Health Insurance

Almost 4 in 10 Americans Cut Back on Insurance Coverage in 2020, and Most Regretted Doing So

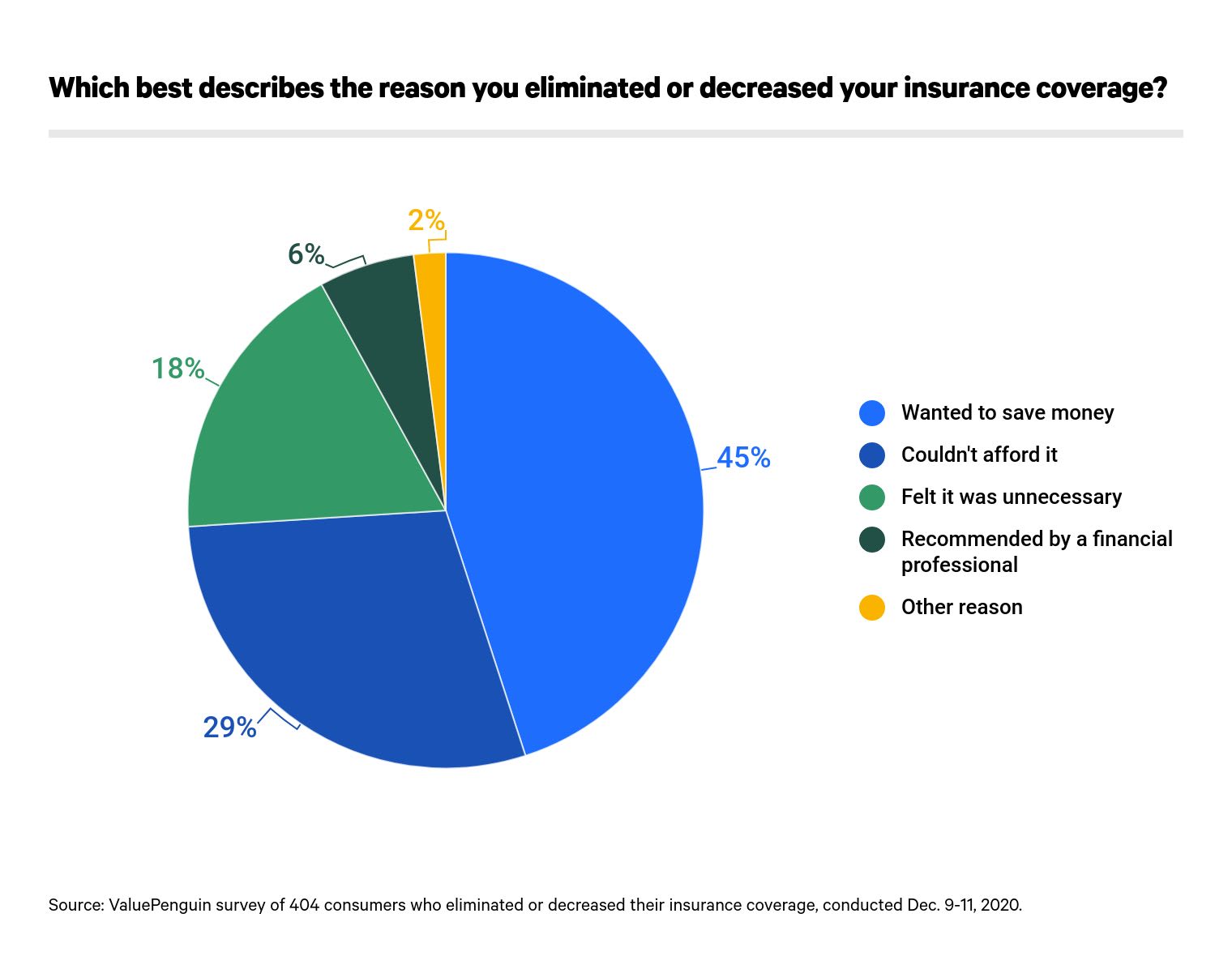

In the past year, 39% of Americans either cut down or eliminated insurance, according to the latest survey from ValuePenguin. Most of them — 45% — wanted to save money, while 29% simply couldn't afford the cost of coverage. While a large percentage of people would use their insurance savings to pay for necessities such as groceries and housing, 63% of Americans regret cutting back or eliminating their insurance coverage.

The data from more than 1,000 respondents indicates that people generally don't want to reduce their insurance protections. Seventy-five percent of people cut expenses in other areas before they reduced their insurance. And most people view their insurance cutbacks as temporary. More than half — 52% — of people plan to restore the cuts they made to their insurance plans.

Key findings

- Almost four in 10 Americans cut back on insurance coverage in 2020, primarily to save money. That number jumps to 65% of those laid off or furloughed due to the coronavirus pandemic.

