Homeowners Insurance

Most and Least Affordable Cities in North Carolina for Homeowners and Renters

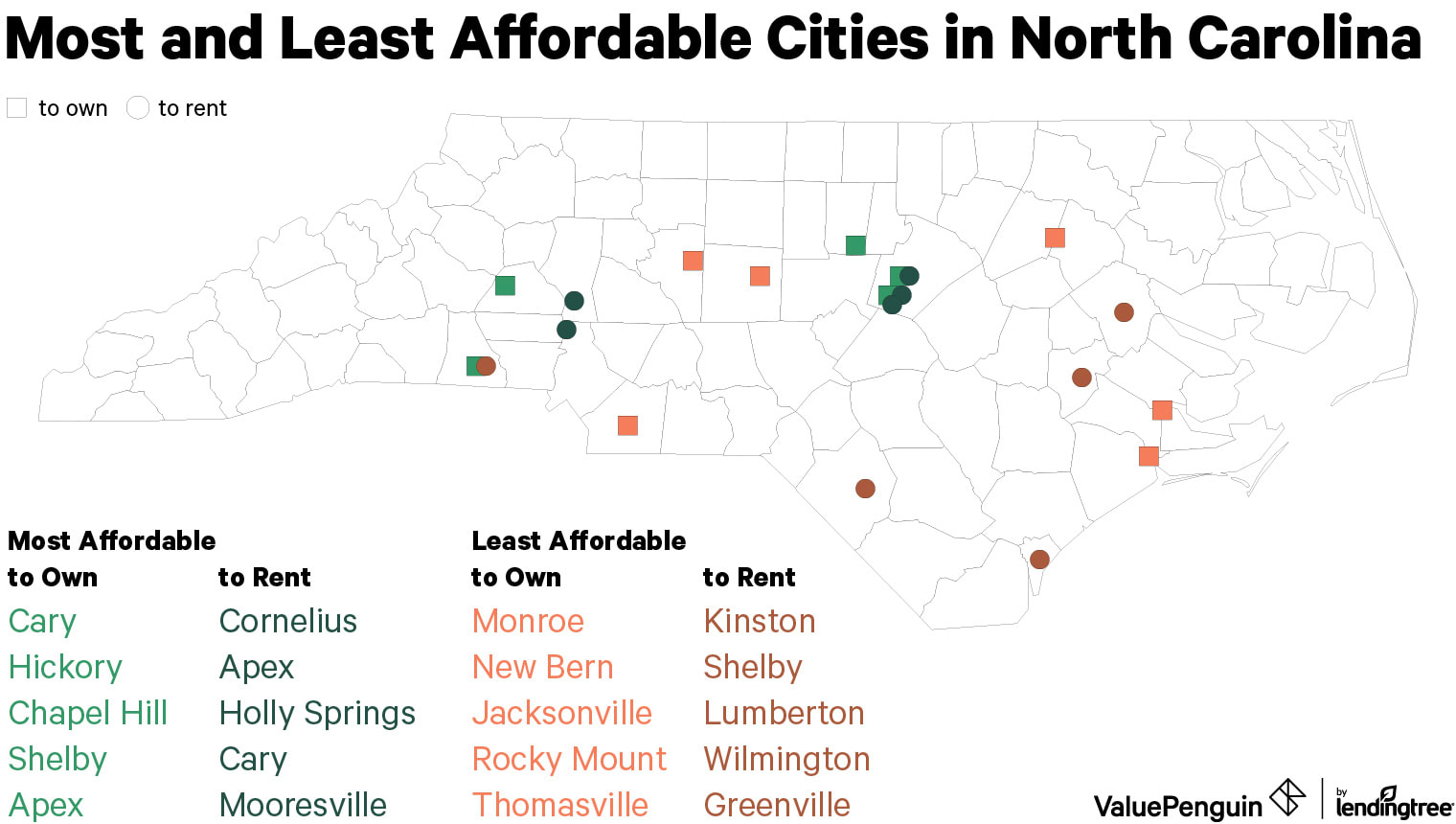

We surveyed the largest cities in North Carolina and found it's much less affordable to be a renter than a homeowner in the state.

On average, renters spend 31% of their income on housing, while homeowners spend just over 18%.

