How to Add a Driver to Your Car Insurance

Find Cheap Auto Insurance Quotes in Your Area

You'll need to add someone to your car insurance policy if they live with you and have regular access to your car: otherwise, you risk being denied coverage if they get in a crash.

Adding someone to your car insurance does impact your rates, but it won't always have a negative effect — sometimes, you'll actually save money, depending on the age and driving history of everyone you add to your policy.

On this page:

How to add a driver to your insurance policy

For most major insurers, including Geico, State Farm and Progressive, you can add a driver to your car insurance policy simply by calling your insurance agent or provider; you can usually also add a driver online.

You'll likely need the following info about your new driver to add them to your car insurance policy, though the exact requirements vary by insurer.

- Name

- Date of birth

- Gender

- Social Security number

- Occupation

- How long they've had their license

- Any recent traffic tickets or accidents

If you're permanently adding a driver to your insurance policy, like if your child just got their driver's license, we recommend that you shop around for a new policy — you might be able to find cheaper car insurance rates at another company.

The cost of adding a driver to your car insurance

Adding a driver to your car insurance policy will have an impact on your rates. However, it isn't the case that adding another driver will always raise them — depending on who the primary and secondary drivers are, adding another driver can actually bring your car insurance costs down a lot.

Find Cheap Auto Insurance Quotes in Your Area

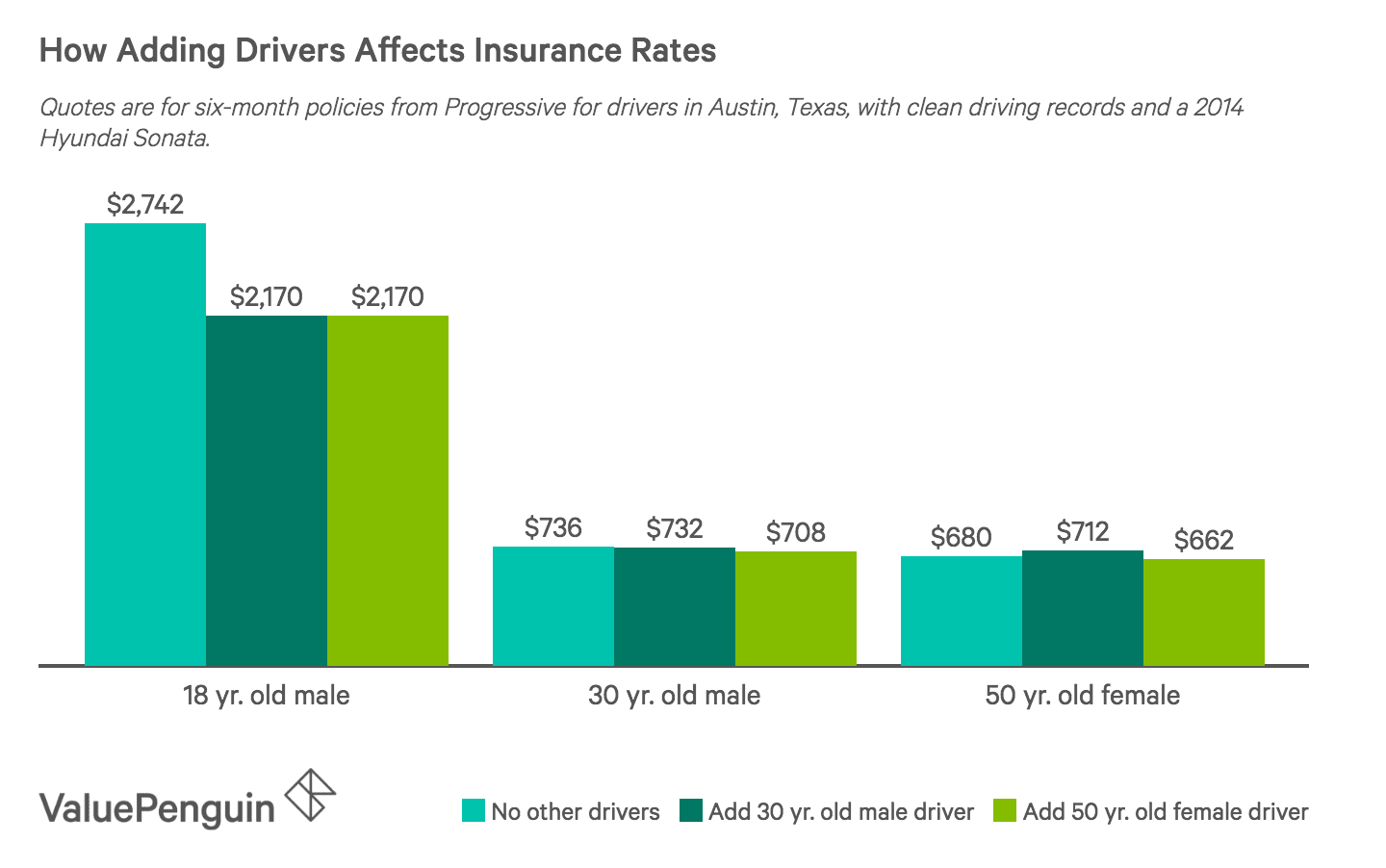

To understand the financial impact of adding a driver to an insurance policy, we collected quotes for three solo drivers — an 18-year-old man, a 30-year-old man and a 50-year-old woman — and added two different secondary drivers to see how they would impact rates.

In almost every case, adding a driver lowered the rates our sample driver would pay. Young drivers can expect to save the most: Adding another driver to his policy reduced our 18-year-old's rates by more than $500. The only driver who actually paid more when adding al driver is a 50-year-old woman who added a 30-year-old man to her coverage.

This is because insurers set rates based on the overall chase that a vehicle will be involved in a crash, and thus, make an insurance claim. Teens are by far the most likely to get into automobile accidents and have the highest rates, so a car shared by a 30-year-old and an 18-year-old is less likely to be involved in a crash than one driven exclusively by a teen.

When you need to add someone to your car insurance

