Pet Insurance

76% of Pet Owners Would Go Into Debt To Save Their Animal’s Life, but Only 29% Have Pet Insurance

For many Americans, their fur babies may as well be their children — and they’d do anything to ensure their health. In fact, according to the latest ValuePenguin survey of nearly 2,000 U.S. consumers, pet owners spend an average of $1,507 a year on medical care for their fur-legged friends. However, pet insurance may lower vet bills.

Here’s what else we found.

On this page

Key findings

- Caring for furry friends can be costly, but most pet owners would go into debt if it meant saving Fido’s life. The 75% of Americans with at least one pet report spending an average of $1,507 a year on medical care. However, 76% of pet owners would spend much more and take on debt if it meant saving their fur baby’s life.

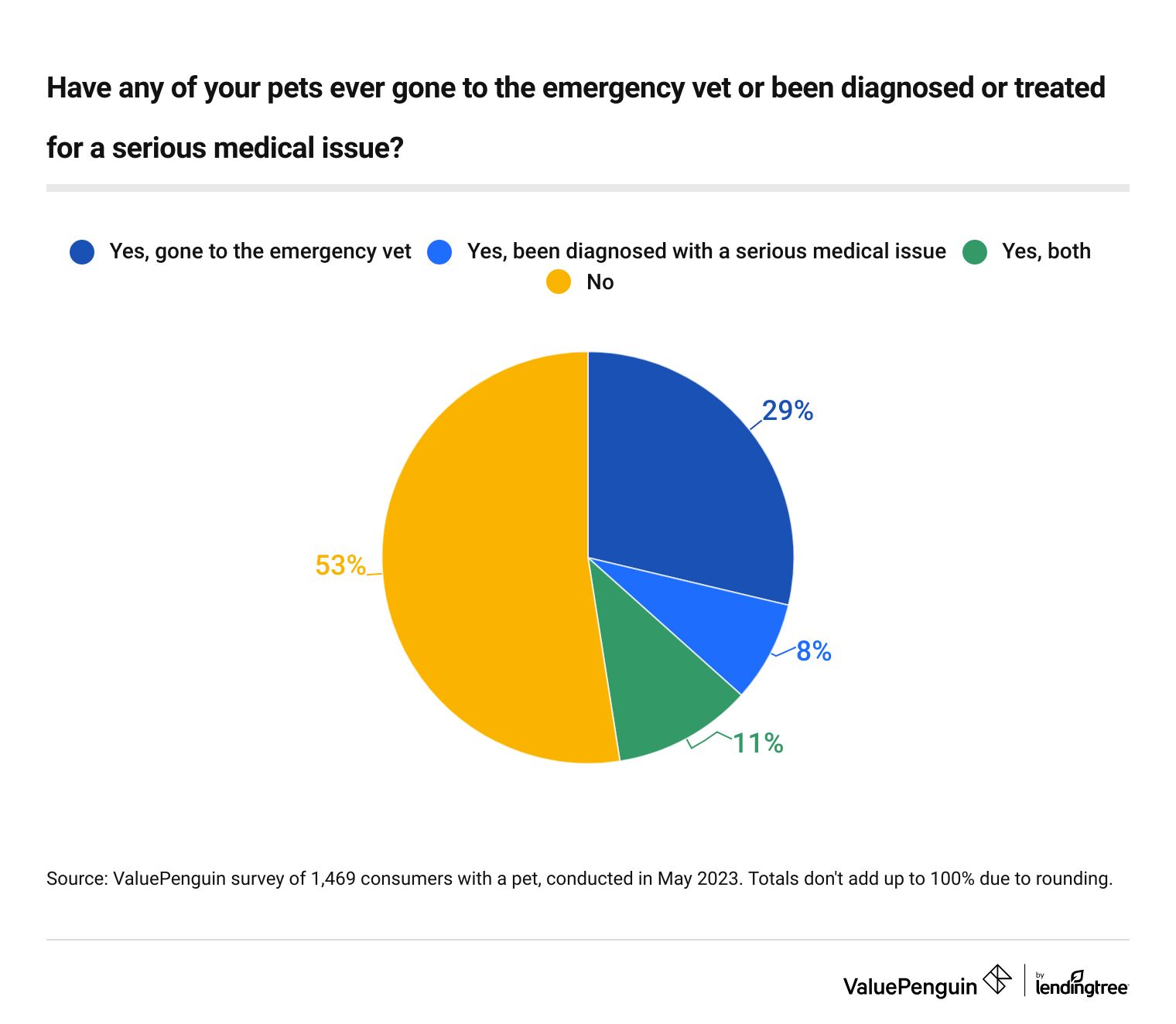

- Many pet owners are no stranger to a big bill, but pet insurance may ease the sting. Almost half of pet owners (47%) have had an animal experience a serious medical issue or require a trip to the emergency vet. Even though only 35% of pet owners reported having pet insurance amid this issue, more than half (54%) say the insurance covered all associated medical costs. For those whose pet insurance didn’t cover the total amount, the average out-of-pocket cost was $562.

