How Do Deductibles Affect Car Insurance Premiums?

Changing the deductibles on your car insurance policy affects what you pay in premiums. The higher your deductible, the less you will pay up front for coverage.

Choosing your deductible is about balancing your budget and the amount of risk you can tolerate. While lower deductibles can save you money on premiums, there may be trade-offs if your car needs repairs after an accident.

How does changing your deductible impact auto insurance premiums?

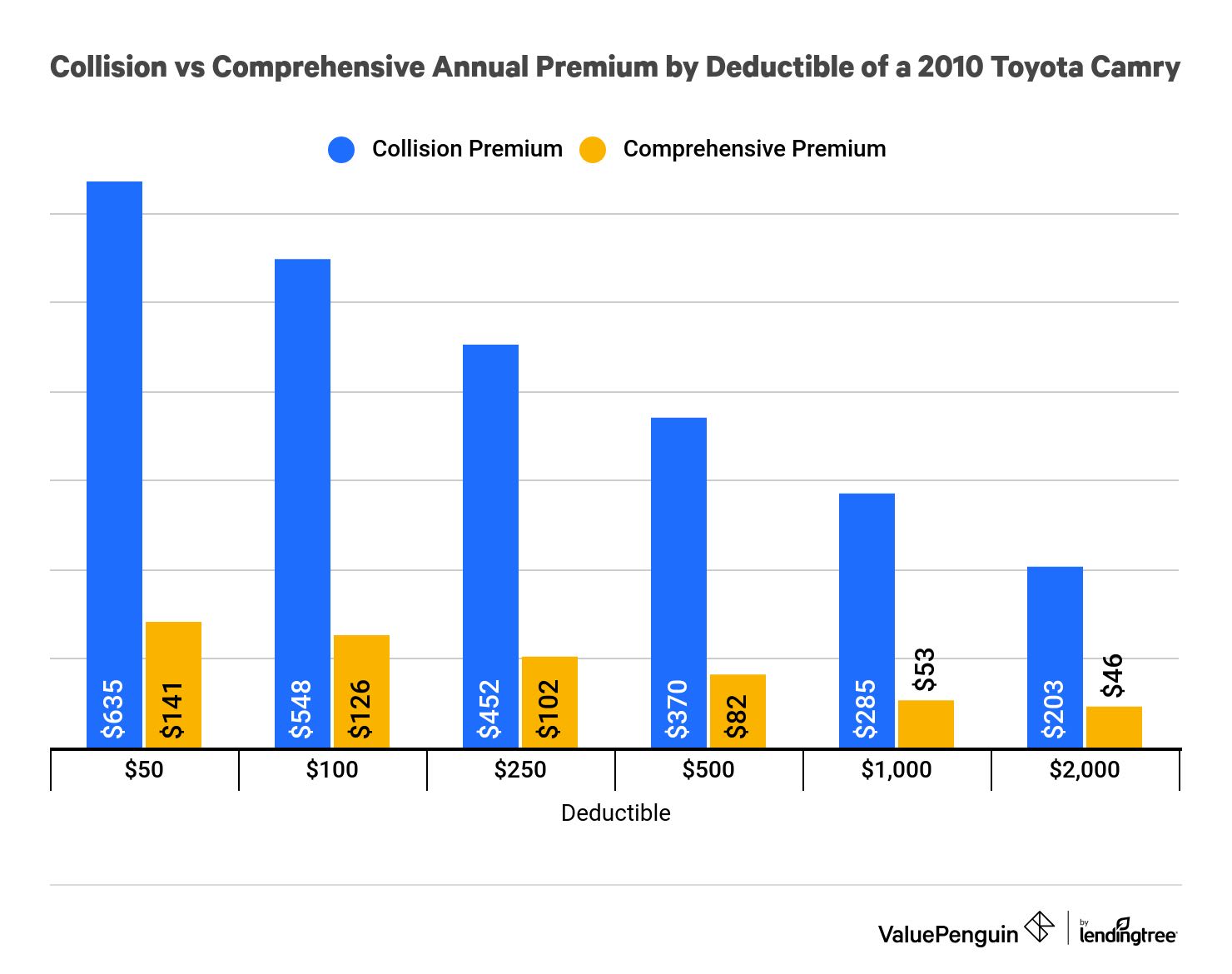

We took a look at auto insurance quotes for a 34-year-old married man and varied his deductible levels for collision and comprehensive coverage to see how his premiums changed.

