Health Insurance

Nearly Half of Americans Believe Their Health Insurance Would Cover Them if They Got Sick or Hurt on International Vacation — But It’s Not That Simple

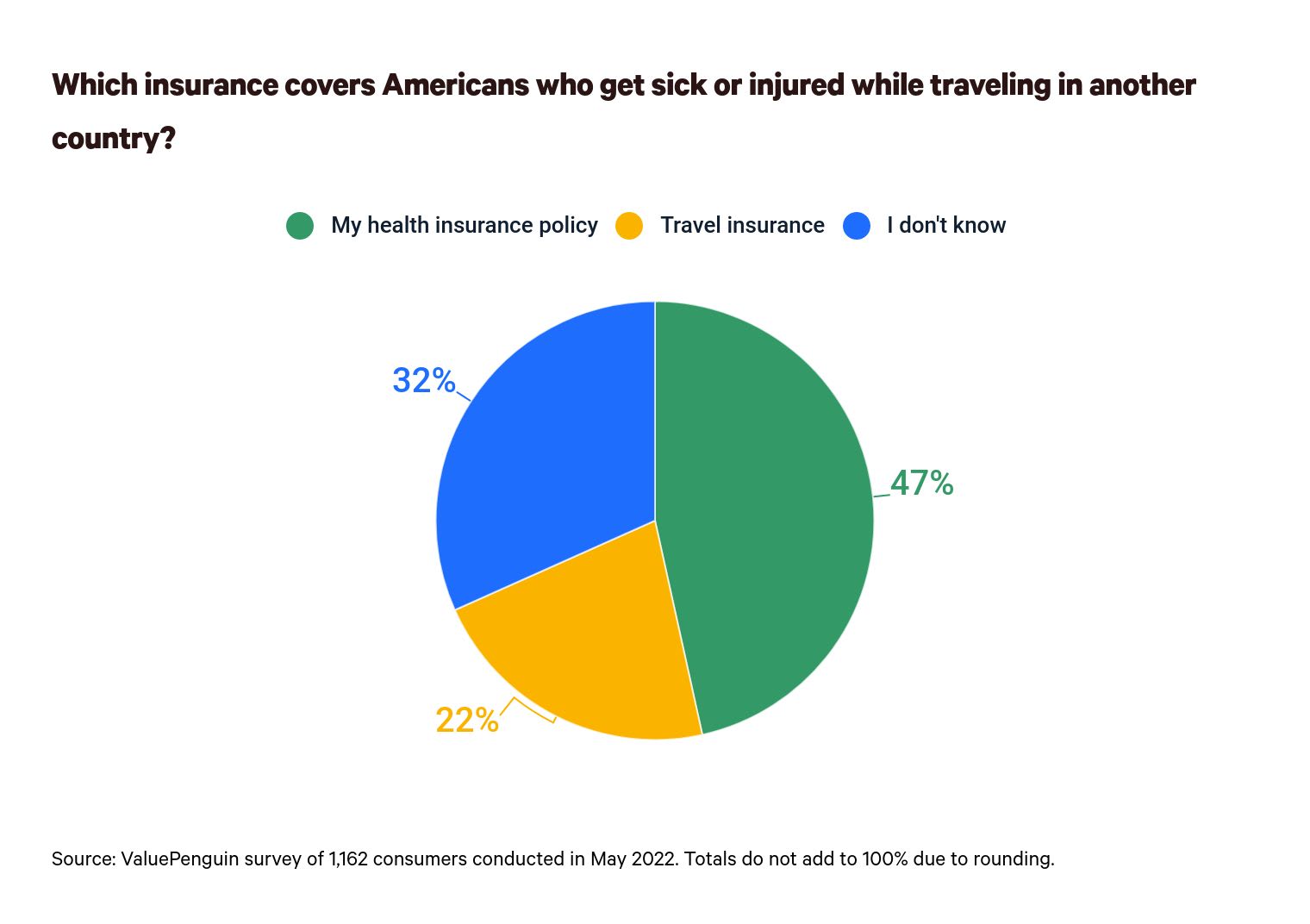

Although 47% of Americans believe their health insurance policy will cover them if they get sick or hurt while traveling abroad, the answer is more complex.