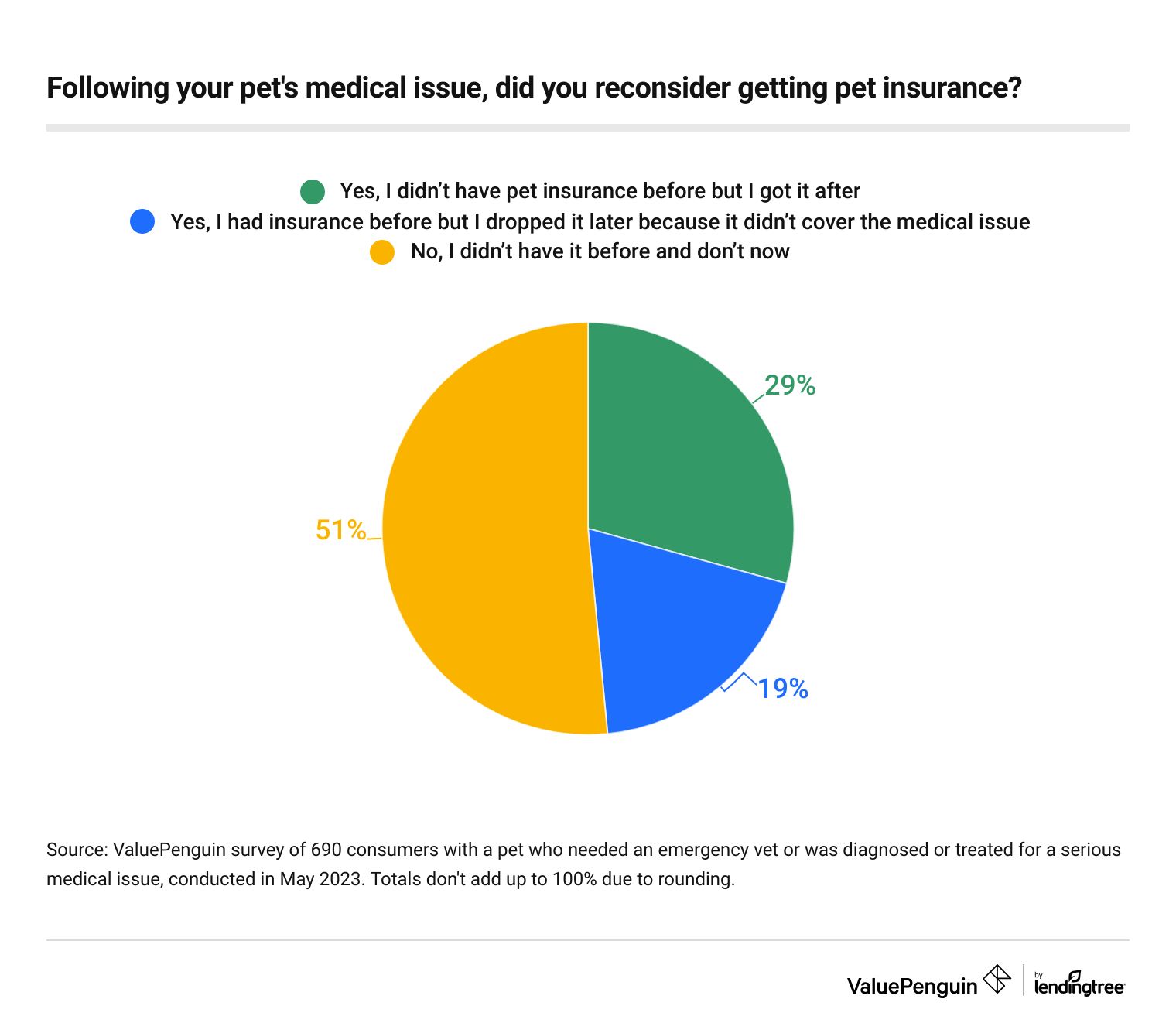

- Experiencing a pricey procedure can change owners’ viewpoints on pet insurance. Almost 3 in 10 owners (29%) whose pet experienced a serious issue didn’t have insurance but got it after. On the other hand, 19% of this group had pet insurance but dropped it because the medical issue wasn’t covered. However, owners are willing to put in the work to lower their pet bills, as 77% of those who’ve had a pet insurance claim denied have challenged it.

