Transamerica Life Insurance Review: Wide Range of Products & Competitive Term Prices

Transamerica is a great option for term life insurance and final-expense insurance products, particularly if you don't have a perfect health profile.

Transamerica's wide variety of policies means that you can typically find one that fits your preferences. While many insurers offer similar types of policies, we've found that few have the customization options that Transamerica has.

Overview: Transamerica life insurance products

Transamerica offers a wide range of life insurance products including term life insurance, universal life insurance, whole life insurance and accidental death insurance.

Each product has a different underwriting process but, for those who don't require a medical exam, you can typically get coverage within 14 days of submitting an application. Fully underwritten products typically require two to eight weeks before coverage can begin.

Transamerica term life insurance

Transamerica offers two term life insurance policies, the Trendsetter Super Series and Trendsetter LB, which contain similar features. The primary difference is that Trendsetter LB policyholders can receive accelerated death benefits under a wide range of circumstances.

Term policies from Transamerica can be purchased for terms of 10, 15, 20, 25 or 30 years, and their death benefits range from $25,000 to $1 million. Just note that longer term lengths (such as 25 or 30 years) are only available if you're young and reasonably healthy.

As the policyholder, you can choose whether your beneficiaries receive the death benefit as a single lump-sum payment or a monthly payout over a period of 5 to 25 years. If you're a parent with young children and want to make sure they're financially comfortable, the monthly payout is a handy option as you can make sure a child doesn't spend the money too quickly.

Each policy can be customized using riders, which are policy add-ons that will increase your premiums by a small amount. Transamerica offers the following riders for term policies:

- Decreasing coverage: Many people need less coverage over time as they pay off debts or certain expenses. For example, you wouldn't need coverage for your child's education after they graduate college.

- Additional insured and child riders: You can buy coverage for your spouse and children.

- Estate protection rider This extra coverage pays your estate taxes if they are applied to your death benefit for some reason.

- Final-expense rider: This additional payout covers funeral costs.

- Whole life guaranteed insurability rider: At certain points during your term, you can convert a term policy to a whole life policy without medical exams and proving insurability again.

- Return of premium rider: If you live past the term of your policy, a portion of your premiums are returned to you (only available for 20- and 30-year terms).

- Waiver of premium rider: If you become totally disabled, per the insurer's definition, for over six months, premiums are waived.

When the period of coverage ends for a Transamerica term life insurance policy, you can automatically renew coverage, but the policy turns into a one-year term. Premiums will increase each year as you get older and the company's risk increases. However, Transamerica may allow policyholders to convert to a universal life insurance policy, typically when you hit a life milestone (like having a child or getting married) or reach a certain age.

If you primarily want coverage to replace your income before you retire or cover certain expenses, such as a mortgage, we wouldn't recommend converting to a permanent policy. That's because you'll pay higher premiums than if you purchased a new term policy. However, if you've built up a broad portfolio of assets and are interested in using permanent coverage to diversify your investments or as part of an estate plan, then converting to a universal policy is a good consideration.

Trendsetter Super Series vs Trendsetter LB Term Life Insurance

The primary differences between Transamerica's two term policies are their accelerated death benefits and the amount of coverage you may qualify for without a medical exam. While the Trendsetter LB policy has higher premiums than the Trendsetter Super Series, the difference is quite small unless you're a smoker or have health issues.

Trendsetter Super Series | Trendsetter LB | |

|---|---|---|

| Accelerated death benefit | Only for terminal illness; automatically included in policies over $50,000 | For terminal illness, chronic illness and critical illness; included in all policies |

| No medical exam option | Available if the death benefit is below $100,000 | Available if the death benefit is below $250,000 |

| Regional restrictions | Not available in AL, GA, MD, NY, OR, PA, WV | Not available in NY |

The accelerated death benefit is included in every Trendsetter LB policy and can be triggered by a wide range of chronic, critical and terminal illnesses, but only if you're diagnosed after purchasing coverage.

Here are the different illness categories:

- Terminal illness: You are diagnosed with a medical condition, resulting from bodily injury or disease, that is expected to cause your death within 12 months.

- Chronic illness: You are diagnosed with an illness and, for at least three months, are unable to perform two out of the six "activities of daily living" without significant assistance: eating, bathing, getting dressed, using the toilet, walking and controlling your bowels/bladder. Chronic illness can also refer to severe cognitive impairment that requires you to have substantial supervision in order to avoid health and safety risks.

- Critical illness: You are diagnosed with a life-impacting medical condition such as a heart attack, stroke, cancer, ALS or blindness.

With Trendsetter LB, any of these conditions will allow you to accelerate your death benefit, though the amount depends on the severity of your illness. The maximum you can accelerate is 24% of the death benefit per year and 90% of the death benefit over your lifetime, up to $1.5 million.