In reality, travel insurance or extra funds may be needed to fill in gaps left by primary insurers, and some travelers (such as those with government-sponsored plans) may need to completely supplant their insurance while abroad.

The latest ValuePenguin survey of more than 1,100 Americans looks at this, access to medical care abroad and vacation illnesses, among other things. Here’s what we learned.

Key findings

- Nearly half of Americans believe their health insurance would cover them if they got sick or hurt in another country, but it’s complicated. Private health insurance plans and certain supplemental government plans may offer limited coverage abroad, so travel medical insurance is often your best bet to protect against out-of-pocket costs.

- Access to medical care is an important consideration for consumers when choosing vacation destinations. 46% of Americans consider access to medical care when choosing a travel destination, whether domestic or abroad. It’s more common among parents with children younger than 18 (52%).

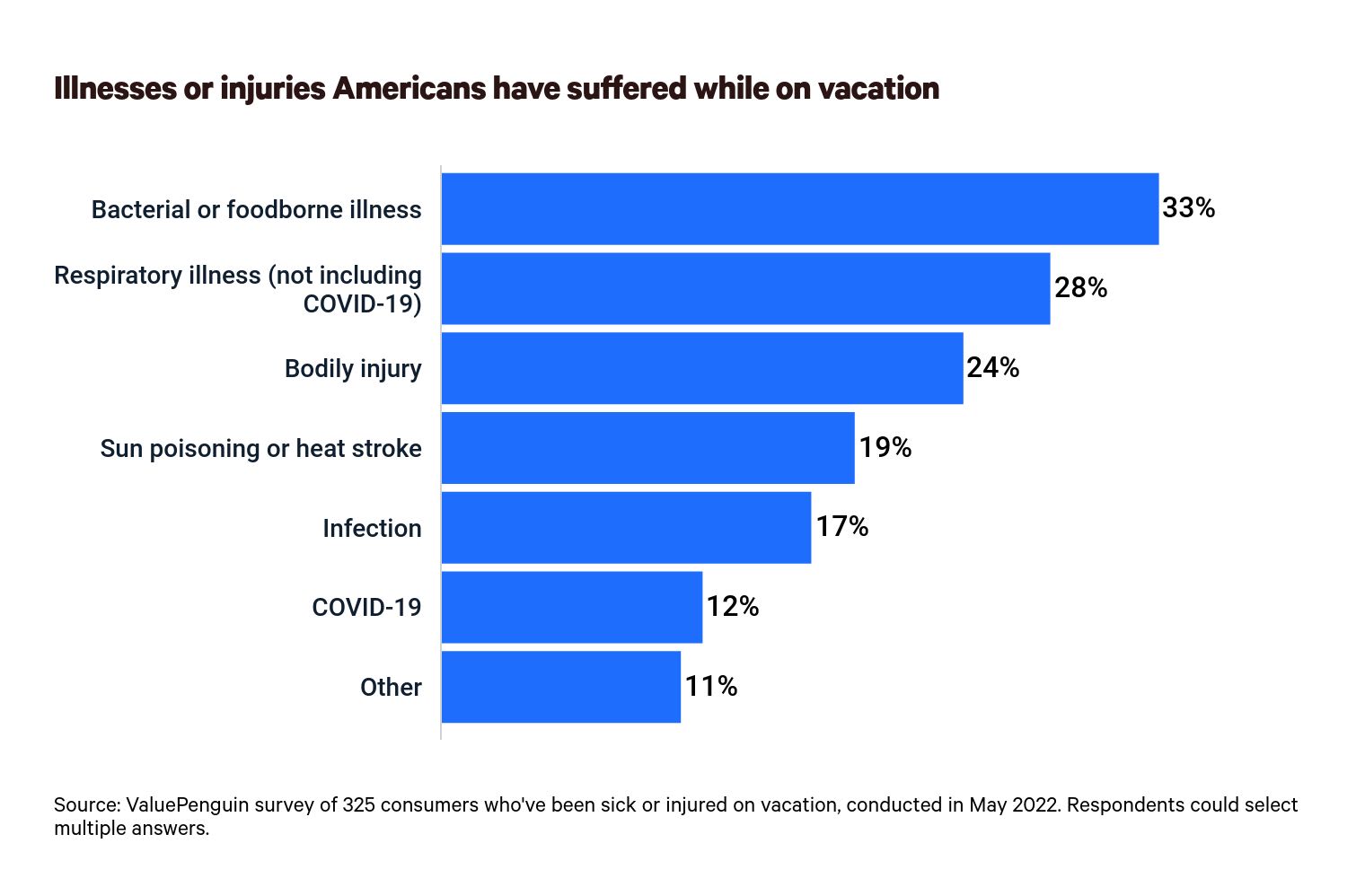

- If your vacation plans have been turned upside down due to an ill-timed illness or injury, you’re not alone. 28% of Americans say they’ve gotten sick or hurt while on vacation. Within that group, bacterial or food-borne illnesses were most common at 33%, followed by respiratory illnesses (28%) and bodily injuries (24%). 12% within this group report getting COVID-19 while vacationing.

