Best Cheap Health Insurance in New Mexico 2023

Find Cheap Health Insurance Quotes in New Mexico

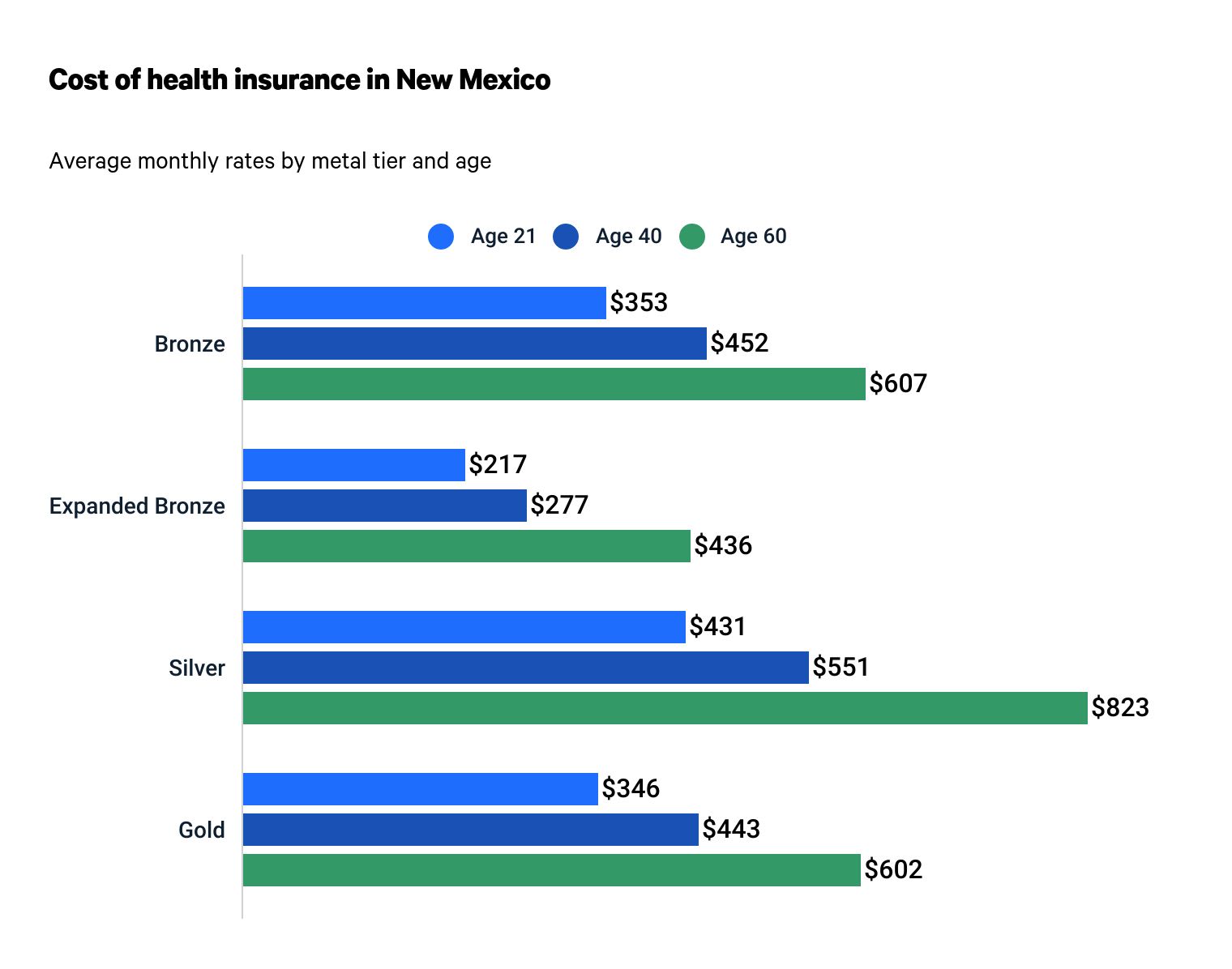

In New Mexico, the average cost of health insurance across all metal tiers is $431 per month for a 40-year-old.

