ATV Insurance: What Does It Cover and How Much Is It?

Find Cheap ATV Insurance in Your Area

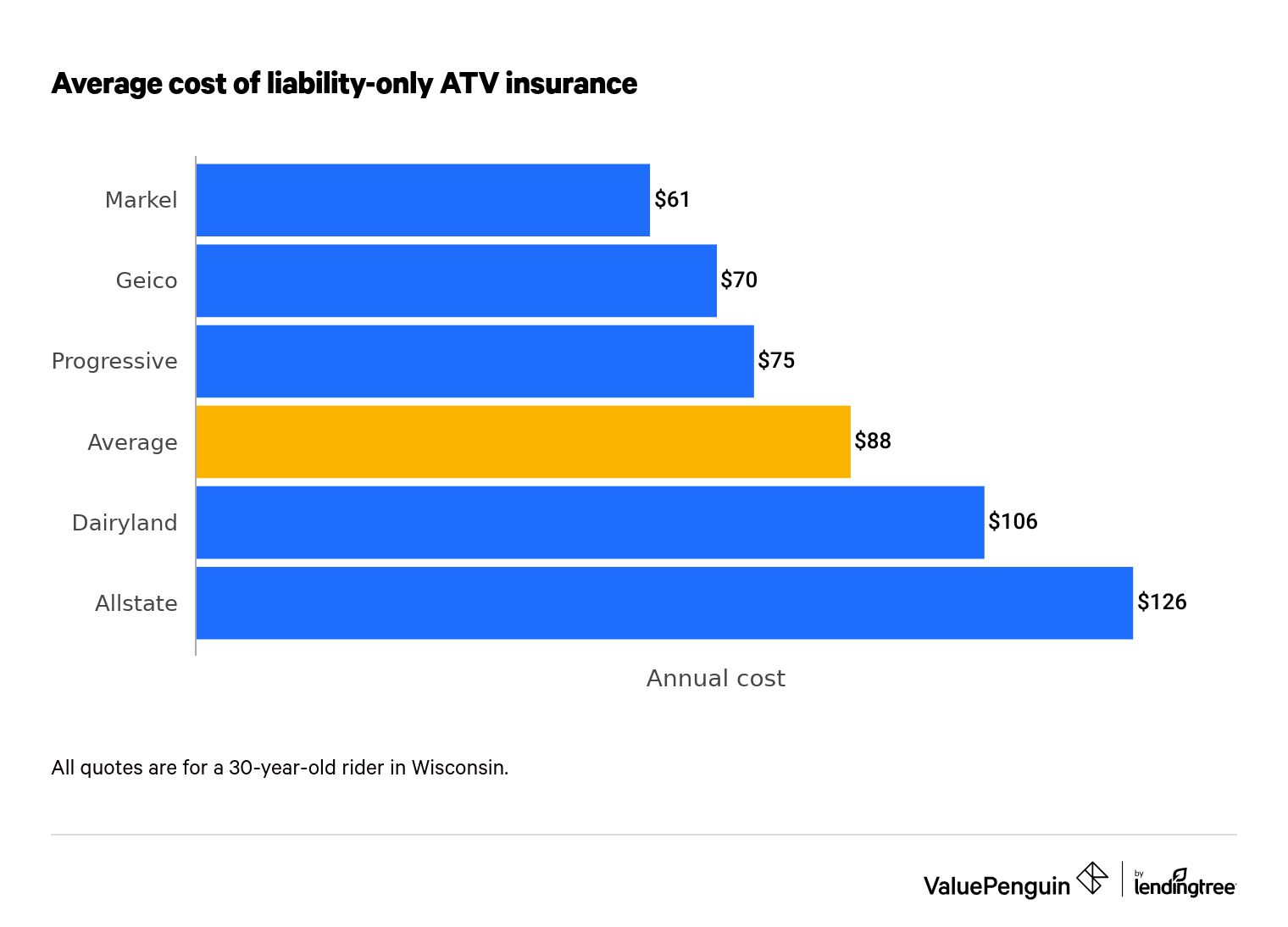

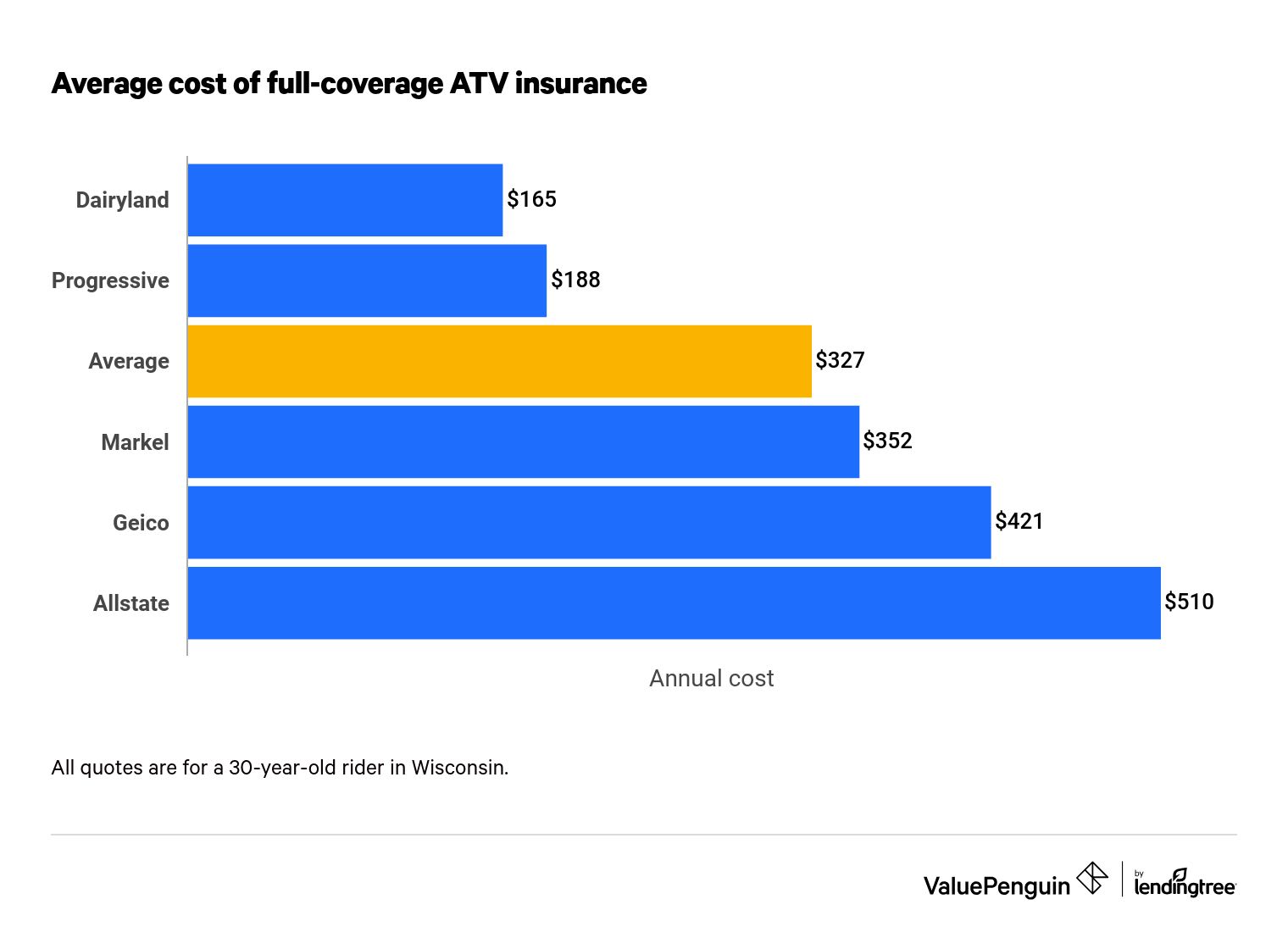

Insurance for your all-terrain vehicle (ATV) works a lot like motorcycle insurance and protects you financially if you are in a crash. It costs about $88 per year for liability coverage and $327 per year for full coverage.

While ATV insurance is not required by law in most states, you'll likely need to buy a policy if you want to ride your vehicle on public trails. Some states also require you to buy insurance in order to ride on anyone's property that isn't your own.

How much does ATV insurance cost?

ATV insurance costs about $88 per year for liability-only coverage.

Meanwhile, full coverage costs an average of $327 per year.

Like motorcycle insurance, ATV insurance is much more expensive if you include comprehensive and collision coverage, which pay to repair or replace your ATV if it's damaged or stolen.

ATV insurance costs

Liability only | Full coverage | |

|---|---|---|

| Markel | $61 | $352 |

| Geico | $70 | $421 |

| Progressive | $75 | $188 |

| Average | $88 | $327 |

| Dairyland | $106 | $165 |

| Allstate | $126 | $510 |

All annual quotes are for a 30-year-old man living in Green Bay, Wisconsin, who rides a 2021 Honda FourTrax Rubicon.