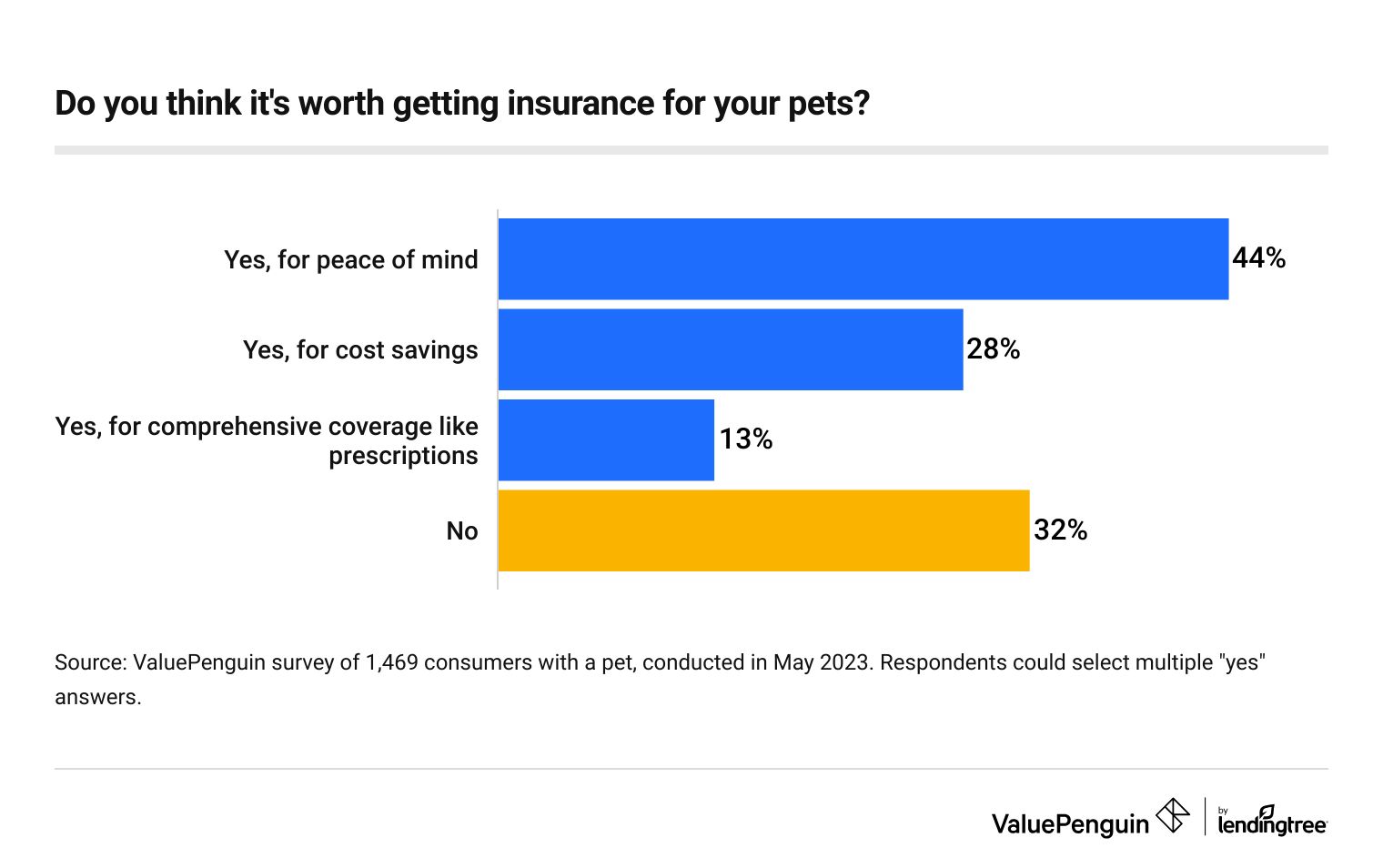

- Overall, more than two-thirds of owners think pet insurance is worth it. 68% of pet owners say this, mostly for peace of mind (44%) and cost savings (28%). These cost savings are especially vital for the 53% of pet owners who couldn’t afford a $1,000 pet emergency without taking on debt.

Owners spend big bucks for their pets — and they’re willing to shell out even more

