Toyota Car Insurance: How Much Does It Cost?

Find Cheap Toyota Auto Insurance Quotes

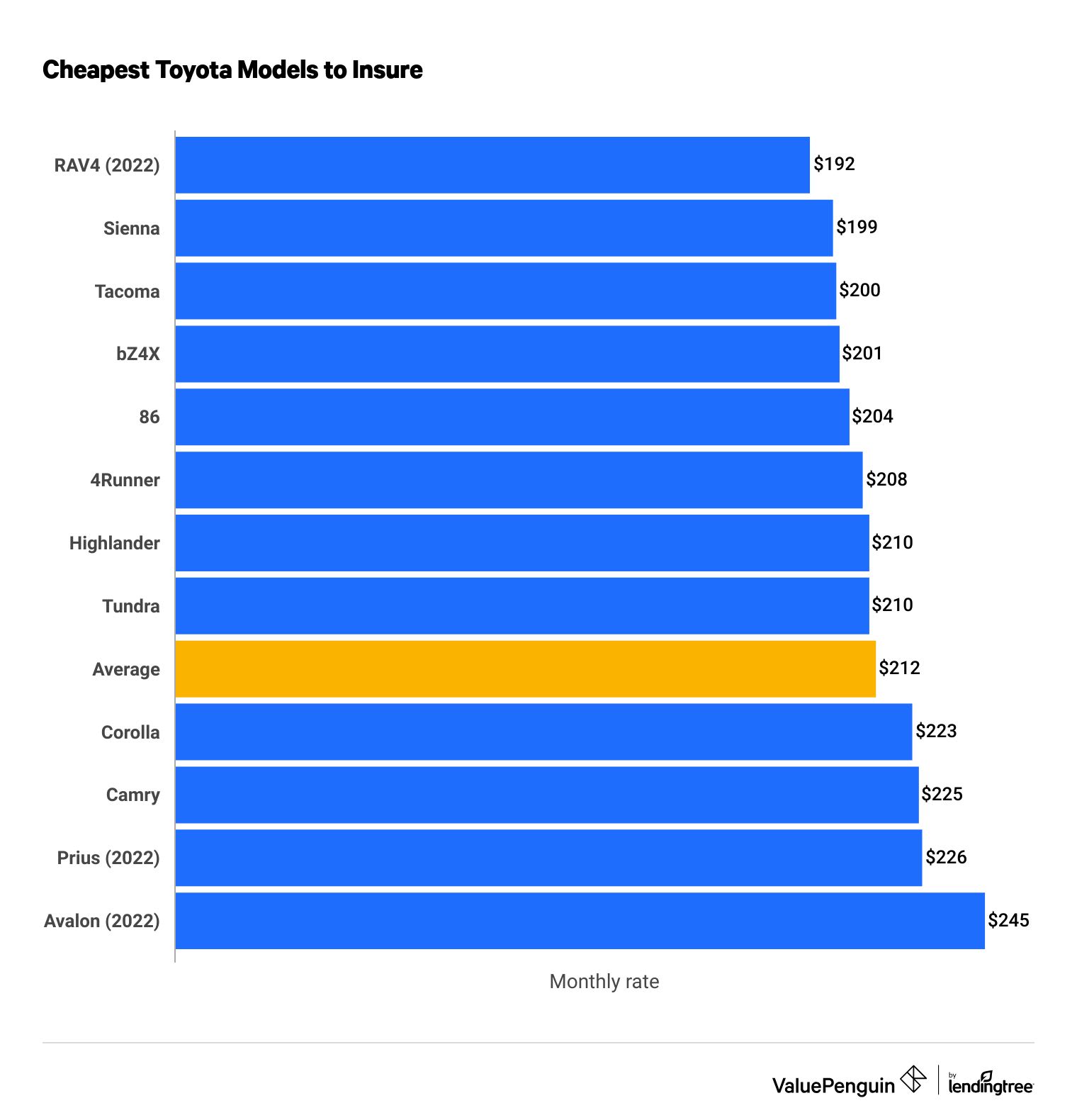

The average cost of Toyota insurance is $212 per month across 12 of the most popular models.

Prices can vary dramatically depending on the Toyota model, where you live, your age and your driving history.

The best way to find the cheapest insurance for your Toyota is to compare quotes from multiple insurance companies.

Toyota insurance rates by model

The Toyota RAV4 has the lowest average insurance rates among current models. It costs $192 per month to cover — 22% cheaper than the $245 monthly price to cover the Toyota Avalon, the most expensive model.

Find Cheap Toyota Auto Insurance Quotes

Toyota full coverage insurance cost

Toyota RAV4 insurance cost

Auto insurance for the Toyota RAV4 costs, on average, $192 per month for adult drivers and $671 per month for teen drivers. This is the cheapest among the most popular Toyotas. It is also one of the cheapest cars to insure on the market today and the top-selling Toyota.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 RAV4 | $192 | $671 |

| 2021 RAV4 | $186 | $648 |

| 2020 RAV4 | $182 | $637 |

| 2019 RAV4 | $179 | $628 |

| 2018 RAV4 | $172 | $609 |

*Monthly cost

Farm Bureau has the cheapest rates for a RAV4, with an average of $95 per month. Rav4 insurance rates are cheaper than rates for the Toyota Highlander — another Toyota SUV — for the most recent models, with the rate difference between the two vehicles being around $216 per year.

