Who Has The Cheapest Auto Insurance Quotes in Portland, OR?

State Farm has the cheapest insurance in Portland, OR, at $58 per month for liability-only coverage and $93 for full coverage.

Compare Car Insurance Rates in Portland, OR

Portland is one of the most expensive cities in Oregon for insurance. It's 22% more expensive to buy a car insurance policy in Portland than in other cities, due in part to high rates of auto theft.

Best cheap car insurance in Portland

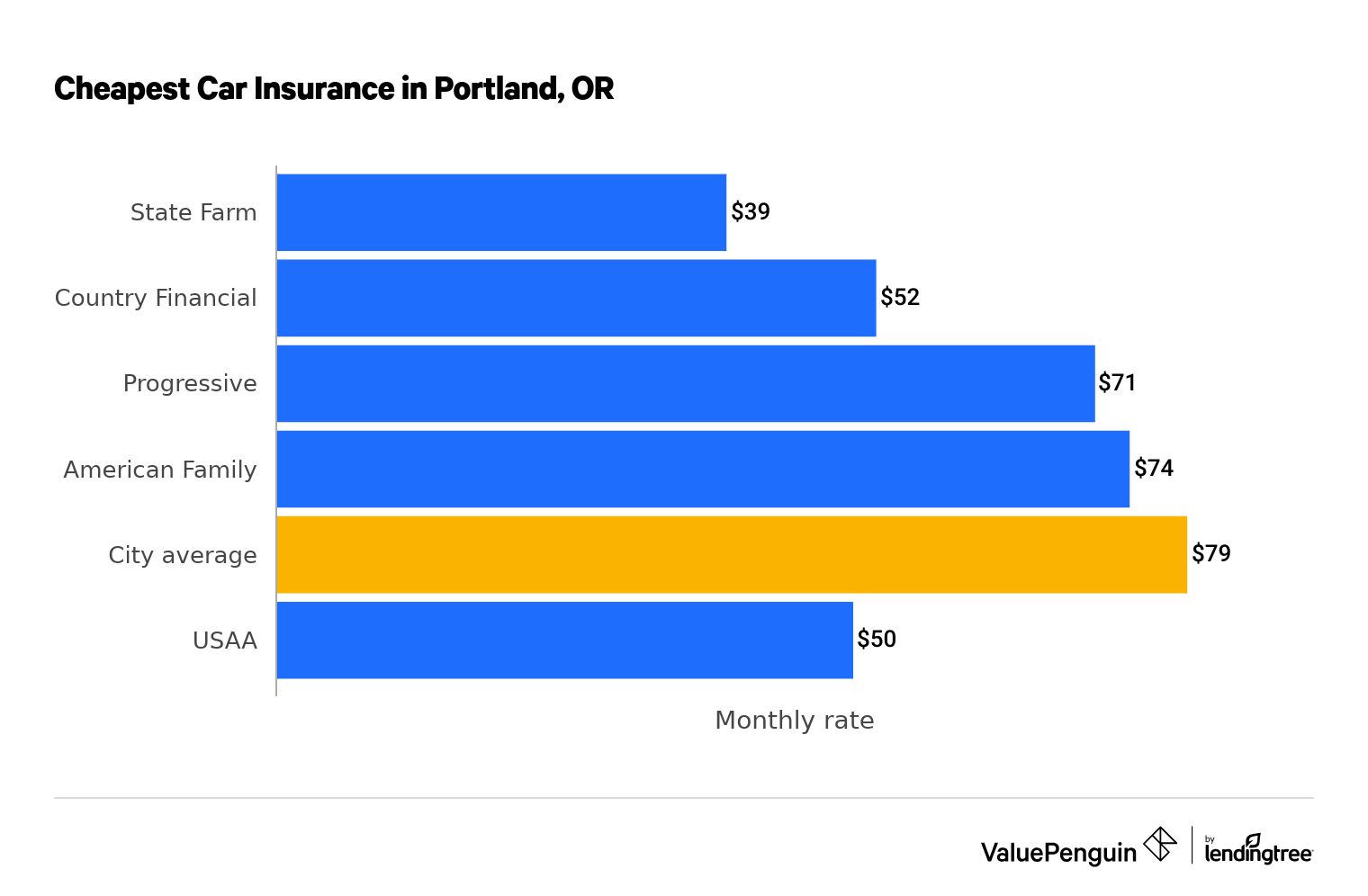

Cheapest auto insurance in Portland: State Farm

State Farm has the lowest price for car insurance in Portland, at $58 per month for liability-only coverage.

