Gerber Grow-Up Plan & Life Insurance Review: Better for Seniors Than Saving for College

Gerber Life has a wide variety of life insurance products, and its whole life insurance policies for adults and seniors provide good rates for coverage with limited underwriting. However, Gerber Life’s Grow-Up Plans and College Plans are not recommended as investments, as they both grow in value very slowly and provide limited death benefits. Similarly, Gerber’s term life insurance is limited in coverage and has high premiums compared with other no medical exam policies.

Gerber Life Insurance Products

Gerber offers several life insurance policies that are designed to cover children, adults and seniors. The majority of Gerber’s insurance offerings are a form of whole life insurance, and these are their best policies. They also provide term life insurance, although we would recommend other insurers over Gerber for term policies.

Gerber Life Grow-Up Plan

Gerber Life’s Grow-Up Plan is a whole life insurance policy that you can purchase on your kids or grandchildren, if they’re between the ages of 14 days and 14 years old. The Grow-Up Plan is a typical whole life insurance policy that has level premiums and builds cash value, but there are a few differences:

- Until the child turns 21, you’re the policyowner. When they turn 21, they become the policyowner and have the option to purchase additional coverage without any health assessment.

- You can purchase only between $5,000 to $50,000 of Grow-Up Plan insurance for the child. However, the policy’s death benefit will double when the child turns 18. A $25,000 policy would turn into a $50,000 policy, then, without any rise in premiums.

The Grow-Up Plan’s cash value grows at a guaranteed rate over time so that, after 25 years, it should equal or be greater than the amount you’ve paid in premiums. The downside is that, since child life insurance is quite inexpensive, the policy’s cash value does not accumulate much money. In addition, the Grow-Up Plan is similar to other whole life insurance policies in that it will often take three to four years before you have any cash value, as early premium payments go to paying the insurer’s fees.

As a result, should you wish to surrender your policy within the first few years of coverage, you would receive little to no money back. Further, even if your child held on to the policy for 25 years, say, the cash value would still likely be too small to cover large expenses, such a wedding.

To illustrate, we compared quotes and guaranteed cash values for the Gerber Grow-Up Plan, assuming you bought coverage for a male baby who was born recently.

Initial Death Benefit | Monthly Premium | Guaranteed Cash Value After 25 Years |

|---|---|---|

| $5,000 | $3.27 | $981 |

| $10,000 | $6.53 | $1,959 |

| $15,000 | $9.80 | $2,940 |

| $25,000 | $15.70 | $4,710 |

| $35,000 | $21.98 | $6,594 |

| $50,000 | $31.40 | $9,420 |

As these figures show, the cash value in a Gerber Grow-Up Plan takes decades to become sizable, and even after it doubles in size, the death benefit is much smaller than an adult would typically need. Therefore, the primary value of a Gerber Life Grow-Up Plan is its initial death benefit, since it’s sufficient to easily cover the costs of a funeral and counseling for family members should your child pass away.

That said, if you do want this sort of coverage for your children, you might do better by buying a child rider on your own life insurance policy. A child rider is likely to be less expensive and will cover all your children with a single premium. By contrast, you would have to purchase multiple Grow-Up Plans if you had more than one child for whom you wanted coverage.

Gerber Life Young Adult Plan

Gerber Life’s Young Adult Plan is identical to its Grow-Up Plan, except that it’s for teens between the ages of 15 to 17. The only real difference between the plans is their pricing, with the Young Adult life insurance coverage being more expensive.

Gerber Life College Plan

Gerber Life’s College Plan is not a traditional college savings fund, like a 529 plan, but is rather an endowment life insurance policy. An endowment policy builds cash value at a guaranteed rate and has level premiums, similar to a whole life insurance policy.

However, unlike a whole life policy, coverage with an endowment policy lasts only for a fixed number of years. If you pass away during the period of coverage, your beneficiaries would receive the entire face value of the policy. If, however, you live longer than the period of coverage, you receive the policy’s face value which, at that point, would equal its cash value.

Gerber College Plans come with face values between $10,000 to $150,000, and are priced according to your health, since you’re the one who’s insured for the length of coverage.

Gerber’s endowment life insurance policy is called a College Plan, on the assumption that you’ll use the policy’s proceeds to pay for your child’s education. As an endowment life insurance policy, however, Gerber’s College Plan has several key differences compared with other college savings alternatives, such as 529 plans. Here’s how it’s different:

- The premiums are not state tax-deductible.

- You cannot choose how your cash value is invested; rather, the policy’s value at maturity is guaranteed.

- Endowment life insurance isn’t considered by colleges in financial aid calculations.

- You’re free to use the proceeds however you choose, not just for educational expenses.

While the College Plan provides life insurance coverage, it doesn’t have all the benefits of other life insurance policies. The biggest distinction is that your cash value investment gains are not tax free, which reduces the policy’s overall benefits. Considering the policy’s returns are fairly low, simply buying term coverage and investing in an alternative college savings account would probably be more lucrative.