For our sample driver, switching from $50 deductibles for comprehensive and collision to $250 deductibles would save him a total of $222, or 29% a year, on his physical damage premium ($776 to $554). Jumping from $50 deductibles to $1,000 deductibles would more than halve his premium, reducing it by $338, or 56% a year.

Find Cheap Auto Insurance Quotes in Your Area

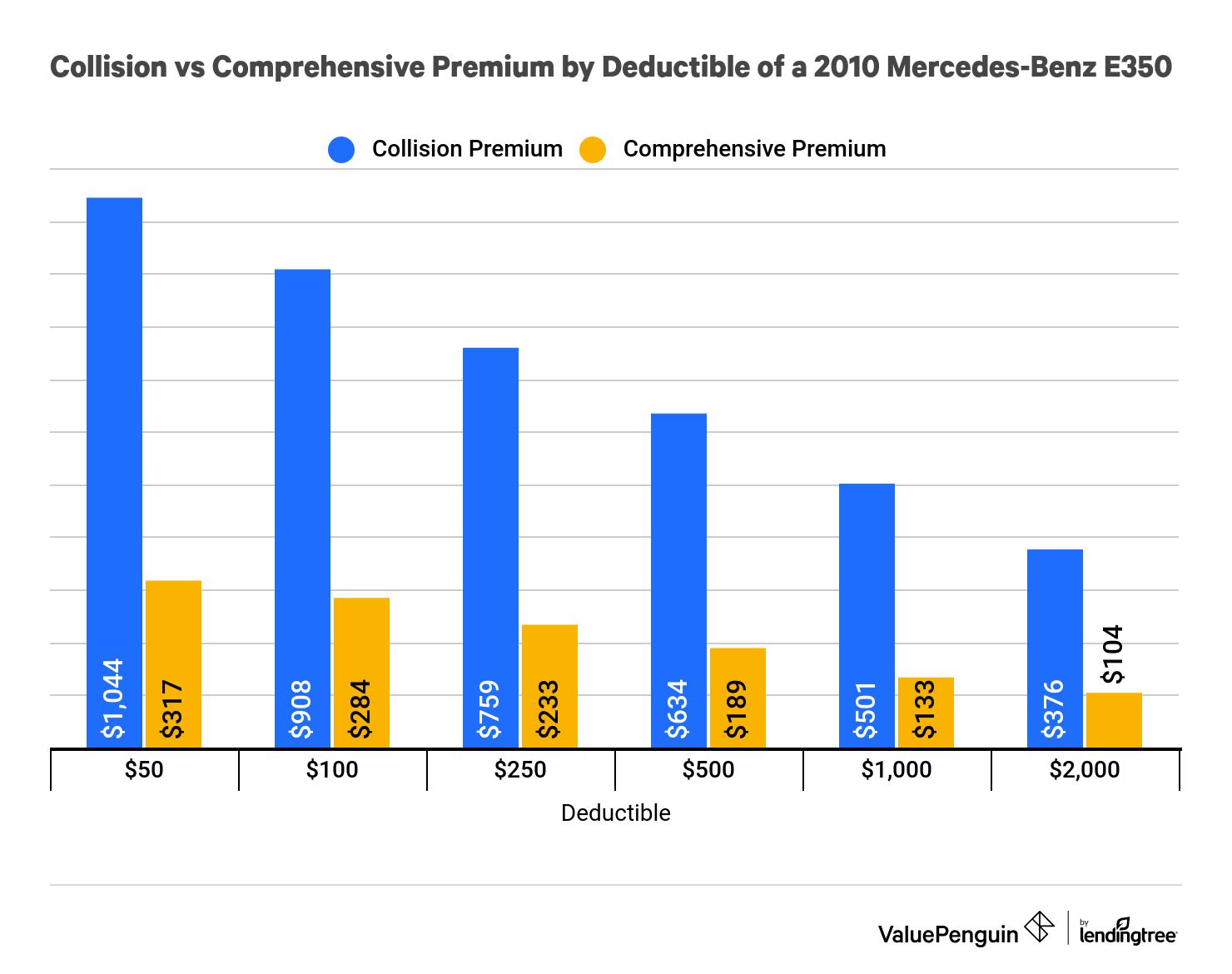

The potential for savings is even greater if our sample driver owns a more expensive car, such as a 2010 Mercedes-Benz E350. The change is especially evident once he raises his deductibles past $1,000. He can save a total of $369 on his physical damage premiums by switching from $50 deductibles to $250,but bumping his deductibles all the way up to $2,000 will save him $881 a year.

Changing the collision vs. comprehensive deductible

As the two graphs above show, collision coverage costs about 3–5 times more than comprehensive coverage. Since collision coverage makes up most of the premium cost, it is more cost effective to select a higher deductible for it and a low deductible for your comprehensive coverage.

However, it's not as simple as recommending that you raise your deductibles to lower your monthly payments. You should consider the risk that comes with higher deductibles: the potential for having to pay out of pocket for claims. Your insurer is willing to charge you a lower premium because you have reduced their risk by undertaking it yourself. When your deductibles are high, the chance you'll file a claim decreases, because your auto repair bill has to cost more than your deductible before you can ask your insurance company to cover any costs.

How should I choose my car insurance deductible?

The best deductible strategy largely boils down to balancing your budget flexibility and psychological comfort, which can be difficult to quantify. If your budget is tight, you may prefer a lower deductible and slightly higher monthly premium to avoid the potential stress of covering a high repair bill out of pocket. If you have more savings, you may be able to pay a larger portion of your repair cost if you file a claim in the future, so you can opt for lower monthly premiums.

