How to Buy Cheap Car Insurance for First-Time Drivers

Find Cheap Auto Insurance Quotes in Your Area

Car insurance for first-time drivers can be expensive. That's why when you're getting car insurance, you should start by comparing free online insurance quotes from multiple companies.

State Farm has the cheapest car insurance quotes for first-time drivers — rates are 64% cheaper than other top companies.

A minimum-coverage policy from State Farm costs an average of $128 per month for an 18-year-old. Geico also has cheap rates, averaging $160 per month.

How to get car insurance for the first time

When buying car insurance for the first time, you will need to:

- Gather personal and vehicle info.

- Decide how much coverage you need.

- Get online quotes or work with an insurance agent.

- Compare companies to make sure you're getting the best deal.

What do you need to get car insurance for the first time?

When you're shopping for quotes, you will need some personal info about yourself and anyone else listed on the policy:

- Driver's license

- Date of birth

- Address

- Occupation

- Marital status

- Education level

- Driving history

- Insurance history

You will also need details about your vehicle, including the year, make and model.

Some of this infon — like driving history and location — affects the cost of insurance for first-time drivers.

When comparing car insurance quotes, write down the reference numbers or save the quotes so you can come back to them later.

You'll usually need to sign up for a policy within a few weeks to get the price you're quoted. Prices don't usually change much, but you could see rates go up if your credit score changes or you get a ticket.

How to get car insurance when buying your first car

Car dealers may offer to sell you insurance when you're buying a car. However, the insurance they offer is typically very expensive, so it's usually a bad idea to buy insurance from the dealer. Compare other quotes directly from car insurance companies to make sure you're getting the cheapest rate.

Insurance companies need your car's vehicle identification number (VIN) when you buy a policy.

However, you can get a quote from most companies without the VIN. You'll just need to provide the make, model and year of the car you plan to buy. Once you choose a car, you can contact the insurance company to provide the VIN and pay for your policy.

If you don't plan to buy a car, but occasionally drive someone else's vehicle, you can get non-owner car insurance. This type of policy pays for damage you cause to others in an accident, but it won't pay for any damage to the car you're driving.

First-time driver insurance cost

The cost of insurance for a first-time driver varies widely based on age.

On average, first-time drivers who are getting car insurance at age 18 pay $288 per month for minimum coverage.

A 30-year-old first-time driver pays an average of $93 per month for the same insurance coverage. The difference is because age, and not just driving experience, has a big impact on car insurance costs.

