Which Gender Pays More for Car Insurance?

In most states, car insurance companies are allowed to consider your gender when setting car insurance rates. Over the course of their lifetimes, women tend to pay slightly less — but only by a small amount. Younger men and women will see the biggest gender gap, while adult drivers can typically expect a price difference between men and women of less than 1%.

Some insurers might recommend that transgender or nonbinary drivers list themselves by the sex designation on their birth certificate, although some insurers in some states provide the option for you to list yourself as something different than male or female.

Who pays more for car insurance, men or women?

For the most part, men and women pay about the same amount for car insurance. For typical adult drivers, we found only a slight difference in the cost of insurance between men and women.

We found a price difference of less than 1% between men and women in their 30s.

It's worth noting that different insurers we looked at factored in gender slightly differently. Geico charged women slightly more, while Progressive charged them slightly less. Allstate and State Farm both kept their rates exactly the same, regardless of gender.

Car insurance company rates by gender

Insurer | Women | Men | Change |

|---|---|---|---|

| Allstate | $2,493 | $2,493 | 0% |

| Geico | $1,707 | $1,682 | 2% |

| Progressive | $1,963 | $2,048 | -4% |

| State Farm | $1,160 | $1,160 | 0% |

The cost difference among insurers was substantially greater than the difference between men and women — which is why it's so important to compare rates to find the cheapest car insurance for you.