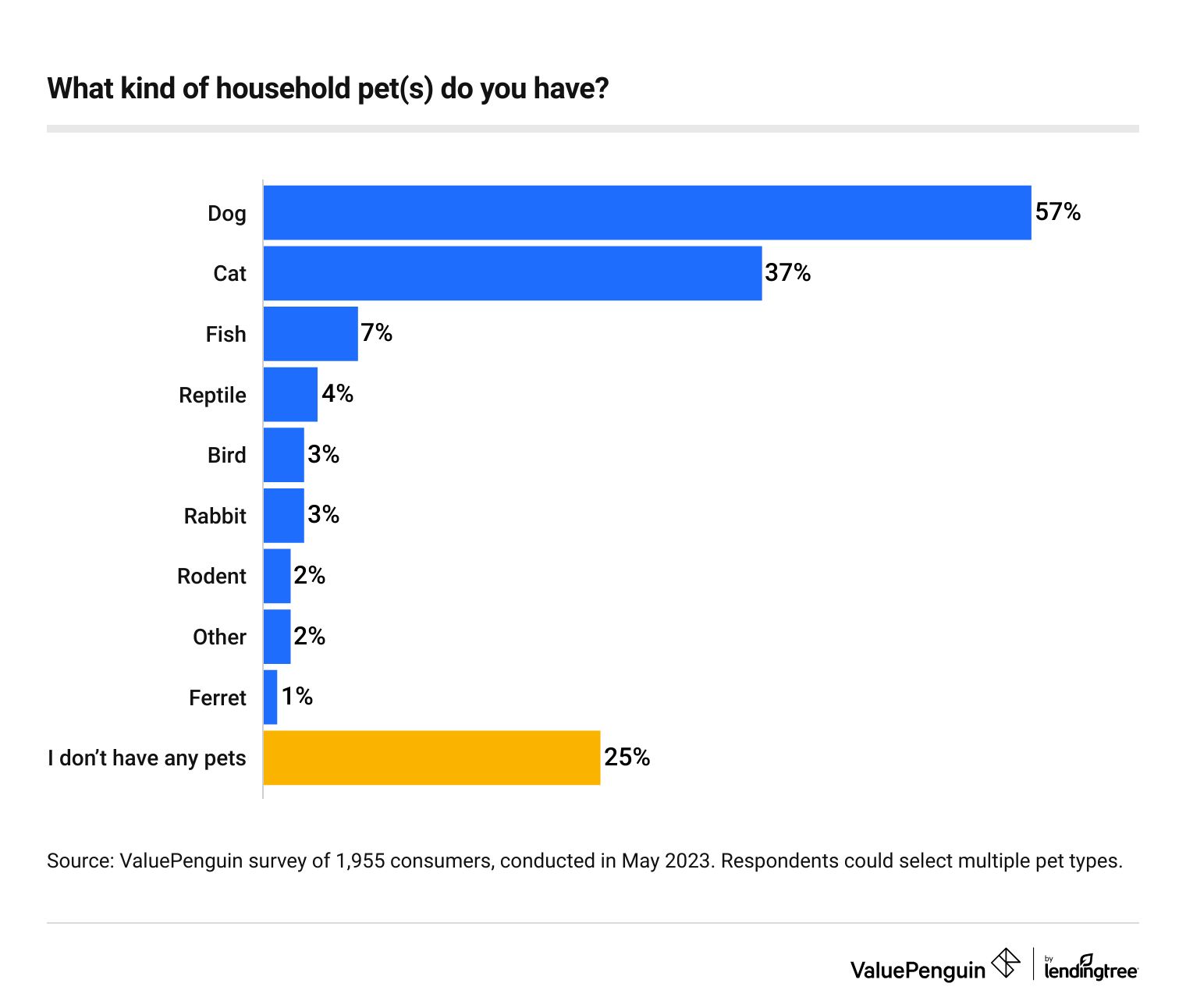

Pets are prevalent in the U.S. — particularly dogs. Three-quarters (75%) of Americans have at least one pet. Overall, 57% of respondents report owning a dog, followed by cats (37%) and fish (7%).

Gen Zers ages 18 to 26 are the most likely demographic to own a dog at 71%, while baby boomers ages 59 to 77 are least likely at 41%.

Meanwhile, parents with children younger than 18 (48%) and millennials ages 27 to 42 (43%) are particularly keen for feline friends. That compares with 32% of respondents without children and 28% of baby boomers. Women are also more likely to prefer cats than men, at 41% versus 33%.

These four-legged, finned or feathered companions come at a cost, though. On average, consumers with pets spend $1,507 a year on medical care. According to ValuePenguin health insurance expert Divya Sangameshwar, this figure will likely rise.

Americans spent $35.9 billion on vet services and clinic product sales in 2022 alone, according to the American Pet Products Association (APPA). "So why are Americans spending so much caring for their sick pets?" Sangameshwar asks. "Because we take such good care of our pets, they’re living longer and more at risk for developing cancer." According to the American Veterinary Medical Association (AVMA), almost 50% of dogs older than 10 will get some kind of cancer, which is very expensive to treat. "We’re also seeing an increase in the cost of medications and other operating costs for vets," she says.

Perhaps unsurprisingly, pet owners earning six figures spend the most on medical care for their pets, shelling out an average of $4,782 a year — more than three times the average spend across all pet owners. By age group, millennials spend the most on their pets’ medical care at $2,422 a year. That compares with:

- Gen Zers: $1,904

- Gen Xers ages 43 to 58: $684

- Baby boomers: $456

Those without children spend more on their pets than those with children, shelling out $2,334 annually for their fur babies. Meanwhile, those with children younger than 18 spend an average of $1,249 annually on their pets and those with children older than 18 spend $587. Among men, that figure jumps to $2,117 a year. Comparatively, women spend $977 annually.

The majority agree that quality care is worth a much higher cost. In fact, 76% of pet owners would spend significantly more than they already do and take on debt if it meant saving their fur baby’s life. That’s especially true of Gen Zers (82%) and millennials (80%).

How much, exactly, would put owners in the red? On average, pet owners say they can spend $2,818 on their pets’ emergency medical costs before taking on debt. Meanwhile, six-figure owners say they can spend $9,062 before taking on debt — the most of any demographic.

