Liability vs. Full-Coverage Car Insurance: Which Is Better?

Find Cheap Auto Insurance Quotes in Your Area

Liability-only insurance pays for injury and damage to others you're responsible for. In comparison, full-coverage policies cover both your liability and property damage to your own vehicle.

When finding the right car insurance policy for you, it's important to understand the different types of coverage and how much you need, including whether you want liability or full-coverage car insurance.

Liability vs. full-coverage insurance cost

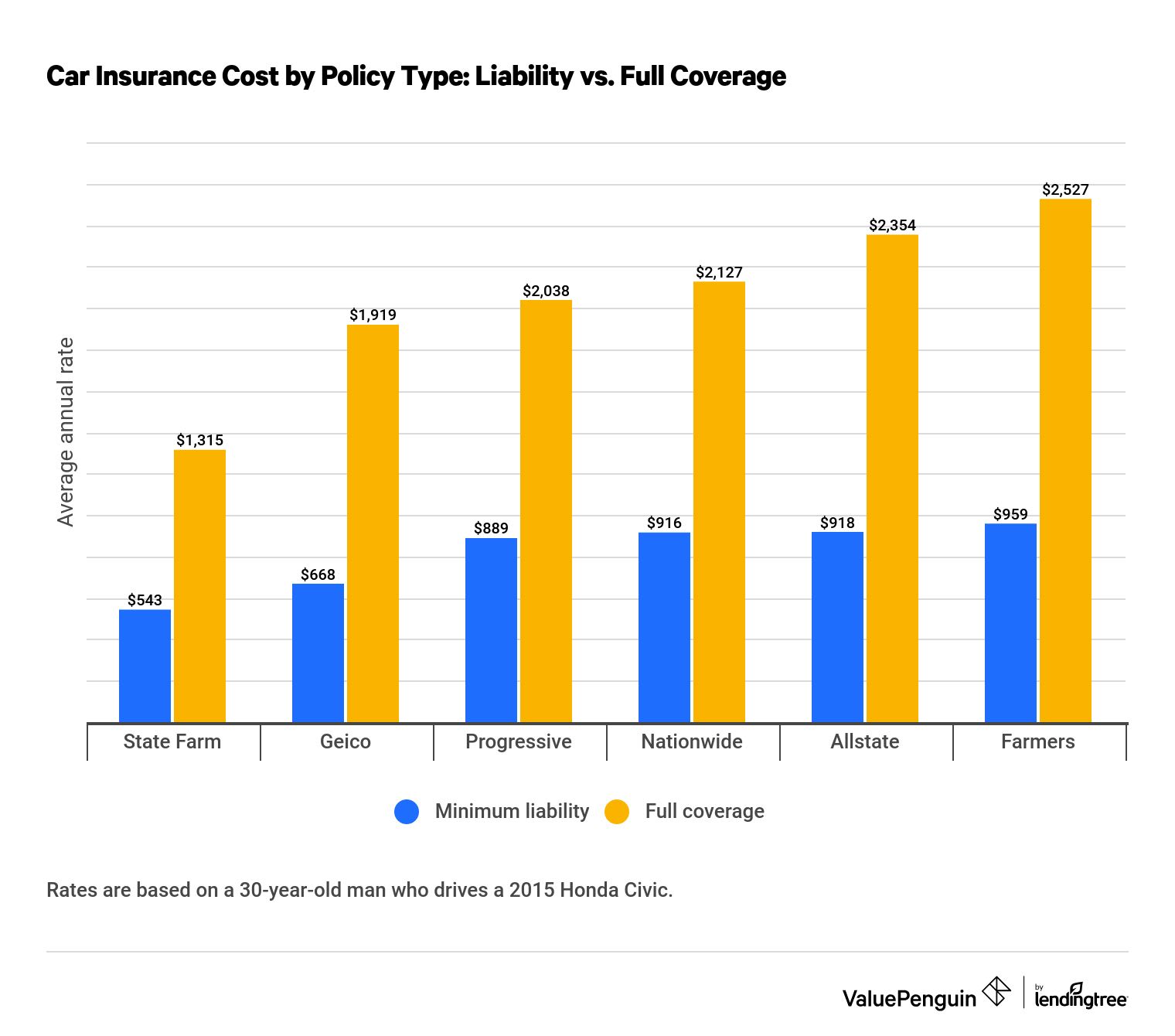

On average, we found you could save more than $1,300 per year when you buy minimum liability coverage instead of a policy that includes comprehensive and collision insurance and higher liability limits.

Find Cheap Auto Insurance Quotes in Your Area

Farmers is the most expensive for full coverage — a policy costs $2,527 per year. However, drivers insured with Farmers could save $1,586 by choosing minimum liability coverage.

Car insurance cost by policy type: liability vs. full coverage

Company | Liability only | Full coverage | |

|---|---|---|---|

| State Farm | $543 | $1,315 | |

| Geico | $668 | $1,919 | |

| Progressive | $889 | $2,038 | |

| Nationwide | $916 | $2,127 | |

| Allstate | $918 | $2,354 |

What is liability insurance vs. full coverage?

Liability-only car insurance will cover damage to other vehicles or injuries to other people when you're driving. Full-coverage policies includes liability insurance and protection to cover damage to your own vehicle.

In most states, you are required to have a minimum amount of liability coverage. Full coverage includes your state's required liability coverage plus comprehensive and collision coverage. It's typically only required if you lease or finance your car.

