Compare Motorcycle Insurance Quotes

Comparing motorcycle insurance quotes could save you hundreds of dollars a year.

Find Cheap Motorcycle Insurance Quotes in Your Area

Since motorcycle insurance companies often quote the same rider at different rates for the same vehicle, comparing motorcycle insurance quotes is an important part of shopping for policies. Doing so can potentially save riders hundreds of dollars per year.

See how your location, motorcycle model and insurance provider can all affect the price you pay for coverage.

Why should you compare motorcycle insurance quotes?

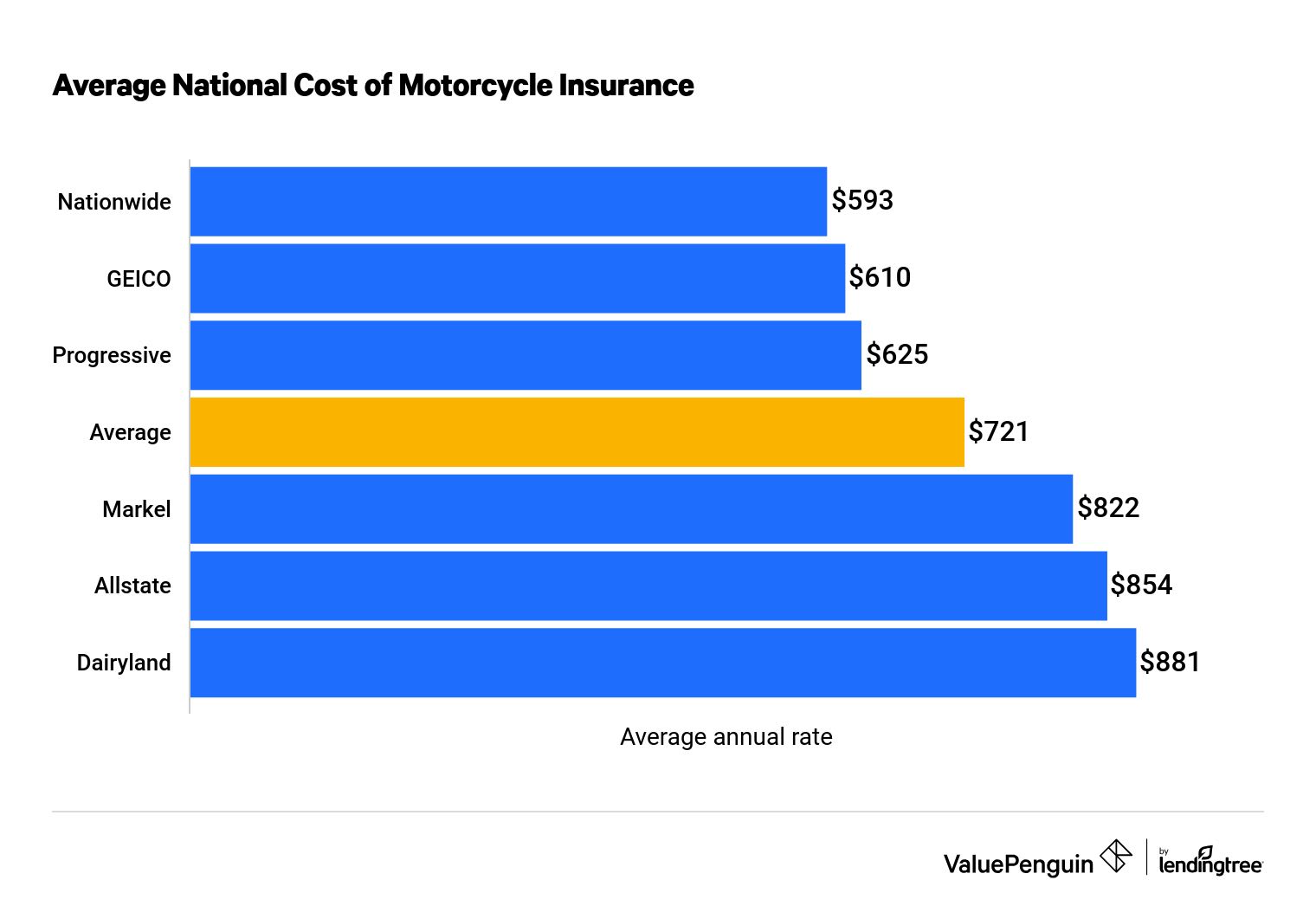

Comparing motorcycle insurance quotes can save you a lot of money, as different insurers offer a range of prices for the same policy. We averaged the national cost of six motorcycle insurance companies and found that the premiums could vary by up to $2,000 depending on your state and provider.

While national rate data can give you a clue about how expensive an insurer tends to be, it's harder to say how much motorcycle insurance will cost for riders in your area or state. As you'll see, a company's average motorcycle insurance price can be cheaper or much more expensive than prices quoted locally. Some providers, like Nationwide, offer affordable national premiums but may not necessarily be available in your area.

Insurer | AZ | CA | MI | NY | TX | WA | |

|---|---|---|---|---|---|---|---|

| Allstate | $1,218 | $1,399 | $1,129 | $661 | $1,092 | $716 | |

| Dairyland | $923 | $2,311 | $962 | $1,224 | $784 | $697 | |

| Geico | $544 | $780 | $1,018 | $488 | $757 | $706 | |

| Markel Corporation | n/a | n/a | n/a | n/a | $928 | n/a | |

| Nationwide | $633 | n/a | n/a | $530 | $739 | n/a | |

| Progressive | $506 | $2,774 | $702 | $621 | $631 | $814 |

If you're looking for coverage in any of the states highlighted in our table, you should check out reviews of the best motorcycle insurance providers in your area.

Getting an online motorcycle insurance quote

Most major motorcycle insurance companies allow insurance shoppers to gather quotes online. Getting motorcycle insurance quotes online is a great way to compare rates from several insurers, as the process is quick and requires no commitment to purchase a policy.

To gather quotes online, be prepared to provide the following information:

