21st Century Auto Insurance Review

Good prices for most drivers, but a high rate of complaints suggests drivers may find better service elsewhere.

Find Cheap Auto Insurance Quotes in Your Area

21st Century offers rates that are a hint better than average relative to national auto insurers, though it is more expensive for drivers with accidents. Complaints about the company included several issues with claims and quick cancellations of policies because of missed payments.

The company operates online and by phone, and its policies are available in California. It offers a helpful feature that allows customers to change coverages and alter payment plans online.

Pros and cons

Pros

Good rates for drivers with clean records or a DUI

Easily change coverage online

Cons

Expensive after an accident

Difficult claims process

Only available in California

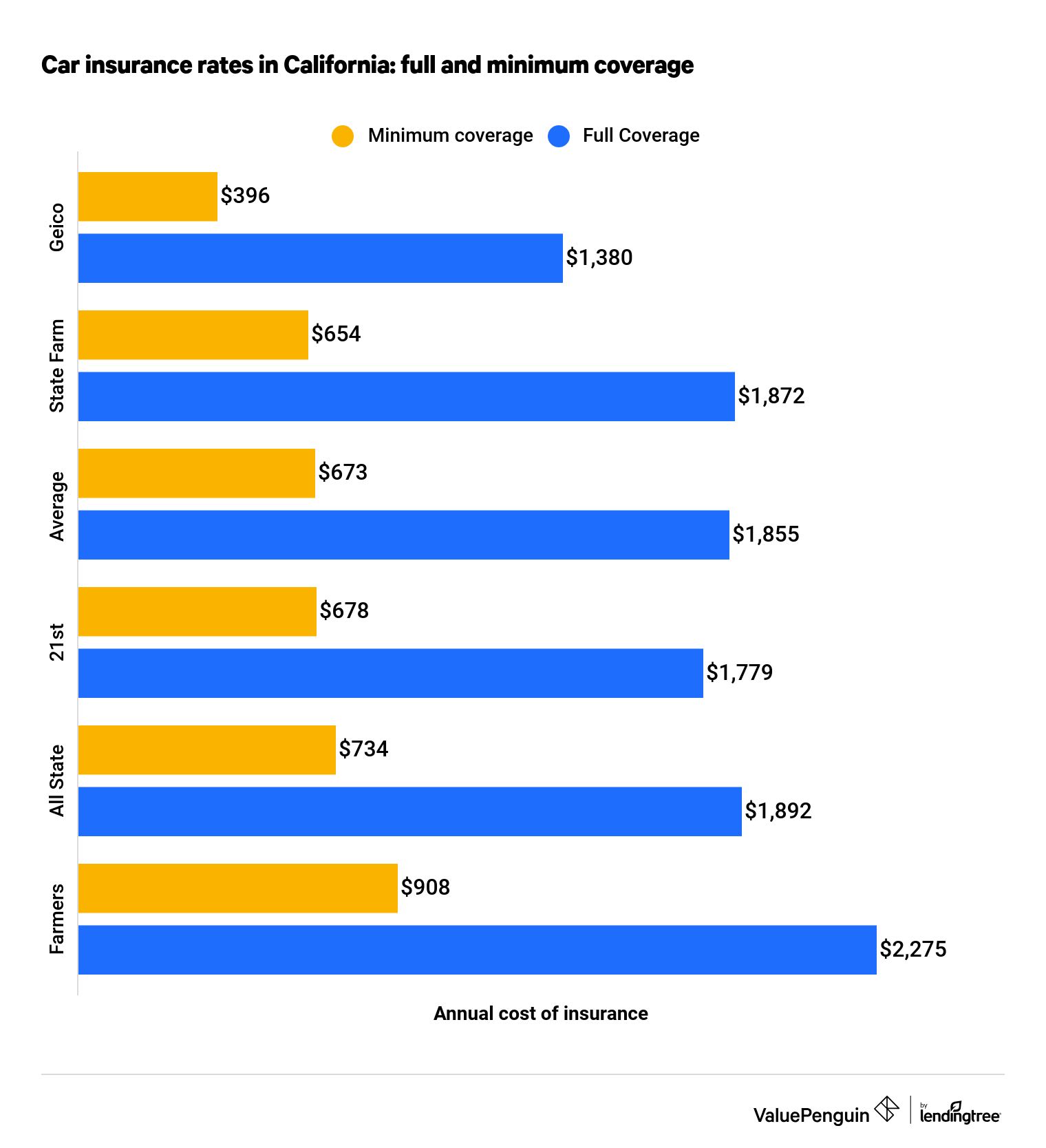

21st Century auto insurance rates compared to other companies

21st Century offers slightly better-than-average rates for full coverage car insurance, our analysis found.