Gerber’s College Plan might be a good option only if you’re concerned about your ability to consistently contribute to a college savings plan or are extremely risk-averse. Returns are guaranteed and, in the event you have an emergency and need access to money, you can either access the policy’s cash value through a loan or by surrendering the policy.

Policy loans come with an 8% interest rate, but you’re free to keep the money as long as is needed. Surrenders come with large fees initially, and typically no cash value is accumulated for the first three years of coverage. That said, once you pass the policy’s midway point, you are able to recoup the sum of all premiums paid.

Gerber Whole Life Insurance

Gerber Life also provides whole life insurance for adults, with policy death benefits ranging from $25,000 to $150,000. Gerber’s whole life insurance is similar to their child insurance, in that it has level premiums and builds cash value. However, their adult policies also allow you to add a waiver of premium rider. This rider costs more but allows you the option to maintain coverage without paying premiums should you be totally disabled for more than 6 months.

Gerber’s whole life insurance policies can be purchased without a medical exam, as long as you are under 51 and seeking less than $100,000 in coverage. If you aren’t in good health and don’t need a large amount of coverage, Gerber Life is a fairly good alternative for simplified issue whole life insurance. Most insurers who sell such policies offer a maximum of $50,000 of whole life coverage without a medical exam. In addition, Gerber’s rates are actually lower than those you might get with fully underwritten coverage, if you have a poor health rating.

However, you might be better off with a term life insurance policy. This option may be less costly, since whole life insurance is comparatively expensive. And, if you’re not able to purchase as large a policy as you actually need, you can spend a lot of money on an insufficient solution.

Gerber Term Life Insurance

Gerber’s term life insurance provides between $25,000 to $150,000 of coverage and doesn’t require a medical exam if you’re under 50 or want a death benefit of up to $100,000. Term lengths can extend for 10,15, 20 or 30 years and, should your needs change, you can convert it to a whole life insurance policy. Alternatively, should you get to the end of your term and require a few more years of coverage, you can renew for a 5-year term at the same health rating. However, you will no longer be able to renew once you reach age 65.