The Trendsetter Super Series includes the option for an accelerated death benefit if you have more than $50,000 in coverage, but you can add this feature as a rider for smaller policies. With this policy, you can only accelerate death benefits if you get a terminal illness and the amount is limited to $250,000 or 75% of your death benefit (whichever is smaller). In addition, the option to accelerate death benefits is not available in Illinois, New Jersey, Pennsylvania, South Carolina or Vermont.

Transamerica term life insurance quotes

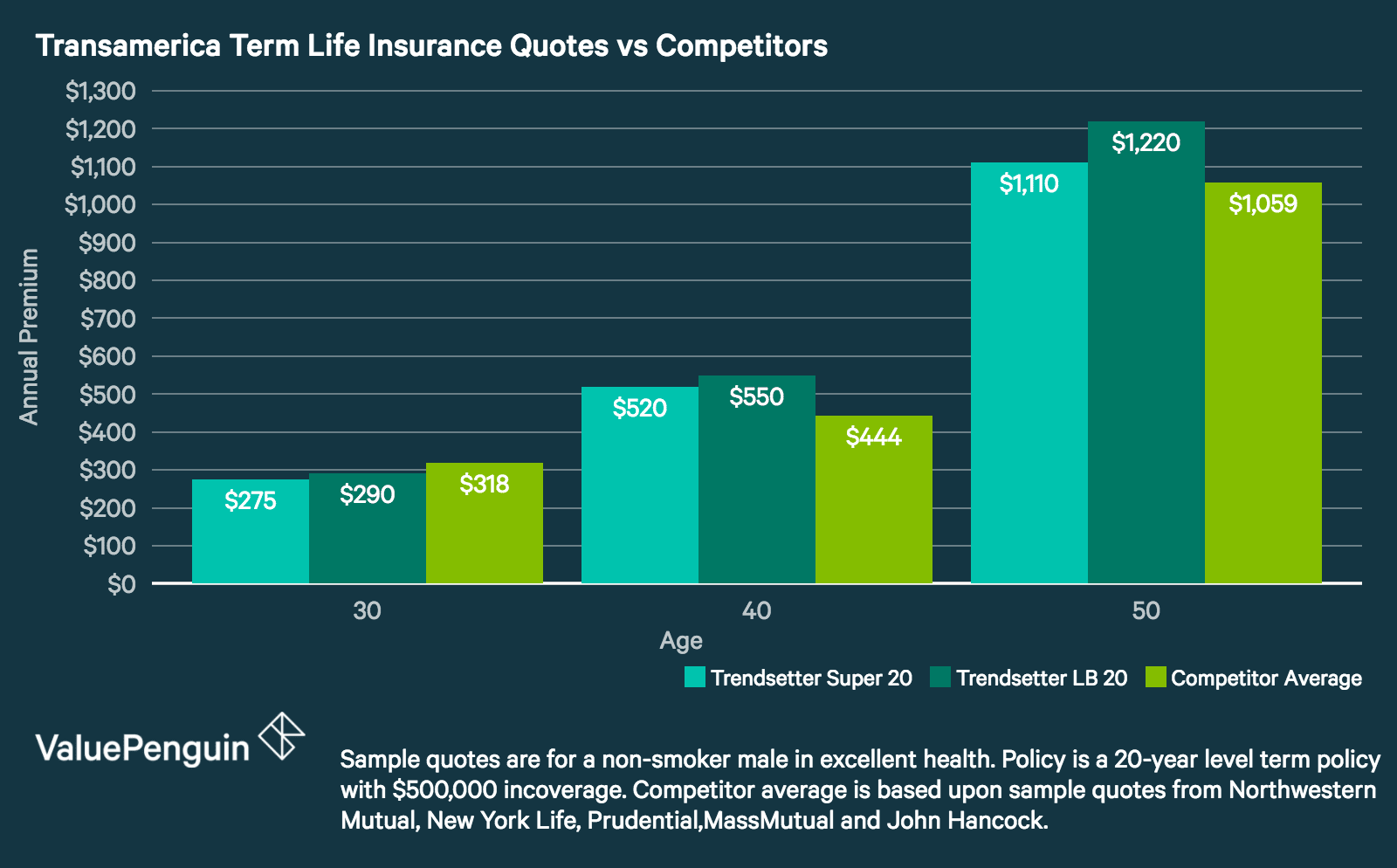

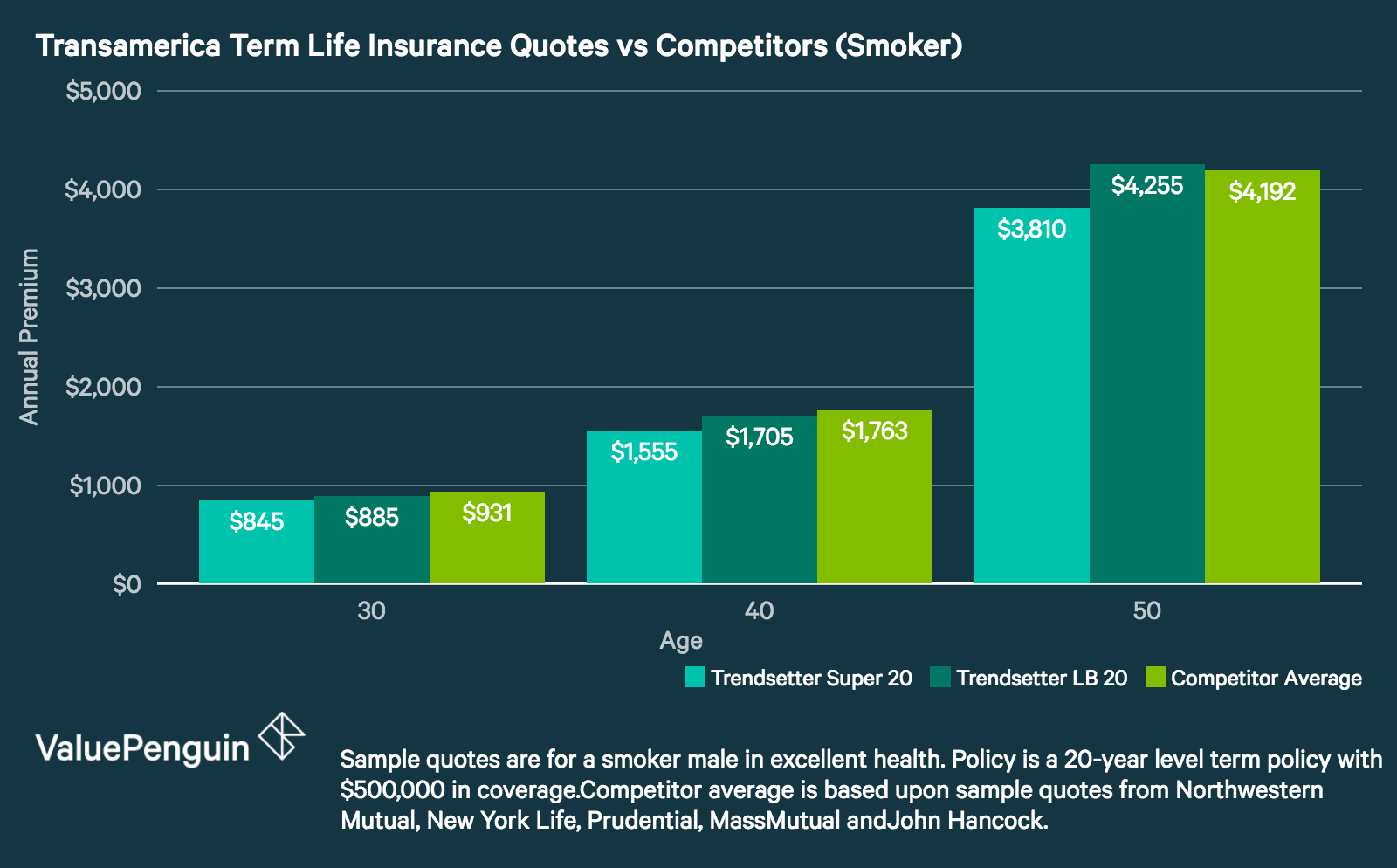

Transamerica term policies tend to be less expensive if you're either young (under 40) or have certain health risks, such as being a smoker, having high blood pressure or being over 70.

If you're healthy, we recommend the Trendsetter LB policy over the Trendsetter Super Series, as the accelerated death benefits are much better and the cost is quite comparable. As you can see below, the Trendsetter Super Series has only 5% – 10% lower quotes:

Find Cheap Life Insurance in Your Area

If you're older or have health risks, we recommend the Trendsetter Super Series because policyholders tend to save money compared to other major insurers.

Transamerica universal life insurance

Transamerica offers both indexed and variable universal life insurance.

Both policies offer a minimum guaranteed interest rate on the cash value, have a minimum death benefit of $100,000 and have the option to use the cash value to pay premiums.

In addition, policyholders can add riders to adjust the death benefit, so it increases over time, it decreases over time or you purchase additional coverage later without medical questions. This is particularly important when it comes to permanent life insurance policies since coverage is already quite expensive.

So, for example, if you decide to upgrade your house and take out a sizable mortgage, you'll want to increase your coverage. With a guaranteed insurability rider, you'll be quoted using your original health rating, even if you've developed high blood pressure or another health issue later in life.