- Your motorcycle's VIN (or its exact make, model and model year)

- The number of miles you ride per year

- The number of years you've been licensed to ride a motorcycle

- The date you completed an accident prevention course, if you've taken one

- Your current motorcycle insurer and policy limits, if you are currently insured

- The dates and details of any traffic violations or accidents you've been involved in

Compare quotes with these motorcycle insurance companies

Below, we've included some of the largest motorcycle insurance companies that can provide you with cheap motorcycle insurance quotes online. Other companies may require you to speak to an agent to obtain a quote.

Progressive motorcycle insurance

Progressive's range of discounts and coverage options make it the best motorcycle insurance company for most riders. Riders automatically receive replacement cost coverage, original equipment manufacturer (OEM) parts coverage and $3,000 of custom parts protection when they have comprehensive and collision coverage.

Furthermore, Progressive typically offers affordable rates for many drivers and features a fast and easy-to-use online quote tool — it only takes about five minutes to get a quote.

Geico motorcycle insurance

Anyone shopping around for cheap motorcycle insurance quotes should be sure to check out Geico, as it typically offers the cheapest motorcycle quotes among its competitors. Because of its low rates, Geico is a great place to start your motorbike insurance comparison.

Even if you're someone who wants more than the absolute cheapest motorcycle insurance, Geico is worth considering. Its customizable limits allow riders to buy policies with higher coverage levels if needed.

Nationwide motorcycle insurance

Nationwide's motorcycle insurance isn't available in as many states as Progressive, but it's a great alternative for people looking to compare motorcycle insurance quotes. Nationwide tends to have the most affordable rates nationally — the average policy costs $539 a year. It's also easy to use Nationwide's quote form to find an online motorcycle insurance quote in minutes.

Motorcycle insurance from Nationwide comes with $3,000 of custom parts protection, along with the chance to upgrade to up to $30,000. Additionally, you can upgrade your policy to include coverage for original equipment manufacturer parts if your bike is damaged and needs repairs.