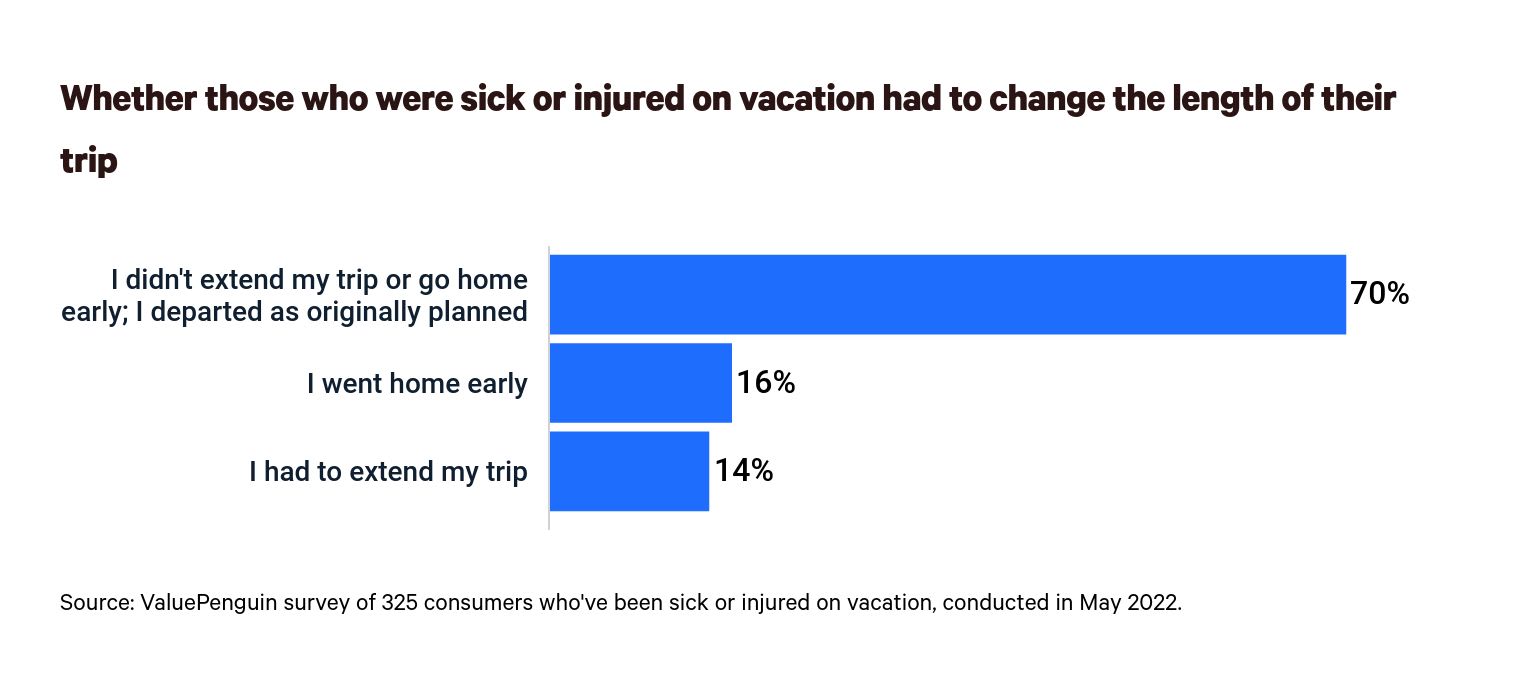

- More than half (56%) who were ill or injured on vacation needed medical treatment, but the costs didn’t stop there. 30% of those who’ve gotten sick or hurt while traveling had to change their plans as a result, either going home early or extending their trip — which could be an issue for those with nonrefundable airfare or lodging.