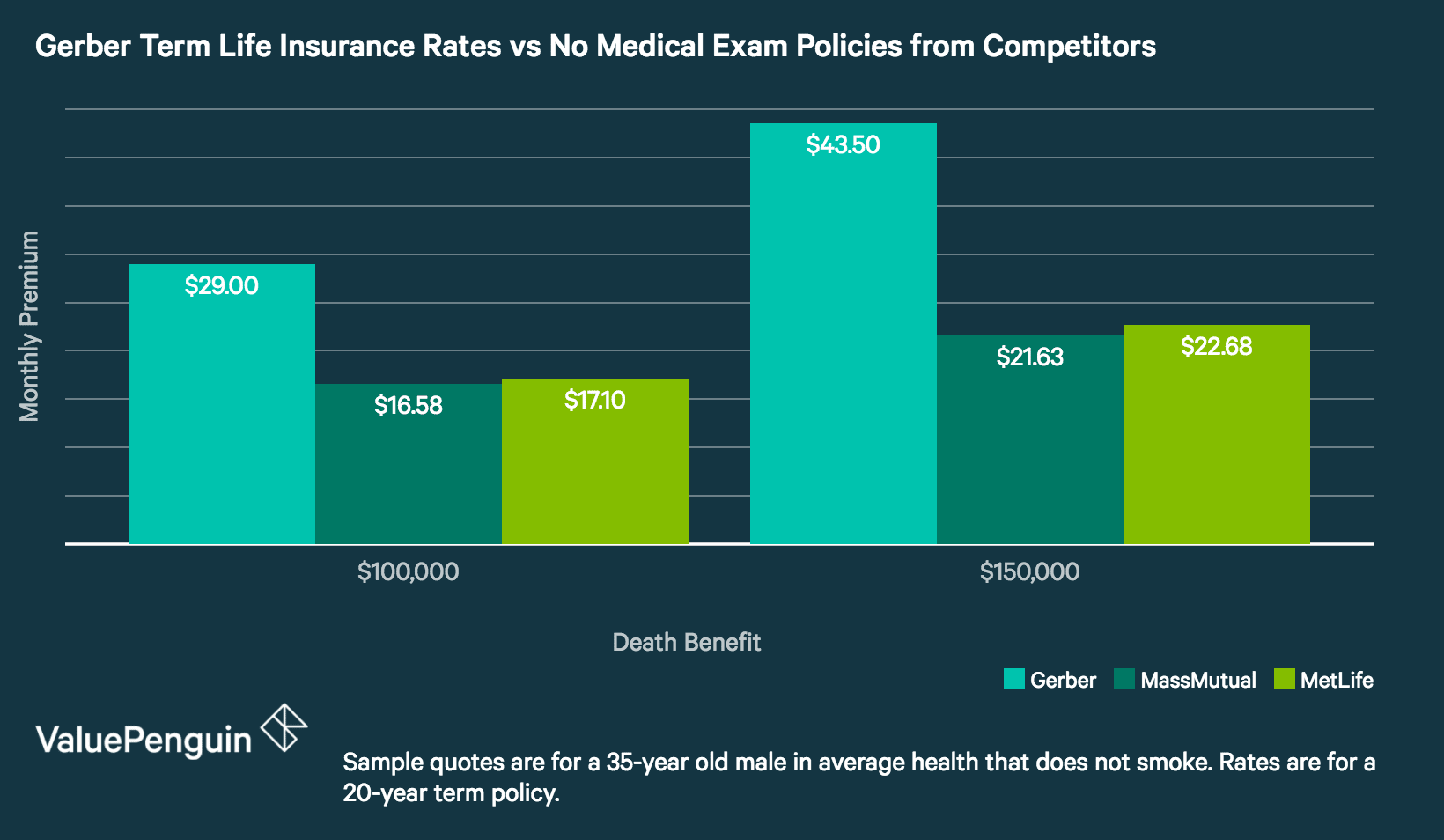

We don’t recommend Gerber Life if you’re looking for fully underwritten or simplified issue term life insurance. Even if you have health issues and would have difficulty passing a medical exam, a large number of insurers offer no medical exam term policies that provide higher maximum death benefits. In addition, Gerber’s rates for term life insurance are significantly higher than those available elsewhere for simplified issue policies.

Find Cheap Life Insurance in Your Area

Gerber Guaranteed Acceptance Life Insurance

For seniors between the ages of 50 and 80, Gerber offers guaranteed acceptance whole life insurance. This policy builds cash value and has level premiums, but death benefits are limited to between $5,000 and $25,000. There’s a two-year waiting period during which, if you pass away for any reason besides an accident, the full death benefit would not be paid. Instead, your beneficiaries would receive the sum of premiums paid, plus 10% in interest. So, if you died from a heart attack or illness, your family would receive little in life insurance proceeds.

All guaranteed acceptance policies have a small maximum death benefit and a waiting period, making Gerber’s coverage fairly standard. However, Gerber has better rates than most other insurers for this product.

Just keep in mind that guaranteed acceptance insurance is significantly more expensive than other types of life insurances, since the insurer collects no health information and therefore assumes you’re a high insurance risk. This insurance is typically worth considering only if you have a significant pre-existing condition, such as kidney failure that requires dialysis, or you can’t perform normal activities without assistance.

Gerber Accidental Death & Dismemberment Insurance

Accidental death and dismemberment insurance provides benefits to your family if you pass away or become disabled in an accident. It’s typically less expensive than traditional life insurance, since you’re unlikely to actually die due to an accident (since mishaps account for only about 5% of deaths).

Gerber Life’s rates for accidental death and dismemberment insurance are relatively low compared with other insurers, particularly if you’re older or have any health issues. Their AD&D insurance has guaranteed acceptance, which means no medical exams or health questions are required, and premiums aren’t determined by your age. However, policies are restricted to $100,000 in death benefit and are only available if you’re between the ages of 19 and 69.

Death Benefit | Monthly Premium |

|---|---|

| $20,000 | $1.92 |

| $35,000 | $3.36 |

| $50,000 | $4.80 |

| $75,000 | $7.19 |

| $100,000 | $9.59 |

Sample monthly premiums include a discount for making automated payments.

Depending on the severity of your injuries from an accident, Gerber Life would pay out differing amounts of money, which is standard procedure for AD&D insurance. Here’s the breakdown:

- If you pass away, your beneficiaries will receive the policy’s entire death benefit.

- If you lose one eye, one foot or one hand, Gerber Life will pay out 50% of the death benefit.

- If you lose two limbs, both eyes or an eye and a limb, Gerber will pay 100% of the death benefit.

Note that Gerber Life does not provide any compensation if you lose your hearing, speech or ability to move due to an accident. If you want broader coverage, some insurers offer coverage for these sorts of disabilities in addition to covering the loss of limbs.

Gerber Life Customer Reviews & Complaints

The Gerber Life Insurance Company’s NAIC complaint ratio is 0.68, meaning they receive a proportionately low number of negative reviews compared to the amount of business they write. Also, many policyholders give Gerber Life glowing reviews for enrollment, praising how simple it is to sign up for a policy and to qualify for coverage.

However, the company does have some negative reviews. These are primarily focused on difficulties that some customers experienced in receiving payment from Gerber Life which makes it not one of the best life insurance companies in the industry. Customers complain of problems receiving money from Gerber, whether in trying to surrender a policy, take out a policy loan or file a claim after the death of a family member.

Gerber Life also has a number of negative reviews for its marketing communications. In some cases, customers thought they were increasing their coverage but were in fact purchasing an entirely new policy.

Other reviewers were confused between Gerber’s Grow-Up Plan and College Plan, since the company has featured the Grow-Up Plan’s cash value as a way to help pay for college. If you’re considering coverage from Gerber Life, or any insurer, make sure that you clearly understand exactly what you’re paying for. The costs of cancelling coverage, and the associated challenges, make it worth the time to double-check these details.

Gerber Life Payments

You can make payments for Gerber Life insurance via check or online. While many insurers offer the option of billing directly from a checking or savings account, Gerber Life also offers the option to make payments with your credit card. In addition, if you set up automatic billing, you receive discounted premiums for some products, such as accidental death insurance.