While some demographics can shell out a few grand on their pets, the majority would be in the red well below that. For more than half of Americans (53%), spending $1,000 on their pets’ medical costs is the most they can afford without taking on debt. That’s particularly true of those earning less than $35,000 (76%) and Gen Xers (62%).

Pet insurance can lower emergency vet costs

Big vet bills aren’t anything new to many pet owners. Almost half of pet owners (47%) have had an animal experience a serious medical issue or require a trip to the emergency vet.

Perhaps due to more access to screenings and testing, those who spend more on their pets’ medical care are more likely to say their pets have experienced serious medical issues or required trips to emergency vets. Among owners earning six figures, 63% report serious medical issues or emergency vet trips for their pets. For millennials, that figure’s 52%.

Despite the high costs associated with pet medical care, just 35% of pet owners reported having pet insurance amid their animal’s health issues — but those who had insurance had lower financial burdens. In fact, 54% of this group say their insurance covered all associated medical costs. Meanwhile, 42% say it partially covered their pet’s treatment.

For those whose pet insurance didn’t cover the total amount of treatment, the average out-of-pocket cost was $562.

High vet costs can change an owner’s perspective on pet insurance

With the cost of pet procedures so high, it may be unsurprising that 29% of owners whose pets had a medical issue reconsidered getting pet insurance. But it doesn’t always work out. In fact, 19% of owners whose pets had medical issues did have pet insurance but dropped it because their pets’ medical issues weren't covered.

What reasons are pet insurance claims denied? For 32%, it’s because they filed their claim before their waiting period was over — making it the top reason for claim denials. That’s followed by:

- Preexisting conditions (30%)

- Policy exclusions (22%)

- Uncovered treatments (6%)

- Other (5%)

- Non-compliance (4%)

- Fraudulent claims (1%)

While nearly 80% of owners with insurance say their claims have never been denied, those who have had claim denials are willing to fight it. Of this group, 77% have challenged their claim denial.

Still, not everyone chooses pet insurance. Nearly three-quarters of polled pet owners (71%) say that they don’t have pet insurance on their four-legged family members, a figure that jumps to 91% and 84% among baby boomers and Gen Xers, respectively.

On the other hand, Gen Zers are the most likely age group to take out a pet health insurance policy, at 54%.

Is pet insurance worth it? Most owners say yes

Despite the majority of owners opting out of pet insurance, the majority (68%) of those who do have it say it’s worth it, naming peace of mind (44%) and cost savings (28%) as the top reasons for their satisfaction.

For the 53% of pet owners who wouldn’t be able to afford a $1,000 pet emergency without taking on debt, the potential savings of insuring their pet may be essential to keep them out of debt. For those looking into pet insurance, Sangameshwar offers the following advice:

- Have an emergency fund for your pet. "Unlike human health insurance, most pet insurance companies work by requiring owners to pay for medical bills upfront and then apply for reimbursement," she says. "So if you have a $5,000 veterinary bill, you need to be prepared to be able to pay that upfront. If you want to negotiate the price, you may have to do it upfront, too, which can be hard to do when your pet is sick and suffering."

- Do your research before getting pet insurance. "While it’s easy to go with the cheapest option, that may not always be the best option," Sangameshwar says. "The last thing any pet parent wants is to find out that their pet’s insurance won’t reimburse the entire vet bill or cap the reimbursement at a much lower rate than they were billed. To determine which insurance is right for you, discuss what your pet’s future medical needs may be with your vet and learn more about the average cost of pet insurance."

- Switching pet insurers can be a bad idea in some cases. "While shopping around for a good deal is encouraged for home, auto or health insurance, with pet insurance it can be challenging to do so," she says. "Any diagnosis or condition made prior to the change of policy will not be covered under the new policy. In fact, some pet insurance companies even exclude treatments based on a single historic symptom. This is why taking your time to understand pet insurance and get the right type of coverage early on is so important."

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,955 consumers from May 16-18, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77