First-time driver car insurance by company

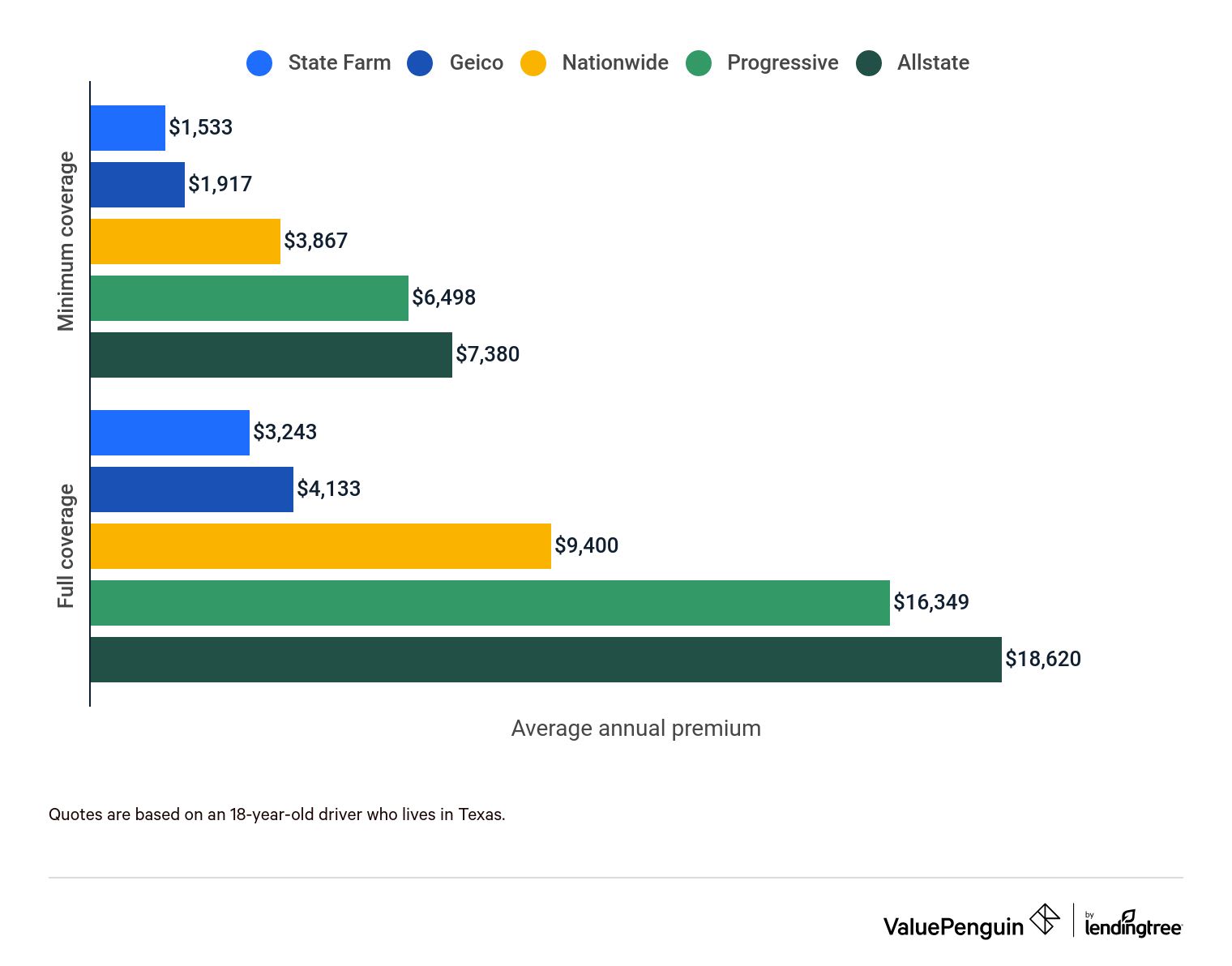

18-year-old

30-year-old

State Farm has the cheapest car insurance quotes for 18-year-old first-time drivers. A minimum-coverage policy costs $1,533 per year, which is 56% cheaper than average.

State Farm is also the cheapest for full-coverage car insurance, costing $270 per month, which is 66% cheaper than average. Full coverage includes comprehensive and collision coverage, which pays for repairs to your car if you cause an accident.

18-year-old

State Farm has the cheapest car insurance quotes for 18-year-old first-time drivers. A minimum-coverage policy costs $1,533 per year, which is 56% cheaper than average.

State Farm is also the cheapest for full-coverage car insurance, costing $270 per month, which is 66% cheaper than average. Full coverage includes comprehensive and collision coverage, which pays for repairs to your car if you cause an accident.

