Kemper Auto Insurance Review

Kemper Preferred is a lackluster car insurance company. It doesn't offer affordable rates, and its customer service reviews are below average. However, it does offer some appealing discounts and coverages, especially for families.

Kemper Preferred auto insurance: High prices and subpar service

Kemper Preferred is a below-average car insurance company that has higher prices and worse service than its competitors.

As a non-standard insurance company, Kemper specializes in providing coverage to drivers with multiple at-fault crashes, speeding tickets or a DUI, but we only recommend Kemper as a last resort.

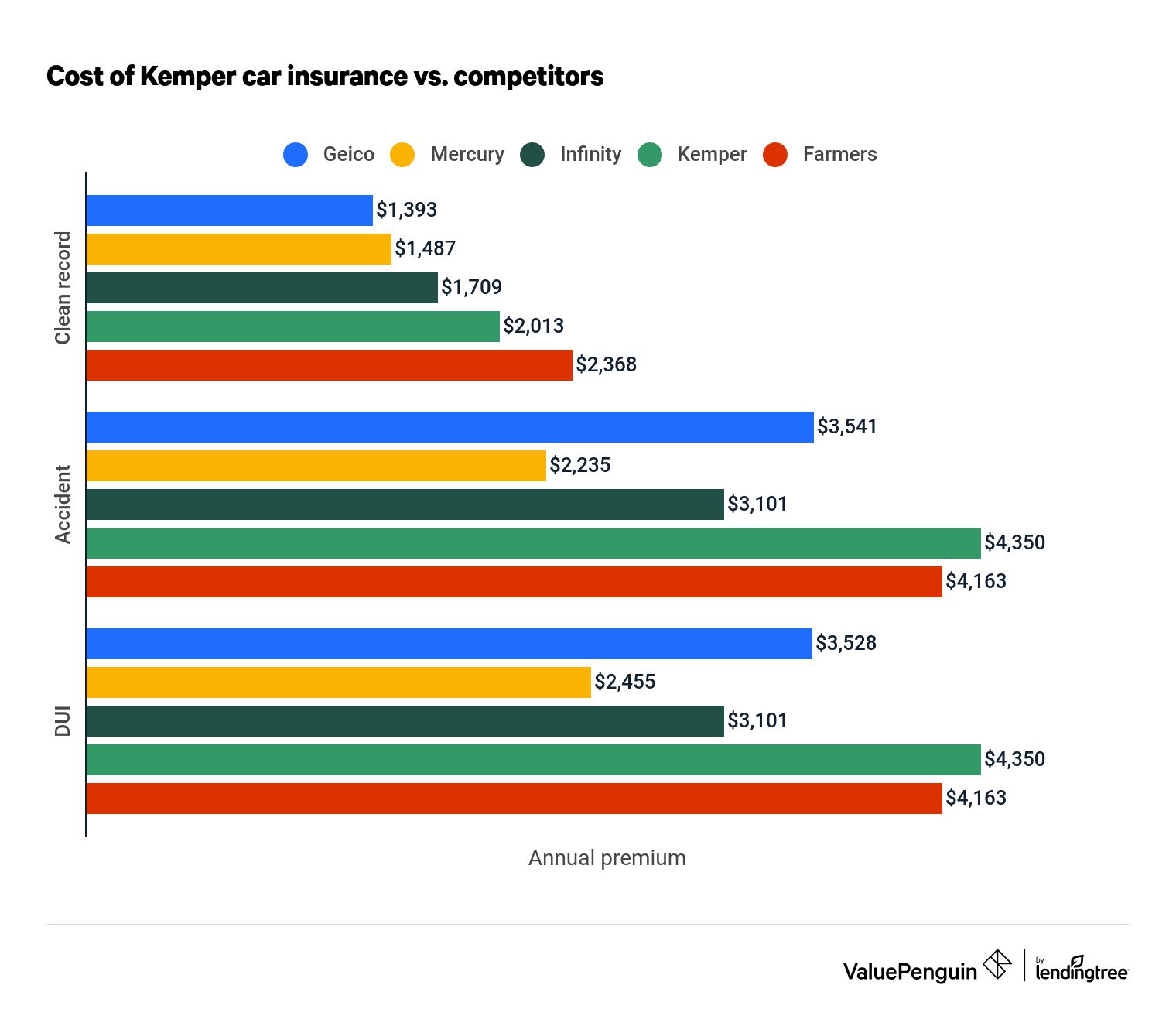

The price of Kemper insurance is higher than average for most drivers, whether you have a clean record or multiple recent infractions. The average price for a good driver is $2,013 per year, which is 13% more than we found at competing insurers.

