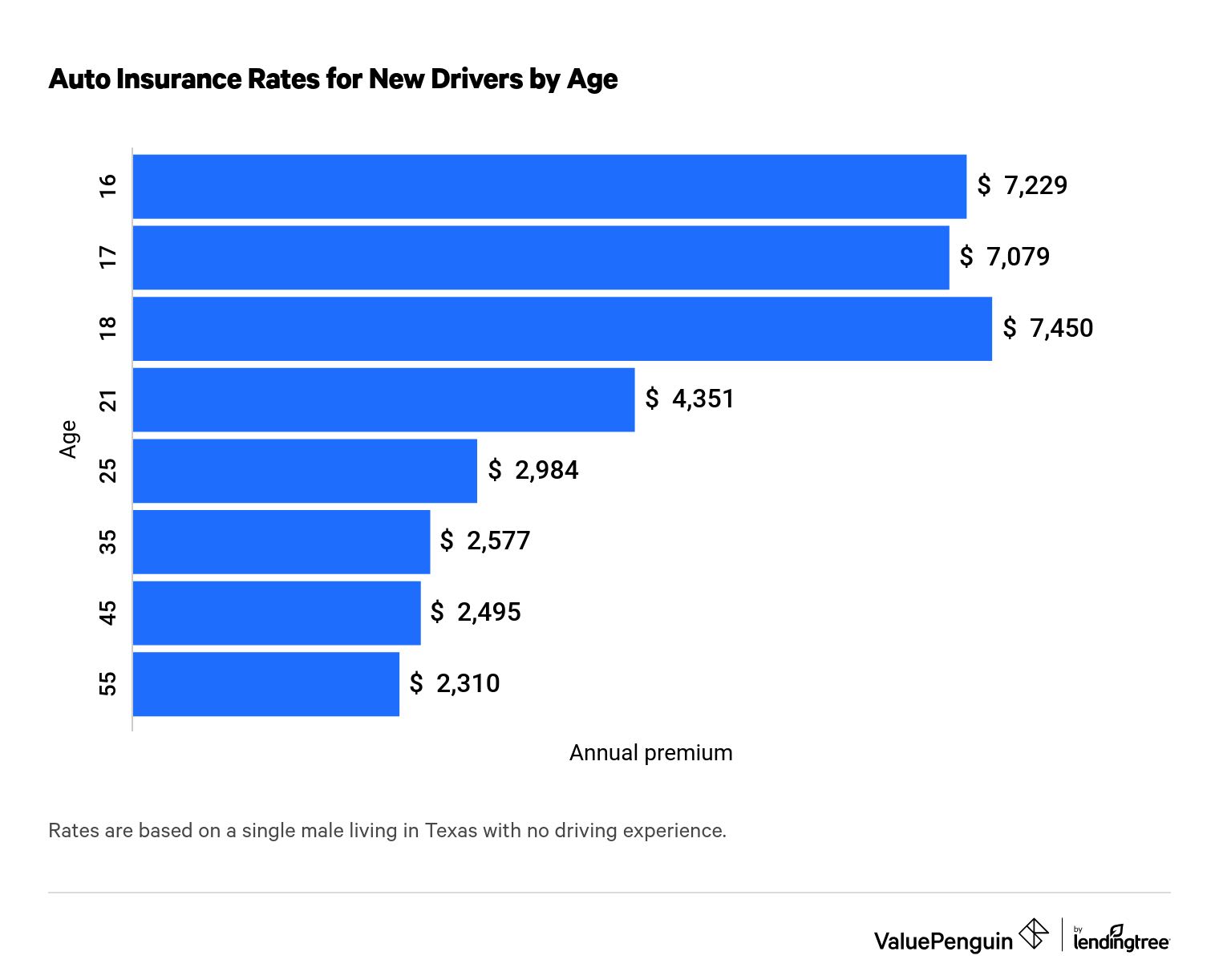

How does age affect car insurance rates?

