The Best and Cheapest Home Insurance in Georgia

Progressive has the cheapest home insurance rates in Georgia. Homeowners should also consider Cincinnati Financial, which is affordable and has solid customer service.

Find Cheap Homeowners Insurance Quotes in Your Area

Best cheap home insurance in Georgia

ValuePenguin editors collected thousands of home insurance quotes from every ZIP code in Georgia, along with coverage options, discounts offered and customer service metrics. Those are evaluated to pick the best and cheapest options for you, the customer.

Home insurance rates are for a 2,100-square-foot home that is the median age and value in the state, according to the U.S. Census. Full methodology

Cheapest homeowners insurance in Georgia

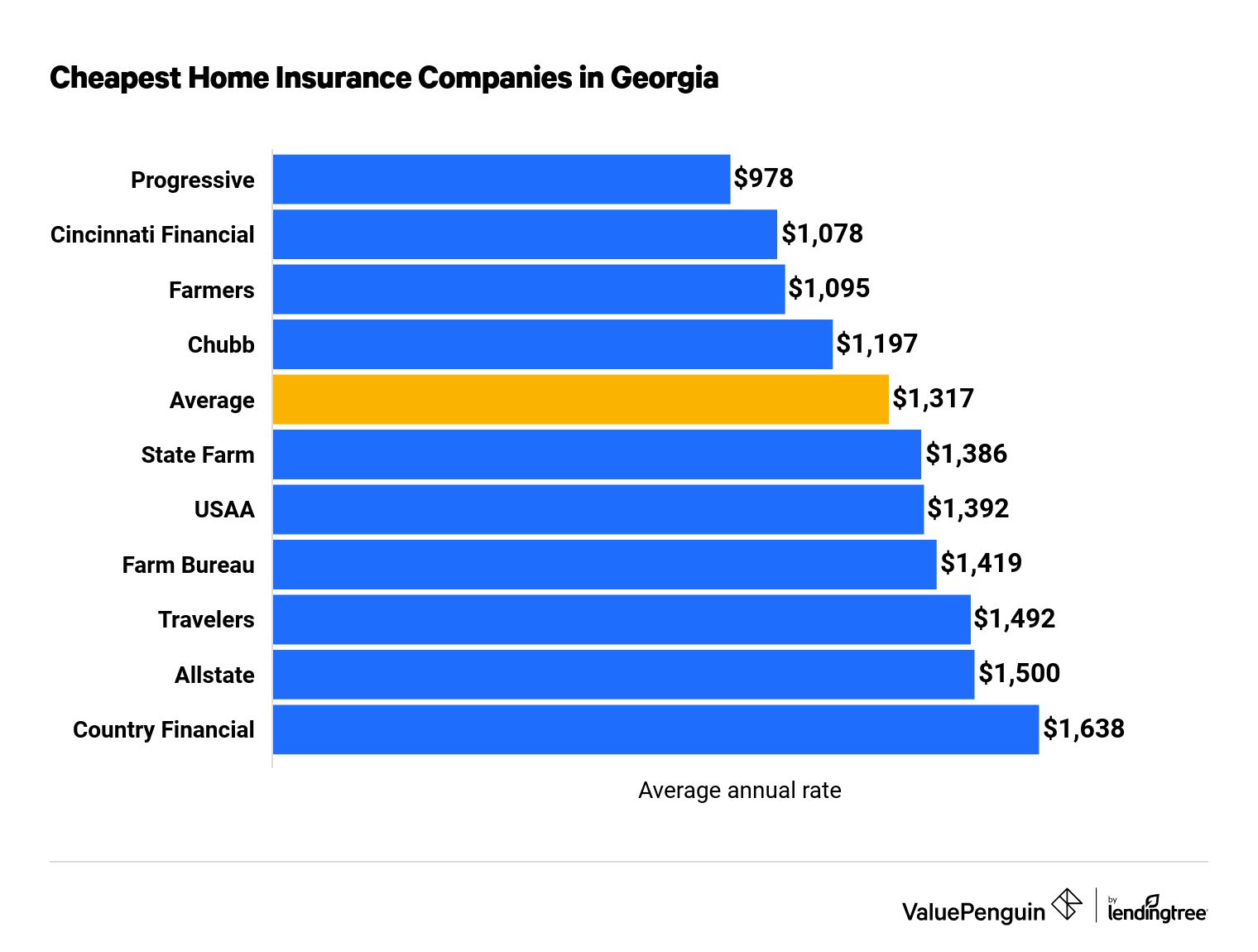

The average cost of homeowners insurance in Georgia is $1,317 per year.

The cheapest homeowners insurance company for most Georgians is Progressive, while Country Financial has the most expensive rates.

The average annual price of homeowners insurance in Georgia is about $1,317 per year. That's $178 more expensive than the average cost of coverage in the U.S., which is $1,495 per year.

Find Cheap Home Insurance Quotes in Georgia

Cincinnati Financial also has great rates for Georgia homeowners — a policy costs 18% less than the statewide average, and the company has excellent customer service scores.

Cheap annual home insurance rates in Georgia

Company | Annual cost | |

|---|---|---|

| Progressive | $978 | |

| Cincinnati Financial | $1,078 | |

| Farmers | $1,095 | |

| Chubb | $1,197 | |

| State Farm | $1,386 |

Best homeowners insurance for most people: Cincinnati Financial

The best homeowners insurance company in Georgia for most people is Cincinnati Financial. At $1,078 per year, a policy from Cincinnati is $239 per year cheaper than the statewide average.

The company also has strong customer service scores — it's one of the best-rated insurers in Georgia. According to the National Association of Insurance Commissioners (NAIC), Cincinnati gets 75% fewer complaints than expected based on its size.