ATV insurance is usually slightly cheaper than motorcycle insurance, even though ATVs are covered under motorcycle insurance policies.

People generally spend less time and drive fewer miles on ATVs than motorcycles, resulting in fewer accidents and claims. ATVs also typically can't travel as fast as most motorcycles, and they are usually used on rural trails where there aren't many other vehicles around.

To get the best ATV or UTV insurance rate, you should always compare quotes from at least three insurers. ATV insurance companies evaluate the risk of riders and vehicles differently, so depending on your location and driving history, you may receive a much better rate with one insurer than another.

ATV insurance discounts

ATV insurance has discounts available for some policyholders, similar to insurance for motorcycles and other vehicles.

Most carriers offer lower quotes for ATV insurance if you have more than one ATV or motorcycle, have multiple insurance policies (such as homeowners or renters insurance) or have an anti-theft device installed on your ATV.

Common ATV insurance discounts and ways to save

- Bundle your ATV insurance with other policies, like home or auto

- Insure multiple ATVs or motorcycles

- Have an anti-theft device installed on your ATV

- Avoid accidents and claims

- Have good credit

- Join a professional or motorcycle association

- Take an ATV safety course

What does ATV insurance cover?

Find Cheap ATV Insurance in Your Area

Most insurance companies cover ATVs under their motorcycle insurance policies. That means the coverages you can choose are the same, too, including things like liability insurance, coverage for medical bills and comprehensive/collision coverage.

Is there a minimum ATV insurance requirement?

Even though ATV insurance isn't usually required by law, your ATV insurance policy will likely need to meet your state's motorcycle insurance requirements. All ATV insurance policies will include liability protection. Uninsured motorist coverage and medical payments coverage may be required too, depending on your state.

Bodily injury liability (required): This coverage pays if someone besides you or your passenger is injured or killed in an accident associated with your ATV (whether you're driving or not). The limits of bodily injury liability are typically an amount per person and a total amount per accident, regardless of the number of people involved. For example, a $50,000/$100,000 policy will pay up to $50,000 toward each person's injuries and a total of $100,000 for an incident overall.

Property damage liability (required): Similar to bodily injury liability, this coverage pays for any damage an ATV driver causes to another person's property — including their belongings, as well as their home or yard. Property damage just has a single limit per incident: If your limit is $25,000, your policy will pay out up to that amount, regardless of how many people are involved.

Medical payments coverage/personal injury protection (optional in most states): Medical payments coverage pays for any medical expenses incurred by those riding your ATV. It will cover things like surgeries, X-rays, hospital stays and even transportation via ambulance. "No-fault" states require car drivers to carry personal injury protection (PIP) coverage on their policies. But PIP is often not required for motorcycles or ATVs because it is expensive.

Uninsured/underinsured motorist (requirements vary): In the event you or someone riding your ATV is injured by someone who doesn't have insurance, or doesn't have enough to cover your expenses, this coverage will make up the difference. Ideally, if someone else is at fault for your injury or damage, their insurance would cover the costs they are responsible for. Some states require one or both of these coverages, but not all.

Uninsured/underinsured coverage for ATV insurance also has claim limits. Like bodily injury liability, uninsured and underinsured motorist coverage has limits per individual and per accident.

Collision (optional): This coverage pays to repair damage to your ATV caused by a collision with another vehicle or if it overturns. Policyholders choose a deductible — the amount they pay before their insurer begins to cover costs — and the insurance company will cover up to the value of the ATV.

To keep rates low, the owner of an ATV with a low value might choose to forgo this coverage. You may want to determine how much your ATV is worth before adding collision to a policy. Collision coverage is often required of owners who financed the purchase of their ATV or are leasing it.

Comprehensive (optional): Comprehensive coverage pays for damage not caused by a collision with another vehicle. It also covers the loss of the ATV due to theft, vandalism, flooding, earthquake, fire and other causes. Like collision, comprehensive coverage has a deductible. For example, if someone steals your ATV, you could file a comprehensive claim and your insurer would pay up to the cash value to replace it, minus the deductible.

Where is ATV insurance excluded?

Owners and riders need to be aware of circumstances when ATV insurance won't cover you, either because of higher levels of risk or illegal behavior.

For example, standard ATV insurance policies only cover use for recreational or commuting purposes. They don't cover loss or damage related to racing. Most ATV racing insurance policies are offered by specialty insurers.