- Health insurance was the most common policy that consumers decreased coverage for or eliminated altogether, followed by auto insurance and dental insurance. Forty-two percent of women who eliminated or decreased their insurance coverage said they couldn’t afford it, compared with 23% of men.

- Of those who eliminated or decreased their insurance, most are putting that money toward groceries (27%), savings (23%) and debt payments (21%), as well as monthly housing costs (15%).

- Sixty-three percent of those who reduced insurance coverage in 2020 regretted doing so, and more than half expect to restore their coverage level at some point in the future.

- Although insurance is costly (about one in five respondents said they spend $500 or more on monthly premiums), not having insurance can be expensive, too. For example, 58% of respondents don’t have dental insurance, which means they could be facing a big out-of-pocket bill should they have a tooth-related emergency.

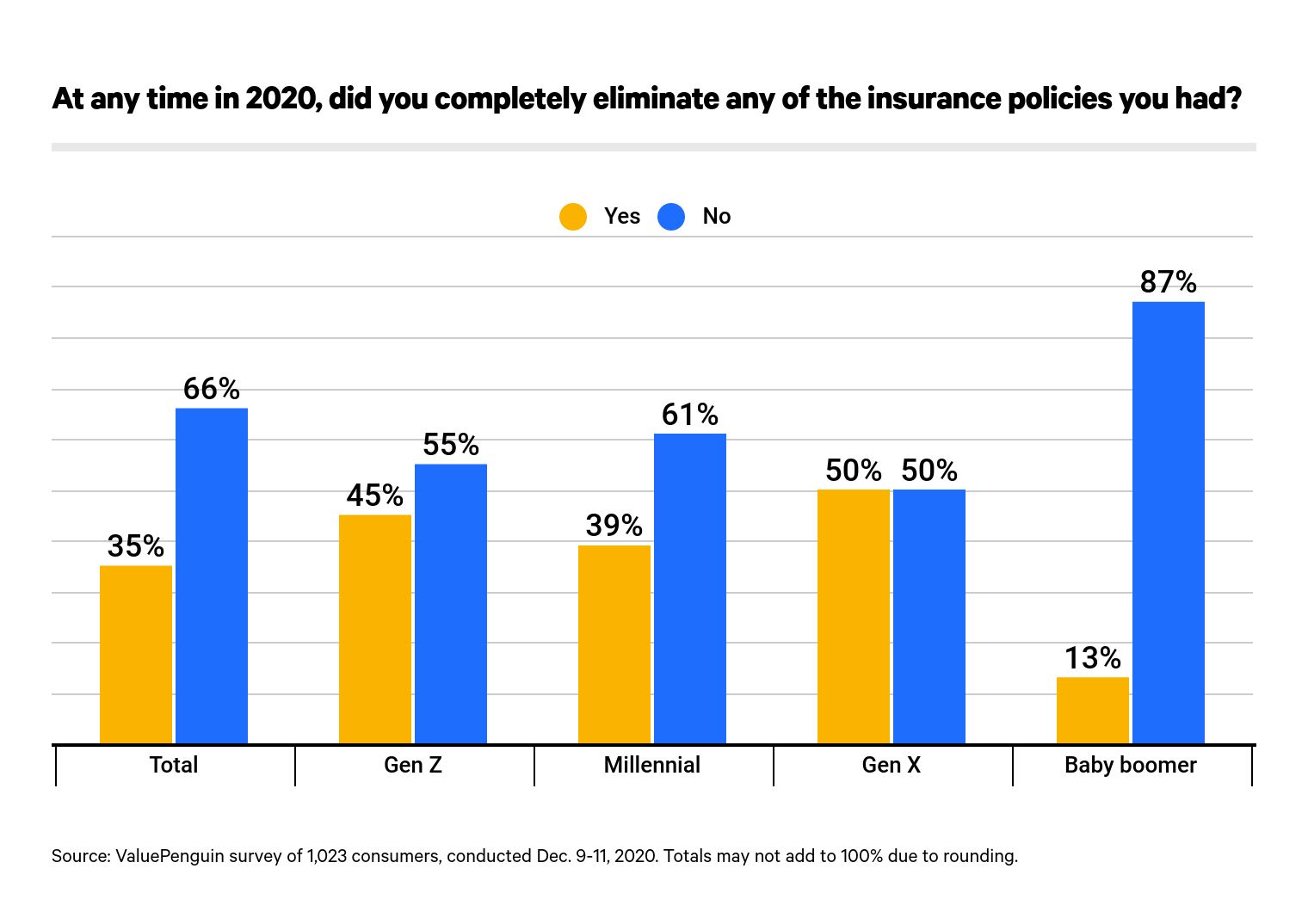

More than one-third of Americans eliminated one insurance policy in 2020, but those out of work because of COVID-19 were much more likely to get rid of coverage

Thirty-five percent of respondents completely eliminated at least one policy this year, while 31% reduced coverage. The main reason consumers eliminated or decreased their insurance coverage was to save money. Forty-five percent made their decisions with this goal in mind. Similarly, 29% who cut back on their insurance could no longer afford the policy.