According to the US Census Bureau, when housing expenses exceed 30% of a household's total income, those households are considered burdened by unaffordable housing. We used this figure as a benchmark to evaluate which cities in North Carolina are the most and least affordable for homeowners and renters.

Key findings

- Although it's affordable to own a home in each of the state's cities with over 20,000 people, renting one is unaffordable in 24 of the 43 cities we surveyed. Low incomes often drive unaffordability among renters. In 17 of the 24 cities where rental housing is unaffordable, residents make less than the state's median household income of $63,390.

-

Raleigh has a concentration of affordable cities surrounding it. Raleigh's well-paying tech industries and low overall unemployment seem to have benefited residents in nearby cities and suburbs, such as Cary, Apex and Holly Springs. Raleigh is a good city for residents looking to move, and those with high-paying jobs may find the city's satellite communities even better.

-

Despite its growing numbers of newly arriving millennials, Charlotte doesn't stand out in our data — and neither do its suburbs. While the median income in Charlotte is among the state's highest, at over $40,000, monthly costs mean that renters spend over two-thirds of their income on housing.

-

Homeowners and renters insurance is affordable for most residents. The average cost of home insurance with flood protection in North Carolina represents about 3% of the typical housing expenses for the typical homeowner or renter.

For homebuyers, high-paying job opportunities make North Carolina more affordable

