Do Drivers License Points Increase Car Insurance Rates?

Getting points on your driver’s license as a result of a traffic violation typically leads to an increase in car insurance costs. We analyzed quotes from several insurers and found that having two points on your driver's license could lead to a 180% increase in auto insurance rates. However, depending on the insurance company, state and violation, driver's license points impact insurance rates differently.

We’ll go over how driver's license points affect car insurance rates for different violations and which insurance companies may offer you the cheapest auto insurance rates if you have points on your license.

Contents

How much do driver's license points affect auto insurance costs?

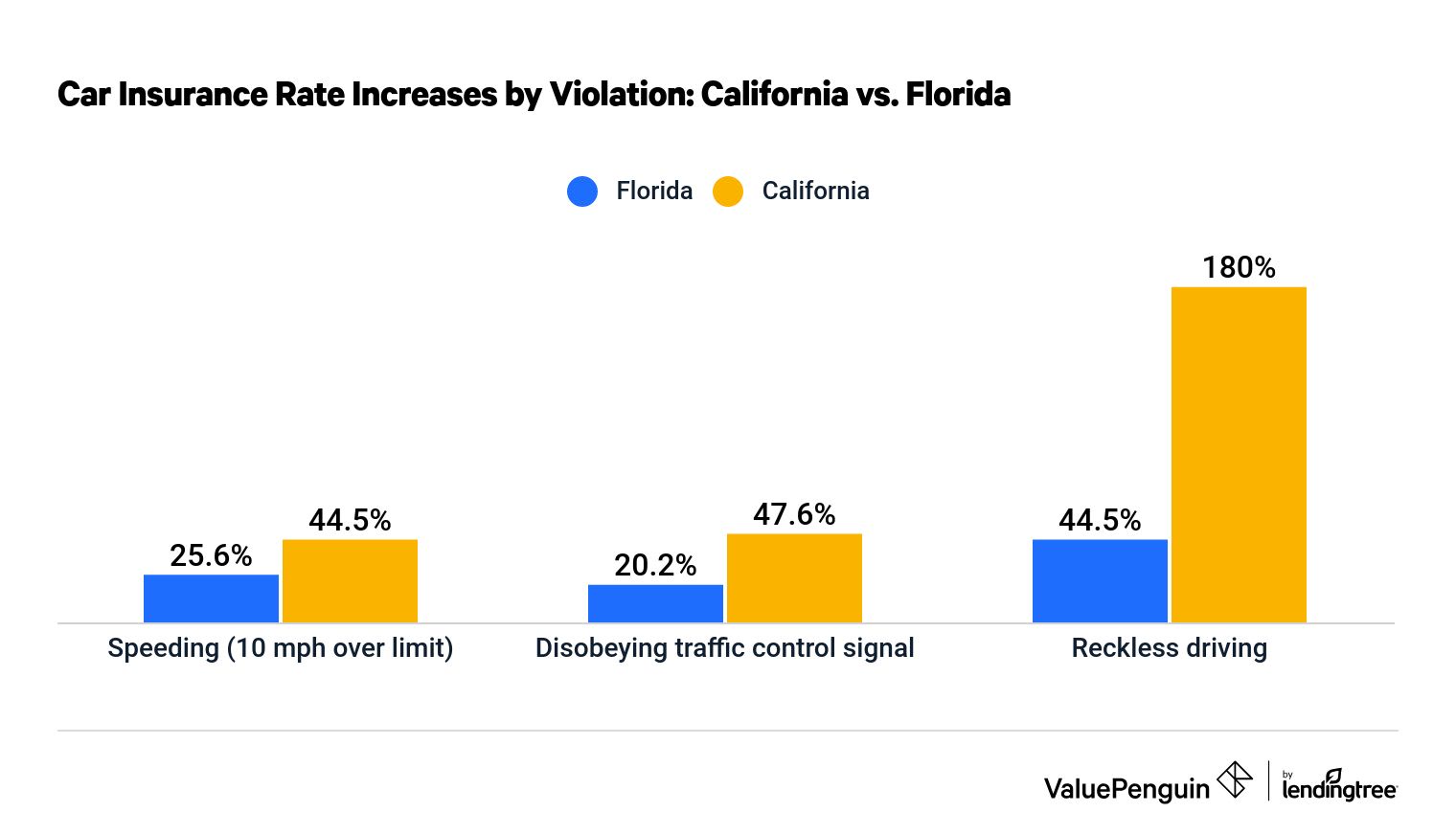

Although getting points on your license typically results in an increase in auto insurance rates, the extent to which rates go up depends on how significantly insurers weigh the violation. For example, in California, disobeying a traffic control signal caused rates to increase 20.2%, while speeding resulted in a 25.6% rate increase, despite the fact that each violation is worth one point on your license.