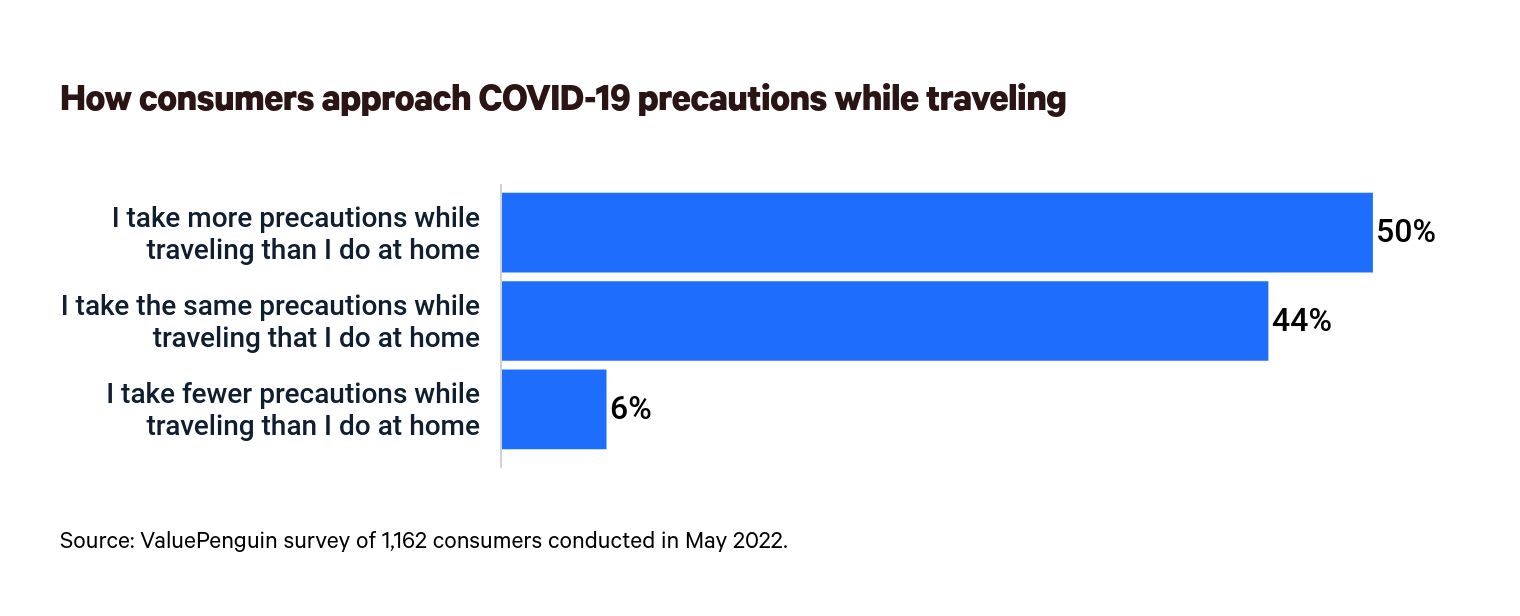

- As COVID-19 cases continue, many Americans are taking extra care to avoid contracting the coronavirus while on vacation. 50% of Americans take more COVID-19 precautions while traveling than they do when they’re home. This includes wearing masks more frequently or testing more often.

Does health insurance cover international travel?

It depends. Private health insurance plans vary, with some offering limited coverage abroad, though there might be out-of-pocket costs for some expenses such as prescriptions. And injuries because of natural disasters, adventure activities or similar scenarios may be excluded from coverage.

Meanwhile, those on government plans will generally fare worse. Medicare coverage outside the U.S. is extremely limited. And some policies that supplement Medicare — such as Medigap and Medicare Advantage — provide limited foreign travel emergency coverage.

Affordable Care Act plans don’t cover medical care outside the U.S., according to Robin Townsend, a ValuePenguin health insurance analyst.

This could complicate travel for the 47% of Americans who think their health insurance policy will cover them if they get sick or hurt while traveling in another country. The answer isn’t that simple, which could mean even more trouble for the 54% of parents with kids younger than 18 who believe this — the highest among any demographic.

Another 22% believe medical coverage from travel insurance can fill the gaps, led by 26% of baby boomers ages 57 to 76. (To some, it could be even more concerning that 32% of Americans — and 38% of Gen Zers ages 18 to 25 — say they don’t know what type of insurance would cover them while they travel in another country.)

If you’re traveling abroad, it’s imperative to check with your insurance provider about your coverage.

Travel insurance might fill health insurance gaps

If your government-sponsored plan or private insurance might be inadequate overseas, travel insurance can step in to offer protection. This could be the case under many scenarios, from overnight hospital stays to X-rays to setting bones and casting and even emergency surgeries or evacuations.