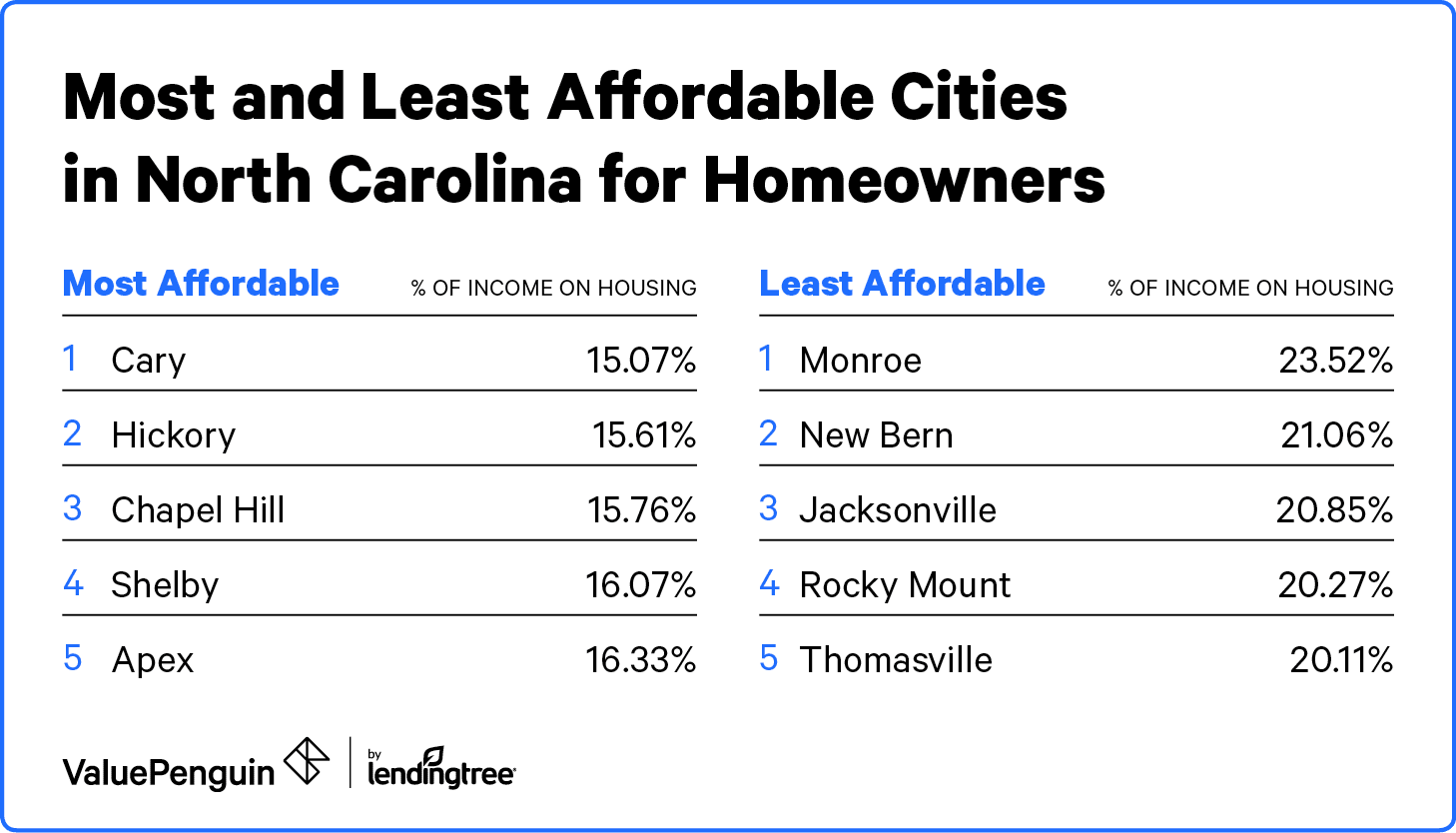

All of the cities we included in this study were affordable for homeowners, with living costs in each place accounting for less than 30% of the median homeowner income.

This means that even the most expensive cities in North Carolina offer homes for purchase at prices that most local families can afford.

Homes in North Carolina's inland expanse tend to be more affordable than in cities to the east. Raleigh's proximity to the research triangle — anchored by Duke University, the University of North Carolina and North Carolina State University — serves as a draw for businesses and high-paying tech jobs that compensate for the area's comparatively high housing costs.

Most affordable cities for North Carolina homeowners

The most affordable city for homeowners is Cary, where residents spend 15% of their income on housing. Cary also ranks high for renters. However, it's not an inexpensive place to live. Cary's homeowners have a median income of over $120,000, and the monthly costs of owning a home are higher compared with most of the other locations we included.

Homeowners in Hickory and Chapel Hill spend just under 16% of their income on housing. Chapel Hill's homeowners have a median income of over $131,000, but they also pay the most per month in housing costs. Hickory, located northwest of Charlotte, houses data centers for tech giants Apple and Google. Here, homeowners make a median of $63,024 per year and pay only $820 per month in housing costs.

Shelby's residents spend a little over $700 per month on housing. Shelby is an outlier among this study's top five most affordable cities for homeowners. Affordability in Shelby isn't a reflection of the area's high incomes, unlike other cities. Homeowners here make an average of about $53,000, which is less than the state's median of $63,390. Shelby's affordability is the result of low costs — the third lowest in the state for homeowners.

Located outside Raleigh, Apex rounds out the top five most affordable cities for homeowners in North Carolina. Its homeowners spend 16.33% of their income on housing costs per year. Besides Cary, Apex is the only other city in our study that's affordable for homeowners and renters, even though homeowners make $57,000 more than renters here.

Yet, like Cary, Apex may not be a fit for all prospective residents. Even though Apex is among the most affordable cities in the state, the housing costs are still expensive — over $1,600 per month. Its affordability is a reflection of the higher income of its homeowners and renters. Both homeowners' and renters' incomes here are in the top three in North Carolina.

In the least affordable cities, low income may be a greater factor than high costs

The state's least affordable cities are located to the east — especially near the coast. Some cities, like Rocky Mount and Kinston, have been negatively affected by departing manufacturing jobs and damaging floods.

As such, homeowners living in the top five cities in this category have a median income of $56,474 and pay almost $1,000 for housing per month. This figure is lower than the state's median income of $63,390 for homeowners. North Carolina is still an affordable place in general, since affordability doesn't exceed even 24% for most people. Households making $57,625, the country's median income, could likewise be comfortable here.

Monroe is the least affordable city for homeowners in the state. Residents spend almost 24% of their income on housing per year. The median income of the city's homeowners is about $56,000, but monthly costs are high — over $1,107 per month.

In fact, despite having a relatively low median income, Monroe has disproportionately high monthly housing costs. Comparably, the median income for homeowners in Concord, the city with the next highest monthly costs, is nearly $30,000 more.

In New Bern, located along the Neuse River, homeowners pay 21.06% on housing per year. The city isn't very affordable for renters, either, who might pay housing costs that take up as much as 37% of their income per year.