That's 44% cheaper than the average car insurance quote across the state's top companies, and $18 per month cheaper than Country Financial, which has the second-best price overall.

Compare Car Insurance Rates in Portland, OR

Remember that minimum coverage is the cheapest policy you can buy, so it doesn't provide much protection. People who drive a lot or own a newer or more valuable car should consider upping their coverage beyond the minimum.

Best cheap car insurance rates in Portland, OR

Company | Monthly rate | |

|---|---|---|

| State Farm | $58 | |

| Country Financial | $76 | |

| Progressive | $90 | |

| American Family | $98 | |

| Geico | $113 | |

| Travelers | $125 | |

| Allstate | $141 | |

| Farmers | $175 | |

| USAA | $63 |

USAA is only available to current and former military members and their families.

Cheapest full coverage car insurance in Portland: State Farm

For drivers who want or need a full coverage policy, State Farm is still the way to go. The company offers an average rate of $93 per year, which is $43 cheaper than the second-cheapest option.

Eligible drivers should also take a look at USAA. Its rates are nearly as affordable as State Farm's, and it has some of the best-rated service of any insurance company. But it's only available to people who've either served in the military or had a parent or spouse who has.

Company | Monthly rate |

|---|---|

| State Farm | $93 |

| Country Financial | $136 |

| American Family | $177 |

| Progressive | $181 |

| Geico | $218 |

| Allstate | $229 |

| Travelers | $235 |

| Farmers | $289 |

| USAA | $112 |

USAA is only available to current and former military members and their families.

Besides the minimum legally required coverages, full coverage includes comprehensive and collision coverage.

- Comprehensive coverage: Pays for damage to your car not caused by a crash, such as damage from hail or vandalism. Also covers theft.

- Collision coverage: Pays for damage to your car after a crash, regardless of who was at fault.

Cheap car insurance for drivers with prior incidents

State Farm offers the best rates for drivers with incidents on their records, like a recent crash or speeding ticket.

Having a less-than-perfect driving history may mean you'll pay more for car insurance than if you have a clean record. It also makes it even more important to shop around for the best rates; in this situation, finding the best deal for you could save you thousands of dollars per year.

Cheapest car insurance in Portland after an accident: State Farm

State Farm has the best rates for drivers after an at-fault crash in Portland, with an average of just $118 per month for full coverage. That's less than half the average rate across all insurance companies.

Being at fault in an accident has a major effect on your insurance rates because companies have found that drivers who have been at fault in one crash are more likely to be at fault again in the future.

Company | Monthly rate |

|---|---|

| State Farm | $118 |

| Country Financial | $206 |

| American Family | $292 |

| Progressive | $306 |

| Travelers | $340 |

Cheapest car insurance for people with a speeding ticket: State Farm

State Farm has the best prices for drivers with a speeding ticket in Portland. It offers an average rate of $100 per month for full coverage after one speeding ticket, which is 58% cheaper than the average across all insurance companies. It's also $83 less than the second-best option, Country Financial.

Companies have found that drivers with recent speeding tickets are more likely to get in a crash or make a claim on their policy, so you pay more for coverage after getting one.

Company | Monthly rate |

|---|---|

| State Farm | $100 |

| Country Financial | $183 |

| American Family | $211 |

| Progressive | $248 |

| Allstate | $275 |

Cheapest car insurance for drivers with a DUI: State Farm

State Farm has the best rates for a driver with a DUI. There, you may find rates as low as $100 per month for full coverage. That's a 65% discount compared to the average rate citywide.

