Car Insurance Refund: 3 Times When You're Eligible

If your car insurance policy is cancelled in the middle of your term, whether it's by you or the insurer, you're generally eligible for a refund of whatever premium you haven't used.

But exactly how much you can get back depends on whether it was you or your insurer who elected to cancel the policy, how much time you have left on your policy and your insurer's rules when it comes to refunds.

You've chosen to cancel your car insurance policy

One of the most common scenarios in which you can get a car insurance refund is if you've decided to cancel your policy in the middle of your term. You may have found a better rate elsewhere, are selling your car or are moving to another state or country. In general, you'll be eligible to receive most or all of your unused premium.

Cancelling your insurance policy can result in higher rates in the long run if you don't have another policy in effect. This is because insurers see lapses in coverage as indicative of higher risk.

We only recommend cancelling your insurance policy if:

- You've already bought a policy at another insurer

- You're getting rid of your car completely

- You're moving out of the country

Whether insurers require you to pay a cancellation fee depends on their rules, as well as on state law. For example, South Carolina allows insurers to charge a $20 fee at the beginning of the term, which is generally not refunded. You'll need to contact your insurer directly to be sure of what you're entitled to.

Some insurers, like State Farm, Progressive and Geico, state on their websites that they don't charge a cancellation fee.

There's one more exception to be aware of. While an insurer might not technically charge you a fee to cancel a policy, it may opt to "short rate" your policy. If your insurer does this, it considers the first part of your policy term to be more expensive because of set-up costs. That means it has to do things like determine your rates and send you new paperwork. As a result, you may get back less than an even fraction of your total amount paid.

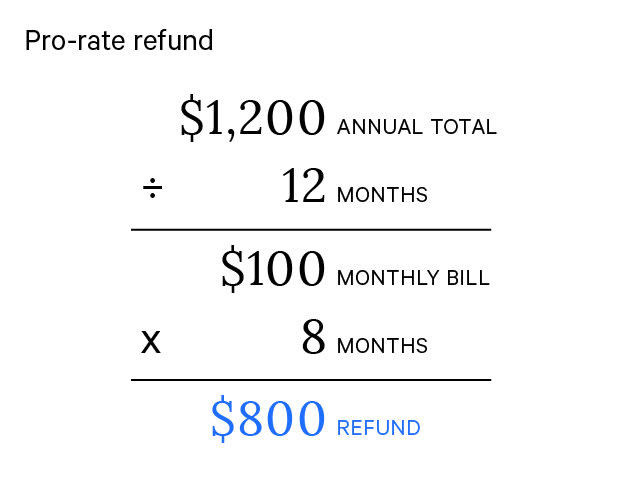

For example, suppose your annual insurance bill is $1,200 and you've paid the entire sum up front. You decide to cancel after four months. If your insurer divides the cost of your policy evenly over the year, you'd get $800 back.

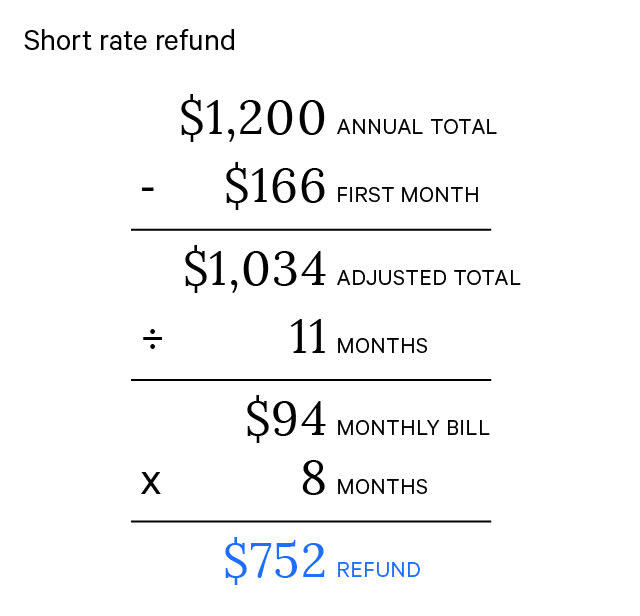

But if your insurer short-rates your policy, it could consider the first month to cost 66% more, or $166, and the remaining months cost $94. In this case, you'd only get $752 back from your insurer.

This can have the same effect of a cancellation fee, although it's not allowed in every state.

Getting a refund for paying in full vs. installments

One thing that can impact your refund is whether you've opted to pay for your insurance in installments or in a lump sum. Many insurers give you a cheaper rate if you pay the full amount of a six-month or one-year policy all at once.

If you opt for a lump payment, keep a possible cancellation in mind. You'll still be eligible for a refund, just remember that by paying in full, you're entrusting your insurer with more of your money. If you're signing up for insurance and think you may need to cancel mid-policy, weigh that against the difficulty of getting your money back.

You've made a change to your policy

It's also possible that you are eligible for a car insurance refund because of a change you made to your policy. Maybe you took a teenage driver off your policy or lowered your coverage limits. If you make a change like this, your insurer will give you the money back for the remaining time in your premium.

It's possible that by default, they will keep the extra money and apply it to your next insurance bill. But if you'd like the cash back now, call your insurer to have them issue a refund.

Your insurer cancelled your policy

It doesn't happen often, but insurers sometimes opt to cancel your insurance policy. If this happens to you, you may be entitled to a partial refund.

First, keep in mind that there are two main situations in which an insurer will cancel your policy in the middle of the term. The first is for non-payment: you're behind on your insurance bill, so your insurer has cancelled your contract. In this case, you wouldn't be eligible for a refund, and it's likely that you actually owe your insurer money.

The other reason an insurer may cancel a policy mid-term is if your risk profile has changed, usually in a substantial way. The reason could be that you've been convicted of a particularly serious driving violation, such as a DUI or high speeding ticket. Or you may have let your car's registration lapse.

If your policy was cancelled due to a risk change, you are almost always entitled to a refund of the money you've paid.

Am I eligible for a refund if my insurer cancels my policy?

Reason | Non-payment | Risk change (such as DUI or high speeding ticket) |

|---|---|---|

| Am I eligible? | No | Yes |

Note that your insurer cancelling your policy is different from a car insurance non-renewal, meaning your insurer has opted not to renew your contract at the end of the six-month or one-year period. In that case, you wouldn't be eligible for a refund, as all the premium you've paid has been used up.

How to get a car insurance cancellation refund

For the most part, getting a car insurance refund is as simple as calling your insurer. If you haven't yet cancelled your policy, make sure to ask how the refund is issued as part of the cancellation process. The amount you are owed may be paid back via check, direct deposit or a refund via the original payment method.

Coronavirus car insurance refunds

In the early months of the coronavirus pandemic, driving rates dropped precipitously — as did car accidents and associated claims. As a result, many insurers refunded unused premiums to their policyholders and offered discounts to new customers.

As of now, most insurers have already paid out most of the discounts and refunds they expect to provide. However, if you still haven't received your refund, contact your insurer to understand what you're entitled to and how to get your money back.