Consumers who lost their jobs or were furloughed because of the pandemic were far more likely to cut back on their insurance. While just 15% of those whose jobs were unaffected by the pandemic cut out a form of insurance coverage, 59% of Americans who lost their jobs or were furloughed completely eliminated at least one type of coverage. Fifty-six percent reduced their coverage after losing a job because of the pandemic, compared with the 13% who decreased their insurance but whose employment was unaffected.

Compared to other forms of insurance, health and auto were the most likely to be carried by consumers. By effect, health and auto plans were the most likely to be eliminated in the past year (though the latter is required in some form in every state). Forty percent of people who reduced their insurance costs got rid of their health coverage, followed by 36% who eliminated their auto insurance.

Homeowners insurance was the exception to this pattern. Whereas 42% of respondents had homeowners insurance, only 14% of those who eliminated a form of coverage chose to forgo their home insurance. This may be because lenders can penalize homeowners who allow their coverage to lapse, and only renters or those who have paid off their homes could feasibly go without this type of insurance.

Among those respondents who elected to partially decrease their insurance coverage levels or eliminate add-ons for at least one policy type in the past year, health and auto policies saw the largest percentages of cutbacks. Among those who reduced a form of insurance, 43% lowered their health coverage and 42% their auto.

More than 6 in 10 regret cutting back or eliminating their insurance, even though money is being used on necessary expenses

Sixty-three percent of consumers who reduced or terminated a form of their insurance have regretted it. In fact, when it comes to deciding how to cut costs, most policyholders didn’t eye cutting their insurance as the first option. Three-quarters of those who eliminated or decreased an insurance policy to save money said they cut back on other expenses before insurance.

More than one-quarter of people who lowered or terminated their insurance put that money toward groceries.

Twenty-seven percent of people who reduced their insurance protections are using their savings to pay for groceries. Consumers were also likely to bolster their savings with their extra cash, as 23% used their money this way. Similarly, 21% said their insurance savings helped them pay off debts, while 15% allocated their money to housing.

What Americans are spending their cost savings on by household income

Expense | Total | Under $50,000 | Over $50,000 |

|---|---|---|---|

| Groceries | 27% | 33% | 23% |

| Savings | 23% | 15% | 28% |

| Debt | 21% | 23% | 21% |

| Housing | 15% | 17% | 13% |

| Child care | 7% | 7% | 6% |

Totals may not add to 100% due to rounding.

While most consumers distributed their insurance savings in these ways, poorer households were far more likely to prioritize food and housing, often at the expense of contributing to their savings. Just 15% of residents making less than $50,000 who reduced their insurance used that money for savings, on average.

An average of 33% of these respondents used their insurance savings to pay for groceries. Thirty-nine percent of households making less than $25,000 per year — lower than the federal poverty level for families of four or more — that cut back on their insurance were likely to put that money toward groceries.

Conversely, those who lost their jobs or were furloughed due to COVID-19 were more likely to pay off their debt and housing with the money they saved from cutting their insurance coverage. One-quarter of these people used the money to pay off their debts, while 20% used this money for housing costs.

More than half plan to restore their reduced or eliminated policies in the future, but the poorest households were the most likely to say they wouldn't

On top of the 52% who plan to restore their reduced policies, another 38% said they might do so. This means that just 10% wouldn’t replenish their insurance. However, uncertainty increases drastically for the poorest households, as just 35% of households making less than $25,000 would commit to restoring their policies, and 19% wouldn’t.