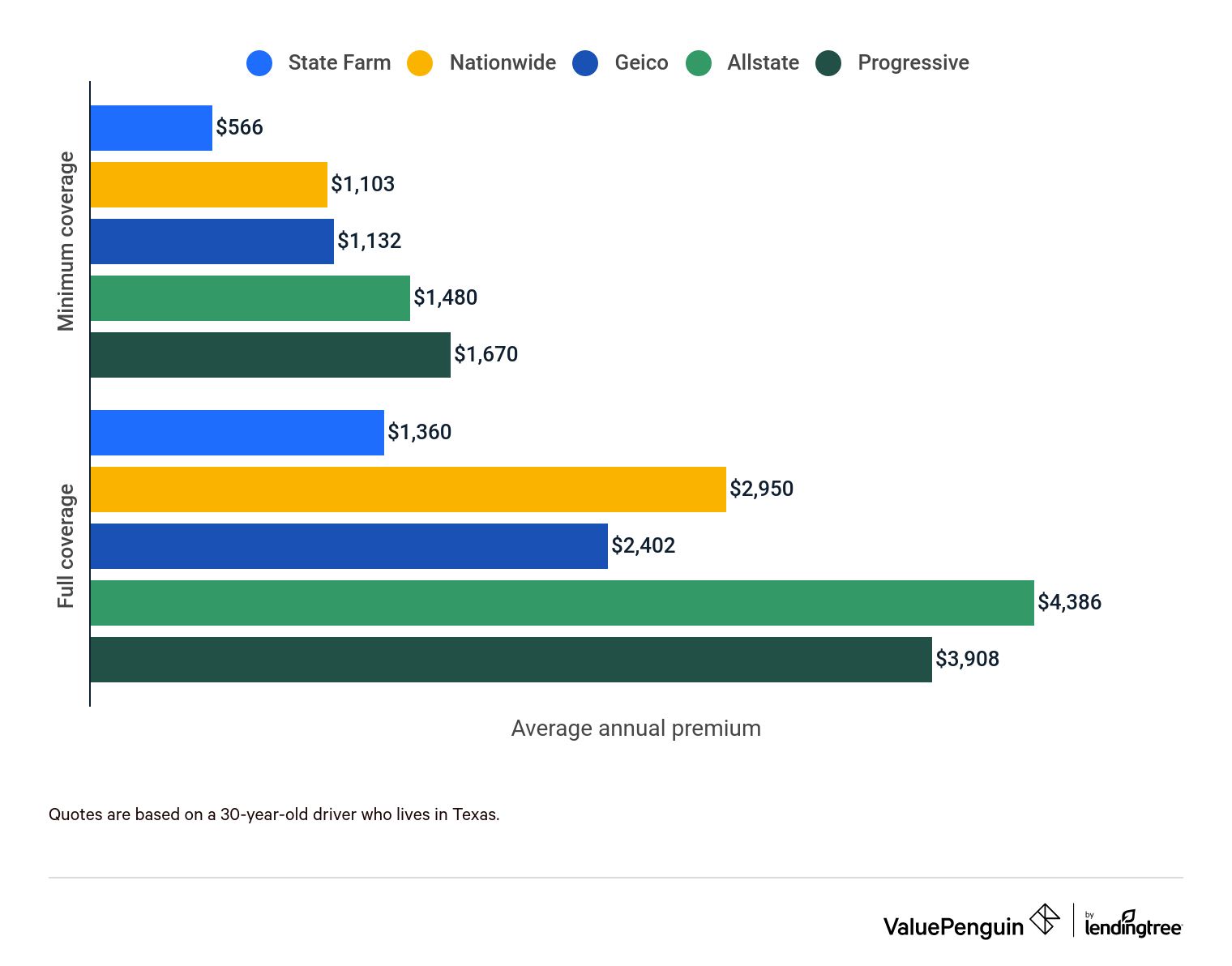

30-year-old

State Farm offers the cheapest car insurance quotes for 30-year-old first-time drivers. A minimum-coverage policy costs $566 per year — roughly half the price of the average policy for these drivers.

The cheapest full-coverage insurance also comes from State Farm. At $1,360 per year, a policy is $1,295 per year less than average.

Find Cheap Auto Insurance Quotes in Your Area

Average annual minimum-coverage rates

Company | 18-year-old | 30-year-old | |

|---|---|---|---|

| State Farm | $1,533 | $566 | |

| Geico | $1,917 | $1,132 | |

| Nationwide | $3,867 | $1,103 | |

| Progressive | $6,498 | $1,670 | |

| Allstate | $7,380 | $1,480 |

Why first-time drivers pay more for car insurance

New drivers are more likely to get into a car accident than experienced drivers. Insurance companies charge more because there's a greater chance they'll need to pay for damages.

Driving experience is one of the most important factors when it comes to setting car insurance rates.

However, many factors affect the price of car insurance for new drivers, including where you live, the car you drive, the types of coverage you have and how much you drive.

How to find the cheapest car insurance for first-time drivers

Drivers can find cheap car insurance by comparing multiple quotes, choosing the right coverage and proving you're a low-risk driver.