On the eastern side of the state, the residents of Jacksonville and Rocky Mount spend about a fifth of their income on housing per year. Neither city is affordable for renters, either, with Rocky Mount claiming the sixth least affordable city.

The fifth least affordable city in North Carolina is Thomasville. Homeowners here have the fourth lowest median income in the state. Still, Thomasville's residents spend much less than the 30% threshold of their income on housing. Additionally, Thomasville is more affordable for homeowners than the least affordable city for renters.

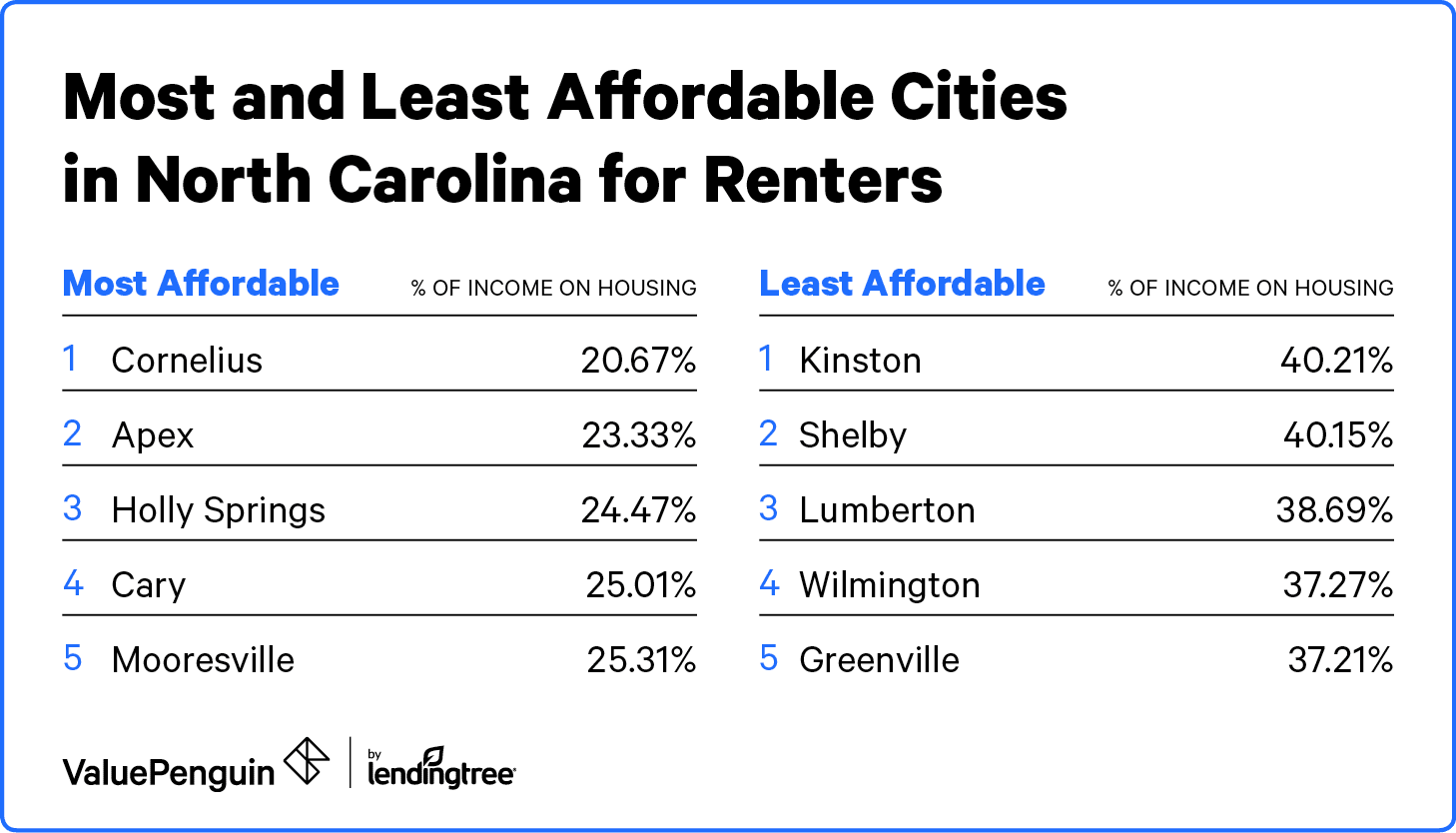

In North Carolina, low wages among renters contribute to unaffordable housing across the state

