Mobile Home Insurance in Texas

Find Cheap Mobile Home Insurance Quotes in Texas

Mobile home insurance is optional in Texas, however, many mobile home communities and mortgage lenders require homeowners to purchase coverage. Whether it's required or not, having mobile home insurance in Texas ensures you have adequate protection in the event your home is damaged.

Mobile home insurance policies are customizable and rates vary between companies, so you'll want to compare quotes from several Texas insurance companies before purchasing coverage.

Mobile home insurance rates in Texas

The cost of mobile home insurance in Texas depends on several factors, but often coverage is more expensive than typical home insurance.

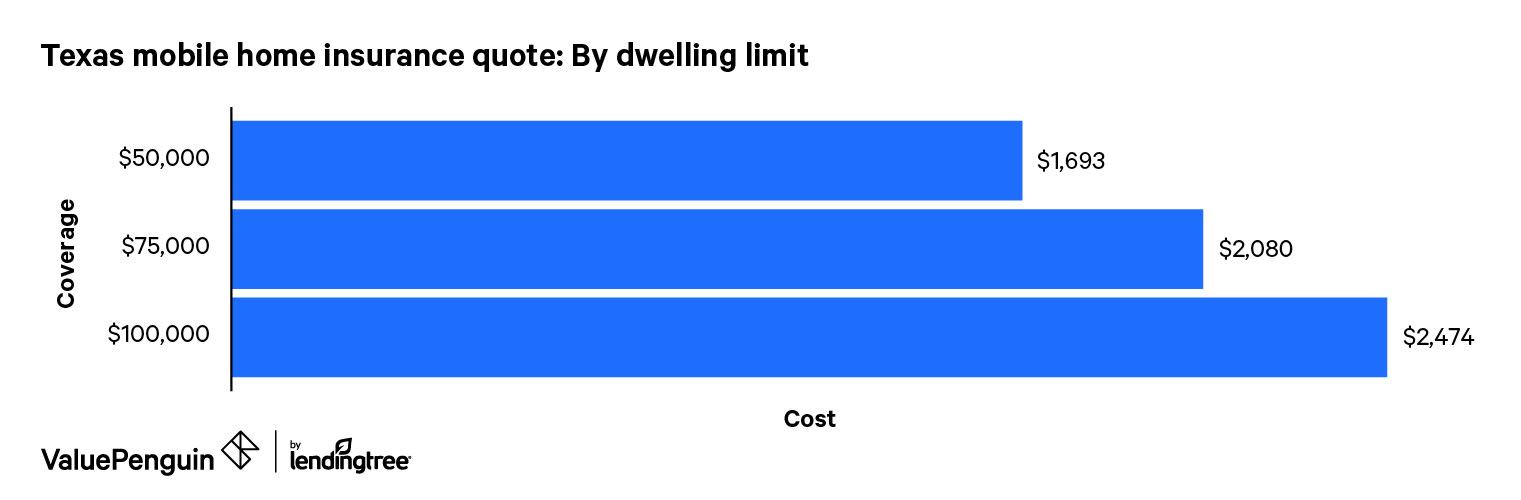

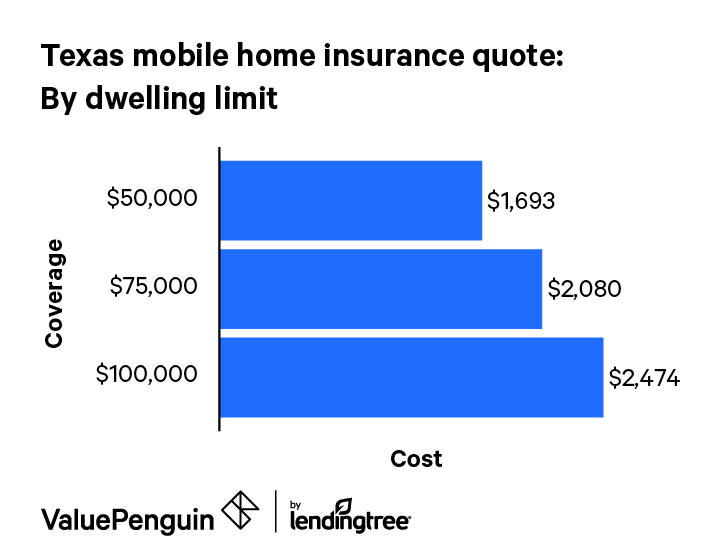

Texas' mobile home insurance rates vary depending on where your home is located, how old it is and the coverage you need. One of the largest factors impacting your mobile home insurance rate is your dwelling coverage limit. Below, we provide a sample quote for mobile home insurance in Houston, Texas, for multiple dwelling coverage limits.