The primary difference between Transamerica's indexed and variable universal life policies is the set of options available for how to invest the policy's cash value:

- With the variable life insurance, you choose which set of sub-accounts to invest in, with each sub-account behaving similarly to a mutual fund. The downside of this type of policy is that, if your investment choices are poor, your cash value can decrease.

- The cash value in Transamerica's indexed universal life insurance policy can only be invested in two sub-accounts: a fixed account and an indexed account. The fixed account mirrors Transamerica's performance and has a guaranteed 2% interest rate, while the indexed account tracks a particular index (such as the S&P 500 minus dividends) and has a guaranteed 0.75% interest rate.

Transamerica whole life and final-expense insurance

Transamerica offers whole life insurance as well as three final-expense insurance products (Immediate Solution, 10 Pay Solution, and Easy Pay Solution). All these policies are quite similar in that they offer permanent coverage, have a limited death benefit (less than $50,000) and build cash value.

Whole life insurance | Immediate Solution | 10 Pay Solution | Easy Pay Solution | |

|---|---|---|---|---|

| Age availability | 0 – 80 years old | 0 – 85 years old | 0 – 85 years old | 18 – 80 years old |

| Premiums | Level for length of coverage | Level for length of coverage | Level, only pay for 10 years | Level for length of coverage |

| Minimum coverage | $2,000 | $1,000 | $1,000 | $1,000 |

| Maximum coverage | $50,000 | $50,000 (if age 0 – 55); $40,000 (if age 56 – 65); $30,000 (if age 66 – 75); $25,000 (if age 76 – 85) | $50,000 (if age 0 – 55); $40,000 (if age 56 – 65); $30,000 (if age 66 – 75); $25,000 (if age 76 – 85) | $25,000 |

| Payout | Full death benefit | Full death benefit | Full death benefit | Limited payout if you die during first 2 years of coverage |

| Underwriting | Full; medical exam typically required | No medical exam; includes health questions | No medical exam; includes health questions | No medical exam; includes health questions |

The primary difference between Transamerica's whole life insurance policy and the final-expense policies is that you're required to take a medical exam. The company may offer you lower premiums if you're young and healthy, since the insurer is able to verify your health status.

Transamerica's Immediate Solution is a fairly standard final-expense policy and the 10 Pay Solution is identical, except that you'll only pay premiums for 10 years. While premiums will be higher with the 10 Pay Solution, we recommend paying premiums for a shorter period of time if you have enough income to do so easily. Many people have trouble keeping track of things (such as bills) as they get older and, with life insurance, that often means policies lapse after years of paid premiums.

The Easy Pay Solution policy has a small maximum death benefit, but it will be less expensive because Transamerica is able to reduce its risk when you accept a limited payout for the first two years of coverage.

For an insurer, this restriction tends to weed out any terminally ill or particularly sick consumers, and increases the average number of years a customer makes premium payments. Since the company feels secure you're likely to live a certain number of years before passing (and their expenses are limited if you don't), they can reduce your premium.

Transamerica accidental death insurance

Transamerica's accidental death coverage can be bought as a stand-alone policy or as a rider to an existing policy. Coverage is typically low-cost since a policy only pays out if you die accidentally, and accidents account for about 5% of deaths in the United States. With Transamerica, there are no medical exams or health questions in order to get coverage, and you're guaranteed to get a policy if you are between 18 and 80.

Transamerica has two accidental death insurance plans — Plan A and Plan B — which are nearly identical. The only key difference is Plan A has higher payouts and, therefore, will cost more.

Payout | Plan A | Plan B |

|---|---|---|

| Your accidental death | $250,000 | $125,000 |

| Your accidental death (while on bus, train or other "common carrier") | $500,000 | $250,000 |

| Spouse's accidental death (if they're added to plan) | $125,000 | $75,000 |

| Child's accidental death (if they're added to plan) | $5,000 | $5,000 |

Transamerica customer reviews and complaints

The Transamerica Life Insurance Company has a Financial Strength Rating of A+ from A.M. Best and a Complaint Index of 0.58 from the National Association of Insurance Commissioners. A company's Complaint Index measures the number of complaints received as compared to the amount of business they write. The median score across the U.S. is 1.0, meaning Transamerica has a proportionately low number of complaints.

In their reviews, customers who have had poor experiences primarily point to Transamerica's customer service and claims departments. Customers report long wait times in order to reach company representatives and generally poor communications. In addition, many claims take over a month to be paid out.

We recommend that you and your beneficiary maintain copies of your original policy in order to make sure claims are processed smoothly and you can easily refer to the information if any questions arise.

Transamerica life insurance payment options

Transamerica life insurance payments can be made by check, bank draft or credit card (Visa, MasterCard, American Express and Discover), and you can set up autopay for deductions to be made regularly on your behalf. Depending on your preference, premiums can be paid annually, every six months, quarterly or monthly.