You may be able to reduce its higher costs slightly by taking advantage of Kemper's discounts. These include lower rates for teenage drivers with good grades and discounts for taking driver safety classes. There are also bundle discounts for home and auto coverage.

Drivers can only get Kemper Preferred quotes through independent car insurance agents, meaning you can't buy coverage directly from Kemper online. That makes the process of buying a policy more time-consuming and complicated.

Kemper's customer service also leaves a great deal to be desired. Customers are seven times more likely to file a complaint about Kemper than an average insurer, and it finished dead-last in J.D. Power's claims satisfaction survey.

Bottom line: Kemper Preferred offers expensive rates and subpar service, and it is only worth considering if you can't find coverage elsewhere.

Kemper auto insurance quotes

Kemper Preferred car insurance is more expensive than its competitors, both for people with clean driving histories and those with a recent accident or ticket on their records.

For drivers with no recent incidents, ValuePenguin found an average price of $2,013 per year for full coverage at Kemper Insurance. That's 13% more than average among its competitors.

Drivers with a recent at-fault accident or DUI on their records can expect to pay around $4,350 per year. That's the most expensive price we found for each of those drivers and more than $1,000 per year more expensive than other insurers.

Find Cheap Auto Insurance Quotes in Your Area

Kemper car insurance rates vs. competitors

Clean record | Accident | DUI | |

|---|---|---|---|

| Geico | $1,393 | $3,541 | $3,528 |

| Mercury | $1,487 | $2,235 | $2,455 |

| Infinity | $1,709 | $3,101 | $3,101 |

| Kemper | $2,013 | $4,350 | $4,350 |

| Farmers | $2,368 | $4,163 | $4,163 |

All quotes are annual prices of full coverage in California.

A speeding ticket will cost you more at Kemper, too. Its average price after one ticket was $2,659, which is 13% more than average.

Every insurance company calculates its rates differently, so you should always check with multiple companies for the best prices on car insurance.

Kemper Preferred auto insurance discounts

Kemper Preferred offers a range of discounts to its customers including family discounts, car safety features discounts and multi-policy discounts. The discounts available for families with young drivers are particularly desirable, as they allow Kemper customers to lower the typically high cost of car insurance for a family with a teen driver.

- Family discounts: You’re eligible for a family discount if you have a driver away at school, a young driver with good grades in school and driver training (for young and senior drivers)

- Car safety features discounts: Discounts offered for cars with anti-lock brakes, anti-theft devices and passive restraints/air bags

- Multi-policy discounts Multi-car discounts and home and auto insurance bundles

Auto insurance coverages from Kemper Preferred

Kemper Preferred provides policyholders with all of the standard coverage options offered by the majority of national insurance companies. Additionally, Kemper Preferred offers a few notable coverage packages.

- Kemper Total: Bundles multiple benefits for owners of new cars. First, it includes new car replacement coverage. This means if your car is totaled in a crash or stolen, Kemper will pay for you to purchase a completely new vehicle, even if your vehicle is more than a year old. You'll also receive an increased payment for renting a car while your vehicle is being repaired. Kemper Total is only available when you're insuring a brand-new vehicle.

- Parked auto protection: With this optional coverage, your collision deductible is waived if your car is parked and unoccupied when it is struck by another vehicle.

- Auto loan/lease coverage: If your car is totaled in a crash or stolen, loan/lease coverage — also referred to as gap insurance — pays the difference between what your car is worth and the amount you have left to repay on your loan or lease.

Standard coverages from Kemper Preferred

- Liability (bodily injury/property damage)

- Uninsured motorist

- Collision

- Comprehensive

- Roadside assistance

Frequently asked questions

What companies does Kemper own?

Kemper operates Infinity Insurance, which also specializes in providing car insurance to higher-risk drivers. Other Kemper subsidiaries include Kemper Direct, Kemper Specialty and Financial Indemnity Co.

Is Kemper Unitrin?

Yes, Kemper and Unitrin merged into a single company starting in 2011.

Is Kemper a good insurance company?

We don't recommend Kemper to most drivers, as its rates tend to be expensive while customer service is poor. Instead, consider Geico or Mercury Insurance.

Methodology

To evaluate Kemper's car insurance, ValuePenguin collected quotes from across the state of California from Kemper and five competitors: Farmers, Geico, Infinity, Integon and Mercury.

Rates are for a 30-year-old single man who has full coverage on his 2015 Honda Civic.

Coverage | Limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Medical payments coverage | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

Car insurance quotes used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes will be different.

Customer service review data was collected from the National Association of Insurance Commissioners, J.D. Power and AM Best.