National General (Allstate Health Solutions) Health Insurance Review

Health insurance from National General, now Allstate Health Solutions, can be cheap. But customers are often unhappy because claims are frequently denied.

Find Cheap Health Insurance Quotes in Your Area

National General moved its health insurance policies to its parent company, Allstate. The coverage is now offered by Allstate Health Solutions.

Allstate's health insurance policies are usually cheap. You'll save about 9% on a basic short-term health insurance policy and 15% on a Medicare Supplement policy, compared to the national average. The downside is that Allstate Health has a very high rate of complaints.

Pros and cons

Pros

Cheap rates for basic plans

Some plans have instant urgent care coverage

Cons

Bad customer service

High rates for plans with good coverage

Customer reviews of Allstate Health (National General)

Allstate Health has poor overall customer satisfaction and receives four times as many complaints as average.

Allstate Health's four subsidiaries range from average to a very high rate of complaints. This means that in the best-case scenario, you'd have insurance with average customer satisfaction.

Most complaints are about how medical bills are paid including Allstate denying claims, delaying payment, and issues with preexisting conditions.

Allstate Health subsidiaries | Rate of complaints | |

|---|---|---|

| American Heritage | Average | |

| National Health | 1.5 time higher | |

| Integon Indemnity | 6 times higher | |

| Integon National | 8.5 times higher | |

On this page:

Allstate (National General) short-term health insurance rates and coverage

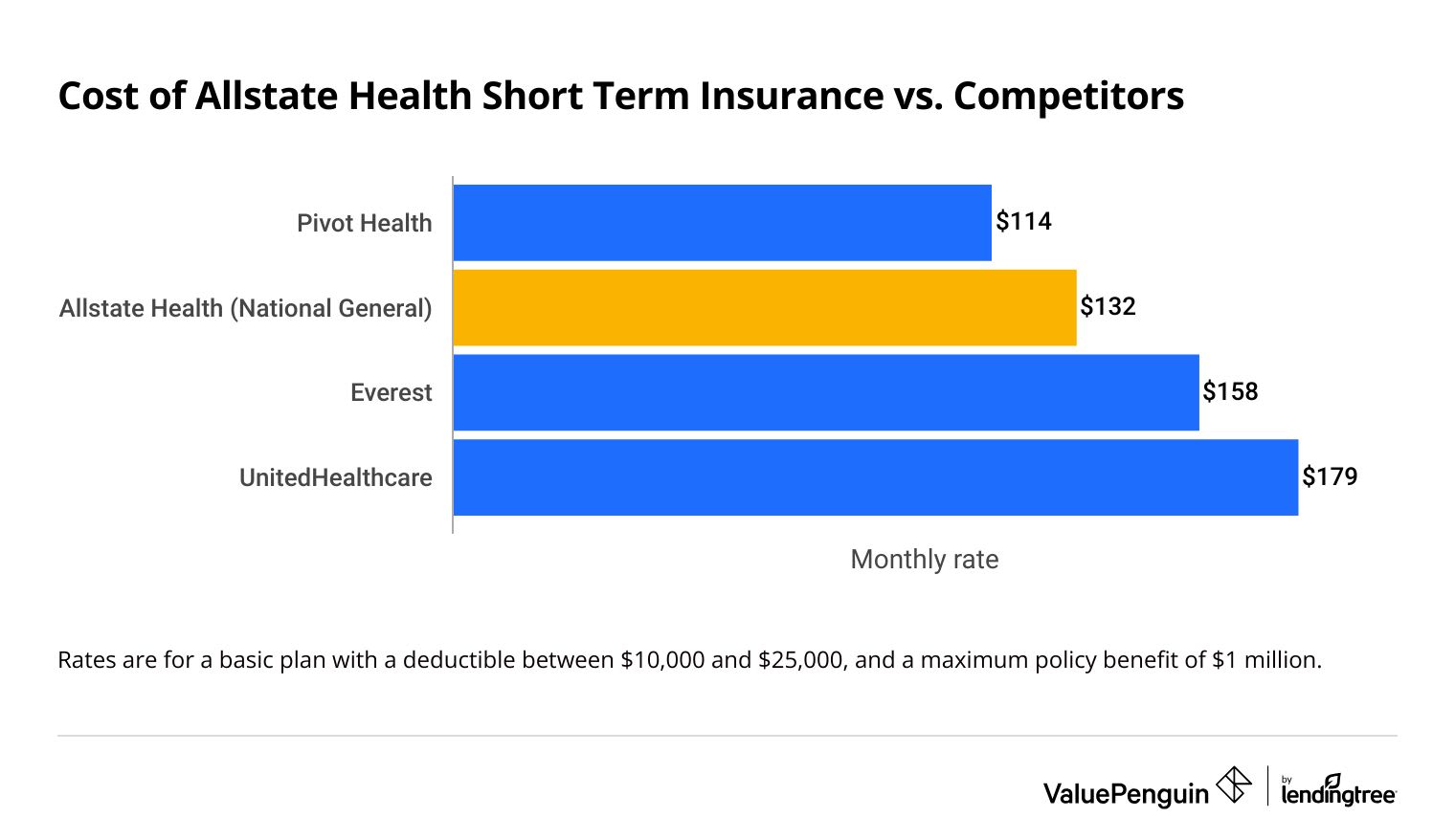

Allstate Health has cheap short-term health insurance, averaging $132 per month, if you want catastrophic-style coverage.

However, if you want a short-term plan that has good coverage, Allstate Health is one of the most expensive companies.

Cost of Allstate short-term health insurance

Allstate's short-term plans cost an average of $132 per month for basic coverage. Though these plans can sometimes cost as little as $70 per month.

Find Cheap Health Insurance in Your Area

Allstate's basic short-term plans are generally much cheaper than options from UnitedHealthcare with similar coverage. However, your cost will vary depending on your age, location and the policy option you choose.

For a plan with good coverage, Allstate Health's rates average $443 per month. That makes Allstate one of the most expensive options available.

Allstate Health (National General) rates versus competitors

Company | Basic plan | Good coverage |

|---|---|---|

| Pivot Health | $114 | $202 |

| Allstate (National General) | $132 | $443 |

| Everest | $158 | $274 |

| UnitedHealthcare | $179 | $390 |

Basic plans have a deductible between $10,000 and $25,000, and a maximum policy benefit of $1 million. Plans with good coverage have a deductible between $2,000 and $2,500, and a maximum policy benefit of $1 million.

Coverage with Allstate short-term health insurance

Some Allstate plans give you cheap Urgent Care visits as soon as you enroll, which is a great added benefit that most companies don't have.

With these plans, Allstate covers Urgent Care before you reach your deductible. This can help you get some value from the plan even in years when you don't need expensive medical care. However, you'll pay for the full cost of most medical expenses yourself until your spending reaches the deductible.

Coverage before your deductible:

Coverage after your deductible:

What's not covered:

Allstate's plans only cover preventive care after you reach the deductible. This means that you'll only get low-cost checkups and screenings after you've spent thousands of dollars on other medical expenses. In contrast, you won't pay anything for preventive care with a cheap health insurance plan through the HealthCare.gov marketplace.

And like most short-term plans, Allstate won't cover the treatment for any medical condition that's already been diagnosed, called a preexisting condition.

You can purchase a short-term health insurance plan directly from Allstate any time of the year. You don't have to wait for open enrollment. Short-term plans aren't sold on the federal marketplace or state marketplaces.

Perks included in Allstate Health's plans

When you buy an Allstate (National General) short-term health insurance plan, you’ll usually get a LIFE Association membership.

This program has several perks, including discounts on medications and vitamins, access to telemedicine, discounts on chiropractic adjustments, and savings on gym memberships and fitness classes.

LIFE Association can also help you with hospital costs. You could save up to 60% on some diagnostic scans, like MRIs, CT scans and PET scans.

Allstate (National General) short-term health insurance options

National General offers three types of short-term health plans — Essentials, Enhanced or Copay Enhanced. The main difference between these plans is the total amount that the plan can pay out, which is called the maximum benefit.

After you pay for enough medical care to meet the plan's deductible, you'll split your medical costs with the insurance company. This is commonly a 60/40 split, with you paying 40% of the bill. But with some plans, Allstate will pay for all of your medical costs after your deductible, up until the plan spending cap.

Essentials

Enhanced

Copay Enhanced

Deductible

|

Cost split

|

Out-of-pocket max

| |

|---|---|---|---|

| $5,000 | 60/40 | $12,500 | |

| $10,000 | 60/40 | $17,500 | |

| $25,000 | 60/40 | $32,500 |

Allstate will pay up to $250,000 with the Essentials plan.

Essentials

Deductible

|

Cost split

|

Out-of-pocket max

| |

|---|---|---|---|

| $5,000 | 60/40 | $12,500 | |

| $10,000 | 60/40 | $17,500 | |

| $25,000 | 60/40 | $32,500 |

Allstate will pay up to $250,000 with the Essentials plan.