There are two types of travel health insurance:

- Primary coverage acts as your main health insurance abroad, with your home-based health insurance available as a backup

- Secondary coverage fills in gaps in your existing plan

As with some other types of insurance, there can be deductibles and certain limitations, including around preexisting conditions. For example, if you’ve had heart problems in the past and you suffer a heart attack in a foreign city, some policies might not cover you. Another limitation could be exclusions related to dangerous or risky sports and activities. (Check your policy if you’re planning to skydive in international waters or ski in the Alps.)

If you have a serious medical problem and prefer or need a specialist in the U.S. — or even a domestic hospital — you might need medical evacuation coverage. This includes airfare back to the U.S.

The best travel insurance companies for you depend on what you need. This ValuePenguin roundup highlights the best travel insurance companies for comprehensive coverage, travel medical coverage, airfare coverage, international travel and secondary travel insurance. Remember that credit card travel insurance can also help supplement travel insurance gaps.

Nearly half of Americans consider access to medical care when choosing a vacation spot

Nearly half of respondents (46%) say they think about access to medical care when choosing a vacation destination — whether domestic or abroad. This rises to 52% among parents with kids younger than 18 and 51% among Gen Zers.

Overall, the 46% figure breaks down to 27% who always consider the possibility of needing health care and 19% who mainly think about this when traveling internationally.

While medical tourism — choosing a destination for a specific procedure — is a whole other matter, a Commonwealth Fund report on top-performing health care systems in high-income countries could be interesting for those who think about this type of access.

The 2021 report from the New York-based health care research nonprofit found that the top-performing countries are Norway, the Netherlands and Australia. The top 10 are primarily in Europe (spoiler, the U.S. finished in last place at 11th).

