How Much Does Private Mortgage Insurance (PMI) Cost?

By clicking "See Rates", you'll be directed to our ultimate parent company, LendingTree. Based on your creditworthiness, you may be matched with up to five different lenders.

The cost of private mortgage insurance (PMI) is based on the loan amount, the borrowers' creditworthiness and the percentage of a home’s value that would be paid out for a claim. Generally, all companies that sell mortgage insurance price their policies this way. Regardless of the value of a home, most mortgage insurance premiums cost between 0.5% and as much as 5% of the original amount of a mortgage loan per year. That means if $150,000 was borrowed and the annual premiums cost 1%, the borrower would have to pay $1,500 each year ($125 per month) to insurance their mortgage.

How Credit Scores Affect the Cost of PMI

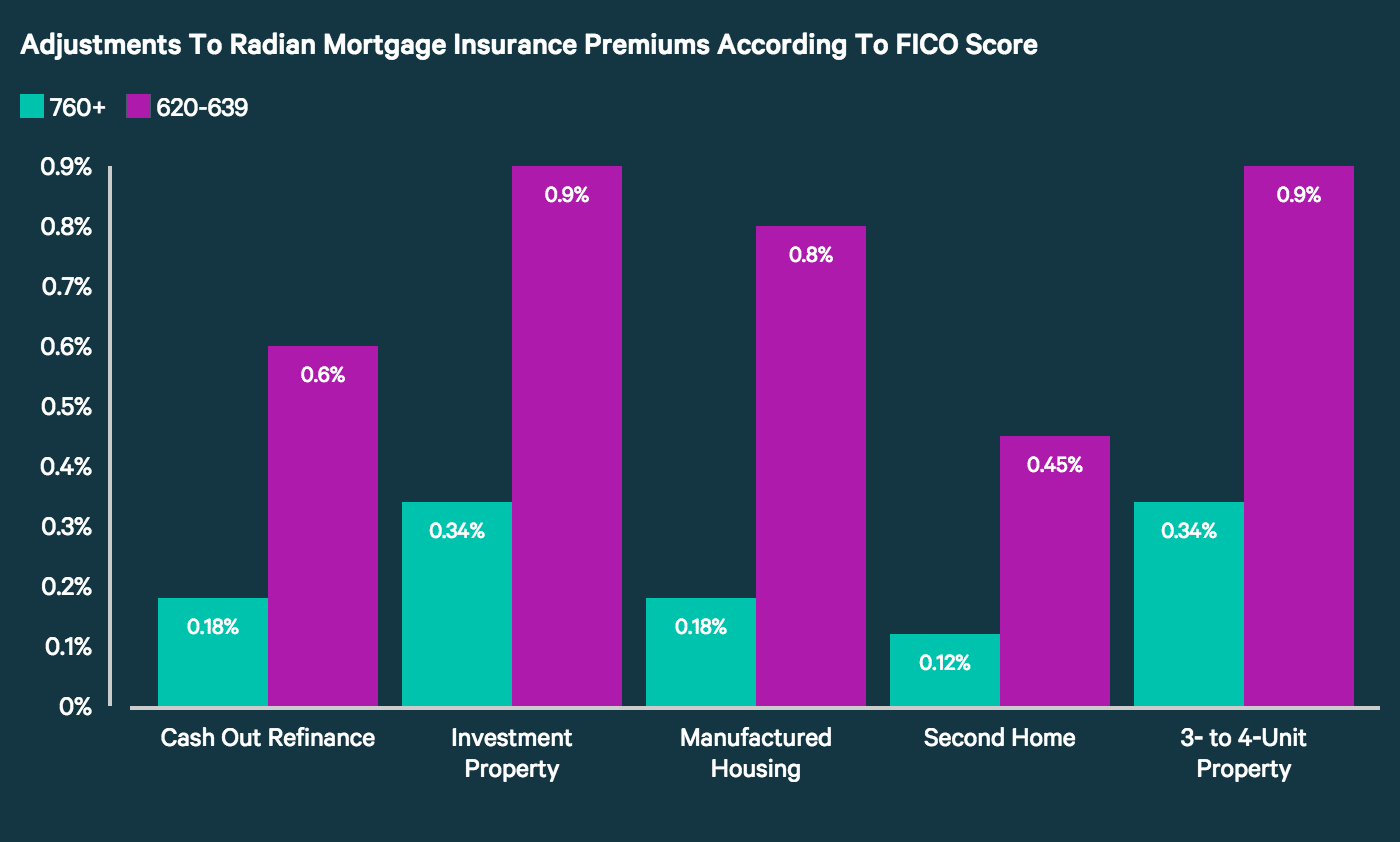

Credit scores don't just affect mortgage and homeowners insurance rates, they also affect PMIS. Here is an example of how factors such as creditworthiness impact the cost of mortgage insurance: Consider two individuals who each want to buy a home valued $100,000 and can each put down $10,000 or 10% of the value of the home. Although they can make the same down payment, their credit scores are major determinants when it comes to the cost of their mortgage insurance policies. To show this, we graphed the price difference across credit score silos for a mortgage insurance policy offered by Radian. The policy is for a borrower-paid mortgage insurance policy that covers a fixed rate loan with a term longer than 20 years. You can see that if Borrower A has a FICO credit score of 760 or higher and Borrower B has a score lower than 639, Borrower B’s mortgage insurance premiums would cost 4x Borrower A’s.

How Loan-to-Value (LTV) and Claim Payout Ratios Affect PMI Costs

In addition to FICO credit scores, companies price PMI premiums according to the loan-to-value (LTV) ratio of a mortgage and what percent of the loan is recovered if a claim is filed. It might sound complicated, but calculating these factors for a policy is easy.

Most mortgages must be insured if they have a loan-to-value ratio (LTV ratio) of 80% to 97%. In other words, if a borrower can only make a down payment between 20% and 3% of the value of a home, they will likely need a mortgage insurance policy. But not all LTV ratios are treated the same. In the table below of a mortgage insurance policy offered by Genoworth Mortgage Insurance Corporation, the difference between LTV ratio and the cost of the policy are clear. The rates are for borrower-paid annual premiums for non fixed rate mortgages and based on LTV ratios, the coverages offered within each ratio, and the cost of the premiums for each PMI policy given the risk pool (the FICO score of the borrower).

