How Credit Scores Can Affect Home Insurance Premiums

Find Cheap Homeowners Insurance Quotes in Your Area

Your credit history is a piece of information that insurance companies frequently use to set the rates you pay for homeowners insurance. Insurers can analyze information about your past financial behavior — like how frequently you've missed or made late bill payments and how much debt you have — to generate your credit-based insurance (CBI) score.

A CBI score is similar to a FICO credit score, but it is calculated differently for each individual insurer. It's also only one part of how your homeowners insurance rates are determined. Depending on the insurer, and the state you live in, a bad credit history may have no impact or can more than double your homeowners insurance rates. An excellent credit score could reduce home insurance premiums by 20% or more.

What is a credit-based insurance score?

A CBI score, also called an insurance score, is a number that describes your overall credit stability in the eyes of an insurance company. It's one of several factors that homeowners insurance companies may use to determine what rate to offer you.

CBI scores are based on many components, and the exact formula varies by insurer, but certain factors can positively or negatively impact your score.

Factors that positively affect your CBI score

- Long credit history

- Several bank and credit accounts in good standing

- No late payments

- Low credit usage

Factors that negatively affect your CBI score

- Bank or credit accounts in collection

- Numerous past-due accounts

- High use of available credit

- Numerous recent applications for credit

In most cases, the two biggest factors in determining your CBI score are your previous credit performance, including whether you pay your bills on time, and the amount and types of outstanding debt you have.

For instance, a $200,000 mortgage is weighed very differently than $200,000 in credit card debt.

Why do homeowners insurance companies use CBI scores?

Insurers use CBI scores because they have found a correlation between a person's insurance score and how likely that person is to file a homeowners insurance claim.

Essentially, your ability to maintain a high credit score is one way for the company to assess how risky you are to insure, as it is a very reliable indicator of how likely you are to make a claim and how large that claim is likely to be. For example, a homeowner who is able to stay on top of their monthly mortgage payments may be more likely to properly maintain their home and be more risk-averse overall.

Therefore, insurers offer more expensive homeowners insurance rates to people with poor credit histories, as they’re likely to have greater loss ratios, and discounts to people with high CBI scores.

The differences between a credit-based insurance score and a FICO credit score

FICO credit score: Calculated by credit bureaus, focused on likelihood of paying back debt.

CBI score: Calculated by individual insurers, focused on potential to make insurance claims.

There are many similarities between a CBI score and a FICO credit score — CBI scores are even referred to as "credit scores" in some situations, making the matter particularly confusing. Your FICO credit score is a number between 300 and 850, and it is used to determine how risky it is for a bank to lend you money or allow you to open a credit card.

Both a FICO credit score and a CBI score are based upon criteria like how much debt you have, whether you pay off your credit cards every month and the length of your credit history. The numbers for each are also often provided by the same agencies, such as FICO.

However, there are a few key differences. Most broadly, while banks and insurance companies use similar attributes about your financial history to make predictions about your future behavior, the predictions they are trying to make are different.

Insurance companies are primarily concerned about whether you're likely to make a claim, and lenders care about whether you will pay them back on time. In practice, this means that a low credit score won’t necessarily mean that your CBI score will negatively impact your homeowners insurance rates.

Another difference is that every homeowners insurance company calculates CBI scores using its own methods, so the exact elements used in each CBI score can vary. On the other hand, nearly all credit scores are calculated by one of the three main credit bureaus — Experian, Equifax or TransUnion — and the techniques the bureaus use are fairly consistent.

Does an insurance credit check impact your credit score?

One way credit and loan companies check your credit — sometimes called doing a "hard pull" — can negatively impact your credit score. However, having an insurer check your credit history to determine your CBI score won't have an effect on your credit.

What is my credit-based insurance score? How does it affect my insurance rates?

Because home insurance companies calculate your insurance credit score based on internal company models, you won't be able to find out your score. However, given that a CBI score is largely based on a credit score, your credit report can give you an indication of how it may be affecting your rates.

Credit scores range between 300 and 850, with most people's scores falling between 600 and 750, and the higher your score the lower risk you're considered.

Insurance scores aren't the same, but they're similar and will generally be rated on a comparable scale.