How to shop for car insurance

Comparing quotes from multiple car insurance companies will help you find which company offers the cheapest insurance quotes for first-time drivers.

First-time drivers usually have higher car insurance quotes than more experienced drivers. But you can still save by comparing companies.

Companies use different factors when calculating your rates, and some shoppers also consider smaller, regional companies to look for low rates.

It's easy to gather insurance quotes online. However, an independent insurance agent can help you get the right type of car insurance and compare multiple quotes.

Also, make sure you're taking advantage of every car insurance discount available to you when looking for cheap first-time car insurance. You could save by using electronic billing, being a safe driver, having a car with safety features and more.

How to choose the right amount of coverage

You can save money on car insurance by buying only the coverage you need for your situation. Otherwise, you're paying for unnecessary expenses.

For example, in some states personal injury protection (PIP) is optional. In other cases, you can decline add-ons like roadside assistance coverage.

Type of coverage | Is it required? | Do I need this coverage? |

|---|---|---|

| Bodily injury liability | Yes, except in Florida | Yes, higher limits offer more protection if you cause an accident |

| Property damage liability | Yes, in every state | Yes, higher limits offer more protection if you cause an accident |

| Collision and comprehensive | No, unless you lease or finance a vehicle | Maybe, if your car is newer than 8-12 years old |

| Uninsured and underinsured motorist (UM/UIM) | Yes, but only in 21 states | Yes, higher limits offer more protection |

| Personal injury protection (PIP) | Yes, but only in 16 states | Not needed unless your health coverage does not include auto-related injuries |

In New Hampshire, you can avoid the car insurance requirements if you show that you can pay for damages from a car accident.

We recommend buying as much coverage as you can afford so that you're protected if you cause a major accident. First-time drivers shopping for the cheapest policy possible may consider getting minimum liability coverage. However, it could cost you more in the long run if you cause expensive property damage.

Factors that affect insurance quotes for first-time drivers

Many factors affect car insurance rates for first-time drivers. Some of them can't be controlled, such as your age, location and the car you drive.

But there are important factors, like your grades, driving habits and financial records that can help you save on car insurance.

For example, if you have at least a B average in school, a good student discount could save you up to 20% on car insurance.

Safe driving habits also help. You could pay less after taking a defensive driving course. You can also use a mobile app to share your driving behavior with your insurance company.

Young drivers can also start to improve their credit score. Those who have low credit scores pay more for insurance because companies think they are more likely to file claims. Raising your credit score by making payments on time can help you pay less for insurance for decades to come.

Frequently asked questions

How much is insurance for a first-time driver?

An 18-year-old first-time driver pays an average $288 per month for a minimum-coverage policy. A 30-year-old first-time driver pays $93 per month for the same coverage, on average.

Do you need insurance to buy a car?

Yes, car dealerships will not let you drive your new car off the lot without proof of insurance. If you're financing or leasing your car, you probably need a full-coverage policy to protect your new car against damage.

Why is car insurance so expensive for young drivers?

Young drivers have less experience behind the wheel and are more likely to get in an accident. Insurance companies charge young drivers high rates because of the greater chance that they'll have to pay for damages or injuries.

How will buying auto insurance help you?

Having an auto insurance policy will keep you from getting a ticket or fine because most states require insurance. Car insurance also gives you financial protection if you're sued after causing damages or injuries. A full-coverage plan can help you avoid unexpected bills to repair your car if you cause an accident.

Methodology

To compare car insurance quotes for first-time drivers, we studied car insurance quotes from ZIP codes across Texas. Our sample driver is a single male who drives a 2015 Honda Civic EX. He has an average credit score and no driving experience. Average rates were for both an 18-year-old and a 30-year-old.

Quotes are based on the following coverage limits:

Coverage | Minimum coverage | Full coverage |

|---|---|---|

| Bodily injury liability | $30,000/$60,000 | $50,000/$100,000 |

| Property damage liability | $25,000 | $25,000 |

| Uninsured/underinsured motorist property damage | waived | $50,000/$100,000 |

| Comprehensive and collision | waived | $500 deductible |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.