You need to add someone to your car insurance policy if they reside in your household, have a driver's license and have access to your car.

This can include your spouse, boyfriend or girlfriend, and any driving-age children you have. It may also include college-age children, depending on how far away they live and whether they drive your car while they're home.

Some insurance companies may also require you to add anyone who lives with you but isn't related to you, like a roommate. But even if your insurance company doesn't require it, consider adding your roommate anyway if they borrow your car even occasionally. If your roommate gets in a crash when driving your vehicle, your insurance company may not cover the damage if they determine the roommate should have been named on your policy but wasn't. Furthermore, it may not cost you much to add them to your policy.

When you don't need to add someone to your car insurance

You don't need to add other drivers to your car insurance policy if they don't live with you and drive your car only occasionally.

For example, if a guest is visiting you from out of town and borrows your car while you're at work, they would be protected by your insurance policy's "permissive user" clause. This is because the car insurance policy you have on your vehicle follows the car, not the driver.

This is true even if the other driver is a family member. The above example still applies if the guest is your son or daughter, so long as their permanent residence isn't your own.

In the case of roommates, you also don't need to add them to your policy if they have their own car and insurance. So if you and your roommate both have your own cars, you don't need to add one another on each policy — even if you occasionally use one anothers' vehicles.

Temporarily adding someone to your car insurance

If someone — whether they're a guest staying with you, a babysitter or anyone else — will be regularly using a car you own over an extended period of time, we recommend adding them to your auto insurance policy temporarily. But the threshold for when it's actually necessary to do so will depend on their exact relationship with you, how long they'll be using your car and your specific insurance company's policies.

Contact your insurer to find out whether you should temporarily add someone to your insurance policy.

Methodology

To understand how adding a driver to a car insurance policy affects rates, we collected sample quotes for three primary drivers in Austin, Texas: an 18-year-old man, a 30-year-old man and a 50-year-old woman.

For each base quote, we also collected quotes adding one of two secondary drivers: a 30-year-old man and a 50-year-old woman.

All sample rates for full coverage insurance were for a 2014 Hyundai Sonata and sourced from Progressive.