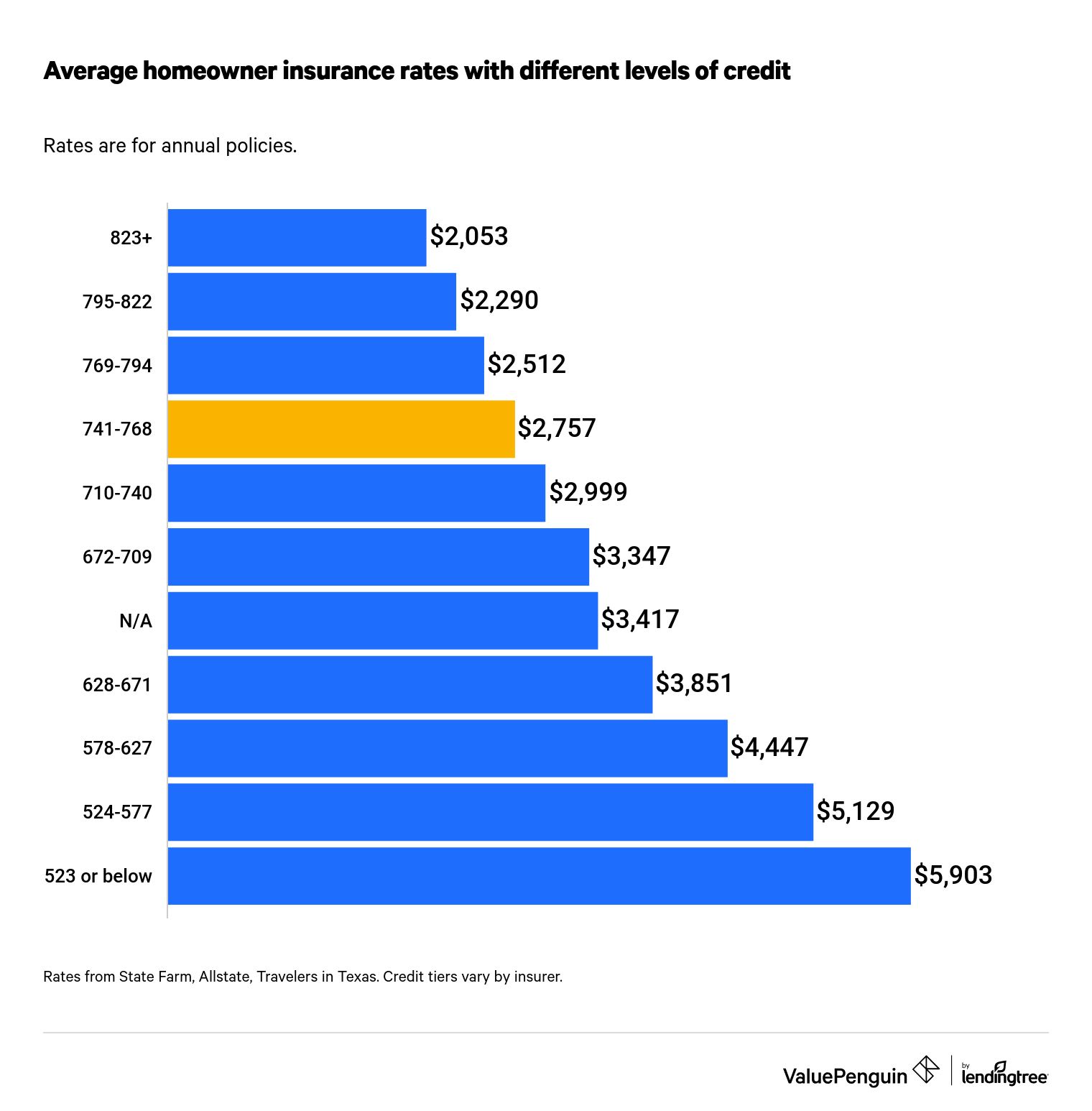

We analyzed a set of insurance rates and found that, in some cases, customers with good or excellent scores could save 20% or more on their base home insurance rates. Conversely, those with particularly bad insurance scores may see their rates more than double, emphasizing the importance of improving your insurance score.