State | Violation | Insurance cost | # of points | % rate increase |

|---|---|---|---|---|

| Florida | No violation | $2,879 | NA | NA |

| Speeding (10 mph over limit) | $3,616 | 3 points | 25.6% | |

| Disobeying traffic control signal | $3,459 | 4 points | 20.2% | |

| Reckless driving | $4,160 | 4 points | 44.5% | |

| California | No violation | $1,831 | NA | NA |

| Speeding (10 mph over limit) | $2,645 | 1 point | 44.5% | |

| Disobeying traffic control signal | $2,699 | 1 point | 47.6% | |

| Reckless driving | $5,125 | 2 points | 180.0% |

The amount that car insurance costs increase after a violation also varies based on the state. For example, our profile driver with two points on their license for reckless driving in California saw insurance costs nearly triple, while the same violation in Florida — despite being worth four points — only caused rates to increase by 44.5%.

Find Cheap Auto Insurance Quotes in Your Area

Why car insurance is more expensive if you have points on your license

Although there is often a correlation between high insurance rates and drivers with several points on their licenses, insurers do not specifically set rates based on how many points a driver may have on their license. Instead, they look at the types of violations the driver committed to assess how likely they may be to cause them to pay out for a claim. For this reason, earning points for violations that indicate a high risk of a future car accident — such as reckless driving — causes insurance rates to increase more than other violations.

How license point systems work

In all but nine states, drivers who are convicted of a moving violation are assigned points on their licenses. The following states have not implemented a license point system:

The number of points assessed for getting a traffic ticket is proportional to the severity of the violation. Minor incidents, such as failing to signal, are worth relatively few points, while more serious infractions — such as drag racing — are worth significantly more points. If, after a period of time, usually three years, you accumulate a certain number of points on your license, your license may be suspended.

North Carolina has a unique system — the Safe Driver Incentive Plan (SDIP) — where getting points on your license causes your insurance rates to increase by a set amount, determined by the North Carolina Department of Insurance. This differs from other states' point systems, where the insurers themselves get to independently determine how much to increase rates after a driver is convicted of a traffic violation. Additionally, the SDIP also dictates rate increases for drivers who are proven to be at fault in an accident.

Violation / At-fault accident | North Carolina SDIP points | % rate increase |

|---|---|---|

| Speeding (10 mph over limit under 55 mph) | 1 | 30% |

| Following too closely | 2 | 45% |

| At-fault accident causing at least $3,085 in property damage | 3 | 60% |

| Reckless driving | 4 | 80% |

| Driving with a suspended license | 8 | 195% |

| Highway racing | 10 | 260% |

| Drunk driving (BAC of 0.08% or more) | 12 | 340% |

This is not a complete list of violations and accidents that earn SDIP points in North Carolina.