Separately, a wider 2020 Bloomberg analysis on efficient health care during the COVID-19 pandemic found Asian countries Singapore, Hong Kong, Taiwan, South Korea and Israel at the top.

Overall, U.S. travelers mostly frequent contiguous Mexico and Canada when traveling internationally, according to a Statista analysis.

28% of consumers have gotten sick or hurt while on vacation

More than a quarter (28%) of Americans have gotten sick or injured on vacation, whether domestically or internationally, according to the ValuePenguin survey. This percentage spikes to 42% among Gen Zers.

The most common reasons cited were bacterial or food-borne illnesses — think food poisoning, parasites and diarrheal diseases — representing a third of medical issues encountered.

This set of maladies was followed by respiratory infections other than COVID-19 — think colds, flu, bronchitis, strep throat and sinus infections — and bodily injuries such as sprains, falls or broken bones. Another 12% say they got COVID-19.

56% of those who got sick or hurt on vacation required medical care

Among those who got sick or hurt while traveling, 56% say they sought medical services at their destination or back home when the trip was over. (A higher rate of women — 61% — needed treatment than men — 51%.)

More than 4 in 10 (41%) sought care at a doctor or an urgent care at their vacation locale. For nearly three-fourths (72%) of these individuals, the medical treatment provided at their destination was covered by their existing health insurance. For another 15% treated in their vacation locale, travel insurance purchased for the trip covered the expenses.

An unlucky 13% of travelers treated at their vacation locale say insurance didn’t cover their treatment.

The other 15% who sought care did so back home when their trip was over. Among this group, the highest percentage — 37% — say their issue wasn’t urgent. And 11% say they weren’t sure whether their health insurance would kick in at their vacation spot. Got hurt or sick while on vacation? 30% had to change their plans Of those who got sick or hurt on vacation, 78% were at a destination in the U.S., while the rest were in a foreign country or got sick on more than one occasion, both abroad and in the U.S.

A wide swath of vacationers — 30% — who got sick or injured while on vacation had to change their departure plans either by going home early or extending their stay, likely to seek care or to wait it out.

If you get sick or hurt while traveling, first get help, including calling emergency services if needed. If traveling internationally, Johns Hopkins Medicine suggests contacting the closest U.S. Embassy or Consulate for a list of local doctors or urgent care clinics.

In case you get sick or hurt while traveling, it’s best to check your insurance coverage before departing. Make sure you know the names — and generic brands — of your prescriptions. Have your prescriptions written down, as well as any preexisting conditions you have. Carry any medical coverage cards or travel insurance contracts.

Amid the pandemic, it could also be smart to anticipate funds to cover the length of any required COVID-19 quarantine. You may also want to find a way to secure food and extended lodging if you test positive.

As for when you’re already on your trip, have another traveler reach out to the host of any lodging to make new arrangements if needed.

How the coronavirus pandemic has impacted vacations

Surprisingly, only 29% of respondents say their vacations have been impacted by COVID-19.

Overall:

- 8% say they canceled a trip because of a positive test (highest among parents with kids younger than 18 at 12%)

- 7% say they canceled or postponed a trip because they couldn’t get a COVID-19 test in time (highest among parents with kids younger than 18 at 12%)

- 4% say they had to quarantine in their vacation home after arrival, whether due to host country regulations or a positive test (highest among millennials ages 26 to 41 and Gen Zers, with each group at 7%)

On June 12, the Centers for Disease Control and Prevention (CDC) lifted the rule requiring travelers to show a negative COVID-19 test result or documentation of recovery from the infection before boarding a flight to the U.S.

Half of respondents say they take more precautions when traveling than they do at home. This includes mask-wearing, more frequent testing and distancing, among other things. Meanwhile, 6% say they take fewer precautions than they do at home — led by 10% of parents with kids younger than 18.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,162 U.S. consumers, fielded May 16-23, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

While the survey also included consumers from the silent generation (those 77 and older), the sample size was too small to include findings related to that group in the generational breakdowns.