The annual premiums are the percentages of the original amount of the mortgage loan in each FICO score column. For example, say a homeowner with a FICO credit score higher than 760 borrowed $100,000 that equated to 92% of the value of the home they purchased. If their mortgage lender took out a policy to cover 35% of the $100,000 loan amount, the borrower's PMI premium would be 2.56% of that amount or $2,560.

Loan-to-Value (LTV) Ratio | % of Loan Covered | FICO Score of 760+ | FICO Score between 620-639 |

|---|---|---|---|

|

95.01 & Greater | 35% | 4.50% | 6.82% |

| 30% | 4.01% | 6.04% | |

| 25% | 3.52% | 5.21% | |

| 18% | 2.60% | 4.13% | |

|

90.01 to 95% | 35% | 2.56% | 6.33% |

| 30% | 2.19% | 5.54% | |

| 25% | 1.94% | 4.99% | |

| 16% | 1.50% | 3.64% | |

|

85.01 to 90% | 30% | 1.66% | 4.06% |

| 25% | 1.59% | 3.50% | |

| 17% | 1.38% | 2.81% | |

| 12% | 1.19% | 2.39% |

PMI Rate Adjustments

Insurance companies also apply price adjustments to the above base rates. Genworth Mortgage Insurance Corporation, for example, offers mortgage insurance and applies several common adjustments that increase and decrease the cost of premiums. Some of the company’s adjustments cut the cost of premiums, such as those for mortgages with an amortization term of 25 or fewer years and for corporate relocation loans. Other adjustments that increase the cost of premiums are for situations in which any loan amount is greater than $417,000 and for mortgages on secondary homes and investment properties.

Below is an example of the five adjustments that have the biggest impact on the base rate of a mortgage insurance policy. Like Genworth, Radian also has adjustments that decrease the cost of a borrower's premium, however those are not included in the chart.

There can be exceptions within the adjustments that carriers apply to premiums. One common adjustment exception is for mortgage insurance premiums in Hawaii and Alaska. Unlike the continental U.S., adjustments to the cost of premiums based on loan amount begin at $625,000 instead of $417,000 in Alaska and Hawaii.

If you're looking for ways to avoid PMI on your first home purchase, there are a variety of methods out there, but beware that many of these might actually cost you more in the long run.

Sources:

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.