One of the biggest factors that raises new-driver rates is age. Teen drivers tend to get into more driving incidents than middle-aged drivers.

However, some people begin driving later in life. If you're a new, but not young, driver, you'll still pay higher rates than other drivers your age. However, you'll see less of an increase than younger drivers.

New-driver car insurance monthly cost by age

Age | Minimum coverage | Full coverage |

|---|---|---|

| 16 | $258 | $602 |

| 17 | $252 | $590 |

| 18 | $259 | $621 |

| 21 | $146 | $363 |

| 25 | $100 | $249 |

In Texas, a 16-year-old driver pays more than twice what a 25-year-old new driver pays for a full coverage policy, despite the fact that they have the same level of driving experience. Rates are even lower for first-time drivers in their 30s, 40s and 50s.

How to save on new-driver car insurance

Regardless of age, you'll probably pay more for insurance if you don't have much driving experience. However, you can lower your monthly bill by combining policies, bundling and finding discounts.

-

Compare quotes from multiple insurance companies.

- Join a family policy.

- Consider the car you drive. Low-to-mid-priced vehicles with a good safety rating are usually cheaper to insure than expensive, high-tech cars.

- Choose a higher deductible.

- Pay your insurance bill up front.

- Bundle your auto and renters insurance policies.

- Ask about a defensive driving or good student discount.

Frequently asked questions

How much is insurance for a first-time driver?

Minimum coverage insurance costs $1,582 per year for first-time drivers, on average, while a full coverage policy costs $3,867 per year. Young drivers may be able to save money by sharing a policy with parents or older family members.

What is the best insurance for first-time drivers?

Full coverage insurance is a good idea for new drivers. Full coverage insurance includes comprehensive and collision coverage, which pay for damage to your car, regardless of fault. That could be worth paying for since first-time drivers are more likely to be involved in an accident. State Farm offers the best full coverage insurance rates for most new drivers.

Does a new driver need insurance?

Every state requires auto insurance or proof of financial responsibility to drive legally. You typically need liability insurance to pay for injuries and damage you cause. You can also choose to buy collision and comprehensive insurance to help pay for damage to your car.

What do you need to get car insurance?

To get car insurance quotes as a new driver, you need to provide your personal info (full name, age, address and driver's license number), vehicle info (make, model, date of purchase and mileage) and your payment info (usually a bank account or credit card).

How much does car insurance cost for a 16-year-old?

A full coverage policy for a 16-year-old costs $813 per month for a female driver and $876 per month for a male driver. However, policies can range from $313 to $1,141 per month, depending on the company, which is why it's important to compare quotes.

How much do car insurance rates drop when you turn 25?

A 25-year-old driver pays 60% less than an 18-year-old, on average. The biggest rate decrease happens between ages 18 and 21.

Methodology

We collected thousands of quotes from ZIP codes across Texas for the largest insurers in the state to determine the best rates for new drivers.

For our minimum coverage rates, we gathered quotes for a policy with the minimum required limits in Texas. Minimum and full coverage limits are shown below:

Coverage | Minimum coverage limit | Full coverage limit |

|---|---|---|

| Bodily injury liability | $30,000 per person; $60,000 per accident | $50,000 per person; $100,000 per accident |

| Property damage liability | $25,000 per accident | $25,000 per accident |

| Uninsured motorist bodily injury liability | - | $50,000 per person; $100,000 per accident |

| Comprehensive deductible | - | $500 |

| Collision deductible | - | $500 |

The driver for the study is a 30-year-old man with average credit who drives a 2015 Honda Civic EX. Characteristics were changed to reflect age and driving experience.

For the difference in rates after adding a first-time driver to a family policy, quotes are based on a 16-year-old male sharing a policy with a married couple who are both 50 years old.

Insurance rate data for ValuePenguin's analysis was provided by Quadrant Information Services. Rates are publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes will differ.