Enhanced

Deductible

|

Cost Split

|

Out-of-pocket max

| |

|---|---|---|---|

| $2,500 | 100/0 | $2,500 | |

| $2,500 | 80/20 | $7,500 | |

| $2,500 | 50/50 | $7,500 | |

| $5,000 | 100/0 | $5,000 | |

| $5,000 | 80/20 | $10,000 |

Allstate will pay up to $1 million with the Enhanced plan.

Copay Enhanced

Deductible

|

Cost Split

|

Out-of-pocket max

| |

|---|---|---|---|

| $6,000 | 100/0 | $6,000 | |

| $8,000 | 100/0 | $8,000 |

Allstate will pay up to $5 million with the Copay Enhanced plan.

Typically, the lower your deductible and out-of-pocket maximum are, the more you'll pay each month. You'll also pay more for plans that have better benefits. For example, it will cost more for plans where you pay a smaller portion of your medical costs after reaching your deductible. The plan costs more because the insurance company would pay for more of your medical care.

Which doctors accept Allstate's short-term health insurance?

Allstate (National General) short-term health insurance has fairly large networks, which means there are likely doctors near you who will accept your plan. Depending on where you live and what policy you choose, plans use the Aetna or Cigna health insurance network.

Short-term medical plans are good when you need temporary coverage that starts right away, such as when you're between jobs or are waiting for a new plan to begin. However, most plans don't provide as much coverage as a standard health insurance plan.

Short-term health insurance can be a good choice if you:

- Missed open enrollment to buy an individual health insurance policy

- Switched jobs and are waiting for your new benefits to begin

- Are a student and are losing your parents' coverage at age 26

- Need temporary health insurance for any other reason

Allstate Health Solutions Medicare Supplement plans

Allstate has cheap Medicare Supplement (Medigap) plans that cost 15% less than average.

Allstate's Medigap plans will typically save you between $10 and $30 each month, compared to average rates. Though you can sometimes save more than $50 each month with Allstate.

Medigap plan | Allstate | U.S. avg. | Savings |

|---|---|---|---|

| N | $102 | $111 | $9 |

| G | $133 | $148 | $15 |

| F | $161 | $184 | $23 |

Monthly rates for a 65-year-old female.

Find Cheap Health Insurance in Your Area

Medigap plans have the same coverage no matter which company you choose. So you'll get the same benefits with Allstate as with a different company.

Plan discounts can help you lower your rates even more. Allstate offers a 7% discount if you don't live alone and a discount of about 9% to 12% for using a wearable device such as a smartwatch or fitness tracker.

Allstate sells less than 1% of all Medigap policies so it's not nearly as popular as the top Medigap insurance companies such as AARP/UnitedHealthcare or Blue Cross Blue Shield. However, Allstate does have a strong ability to pay claims based on its A+ financial rating from A.M. Best.

Allstate does not have its own Medicare Advantage plans. Instead, it has a subsidiary called MedicareEnrollment.com where you can shop and compare Medicare Advantage plans sold by other companies.

Allstate Benefits group health insurance for small businesses

Allstate Benefits' is not a top choice for small businesses offering health insurance to employees because of its high rate of complaints.

Allstate offers two types of small business health insurance plans, offering group health insurance.

-

Allstate Secure Choice is a PPO plan that follows the rules of the Affordable Care Act (ACA).

That means medical care from an out-of-network doctor will be covered to a degree, you can choose coverage tiers (Bronze, Silver, and Gold) and preventive care like check-ups will be free. These group health insurance plans are sold in Florida, Indiana and Texas, where there is the option to add on fertility coverage.

For small businesses that are concerned about medical costs, Allstate covers the full risk of employee medical expenses because these plans are fully insured. The downside is fully insured plans will typically cost more than self-insured plans.

-

Allstate Benefits also provides self-funded health insurance plans for small businesses, which is a popular way for companies to save money.

Generally, with a self-funded plan, your company will pay the cost of employee medical care up until it gets very expensive. At that point, another insurance policy will kick in to protect your company from very high costs. Employee medical claims are handled by Allstate, and employees typically have the same experience using a self-funded insurance plan as a regular plan.

Allstate's self-funded plan option gives companies the flexibility to set the benefits they want to offer to employees.

Supplemental insurance from Allstate Health Solutions

Allstate also sells dental, dental and vision, accident, and critical illness insurance. These supplemental policies can be helpful add-ons to your primary health insurance.