Find Cheap Auto Insurance Quotes in Your Area

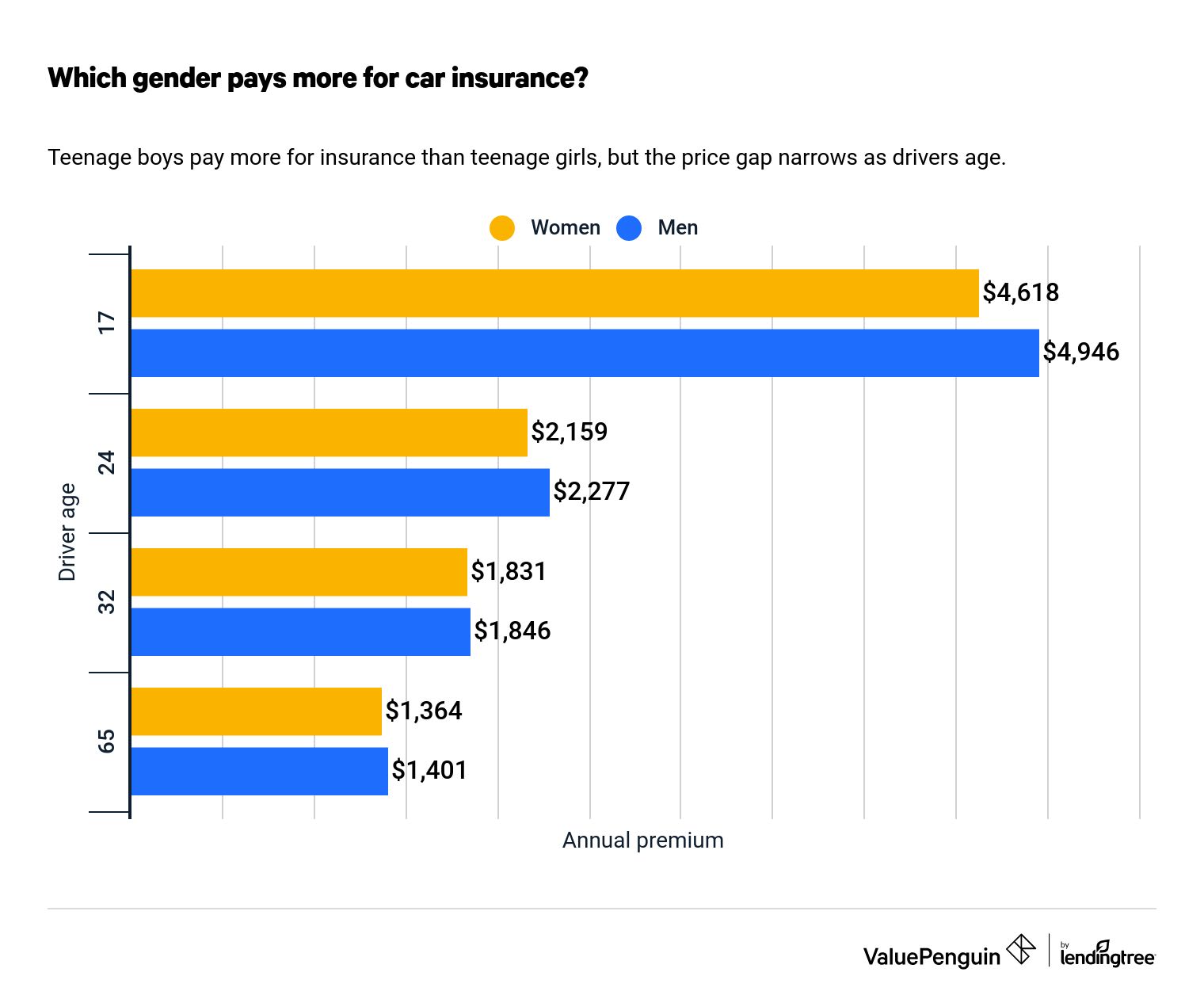

Age affects the insurance cost gap between genders

While adult men and women pay about the same amount for car insurance, the gap changes as drivers get older.

While all teens pay more for car insurance than older adults, teenage boys pay the most of all. Our sample boy driver got a quote for $4,946 per year, or $328 more than a girl of the same age.

On the other hand, a 32-year-old man can expect to pay about $15 more per year than a woman.

Car Insurance annual price by age and gender

Age | Women | Men | Change |

|---|---|---|---|

| 17 | $4,618 | $4,946 | -7% |

| 24 | $2,159 | $2,277 | -5% |

| 32 | $1,831 | $1,846 | -1% |

| 65 | $1,364 | $1,401 | -3% |

Why do men pay more for car insurance?

Insurance companies don't explain directly why one group of people pays more for car insurance than another. But in general, insurers charge more for people who are statistically more likely to be involved in an accident or make a claim on their policy.

In other words, insurers have found that boys and young men are more likely to get in car accidents than other drivers — even more than young women. Young men may be more likely to purchase a sports car, speed or take risks behind the wheel.

Some states don't permit gender to impact insurance rates

There are a few states that explicitly forbid insurance companies from considering gender when it comes to insurance rates. Those states are:

If you live in one of these states, your insurer cannot take your gender into consideration when setting rates — in most cases, the insurer won't even ask.

Car insurance for trans or nonbinary drivers

How insurers recognize trans or nonbinary drivers will likely depend on the company and state. Sex designations on birth certificates have traditionally been the way DMVs denote gender and a factor in how insurers set rates.

For example, a person who was assigned male at birth but identifies as female may mark "female" on their insurance application. All else being equal, they could be quoted a more affordable rate. However, if the person's sex is legally "male" — which is defined by the DMV as what's listed on a birth certificate — the insurer might adjust the premium when writing the final policy.

As of mid-2022, more than 20 states have gender-neutral options on driver's license forms. In other states, you might have to provide documentation to change your gender on your license.

How to save on insurance, no matter your gender

Whether you're male, female or nonbinary, if you're having trouble finding an affordable price for car insurance, there are several ways for you to bring down your monthly rate.

First, shop around. Every car insurer sets rates differently, and a factor like a speeding ticket might have a smaller impact on your rates at one company than another. We recommend shopping for car insurance at least every two years, or any time you experience a life change that could impact your rates.

Second, maximize how many discounts you're eligible for. Some insurers offer more discounts than others, but there's no single insurer that offers every discount under the sun. You might find big savings for good grades at one insurer, or a discount for being a teacher at another. Just make sure you're not leaving money on the table by not applying for discounts that you're eligible for.

Two particularly big discounts to look into are pay-per-mile insurance and telematics programs. These similar programs use a plug-in device or a smartphone app to see how much or how safely you drive and adjust your rates accordingly.

A pay-per-mile insurance program tracks how much you drive and charges you a per-mile rate (in addition to a monthly base). If you don't use your car much, this kind of program can be a great way to reduce your bill.

On the other hand, a telematics device simply monitors your driving habits. If you are a safe driver, you'll see your rates go down, regardless of how often you use your car.

Frequently asked questions

Which gender pays more for car insurance?

Men tend to pay more for car insurance overall, though the difference is slight — about 1%. The difference is most pronounced for teens and young adults.

Why do men pay more for car insurance?

All car insurance rates are set based on historical data and statistical correlation. If an insurer has found that a certain group is more likely to make a claim or be involved in a crash, that insurer will charge higher rates to that group.

Methodology

We compared rates for male and female drivers in Indiana. Our sample drivers all had a full coverage policy on a 2015 Honda Accord.

ValuePenguin's rate data was provided by Quadrant Information Services. Quotes are publicly sourced from insurer filings and intended for comparative purposes only. Your own rates could differ.