Cincinnati offers three levels of homeowners insurance coverage. The most basic policy, Executive, includes the standard coverage you would expect from home insurance. The Executive Capstone and Executive Classic offer broader coverage tailored to the needs of high-value homeowners, including:

- Enhanced replacement cost

- Identity theft coverage

- Sewer or sump pump backup coverage

- Service line coverage

- Equipment breakdown coverage

- Flood insurance

Most affordable homeowners insurance: Progressive

-

Editor rating

-

Annual rate

$978 ?

Pros and cons

Progressive has the cheapest home insurance rates in Georgia. You can typically get coverage for $978 per year, which is 26% less than the average cost of homeowners insurance in the state.

The coverage offered by Progressive is fairly standard. However, its personal liability coverage is less comprehensive than most major insurers — you need to buy extra coverage to get protection against slander and libel.

Another downside to buying home insurance from Progressive is that it doesn't underwrite its own policies. After buying a policy, you'll work directly with one of its 13 partners for any claims or service needs, meaning it can be hard to predict the quality of service you'll get.

Best auto and home insurance bundle: State Farm

-

Editor rating

-

Annual rate

$1,386 ?

Pros and cons

The best home and auto insurance bundle for people in Georgia can be found with State Farm. The company offers an estimated 15% off of your auto insurance rate when you buy a home policy, too.

Although State Farm's average homeowners insurance rate is slightly above the Georgia average at $1,386 per year, it has some of the cheapest auto insurance rates in the state — a full-coverage policy costs $1,410 per year. That makes for the best combined home and auto prices in the state.

Aside from great rates, State Farm also offers excellent customer service. It earned top scores from our editors, as well as high marks on the J.D. Power customer service study. The company also has fewer complaints than expected based on its size, according to the NAIC.

Find Cheap Home Insurance Quotes in Georgia

Georgia homeowners insurance rates: City-by-city breakdown

Homeowners in Athens have the cheapest home insurance costs in Georgia — a policy costs $1,093 per year. People living in Cotton pay the highest rate at $1,954 per year, on average.

In Atlanta, Georgia's largest city, the average homeowners insurance rate is in line with the statewide average at $1,317 per year. Augusta residents pay 5% more for home insurance — $1,381 per year.

Average annual home insurance quotes by city

City | Annual cost | Difference from average |

|---|---|---|

| Abbeville | $1,374 | 4% |

| Acworth | $1,181 | -10% |

| Adairsville | $1,265 | -4% |

| Adel | $1,365 | 4% |

| Adrian | $1,390 | 5% |

Georgia insurance company ratings

The best-rated homeowners insurance companies in Georgia are Cincinnati Financial and USAA.

To judge which homeowners insurance companies in Georgia have the best customer service, we factored in ValuePenguin editor's ratings, National Association of Insurance Commissioners (NAIC) complaint index figures and J.D. Power customer satisfaction scores.

Company |

Home insurance rating

|

|---|---|

| Cincinnati Financial | |

| USAA | |

| State Farm | |

| Country Financial | |

| Chubb | |

| Farmers | |

| Progressive | |

| Allstate | |

| Travelers | |

| Farm Bureau |

Most common homeowners insurance perils in Georgia: Severe storms and flooding

Georgia's proximity to the Atlantic Ocean and Gulf of Mexico puts homeowners in the path of hurricanes. Tornadoes also come through Dixie Alley and affect the state. In fact, according to the National Weather Service, there were about 75 tornadoes in Georgia in 2020. Parts of Georgia are also susceptible to flooding.

No matter your home's location, it's important to understand how your homeowners insurance protects you against the perils you're most likely to encounter. Before you buy insurance, you should factor in how each company treats the natural disasters that could impact your household.

Does homeowners insurance cover tornadoes?

Most homeowners insurance companies provide coverage against damage caused by tornadoes. That's because wind is often listed on your policy's declarations page as a covered peril, which includes wind damage from both tornadoes and hurricanes.

Does homeowners insurance cover flooding?

Your homeowners insurance doesn't cover flood damage. If you want to protect your home from floods, you have to buy a separate flood insurance policy from the National Flood Insurance Program (NFIP) or a private insurance company. An NFIP flood insurance policy costs about $985 per year, but low-risk properties can find cheaper coverage with the NFIP's Preferred Risk Policy.

There are more than 75,000 policies in effect in Georgia, and the average policy includes $280,000 of coverage. While you aren't required to carry flood insurance unless your lender requires it, it's worth knowing your home's risk level using the flood map tool from the Federal Emergency Management Agency (FEMA).

Frequently asked questions

How much is home insurance in Georgia?

Homeowners insurance in Georgia costs an average of $1,317 per year, or $110 per month. However, average rates can fluctuate by up to $861 per year depending on where you live.

Who has the cheapest homeowners insurance in Georgia?

Progressive offers the cheapest home insurance rate in Georgia at $978 per year, which is $339 less expensive than the statewide average.

How much is homeowners insurance in Marietta?

Homeowners in Marietta can expect to pay $1,216 per year for insurance, on average. That's 8% below the state average.

How did we pick the best homeowners insurance in Georgia?

In order to decide the best homeowners insurance companies in Georgia, we evaluated each provider's rates, policy offerings and customer service reputation. We collected quotes from every ZIP code in the state using a sample profile for a $176,000 home built in 1989. That's the median year homes were built in the state and the median home value in Georgia.

We gathered rates from the following companies:

- Allstate

- Chubb

- Cincinnati Financial

- Country Financial

- Farm Bureau

- Farmers

- Progressive

- State Farm

- Travelers

- USAA

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.