For full coverage car insurance in California, 21st Century’s rates were $76 cheaper than the average per year. But for minimum coverage, 21st Century came in a few dollars more than Geico and State Farm. The company also beat the average for drivers with a DUI by $93 per annual policy.

However, an accident made the Farmers Insurance subsidiary notably more expensive than the competition.

Find Cheap Auto Insurance Quotes in Your Area

Drivers with an accident on their record will likely pay a good bit more for coverage from 21st Century. Full coverage cost 16% more than the average, a difference of $609 per year. Even with minimum coverage, 21st Century was 11% more expensive than average, although it was cheaper than Allstate.

Company | Annual full coverage policy cost | Cost with an accident |

|---|---|---|

| Geico | $1,380 | $2,510 |

| State Farm | $1,872 | $3,712 |

| Farmers | $2,275 | $4,000 |

| 21st Century | $1,779 | $4,434 |

| Allstate | $1,892 | $5,080 |

21st Century car insurance discounts

The list of discounts 21st Century offers is not as exhaustive as some of the larger national insurers. However, the company provides most standard discounts.

Drivers who have avoided an accident or ticket for four or five years can benefit from the pairing of good and superior driver discounts that 21st Century offers. Those discounts give drivers breaks on their insurance premiums if they go a certain amount of time — three to five years — without an incident.

However, drivers with marks on their records, or those who could benefit from discounts connected to their profession or for taking a defensive driving course, could look to other companies, such as State Farm or Geico.

21st Century discounts

- Good driver discount: averages 20% or more

- Superior driver discount: average discount of 10% to 20%

- Good student discount: average discount of 15%

- Mature driver discount: average discount 2%

- Multi-car discount

- Anti-theft discount: average discount of 15%

21st Century car insurance coverages

The range of insurance policy offerings from 21st Century includes most standard coverages, such as liability and collision. Roadside assistance is also included as part of the policy. However, the company does not have many additional coverage options.

One notable 21st Century coverage option is for additional or customized equipment. This can include permanent accessories not installed by the manufacturer that change the look or performance of the car.

Coverage options available through 21st Century

- Liability

- Comprehensive

- Collision

- Underinsured motorist (up to $50,000/$100,000 in California)

- Personal injury protection (Up to $10,000)

- 21st roadside assistance ($75)

- Rental reimbursement (up to $90 per day, $2,700 total)

- Additional/customized equipment coverage

One of our favorite features 21st Century offers is some flexibility to adjust policies online. That includes the ability to change certain coverages, alter payment plans and see how much an extra vehicle may change premiums.

21st Century customer service ratings and reviews

21st Century has a high rate of complaints relative to its premiums written. The National Association of Insurance Commissioners (NAIC) Complaint Index rating for 21st Century was 2 1/2 times the national median.

Complaints made to the Better Business Bureau often included issues with claims or payouts and with quick cancellations after missing payments. The amount of time between a missed payment and policy cancellation varied depending on when it happened during the policy, and could be as short as a few days.

However, 21st Century has an A+ rating from the Better Business Bureau, which rates how the company responds to customer concerns. The company also has an A credit rating from AM Best.

Frequently asked questions

Is 21st Century a good insurer?

We found 21st Century to be about average among its competitors. Its prices are on the affordable side, but it has lackluster customer service reviews.

Is 21st Century cheap for car insurance?

Car insurance rates at 21st Century are about average among its competitors for both state minimum coverage and full coverage. However, it charges high rates for drivers with a recent crash on their record.

What company owns 21st Century?

21st Century has been owned by Farmers since 2009.

Methodology

Quotes were based on data publicly sourced from insurer filings. ValuePenguin used Quadrant Information Services to compile the data and analysis. Rates should only be used for comparative purposes. Your rate may be different.

Rates were for a 30-year-old male driver in California with a 2015 Honda Civic. The driver had a clean driving record unless infractions were specified.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.