Based on the Census Bureau's definition, North Carolina isn't a very affordable state for renters. Low income among the state's renters typically contributes to unaffordable housing. In fact, renters who live in the state's 12 most unaffordable cities make less than $30,000 per year. Furthermore, while residents in 24 of the state's largest cities spend more than 30% of their incomes on housing costs, renters in only seven of these cities make above $32,220, North Carolina's median income for renters.

These factors mean that despite the low monthly rent costs, renters living in the state's most unaffordable cities don't have an income that can absorb their financial burdens as easily as residents of North Carolina's wealthier cities.

North Carolina's most unaffordable cities for renters

City | Renters' med. income (past 12 mos.) | Renters' med. monthly cost | Renter affordability |

|---|---|---|---|

| Kinston | $20,115 | $674 | 40.21% |

| Shelby | $21,132 | $707 | 40.15% |

| Lumberton | $20,561 | $663 | 38.69% |

| Wilmington | $28,621 | $889 | 37.27% |

| Greenville | $25,026 | $776 | 37.21% |

| Rocky Mount | $24,197 | $748 | 37.10% |

| New Bern | $27,606 | $844 | 36.69% |

| Goldsboro | $24,859 | $750 | 36.20% |

| Burlington | $26,128 | $776 | 35.64% |

| Salisbury | $26,420 | $761 | 34.56% |

| Winston-Salem | $26,773 | $765 | 34.29% |

| Statesville | $25,070 | $713 | 34.13% |

Residents in the state's 24 most unaffordable cities make less than North Carolina's median income for renters

Less than half of North Carolina's largest cities are affordable for renters

The most affordable place for renters in the state is Cornelius, which sits alongside Lake Norman, about an hour outside of Charlotte. Here, residents spend over one-fifth of their income on housing.

Like other affordable cities for renters in the state, Cornelius's residents have a median income that's well above North Carolina's median income for renters. At $68,615 per year, Cornelius's renters outearn the rest of the state's renters by more than 100%.

The second most affordable city for renters is Apex, a suburb of Raleigh. This city's tenants spend 23.33% on housing per year and have an annual median income of $61,421. Apex is the only place in our study besides Cary, another city that's adjacent to Raleigh, that appears on the affordability lists for both homeowners and renters.

Cary's renters spend a quarter of their income on housing, but they make almost twice what's expected for renters in North Carolina. The monthly cost of housing for renters in this city is about $400 less than it is for homeowners, but renters earn $60,000 less here.

Costs associated with housing in Holly Springs amount to 24.47% of its residents' incomes. Even though renters pay about $380 less than homeowners here, Holly Springs is less affordable for renters than the least affordable city for homeowners.

The fifth most affordable city in North Carolina is Mooresville. This city, which also sits alongside Lake Norman, costs its renters about 25.31% of their income per year on housing. Renters spend $1,037 per month on home expenses.

Housing in North Carolina's most unaffordable cities can cost residents more than 40% of their income

As with North Carolina's least affordable cities for homeowners, low wages contribute to the unaffordability of a region for renters. The median income in the five most unaffordable cities in the state is $21,132, about a third less than the median for renters elsewhere in the state.

Kinston is the least affordable city in the state. Its residents spend 40.21% of their income on housing costs per year. This figure is 10% higher than the government's benchmark for affordability. Although the $674 cost per year is the fourth cheapest in the state, Kinston's renters are adversely affected by having the lowest median income — $20,115 — among the cities we surveyed.

Shelby is the second least affordable city in the state. Renters in Shelby spend more than two-fifths of their income on housing per year. Although renters here make $33,000 less than homeowners, the monthly difference in housing costs between the two groups is less than $10 per month. Consequently, despite its unaffordability for renters, Shelby is among the most affordable cities for homeowners in North Carolina.