Find Cheap Homeowners Insurance Quotes in Your Area

The best way to get cheap mobile home insurance in Texas is to shop around and compare quotes. You should be prepared to contact insurance companies by phone, as many companies don't provide quotes online.

In terms of pricing, expect to pay more for mobile home insurance than you would for a standard homeowners insurance policy in Texas. That's because mobile homes are more susceptible to damage and are therefore insured at a higher cost.

Do I need mobile home insurance in Texas?

While no law requires homeowners in Texas to purchase mobile home insurance, most lenders do stipulate that borrowers get coverage. Mobile home communities and parks also may require tenants to have insurance.

In Texas, although a mortgage lender can choose to make insurance a requirement, it can't require that a borrower buy coverage that exceeds the replacement value of the home and its contents. Therefore, the only way to avoid purchasing mobile home coverage in Texas is to buy a manufactured home outright and place it on private property.

In either case, we strongly recommend purchasing mobile home insurance because the policy serves as financial protection. Without it, you'd have to pay out of pocket for any damage that occurs to your mobile home. Home repair costs covered by an insurance policy, like a roof leak stemming from a tree falling on your home, can quickly add up, so it's best to have the safeguard that insurance provides.

Unique considerations: Texas mobile home insurance

Mobile home insurance policies typically cover wind and hail damage, but these may be excluded if you live near the coast. Homes in this area of Texas are susceptible to flood, wind and hail damage. If you're having trouble finding flood insurance in the private market, you could purchase it through the National Flood Insurance Program, which allows homeowners to buy federally backed flood insurance.

For wind and hail coverage, homeowners have the option to purchase coverage through a private insurance company or through the Texas Windstorm Insurance Association (TWIA). The TWIA was formed in 1971 to provide wind and hail insurance to people who live along the coast and can't qualify for private coverage.

The average wind and hail insurance policy from TWIA costs $1,500 per year. Keep in mind that the TWIA only offers wind and hail coverage, meaning you'll still need to purchase a mobile home insurance policy. The counties where homeowners are eligible to purchase wind and hail coverage through TWIA are listed below.

Counties where mobile homes are eligible for TWIA wind and hail coverage

- Aransas

- Brazoria

- Calhoun

- Cameron

- Chambers

- Galveston

- Jefferson

- Kenedy

- Kleberg

- Matagorda

- Nueces

- Refugio

- San Patricio

- Willacy

If the mobile home is located within the limits of the following cities and east of Highway 146, then property is also eligible for TWIA wind and hail coverage in:

- La Porte

- Morgan's Point

- Pasadena

- Seabrook

- Shore Acres

What does mobile home insurance in Texas cover?

Mobile home insurance offers coverage that is similar to what a homeowners insurance policy provides. Both policies provide:

- Coverage for the physical structure

- Replacement for personal items

- Liability protection

Most Texas mobile home insurance companies allow policyholders to customize their policies through endorsements, which function as policy add-ons. The add-ons provide additional coverage that doesn't come standard with a homeowners policy.

Additionally, most mobile home insurance companies in Texas allow policyholders to set custom coverage limits. Below, we provide descriptions of the main coverages of a mobile home insurance policy.

-

Dwelling coverage: Mobile home insurance in Texas provides policyholders with coverage for permanent structures that are attached to the home. For instance, if a car crashes into your living room, then your insurance company will pay to repair the damage inflicted to the walls, roof and an attached deck.

-

Personal property: A mobile home insurance policy also provides coverage for your personal belongings, whether they're damaged or stolen. For example, if your furniture is damaged by a fire, the damage would be covered so long as you pay the deductible.

-

Liability protection: This coverage offers you protection when a guest suffers an injury while on your property. For instance, if your neighbor is hit by a falling ceiling fan in your home, you could end up having to pay legal fees. With this coverage, your insurance company would provide financial protection, up to your coverage limit.

-

Other structures: Most mobile home insurance policies also include coverage for other free-standing structures on your property. For example, any damage to a tool shed or a fence would be covered.

-

Additional living expenses: If your home becomes uninhabitable due to a covered loss, this coverage would compensate you for the costs of living away from home, such as hotel costs.

Filing a mobile home insurance claim in Texas

According to Texas law, your insurance company must acknowledge your claim within 15 days of receiving it.

Once the company has all the information it needs from you, it has 15 business days to accept or deny your claim. However, the deadline may be extended if the claim comes at a time when a major disaster is taking place.

A company may take up to 45 days to make a decision on your claim as long as it has sent you a letter explaining the delay. If the insurance company doesn't meet the aforementioned deadlines, you can sue the insurer for the claim amount, interest and legal fees.