The cheapest health insurance in New Mexico for most people who want a Silver plan is the Focused Silver plan, which is the most affordable Silver plan in 85% of counties.

New Mexico residents can find cheap health insurance on the state exchange or through Medicaid if their income qualifies. Finding your best health coverage may be difficult, as health plans and rates vary by county.

Cheapest health insurance by metal tier

We compared health insurance plans in New Mexico by metal tier to help you in your search for affordable health insurance policies. Plans and rates differ by county, so the policies below may not be available in your region. The table below should serve as a reference when determining the costs and benefits you can expect from a plan of each coverage tier.

Metal tier | Cheapest plan | Monthly cost for a 40-year-old | Deductible | Out-of-pocket maximum |

|---|---|---|---|---|

| Bronze | Ind HMO Bronze 2 with GYM On | $337 | $9,100 | $9,100 |

| Expanded Bronze | Ind HMO Expanded Bronze 1 with GYM On | $277 | $6,800 | $9,100 |

| Silver | Blue Community Silver HMO 203 | $371 | $1,750 | $9,100 |

| Gold | Blue Community Gold HMO 705 | $305 | $2,300 | $8,250 |

Find Cheap Health Insurance Quotes in Your Area

A higher metal tier health plan sometimes means more expensive monthly premiums but lower out-of-pocket costs. For example, the Ind HMO Bronze 2 plan has a monthly premium of $337, which is $34 less per month than the cheapest Silver plan, the Blue Community Silver HMO 203. However, the Silver plan offers a cheaper deductible of $1,750, which is $7,350 less than the Bronze plan's deductible.

Your monthly health insurance rates will also increase with age, regardless of a plan's metal tier. For example, a 40-year-old would pay 28% more on average than a 21-year-old in New Mexico for a Silver plan. This means a 40-year-old would pay $120 more per month on average for a Silver health plan.

Finding your best health insurance coverage in New Mexico

The best health insurance plan for your needs will vary depending on the policies available in your county, as well as your financial situation. Higher metal tier health plans, like Gold policies, typically have the most expensive premiums but affordable out-of-pocket expenses, like deductibles, copays and coinsurance.

This means if you have high recurring medical costs, like prescriptions, or think you may need medical care, a higher metal tier plan may be the best option. But if you are young, healthy and have no expected medical costs — and can cover the higher cost-sharing — a lower metal tier policy may be the choice for you.

Gold plans: Best for high expected medical costs

If you use or expect to use your insurance often, Gold plans typically have the lowest net cost because their deductibles and copays are smaller. Typically, the monthly premium you can expect to pay for a Gold plan will be the highest, but the average monthly premiums on a Gold plan are actually lower than the average monthly premiums on a Silver plan in New Mexico.

Ultimately, Gold plans are best if you have high expected medical costs, such as expenses for chronic conditions that may require constant medical attention, or are concerned about being able to pay out of pocket for an unexpected condition.

The cheapest Gold plan in New Mexico is the Blue Community Gold HMO 705. Compare all tiers in New Mexico above.

Silver plans: Best for people with low incomes or average medical costs

Silver plans usually provide the best health coverage options for those looking for a good balance between costs and benefits. However, Silver plans have the highest average monthly premiums in New Mexico because of cost-sharing reduction (CSR) subsidies, which the federal government no longer funds.

If you are part of a lower-income household, you may qualify for CSR subsidies with a Silver health plan, which would lower your out-of-pocket expenses further. Typical Silver plans cover about 70% of your health care costs, while you pay 30%, but under CSR subsidies, you could qualify for a Silver plan that covers up to 94% of your health care costs.

The cheapest Silver plan in New Mexico is the Blue Community Silver HMO 203. Compare all tiers in New Mexico above.

Bronze and Expanded Bronze plans: Best for young, healthy people

Bronze and Expanded Bronze plans typically have lower premiums than Silver and Gold plans.

These cheap policies come with lower coverage, meaning higher out-of-pocket costs. So, if you need medical care during the year, you have to pay more money yourself in deductibles and copays before the policy provides coverage. We don't recommend these policies unless you can afford the higher deductibles, copays and coinsurance in the case of a medical emergency.