Renters in Lumberton spend only $7,056 per year on housing. However, like those in Kinston and Shelby, renters in Lumberton have relatively low incomes and can't absorb housing costs. In Lumberton, renters earn about $21,000 per year. Incomes here are also below the state's median for homeowners, but they benefit from the city's low cost of $687 per month to own a home.

The cities of Wilmington and Greenville are the fourth and fifth least affordable cities for renters, who spend about 37% of their income on housing. In both Greenville and Wilmington, the median income for renters is about $47,000 less than for homeowners in the same city. These disparities are the seventh and eighth largest among the cities we surveyed.

Is insurance affordable for North Carolina's homeowners and renters?

For both homeowners and renters, the cost of insurance is a factor in determining a home's affordability. Because the cost of insurance varies by household — due to a variety of reasons, including personal history and location — it's best to consider the coverage options from a few providers.

Because homeowners insurance is often a requirement by mortgage lenders, its costs are included in the Census Bureau's calculations of affordability. But the price of insurance isn't factored in for renters.

Homeowners insurance in North Carolina

Homeowners in North Carolina spend an average of $1,089 per year on homeowners insurance. This number is close to the national average of $1,083. Since North Carolina also ranks in the National Association of Insurance Commissioners' (NAIC) list of states that make flood damage claims, it could be a good idea to purchase flood insurance as well. Most homeowners insurance policies don't provide coverage for this peril, but adding coverage often costs only a small percentage of income.

Flood insurance typically costs $814 per year for North Carolinians. Tacked onto a regular homeowners insurance policy, full coverage amounts to an average yearly cost of about $1,900. This number represents 3% of the state's median homeowners' income of $64,000 and 4% for homeowners in the study's lowest-earning city, Asheboro.

Renters insurance in North Carolina

Renters in North Carolina spend an average of $240 per year on insurance. The state's average cost of renters insurance is about $50 more expensive than the country's overall annual cost of $187. Like homeowners, renters in North Carolina should consider flood insurance, as this type of damage is not often covered by a typical policy. The price of protection costs an average of $814 per year.

Because the cost of renters insurance isn't accounted for by the Census Bureau's assessment, renters who purchase this protection must consider its cost separate from utilities. Fortunately, the cost of renters insurance is significantly cheaper than homeowners insurance, even with flood insurance added. Full coverage comes to about $1,050 per year, or 3% of North Carolina's median income for renters. For the state's lowest-earning city, Kinston, this expense takes up about 5% of its median income.

Methodology

We analyzed the affordability of owning or renting a home in this state using data from the Census Bureau's database. The major cities in this study have an estimated population of over 20,000 as of 2018.

More information pertaining to home affordability can be found here.

City | Population | HO med. income (past 12 mos.) | HO. med. monthly costs | Homeowner Affordability | Renters med. income (past 12 mos.) | Renters med. monthly cost | Renter affordability |

|---|---|---|---|---|---|---|---|

| Charlotte | 872,498 | $80,205 | $1,210 | 18.10% | $40,517 | $1,018 | 30.15% |

| Raleigh | 469,298 | $87,941 | $1,287 | 17.56% | $42,168 | $1,010 | 28.74% |

| Greensboro | 294,722 | $65,833 | $1,009 | 18.39% | $31,248 | $813 | 31.22% |

| Durham | 274,291 | $85,477 | $1,216 | 17.07% | $36,560 | $958 | 31.44% |

| Winston-Salem | 246,328 | $61,988 | $908 | 17.58% | $26,773 | $765 | 34.29% |

| Fayetteville | 209,468 | $59,755 | $957 | 19.22% | $32,687 | $892 | 32.75% |

| Cary | 168,160 | $120,679 | $1,516 | 15.07% | $54,370 | $1,133 | 25.01% |

| Wilmington | 122,607 | $74,579 | $1,203 | 19.36% | $28,621 | $889 | 37.27% |

| High Point | 112,316 | $65,570 | $1,039 | 19.01% | $29,542 | $821 | 33.35% |

| Concord | 94,130 | $80,204 | $1,202 | 17.98% | $40,074 | $858 | 25.69% |

| Greenville | 93,137 | $73,357 | $1,036 | 16.95% | $25,026 | $776 | 37.21% |

| Asheville | 92,452 | $64,910 | $1,051 | 19.43% | $35,332 | $954 | 32.40% |