Toyota Corolla insurance cost

Insurance for a 2023 Toyota Corolla costs $223 per month, on average. This rate is only slightly lower — it is $2 lower per month — than the cost of identical coverage for a Toyota Camry. However, young drivers can expect to pay much more for coverage — the average rate for 18-year-olds is $791 per month.

Farm Bureau has the cheapest coverage for a Corolla, at $102 per month for full coverage.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2023 Corolla | $223 | $791 |

| 2022 Corolla | $218 | $773 |

| 2021 Corolla | $212 | $751 |

| 2020 Corolla | $201 | $719 |

| 2019 Corolla | $192 | $689 |

*Monthly cost

On average, insurance for newer Corollas is more expensive than it is for older models, with the 2023 model costing 24% more for our 30-year-old driver and 22% more for our 18-year-old driver compared to the cost of car insurance coverage for the 2015 model. This difference in rates is largely due to the more expensive comprehensive and collision coverage, which pay to repair or replace your vehicle in a covered accident. Newer cars are typically more expensive to replace.

Toyota Camry insurance costs

Car insurance for a 2023 Toyota Camry costs $225 per month for an adult. Younger drivers can expect to pay more than three times that much for an identical policy — with an average rate of $777 per month.

Farm Bureau has the cheapest rates for a Camry, with an average of $108 per month.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2023 Camry | $225 | $777 |

| 2022 Camry | $220 | $758 |

| 2021 Camry | $212 | $731 |

| 2020 Camry | $206 | $711 |

| 2019 Camry | $200 | $695 |

*Monthly cost

The Camry has some of the highest insurance costs among the most popular Toyotas — with average rates for our 30-year-old driver being 17% higher than they are for the RAV4. That's a difference of nearly $400 per year.

Toyota Tundra insurance cost

The 2023 Toyota Tundra has an average cost of $210 per month for an adult with a full coverage policy. Geico offers the cheapest coverage for a Tundra, at just $117 per month, on average.

Year and model | Monthly rates for a 30-year-old | Monthly rates for an 18-year-old |

|---|---|---|

| 2023 Tundra | $210 | $695 |

| 2022 Tundra | $209 | $700 |

| 2021 Tundra | $206 | $716 |

| 2020 Tundra | $201 | $697 |

| 2019 Tundra | $193 | $672 |

Toyota Tacoma insurance cost

The Toyota Tacoma, the company's top-selling pickup truck, is one of the cheapest Toyotas to insure. The average rate to cover a 2023 Tacoma is $200 per month, 5% less than the average for Toyotas overall.

Farm Bureau Insurance charges half that, on average, making it the cheapest company for covering a Tacoma.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2023 Tacoma | $200 | $702 |

| 2022 Tacoma | $196 | $685 |

| 2021 Tacoma | $189 | $664 |

| 2020 Tacoma | $189 | $666 |

| 2019 Tacoma | $182 | $643 |

*Monthly cost

Toyota Highlander insurance costs

The average Toyota Highlander insurance cost is $210 per month. However, teen drivers can expect to pay more than three times as much for an identical full coverage policy, at $701 per month.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2023 Highlander | $210 | $701 |

| 2022 Highlander | $204 | $700 |

| 2021 Highlander | $197 | $676 |

| 2020 Highlander | $198 | $683 |

| 2019 Highlander | $178 | $616 |

*Monthly cost

State Farm has the cheapest rates to cover a Highlander, with an average of $113 per month.

Insurance costs for the Highlander are more expensive than the average rates for the RAV4 for an adult driver — a difference of $18 per month. This makes sense considering that the Highlander has an MSRP 30% higher than that of the RAV4. Standard-size SUVs, such as the Highlander, are typically much more expensive to insure.

Toyota 4Runner insurance cost

Toyota 4Runner insurance is $208 per month on average. The full-size SUV ranks sixth among the best-selling Toyotas and third among SUVs, behind the RAV4 and Highlander.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2023 4Runner | $208 | $709 |

| 2022 4Runner | $203 | $690 |

| 2021 4Runner | $196 | $665 |

| 2020 4Runner | $190 | $644 |

| 2019 4Runner | $184 | $631 |

*Monthly cost

Farm Bureau's average rate of $103 to cover a new 4Runner is the cheapest we found.

Toyota Sienna insurance cost

Toyota's best-selling minivan, the Sienna, is one of the company's cheapest cars to insure. An adult driver can pay an average of $199 per month for full coverage, while a teen driver pays $647 per month.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2023 Sienna | $199 | $647 |

| 2022 Sienna | $195 | $634 |

| 2021 Sienna | $193 | $646 |

| 2020 Sienna | $193 | $651 |

| 2019 Sienna | $188 | $637 |

*Monthly cost

The cheapest coverage for a Sienna comes from Farm Bureau, with an average rate of $106 per month.