One way to think about this is to compare potential savings to the additional out-of-pocket risk you take on. First, how long have you been accident free? Use that number as a proxy for how many years in the future you anticipate being claim free. Multiply the number of years you haven't filed a claim by the anticipated annual savings, and compare it to the deductible increase. This is by no means a definitive way to decide, but it is another piece of information to help you measure the risk trade-off.

For example, let's say our 34-year old married male driver has not had an accident in his Camry in the past five years. He has a $100 collision deductible. If he increases it to $500, his collision premium would be $178 lower. Assuming he stays accident free for three years, his savings would add up to $534. That would hypothetically cover more than the $400 increase in risk from his physical damage deductible. Using the same calculations, it wouldn't make sense for him to change his comprehensive deductible, because he'd need to be accident free for 10 years for his $44 in savings per year to outweigh the $400 increase in risk.

This also shows that it generally makes more financial sense to have a lower deductible for your comprehensive coverage rather than your collision, because you'll save comparatively less, despite the higher deductible. Raising your collision coverage deductible, on the other hand, keeps the total physical damage premiums much more affordable.

Average comprehensive collision claim amounts

Collision and comprehensive claims for repairs are relatively uncommon. According to Insurance Information Institute data, about 5.4% of policyholders with collision protection file a claim each year, and 2.7% of drivers with comprehensive coverage file a claim.

On the other hand, damage caused to your car because of someone else's fault gets paid out under a claim you file with their property damage coverage.

In 2021 the average collision claim was for $5,010, and the average comprehensive claim was for $2,042. However, these numbers don't show the whole range of claims filed, so there will be outliers with much lower and much higher claim amounts. Average claim amounts have been on the rise over the past decade.

Year | Average Collision Coverage Claim | Average Comprehensive Coverage Claim |

|---|---|---|

| 2012 | $2,950 | $1,585 |

| 2013 | $3,144 | $1,621 |

| 2014 | $3,169 | $1,572 |

| 2015 | $3,377 | $1,679 |

| 2016 | $3,454 | $1,951 |

| 2017 | $3,382 | $1,984 |

| 2018 | $3,533 | $1,957 |

| 2019 | $3,673 | $1,929 |

| 2020 | $3,736 | $2,037 |

| 2021 | $5,010 | $2,042 |