How your premium can be altered by higher and lower scores

Find Cheap Home Insurance Quotes

Average homeowner insurance rates with different levels of credit

Credit tier | FICO score | Average rate | Change from average score |

|---|---|---|---|

| Excellent | 823+ | $2,053 | -26% |

| Very good | 795-822 | $2,290 | -17% |

| Good | 769-794 | $2,512 | -9% |

| Average | 741-768 | $2,757 | 0% |

| Fair | 710-740 | $2,999 | 9% |

| Fair to below fair | 672-709 | $3,347 | 21% |

| None | N/A | $3,417 | 24% |

| Below fair | 628-671 | $3,851 | 40% |

| Below fair to Poor | 578-627 | $4,447 | 61% |

| Poor | 524-577 | $5,129 | 86% |

| Worst | 523 or below | $5,903 | 114% |

Different insurers weight scores with unique methodologies and individual insurers may use different weightings depending on the state. Not all tiers use the same set of scores

The vast majority of homeowners insurers do credit checks to create CBI scores in states where they are legally allowed to be used as a factor. So if you're looking to find the best homeowners insurance rates, it's important to maintain a good credit score to get the best price you can from most home insurance companies.

However, insurers may offer reprieve for customers with bad credit scores who have been subject to extraordinary life events.

For instance, say your credit score was negatively affected by a catastrophic illness or the death of a family member. Home insurance companies will still do a credit check, but they may be more forgiving in their use of the insurance score if you notify them of the event.

How can you get cheap homeowners insurance with bad credit?

Nearly all major homeowners insurance companies assess your credit when deciding what price to offer you for homeowners insurance; it's very difficult to find homeowners insurance without a credit check. If you have poor credit, it likely will negatively impact the rates an insurance company gives you.

The good news is that it's very rare for an insurer to decline to sell you a policy based on a bad CBI score alone. Additionally, your CBI score is only one part of how an insurance company determines your rates.

If you don't have the best credit but are fastidious about maintaining your house and rarely make homeowners insurance claims, you may still get an inexpensive rate.

And in some states, companies are required to notify you if your credit history has a negative impact on your insurance quote.

One other note: Insurance companies in California, Maryland and Massachusetts do not use credit scores to set homeowners insurance premiums, as the state governments have barred the practice. If you're a resident of one of these states, you don't need to worry about a low credit score impacting your costs in these states.

But if you've received an expensive quote for homeowners insurance as a result of your poor credit or you were rejected outright for coverage, you have options for how to proceed. We recommend that you shop around to find an insurer that will offer better rates and take steps to improve your CBI score.

Compare quotes from several insurers, some of which will be cheaper than others. Every insurance company uses its own formula for deciding how your credit impacts your homeowners insurance rates, so you may get a different quote based on your credit history.

For example, if you have a lengthy credit history with a small number of late payments (a good thing), but you also carry a high amount of credit card debt (a bad thing), you may find that different insurers weigh these variables differently and give you prices to match.

It's also in your best interest in general to periodically shop around to make sure you're always paying the cheapest rates for your homeowners insurance, particularly as your credit history changes over time. And remember: The type of check involved when getting an insurance credit check doesn't affect your credit or CBI score, so don't be afraid to get quotes from several insurers.

Boost your credit score to lower your homeowners insurance rates

It takes time and persistence, but consistently working to improve your credit history will have a steady, positive impact on your homeowners insurance rates. Some ways to improve your CBI score include:

- Paying your household bills on time.

- Paying your credit card balance — ideally in full — on time each month, and staying below your credit limits.

- Thinking twice before opening up new lines of credit, which can look like you’re overextending yourself creditwise.

- Checking your credit report (at sites like annualcreditreport.com), and resolving any errors or discrepancies you discover.

Again, your CBI score and your FICO credit score are calculated differently, but the actions you take to improve each are largely the same.

Also, you generally can't access your CBI score, but you can access your credit report for free. If you're surprised by an expensive quote for homeowners insurance as a result of a low credit score, you should request a credit report from a credit bureau. You're entitled to one free credit report each year from each of the major bureaus, and you may discover an error or discrepancy that caused your inflated rates.

If you find an error, contact the company who performed the credit report to have the mistake corrected. And even if there aren't any errors, you can use that information to make an informed decision about how to boost your credit most effectively.

Once you've made some improvements to your credit, whether through correcting an error or improving your credit habits, reach out to your homeowners insurance company to get a new quote. And take the opportunity to shop around some more, as other insurers might offer you even better rates.

Methodology

To generate the differences in rates by credit score, we pulled rates from three major insurers in Texas across 11 tiers. The rates were for a $172,500 home built in 1987. The policy covered the full price of the dwelling, included $100,000 in liability coverage and had a $1,000 deductible.

Rates and credit tiers were from Quadrant Information Systems, which sources rates from insurer filings. Rates are for comparison purposes only. Your rates will likely be different.