Toyota Prius insurance costs

Toyota Prius insurance rates average $226 per month for a 2022 model. The price of coverage rises considerably the newer your Prius, with a difference of 27% between the 2015 and 2022 models.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 Prius | $226 | $802 |

| 2021 Prius | $219 | $774 |

| 2020 Prius | $213 | $750 |

| 2019 Prius | $208 | $737 |

| 2018 Prius | $203 | $718 |

*Monthly cost

Among top Toyota models, the Prius' insurance rates are among the most expensive for both adult and teen drivers. You can reduce those rates by going with Farm Bureau, which has an average rate of $106 per month.

Toyota 86 insurance cost

Insurance for the Toyota 86 — a sports coupe — is priced at $204 per month for an adult and $697 per month for a teen driver. These rates make the more recent models of the 86 some of the less expensive Toyotas to insure.

You can pay even less by going with State Farm, which has an average rate of $106 per month for the 86.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2023 86 | $204 | $697 |

| 2022 86 | $201 | $684 |

| 2020 86 | $256 | $927 |

| 2019 86 | $249 | $906 |

| 2018 86 | $243 | $891 |

*Monthly cost, 2021 data not available

The Toyota 86 is unusual both in the fact that it's a cheaper sports car to insure and because the newer models are considerably cheaper to cover than older ones.

Toyota Avalon insurance cost

It costs an average of $245 per month for a full coverage policy for a 2022 Toyota Avalon. The largest full-size sedan the company offered, the Avalon was discontinued in 2022.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 Avalon | $245 | $845 |

| 2021 Avalon | $229 | $782 |

| 2020 Avalon | $231 | $793 |

| 2019 Avalon | $224 | $773 |

| 2018 Avalon | $207 | $718 |

*Monthly cCost

The Avalon has consistently been one of the most expensive Toyotas to insure. Farm Bureau has the cheapest rates, with an average of $111 per month.

Toyota bZ4X insurance cost

The average cost of full coverage insurance for a 2023 Toyota bZ4X is $201 per month. The bZ4X is the company's all-electric SUV, which is similar in size to the RAV4. The company only started selling it in mid-2020.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2023 bZ4X | $201 | $676 |

*Monthly cost

State Farm is the cheapest option to cover your bZ4X, with an average rate of $106 per month.

Toyota lease insurance

Drivers that lease a vehicle from a Toyota dealership are required to have the minimum liability coverage required by their state, as well as physical damage insurance with a maximum deductible of $1,000. The physical damage coverage requirement can be fulfilled by opting for comprehensive and collision coverage. These two types of coverage are standard offerings for major insurers, and they cover your car if it is damaged or stolen.

Those leasing or financing a vehicle should also consider Toyota GAP (Guaranteed Auto Protection) insurance, which kicks in if — in the event of a total loss — your primary car insurance policy pays out less than what you owe on the vehicle. This scenario is common with new vehicles that depreciate rapidly.

For example, say you buy a new Highlander for $36,420. After one year, its market value is $30,000 and you owe $33,000 on it. If you were to total your vehicle, a Toyota GAP insurance policy would cover the $3,000 difference between what your primary auto coverage would pay ($30,000) and what you owe on the car ($33,000).

While Toyota GAP insurance — which is offered by Toyota Financial Services — can be a good addition to an insurance policy on a new or leased vehicle, you may be able to find cheaper gap coverage with a standard insurer. Companies such as Allstate, Farmers and Travelers should all be able to offer you this type of coverage.

Frequently asked questions

How much is car insurance for a Toyota Camry?

The average cost of car insurance for a new Toyota Camry is $225 per month for a 30-year-old and $777 per month for an 18-year-old.

Why is a Toyota Corolla so expensive to insure?

Toyota Corollas are among the most stolen cars in the country because they're so popular, which might explain why it's slightly more expensive to insure a Corolla than the average Toyota. It costs $223 per month to cover a new Corolla, 5% more than average.

Can I get car insurance from Toyota?

Toyota offers car insurance directly through Toyota Auto Insurance. Coverage is underwritten by Toggle, a Farmers brand, and can apply for Toyota and non-Toyota cars. You can get Toyota Auto Insurance in Arizona, California, Colorado, Georgia, Illinois, Indiana, Missouri, Ohio, Oregon, South Carolina, Tennessee and Texas.

What does Toyota GAP insurance cover?

Toyota GAP insurance covers the difference between the value of your payout after an accident that totals your car and what you still owe on a financed or leased vehicle. Having gap coverage means you won't have to pay the remaining cost of a loan for a car you no longer have.

Methodology

ValuePenguin collected thousands of quotes for 12 popular Toyota models from every ZIP code in Texas. Rates are for a 30-year-old and 18-year-old driver with good credit and full coverage.

Coverage | Limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

Insurance quote data for this analysis came from Quadrant Information Services. Rates were publicly sourced from insurer filings and should only be used for comparison purposes. Your actual rates will likely differ.