Allstate Health dental and vision insurance

Allstate's dental plans stand out because you usually don't have a waiting period before coverage begins.

This is different from many other companies which could have a waiting period of one to three months before it will start paying for dental care.

- Costs: Allstate offers multiple dental PPO plans ranging from $16 to $47 per month. You can also combine your dental plan with a vision insurance plan which can cost between $32 and $66 per month.

- Coverage: Benefits vary widely. With the cheapest dental plans, you could only have basic coverage for routine care without coverage for major services like root canals. Other plan options could provide free cleanings, coverage for major services and braces and major services, and a high coverage limit.

Allstate Health accident insurance

Allstate's accident insurance ranges in price from $13 to $200 per month. Plans have either a $250 or $500 deductible and maximum benefits range from $2,500 to $17,500.

Allstate policies are similar to what you can get from other companies in that you don't have to answer medical questions to get a policy. But Allstate's policy details vary. Some plans have a waiting period of one to three months. Other times, you can only get a policy if you're under 65.

Accident insurance can help you pay for costs that aren't covered by your health insurance company when you're hurt or sick because of an accident.

For example, if you fall off a ladder, Allstate's accident insurance would pay you a flat amount that's set by your policy. You could use this money to help pay for costs that aren't covered by your health insurance or to replace income if you can't work.

Allstate Health critical illness insurance

Critical illness insurance is similar to accident insurance, but it only covers cancer, strokes, heart attacks, and other heart conditions. If you're diagnosed with one of these illnesses, your plan pays out a lump sum to help you cover expenses that health insurance doesn't.

Cancer will only be covered by Allstate if it's your first-ever diagnosis.

There are four levels of critical illness coverage to choose from. None of the plans have a deductible, so you'll get a payout right away if your diagnosis qualifies.

Plan name | Maximum benefit | Monthly rate |

|---|---|---|

| Cancer & Heart/Stroke 25K | $25,000 | $24 |

| Cancer & Heart/Stroke 30K | $30,000 | $28 |

| Cancer & Heart/Stroke 50K | $50,000 | $43 |

| Cancer & Heart/Stroke 75K | $75,000 | $63 |

Frequently asked questions

Is National General Insurance owned by Allstate?

Yes, Allstate finalized the purchase of National General in early 2021. National General health insurance is now Allstate Health Solutions.

Does Allstate have health insurance?

Yes, Allstate sells short-term health insurance, Medicare Supplement plans, group health insurance plans for small businesses, and supplemental plans such as dental, vision, and accident insurance. However, it does not sell individual health insurance plans that follow the standard coverage rules of the Affordable Care Act (ACA).

Is there a discount for bundling Allstate health insurance with car or home insurance?

No, you don't get a discount for having an Allstate health insurance plan along with a Allstate home insurance or Allstate car insurance. However, there is a discount for bundling car and home insurance together, and it can be convenient to use one company for multiple policies.

Is short-term health insurance a good way to save money?

Generally, short-term health insurance can save you money if you don't need much medical care. The policies are good for giving you some coverage while you're between jobs or are waiting for the benefits of a regular health insurance plan to begin. But if you need routine medical care, a regular health insurance plan is a better deal. And they'll also protect you from very high medical costs.

Methodology and sources

Rates for short-term health insurance and supplemental insurance are based on the monthly cost for a 40-year-old male in Austin, Texas.

The cost of Medicare Supplement plans is based on comprehensive actuarial data for all private insurers. Average rates are for a 65-year-old woman who does not smoke and who signed up for a Medigap plan when she was first eligible.

Customer complaint data is from the National Association of Insurance Commissioners (NAIC). The customer satisfaction rating is a one-to-five score based on the NAIC complaint index for each Allstate Health underwriting subsidiary. Higher scores mean better customer service and fewer complaints.

Satisfaction score | Customer complaints adjusted for company size |

|---|---|

| 5.0 (top rating) | Over 75% fewer complaints than typical |

| 4.5 | 50% to 75% fewer complaints than typical |

| 4.0 | 25% to 50% fewer complaints than typical |

| 3.5 | 0% to 25% fewer complaints than typical |

| 3.0 | An average rate of complaints |

| 2.5 | 0% to 50% more complaints than typical |

| 2.0 | 50% to 100% more complaints than typical |

| 1.5 | 100% to 250% more complaints than typical |

| 1.0 | Over 250% more complaints than typical |

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.