Expanded Bronze plans extend a typical Bronze plan, which may cover about 60% of your health care costs, to cover up to about 65%.

The cheapest Bronze plan in New Mexico is the Ind HMO Bronze 2 with GYM On. The cheapest Expanded Bronze plan is the Ind HMO Expanded Bronze 1 with GYM On. Compare all tiers in New Mexico above.

Best cheap health insurance companies in New Mexico

New Mexico residents may have more health insurance options compared with people in most of the country because the state requires insurers to offer at least one plan in the Silver and Gold metal tiers statewide. There are currently four health insurance companies on the New Mexico state exchange:

- Ambetter Plan of WSCC

- BlueCross BlueShield of New Mexico

- Molina Healthcare of New Mexico

- Presbyterian Health Plan

In most of the state, Ambetter offers the cheapest Silver health care through the Focused Silver plan.

Cheapest health insurance plan by county

Although insurers are mandated to offer a plan at both the Silver and Gold metal tiers throughout the state, plans and pricing may still vary by county. To help you get started on your search for your best health plan, we identified the most affordable Silver health insurance policies available on the New Mexico exchange by county.

Below you can find the Silver policy with the cheapest monthly rate for your county, as well as sample monthly premiums for an individual and a couple.

County | Cheapest Silver plan | Age 40 | Couple, age 40 |

|---|---|---|---|

| Bernalillo | Blue Community Silver HMO 203 | $371 | $742 |

| Catron | Focused Silver | $500 | $999 |

| Chaves | Focused Silver | $500 | $999 |

| Cibola | Focused Silver | $500 | $999 |

| Colfax | Focused Silver | $500 | $999 |

| Curry | Focused Silver | $500 | $999 |

| De Baca | Focused Silver | $500 | $999 |

| Dona Ana | Focused Silver | $431 | $862 |

| Eddy | Focused Silver | $500 | $999 |

| Grant | Focused Silver | $500 | $999 |

| Guadalupe | Focused Silver | $500 | $999 |

| Harding | Focused Silver | $500 | $999 |

Health insurance rate changes in New Mexico

For a 40-year-old, the 2023 average cost of health insurance in New Mexico is 9% more than the 2022 cost. In turn, the cost of health insurance across each metal tier increased in the last year, except for Expanded Bronze.

Metal tier | 2022 premium | 2023 premium | Change |

|---|---|---|---|

| Bronze | $404 | $452 | 11.79% |

| Expanded Bronze | $294 | $277 | -5.85% |

| Silver | $480 | $551 | 14.78% |

| Gold | $397 | $443 | 11.52% |

Monthly rates are based on a 40-year-old adult.

Recap of the best cheap health insurance in New Mexico

- Bronze: Ind HMO Bronze 2 with GYM On

- Expanded Bronze: Ind HMO Expanded Bronze 1 with GYM On

- Silver: Blue Community Silver HMO 203

- Gold: Blue Community Gold HMO 705

Frequently asked questions

What is the average cost of health insurance in New Mexico?

The average cost of health insurance in New Mexico for 2023 is $431 for a 40-year-old. However, health insurance costs may vary by the metal tier of coverage, where you live and your age.

Which company has the most affordable health insurance in New Mexico?

In most of New Mexico, the company offering the cheapest Silver health insurance plans is Ambetter. But the marketplace offers a variety of companies to choose from, including BlueCross BlueShield of New Mexico, Molina Healthcare and Presbyterian.

How do I get cheap health insurance in New Mexico?

When shopping for a health insurance policy in New Mexico, the best way to get an affordable plan is to compare policies from multiple health insurance companies. Comparison shopping will help you better understand which companies in your area offer the cheapest coverage. Furthermore, you will be able to evaluate these prices based on your individual health care needs.

Methodology

We retrieved health insurance rates for 21-, 40- and 60-year-old shoppers using beWellnm, New Mexico's health insurance exchange. ValuePenguin organized this data according to county, age and metal tier to allow readers to compare rates easily.