Riding an ATV on highways and roads is not included in your insurance coverage because it is illegal in most states. Local government agencies across the U.S. can choose to allow ATV traffic on specific roads and highways, usually within state-owned properties, such as large parks or reserves.

Signage regarding ATVs is usually clear and obvious — do not assume ATVs are permitted on any highway, road or trail.

ATVs can cross roads or highways, but usually only under specific conditions. They must cross at a point designed for vehicles to cross — they cannot simply drive over a median. ATVs crossing any road should come to a complete stop and make sure they are visible to traffic.

Where is ATV insurance required?

Find Cheap ATV Insurance in Your Area

ATVs and UTVs typically aren't street-legal, so there are no state requirements for insurance.

However, many state-owned lands and parks allow ATVs only if riders have ATV liability insurance. And in the states that do allow you to drive your ATV on the street, you'll certainly need insurance (plus a license plate and any required safety equipment).

ATV insurance is not required on private property where someone has permission to ride. For example, you don't need liability or any other coverage to legally operate your vehicle on land you own or lease.

Still, ATV riders should consider purchasing a policy to protect themselves and others. If you're involved in an ATV accident and have no insurance, you'll be held financially responsible for damage you cause, as well as costs related to your own injuries and damage to your off-road vehicle.

Does homeowners insurance cover ATV accidents?

Generally, homeowners insurance will not cover your ATV or UTV if it's damaged in an accident, as your property coverage doesn't extend to vehicles. For insurance purposes, an ATV works just like any other vehicle, like a motorcycle, car or boat. Each vehicle requires its own insurance policy.

But your homeowners liability insurance may cover an ATV accident if you were responsible for someone else's injury or property damage. For example, if a friend was riding a UTV on your property, injured themselves and sued you for damages, your homeowners liability insurance would typically cover the incident.

Will auto insurance cover an ATV accident?

Typically no, individual auto insurance policies will not provide coverage on an ATV if you're involved in an accident. However, you may be able to get a discount on coverage for your vehicles if you bundle your policies with the same ATV insurance company.

Does health insurance cover ATV accidents?

Health insurance generally covers injuries you sustain while riding an ATV, if the injuries aren't covered by your ATV insurance policy or another driver's liability coverage.

However, some health insurance policies specifically exclude "hazardous activities." Policies that have these exclusions usually refer to things like skydiving or mountain climbing, but it's possible that your health insurance policy excludes ATV injuries, too — the only way to be sure is to ask your insurance company directly.

What is an ATV?

An ATV, or all-terrain vehicle, is a vehicle primarily designed for off-road use. When you're riding most ATVs, you straddle the ATV body like a motorcycle and use handlebars to steer, not a steering wheel.

Most people associate single-passenger, four-wheeled, off-road vehicles with ATVs. They are also called four-wheelers, quad bikes, quads or quadricycles. However, there are many ATVs designed for two passengers, and some have greater or fewer than four wheels. For example, the Polaris Ranger 6x6 has six wheels.

In most states, ATV use is typically not allowed on public roads, with specific exceptions like when crossing between trails or driving on dirt roads in rural areas. But some states, like Arizona, do allow you to drive an ATV on public roads, as long as it's properly equipped and registered with the DMV.

A related vehicle is a UTV, or utility task vehicle. UTVs are similarly designed for off-road use but usually have two seats side by side (sometimes with a second row) and a cargo area in the back. They're more designed for carrying cargo and are covered by the same kind of insurance as ATVs.

Frequently asked questions

Is ATV insurance expensive?

No, ATV insurance is very affordable. ValuePenguin found an average price of under $100 per year for basic coverage and $327 for full coverage.

Is ATV insurance required?

ATV insurance is not required by law in most states, but many places (including public trails and some private ATV areas) may not permit you to ride there unless you have coverage.

What does ATV insurance cover?

Like motorcycle insurance, ATV insurance may include liability protection, plus coverage for your own injuries and damage to your ATV — depending on what kinds of coverage you add.

Methodology

Our sample rates are for a 30-year-old man who lives in Green Bay, Wisconsin, and rides a 2021 Honda FourTrax Rubicon. He's been riding ATVs and motorcycles since he was 16 and has no recent driving or riding incidents.

- Liability coverage: $50,000/$100,000/$25,000

- Uninsured motorist: $25,000/$50,000

- Collision deductible (when included): $500

- Comprehensive deductible (when included): $500