Liability is required in most states and covers damage you cause to other drivers and cars in a crash.

- Bodily injury liability - passenger injuries in the other car

- Property damage liability - damage to other cars or property

Full coverage is required for a car loan or lease and covers damage you cause to others plus repairs for your car.

- Bodily injury liability - passenger injuries in the other car

- Property damage liability - damage to other cars or property

- Collision - damage to your car in a crash

- Comprehensive - damage to your car from any other cause

What is liability-only insurance?

Liability insurance covers the cost of injuries to others and damage you cause in an accident.

Liability insurance does not cover damage to your own car or injury to yourself — only damage to others for which you're legally liable.

Liability coverage is split into two components: bodily injury liability and property damage liability.

-

Bodily injury liability coverage will cover the cost of another person's injuries if you are at fault in an accident, up to the policy's limits. Policy limits usually show two figures:

- The maximum amount paid per person injured in an accident

- The maximum amount paid for the entire accident

Typically, the maximum amount for the entire accident is double the per-person limit. For example, a policy might limit coverage to $15,000 per person injured and $30,000 for all injured people.

-

Property damage liability coverage pays for damage to other vehicles — or property — when you are at fault. The policy limit for this type of coverage is listed as a single dollar amount, representing the maximum payout per accident. However, this does not cover damage to your own vehicle.

If you live in a state that does not require car insurance, like New Hampshire or Virginia, you're still financially responsible for injuries and property damage resulting from an accident. So, we recommend you buy some sort of coverage.

What is full-coverage insurance?

Full coverage doesn't mean a policy has all the bells and whistles. This term refers to policies that include liability coverage along with collision and comprehensive insurance.

- Collision insurance covers you in situations where you're driving, and your vehicle is damaged by another vehicle or object, regardless of who is at fault. Collision coverage is usually not offered on its own and is purchased with comprehensive insurance.

-

Comprehensive insurance will pay for repairs in noncollision incidents, also referred to as "acts of god." This includes damage due to vandalism, weather, natural disasters, falling objects, animals and theft.

Many times, full-coverage insurance also implies that a policy has higher liability limits than the state requirement. That means you'll have more financial protection if you cause an accident and have to pay another driver's medical bills or repair their car.

Collision and comprehensive insurance usually will pay for damage to your car up to its actual cash value . When making a comprehensive or collision claim, you will be responsible for covering the cost of your deductible, which may range from $250 to $1,000.

Full coverage is not legally required on a state level but is often required by your lender if you lease or finance your new car.

You may be required to have this coverage because it guarantees you'll be able to pay off at least a portion of your loan if your car is totaled in an accident.

Is it better to have full coverage or liability-only insurance?

We recommend full coverage if you cannot comfortably afford the cost to replace your car if it's destroyed or stolen.

Do I need full coverage on my car?

If your car is leased or financed, the bank or car dealership may require you to buy a full-coverage policy.

If you own your vehicle outright, you have no obligation to buy full coverage. However, full coverage is worth the cost if your car is newer or on the expensive side or if you'd have trouble affording a replacement if it were destroyed or stolen.

When should you drop full coverage on your car?

As your car ages, collision and comprehensive coverage become a worse deal. This is because the value of a car drops faster over time than the cost of comprehensive and collision coverage.

For example, the cost to add full coverage to a new car is often about one-tenth of the car’s value. But for a 10-year-old car, the cost to add is one-fifth of the car's value. That means it's a worse deal, even though the price of coverage is lower.

The right time to drop full coverage will vary depending on your overall financial situation and your risk tolerance. However, drivers should consider dropping comprehensive and collision when the value of their car falls to between four and six times the annual cost of coverage.

That typically occurs when your car is between 8 and 12 years old and worth around $5,000 to $10,000.

Your car’s value will depend on its age, mileage and general wear and tear. Insurers use their own methods to determine the value of a given used car, and you probably won't be able to assess the value of your car by yourself.

If you want a ballpark figure of your car's value, Kelley Blue Book and other car value estimators can help you estimate the value of your vehicle. Though it's not exact, this number can guide you on whether the value of your car exceeds the cost of buying full coverage.

Frequently asked questions

What does full coverage car insurance cover?

Full-coverage auto insurance includes the liability insurance required in your state along with comprehensive and collision coverage, which protects your own vehicle against damage.

Does full coverage cover at-fault accidents?

Yes, full-coverage car insurance covers damage to your car from an accident, even if it's your fault.

How do I know if I have full coverage?

You can check to see if you have full coverage auto insurance by reviewing your insurance declaration page, also known as a dec page. If your dec page lists a deductible in the comprehensive and collision categories, you have full coverage insurance.

How much is full-coverage insurance on a new car?

The average national rate for full-coverage insurance is $2,058 per year. However, new cars are usually more expensive to insure, so your quotes will likely be higher than that.

How much is liability-only car insurance?

The average cost of liability-only auto insurance is $703 per year nationally.

Methodology

To compare auto insurance rates, we gathered quotes from every state. Our sample driver is a 30-year-old man driving a 2015 Honda Civic EX with a clean driving record and an average credit score.

Our car insurance rates for minimum-coverage policies show the average cost of a policy that meets each state's minimum requirements for auto insurance coverage.

Full-coverage rates are based on the following limits. If these limits are lower than those in any given state, the quote was adjusted to match the state's limits.

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

| Personal injury protection | Minimum when required by state |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.