Cheapest auto insurance for drivers with points on their licenses

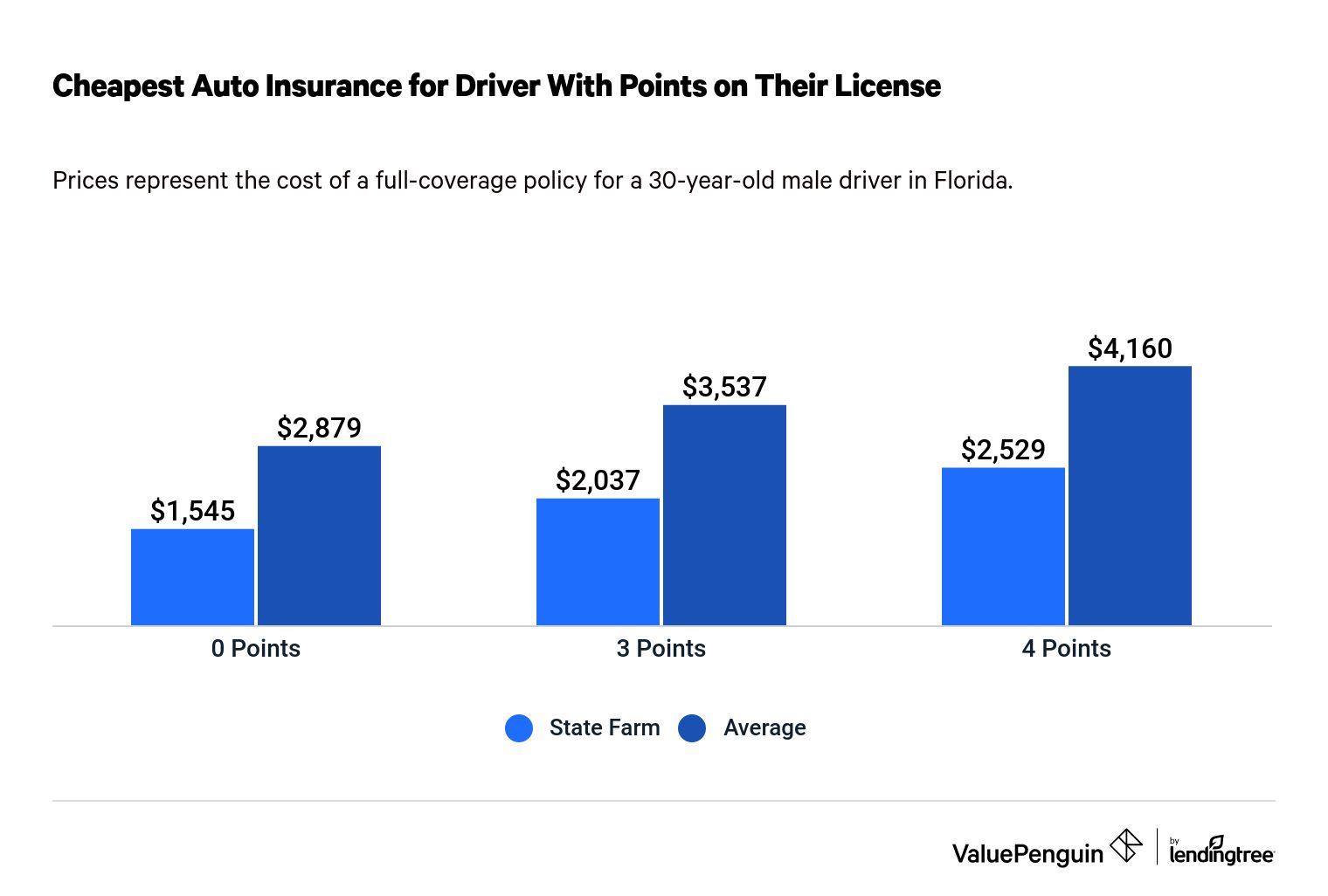

State Farm typically offers the cheapest car insurance for drivers with points on their licenses. State Farm's insurance quotes for drivers with four points on their licenses are 39% less than average.

Find Cheap Auto Insurance Quotes in Your Area

However, since insurance costs may vary widely based on where you live, the best way to get the cheapest auto insurance rates, if you have points on your license, is to compare quotes from multiple insurance companies in your area. To begin comparing quotes from auto insurance companies near you, enter your ZIP code into our tool above.

How much does insurance increase with 3 points on your license?

In some cases, 3 points on a driver's license can increase car insurance rates by up to 23%, or $658 per year, based on our analysis of multiple violations in Florida.

How much does insurance increase with 4 points on your license?

In Florida, 4 points on a driver's license can increase car insurance rates by as much as 44%, or $1,281 per year.

Methodology

Rates were gathered from ZIP codes across Florida and California. The sample driver was a 30-year-old man with a Honda Civic EX. The policy was for a one-year term and for full coverage.

Data came from Quadrant Information Services, which sources rates from publicly sourced insurer filings. Rates are for comparative purposes only. Your rates will likely differ.