If you have a DUI conviction, one of the most serious driving offenses, you're likely to see a big increase in car insurance rates. On average, a Portland driver with one DUI will pay $282 per month for a full coverage policy — that's 52% more than a driver without one.

Company | Monthly rate |

|---|---|

| State Farm | $100 |

| Country Financial | $216 |

| Progressive | $221 |

| Allstate | $311 |

| American Family | $329 |

Drivers with DUIs on their record in Oregon may also need an SR-22 form. In this case, we recommend letting each company know when you request quotes, as it could impact your costs.

Cheapest car insurance for drivers with poor credit: State Farm

In Portland, State Farm has the best insurance for drivers with bad credit. Its average rate is $229 per month for full coverage, which is 29% cheaper than the city average.

Your credit score isn't necessarily indicative of your driving skills, but having bad credit can still make your insurance rates go up. It can sometimes be a challenge to get car insurance with bad credit.

Company | Monthly rate |

|---|---|

| State Farm | $229 |

| Country Financial | $235 |

| Progressive | $275 |

| American Family | $313 |

| Geico | $323 |

Cheapest car insurance for young drivers: Country Financial

Country Financial has the best rates for 18-year-olds in Portland, with an average price of $148 per month for a minimum coverage policy.

That's more than $300 cheaper per year than the second-cheapest option, State Farm, and about half the average cost citywide.

Teenagers typically pay the most for car insurance of any group, as they're less experienced behind the wheel and get in crashes much more often.

The best way for a teen to save on insurance is to share a policy with their parents or an older adult. Also, many insurers offer discounts such as a good student discount.

Company | Liability only | Full coverage |

|---|---|---|

| Country Financial | $148 | $276 |

| State Farm | $175 | $281 |

| Geico | $245 | $470 |

| Travelers | $364 | $687 |

| American Family | $369 | $694 |

Cheapest car insurance for married drivers: State Farm

State Farm has the best rates in Portland for married drivers.

Its average price of $93 per month for full coverage is 48% less than the city average — even though State Farm's rates aren't cheaper for married couples.

Car insurance companies often give married drivers a lower rate for car insurance because they tend to take fewer risks behind the wheel.

Company | Monthly rate |

|---|---|

| State Farm | $93 |

| Country Financial | $117 |

| Progressive | $143 |

| American Family | $177 |

| Allstate | $230 |

Note that these rates don't factor in multicar discounts, which can bring down the rates for married drivers even more.

Best car insurance companies in Portland

USAA has the best-rated car insurance in Portland, based on its excellent customer service reviews and affordable rates.

However, most drivers aren't eligible for USAA insurance. It's only available to you if you've served in the U.S. military, or if your parent or spouse has had USAA coverage at some point.

Drivers that aren't eligible for USAA can find great service at State Farm and Geico.

Best car insurance in Portland

Company |

Editor's rating

|

|---|---|

| State Farm | |

| USAA | |

| Geico | |

| American Family | |

| Farmers | |

| Travelers | |

| Allstate | |

| Country Financial | |

| Progressive |

The best insurance companies have dependable service in addition to affordable prices.

A dependable insurance company will answer your questions and make sure you're compensated quickly and fairly after you file a claim.

Average car insurance cost in Portland, by neighborhood

Powellhurst is the most expensive neighborhood in Portland for car insurance, at $213 per month for full coverage.

That's $46 per month more expensive than the cheapest neighborhood in Portland, which borders the suburb Tigard.

Where you live impacts your car insurance rates. For example, if you live in an area with low crime rates, you might pay less; if your neighborhood has roads in poor condition, you might pay more.

ZIP code | Average monthly cost | Percentage difference from average |

|---|---|---|

| 97201 | $172 | -7% |

| 97202 | $186 | 0% |

| 97203 | $191 | 3% |

| 97204 | $183 | -1% |

| 97205 | $178 | -4% |

Methodology

To determine the best rates in Portland, ValuePenguin collected quotes from the largest insurance companies in Oregon. Rates are for a 30-year-old man with good credit who drives a 2015 Honda Civic EX.

Full coverage policies included more than the minimum required liability, and comprehensive and collision.

Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $15,000 |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.