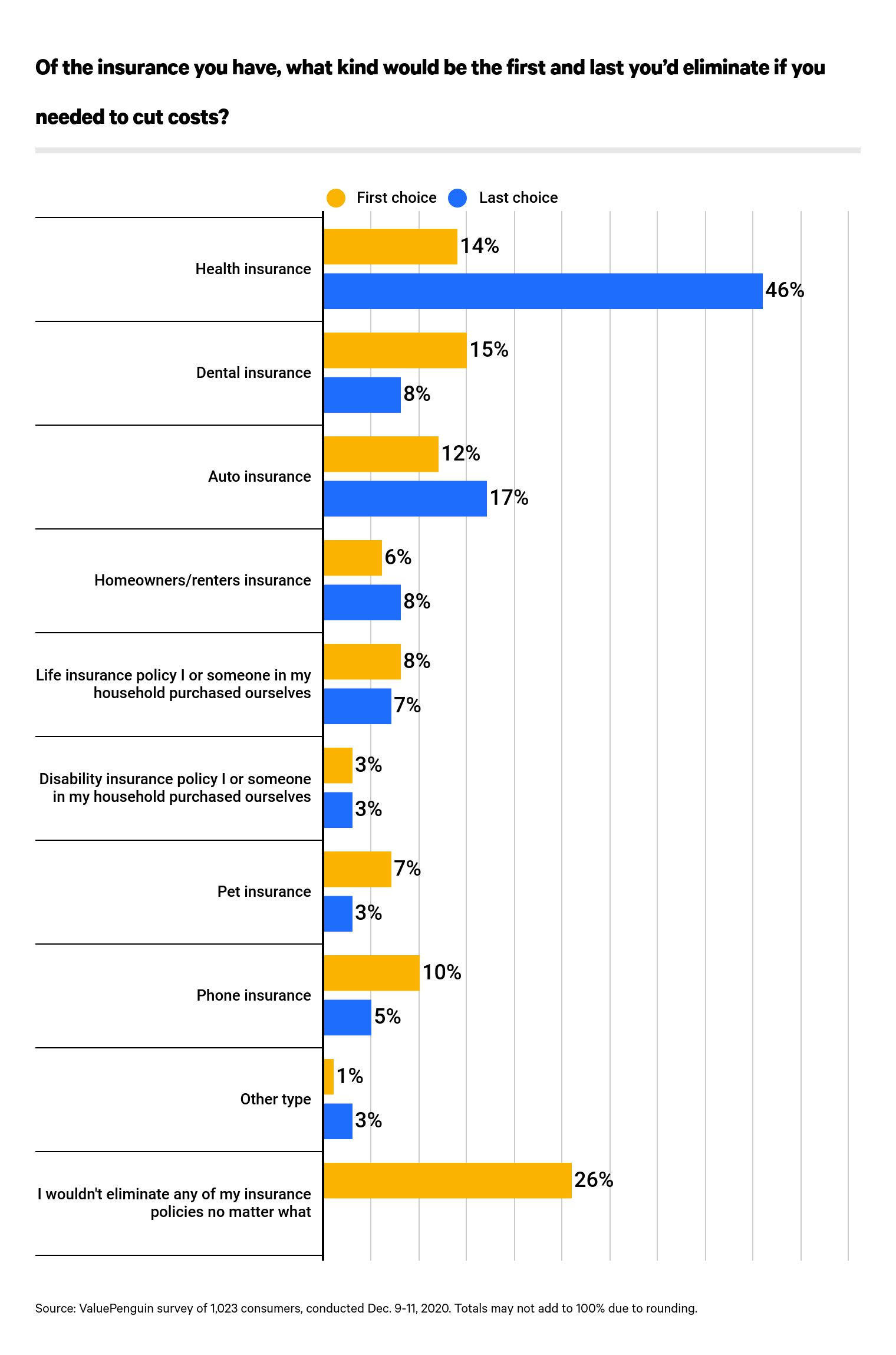

Whether a policyholder did reduce or eliminate their insurance policy, most would prefer not to. When consumers were asked which insurance policy they'd eliminate if they needed to cut costs, 26% said they wouldn't eliminate any policy under any circumstance. This answer had the highest share of respondents.

Beyond that, 15% of people were receptive to eliminating their dental insurance, and 14% would get rid of their health insurance. Twelve percent were open to cutting their car insurance. Conversely, 46% of consumers identified their health insurance as the last thing they'd cancel if they needed to cut costs, scaling back only as a last resort.

It may be tempting for some to cut their insurance to save money, but that's likely not a great idea for most people. ValuePenguin found that nearly one in five people spends $500 or more a month on their insurance premiums, which adds up to at least $6,000 a year.

How to find more affordable insurance

- Compare the cost of coverage offered by multiple insurers

- See if you're eligible for a public insurance option, like Medicaid or Medicare

- Check for discounts, which are offered by insurers for a range of policyholders

- Double-check that you're not paying for more coverage than you need

This number can represent a hefty expense for many Americans, especially those whose household income is lower than $50,000 a year. For these people, the cost of insurance may be more than 10% of their income. However, the cost of not having insurance can also be costly — perhaps more costly if an individual had to cover an unexpected expense on their own.

For example, one in four people doesn’t carry health insurance. Inpatient care at hospitals in the U.S. can cost thousands of dollars a day depending on the state. At the same time, avoiding necessary care could cause chronic health issues in the future, which would compound even further the costs patients would be responsible for.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,023 Americans, with the sample base proportioned to represent the overall population. The survey was fielded Dec. 9-11, 2020.

We defined generations as the following ages in 2020:

- Generation Z: 18 to 23

- Millennial: 24 to 39

- Generation X: 40 to 54

- Baby boomer: 55 to 74

The survey also included responses from the silent generation (ages 75 and older). However, their responses weren’t included in the generational breakdowns due to low sample size among that age group.