Dairyland motorcycle insurance

While it tends to be more expensive than other motorcycle insurance companies, Dairyland's flexible payment plans could appeal to infrequent riders or people who want more freedom to change their coverage limits.

If you're a more serious rider, Dairyland has a variety of coverage options available to purchase, including replacement cost coverage, protection for your bike's special parts and total loss coverage for some bikes.

Markel motorcycle insurance

Markel is our favorite insurance company for motorcycle enthusiasts because it can cover more types of motorcycles than typical insurers. It also provides great discounts for people who are insuring several bikes.

Although you can request quotes online, if you are trying to get a quote for a custom motorcycle, you will have to speak to an agent over the phone.

What causes motorcycle insurance rates to increase?

Motorcycle insurance companies take into account a variety of factors when setting their rates — including your age, riding history and motorcycle make and model.

Each insurer weighs factors differently when setting rates, meaning the cheapest motorcycle insurance company for one rider might not be the cheapest for another rider. If you were recently at fault in an accident or you're insuring a bike that has a higher crash rate, your policy will likely be more expensive, as insurers will charge more for riders who they perceive to be higher risk.

In particular, those who have traffic violations on their driving records (such as speeding tickets) should compare quotes from multiple insurers, as rates for these riders can often vary more. For instance, in the example below, while most providers charged more for riders with just one speeding violation, both Progressive and Nationwide increased rates by over 30%. Geico was the exception — its rates stayed the same for a driver with one speeding ticket.

Find Cheap Motorcycle Insurance Near You

What kind of motorcycle insurance coverage do you need?

Before you can begin collecting motorcycle insurance quotes to compare rates, you have to determine the correct coverages and limits for you as a rider. Additionally, make sure you compare policies that have identical limits.

-

Liability: Unless you live in Florida or Washington state, you will be required to purchase liability coverage for your motorcycle. If you're at fault in an accident, this covers the cost of injuries to other people and damage to their property.

-

Comprehensive and collision: If your motorcycle is worth more than $5,000, we recommend you purchase comprehensive and collision coverage — which pays to repair and replace your bike if it's damaged or stolen.

-

Motorcycle accessory coverage: Typical comprehensive and collision coverage may not pay for repairs or replacement for motorcycle accessories such as fairings, windshields and luggage racks. To ensure these items are insured, you may have to purchase motorcycle accessory coverage as an add-on to your policy.

-

Custom motorcycle insurance: If you own a motorcycle that is custom built or highly modified, you should consider custom motorcycle insurance. These policies are based on on an agreed value rather than the vehicle's Blue Book value, meaning you can ensure the full value of your bike is covered.

Compare motorcycle insurance for mopeds and scooters

Comparing scooter and moped insurance quotes is largely the same process as it is for motorcycles. The only difference is that some states have different requirements for these vehicles. Before you start comparing policies, check your state's moped and scooter insurance requirements to see if coverage is mandatory.

However, even if you don't need coverage, we recommend you purchase liability insurance. This will protect your assets if you are liable for damages that result from an accident.

Frequently Asked Questions

What is the best insurance for motorcycles?

The best motorcycle insurance policy is one that guarantees you financial protection at an affordable rate. We determined that Dairyland Insurance has the best policies for daily riders, while Progressive offers the best coverage for custom bikes.

Which motorcycle insurance is the cheapest?

The cheapest motorcycle insurance company can vary based on where you live, your age and your driving history. We found Nationwide to be the best company for low-cost coverage.

Should I get full coverage on my motorcycle?

Full-coverage motorcycle insurance makes sense for riders who have new or vintage bikes with high price tags, but it may be less important if you're on a budget or starter bike. Consider how the additional cost of comprehensive and collision coverage compares to the cost you would incur if your bike is damaged or destroyed.

Methodology

We collected thousands of quotes from six major insurance companies across the country to determine the average national and state costs of motorcycle insurance.

To calculate the change in rates after a traffic violation, we compared quotes for a 35-year-old male living in Dallas who has been riding for 10 years. For ticketed rates, we chose a speeding violation at 11 miles per hour over the posted limit within the last three months.